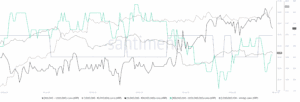

The variety of XRP transactions of greater than $ 1 million has dropped by almost 92% for the reason that starting of March 2025. On-chain data from Santiment show that on March 1st over 220 such high value transactions occurred. By June 12, the count fell to only 18 and marked certainly one of the steepest declines of whale activity this 12 months.

Source: Santiment

The price lasts steadily, however the whales step aside

The price of XRP dropped from $ 2.38 on March 1 to $ 2.24 on June twelfth – a decline of 5.88%. Although this price flatness is comparatively stable in comparison with the broader crypto volatility, it coincides with a withdrawal from large investors.

Waltransactions, often over $ 1 million, are sometimes interpreted as movements of institutions or units with a high network. Their reduced activity signals that the predominant actors either pause or avoid distribution – an indication of market uncertainty and never for the directional assessment.

Data on the segmentation of wall pockets show that essentially the most pronounced decline within the [10M–100M] And [100M–1B] XRP -Holding groups. These cohorts had increased the activity in the beginning of the 12 months, but have been sideways or circumcised positions since then. Meanwhile the [1M–10M] Kohorte stays relatively stable, which indicates that smaller strategic owners maintain their allocations.

Source: Santiment

Source: Santiment

This displacement of the distribution reflects the growing indecisiveness between whales, possibly in response to the continued legal uncertainty within the Ripple vs. SEC case and the dearth of recent catalysts within the XRP ecosystem.

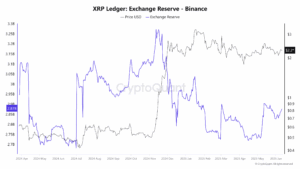

Exchange reserves proceed to fall

The XRP reserves in Binance fell from over 3.25 billion in late 2024 to around 2.87 billion June 2025 – a decline of around 11.7%. Lower substitute reserves often imply less to sale, which might be interpreted as an indication for reduced sales pressure or increased long -term participation.

XRP Exchange Reserve. Source: Cryptoquant

XRP Exchange Reserve. Source: Cryptoquant

In combination with the collapse of whale transaction, nevertheless, it also signals deteriorated liquidity. If each the offer and trading stake fall at the identical time, the worth movement normally compresses.

The network growth – the number of recent items of things that interact with XRP – has decreased sharply. It fell from over 10,000 in early March to only 3,263 from June 11, which is as a consequence of a decline in the brand new user participation by 67%.

The every day transaction variety of XRP also dropped from 1.15 million in March to around 600,000 in June – a decline of 47.8%. The decline in each metrics indicates wider cooling of interest that went through large owners, and even retail activities begin to rejuvenate.

XRP Support Break increases the downward risk

In the 4-hour table, XRP recently fell under the 20-day and 50-day exponential moving average values, that are currently near USD 2.25 or $ 2.27. The price is now testing the 100-European Championship value near USD $ 2.24, which previously acted as short-term support.

XRP/USD 4-hour price diagram. Source: Tradingview

XRP/USD 4-hour price diagram. Source: Tradingview

The relative strength index (RSI) is 44.66, which indicates a weakening impulse. The most up-to-date rejection of EUR 2.38 US dollars – its highlight – formed a lower high, which indicates early signs of a bearish divergence.

You also like: Ripple (XRP) Price could test $ 1 again – here is the explanation why

A break below 2.20 US dollars could open the door to a deeper correction within the demand zone of $ 2.05 to $ 2.10. If buyers receive the range of $ 2.30 to $ 2.35, the bullish dynamics might be resumed, but the present setup leans neutrally.

It is unlikely that XRP will break without renewed whale activity, increased network participation or legal clarity over $ 2.50. In the short term, if the worth is over $ 2.20 and consolidates, a step towards $ 2.35 is feasible. If XRP shouldn’t be kept over $ 2.20