On June 3, 2025, the 4-hour diagram for XRP on US dollar (XRP/USD) on Bitstamp a descending sewer pattern. A descending channel is formed when the worth between two parallel trend lines moved downwards, with typically a controlled sales pressure signals. When the worth breaks over the upper trend line, this often points to a possible bullish reversal.

XRP/USD -relegation channel -Breakout setup. Source: tradingview.com

In this case, XRP/USD has just touched the upper limit of the descending channel and acted with USD $ 2.20562. The 50-year-old exponential sliding average (EMA), which is currently $ 2.22378, also acts as a resistance zone.

If the breakout confirms, the projected goal is sort of $ 2.81432. This marks a possible increase by 28% in comparison with the present price. The projection reflects the quantity of the previous upward movement before the channel began and expands it from the outbreak point.

The trading volume shows a slight accumulation, while the worth exceeds the last lower highs. If the momentum continues and XRP closes several candles above the upper channel and the EMA, this may support the bullish breakout scenario.

An additional confirmation would result from the increasing volume and a continued change over the resistance range of $ 2.30.

XRP relative strength index signals growing bullish impulse

On June 3, 2025, the 4-hour diagram for relative strength index (RSI) for XRP-to US dollar (XRP/USD) showed the RSI to 53.36. The RSI is an impulse soscillator that measures the speed and alter of price movements over a variety of 14 percent. It helps to discover overbought and oversized conditions on a scale from 0 to 100.

XRP/USD – RSI impulse evaluation. Source: tradingview.com

XRP/USD – RSI impulse evaluation. Source: tradingview.com

An RSI over 50 indicates that a bullish dynamic grow, while a measurement is reflected below 50 bear pressure. The RSI of XRP has currently exceeded via its signal line (the yellow sliding average), which is situated at 43.82. This crossover indicates a shift within the direction of a bullish mood.

The RSI stays within the neutral area, far below the overbought threshold of 70 years. This implies that XRP still has space to maneuver before it reaches overheated conditions. In addition, the recent jump of under 30 years of age confirms that buyers are back available on the market after a robust sale.

If the RSI continues upwards and breaks over 60, this might proceed to support the outbreak from the descending channel pattern, which may be seen in the worth diagram.

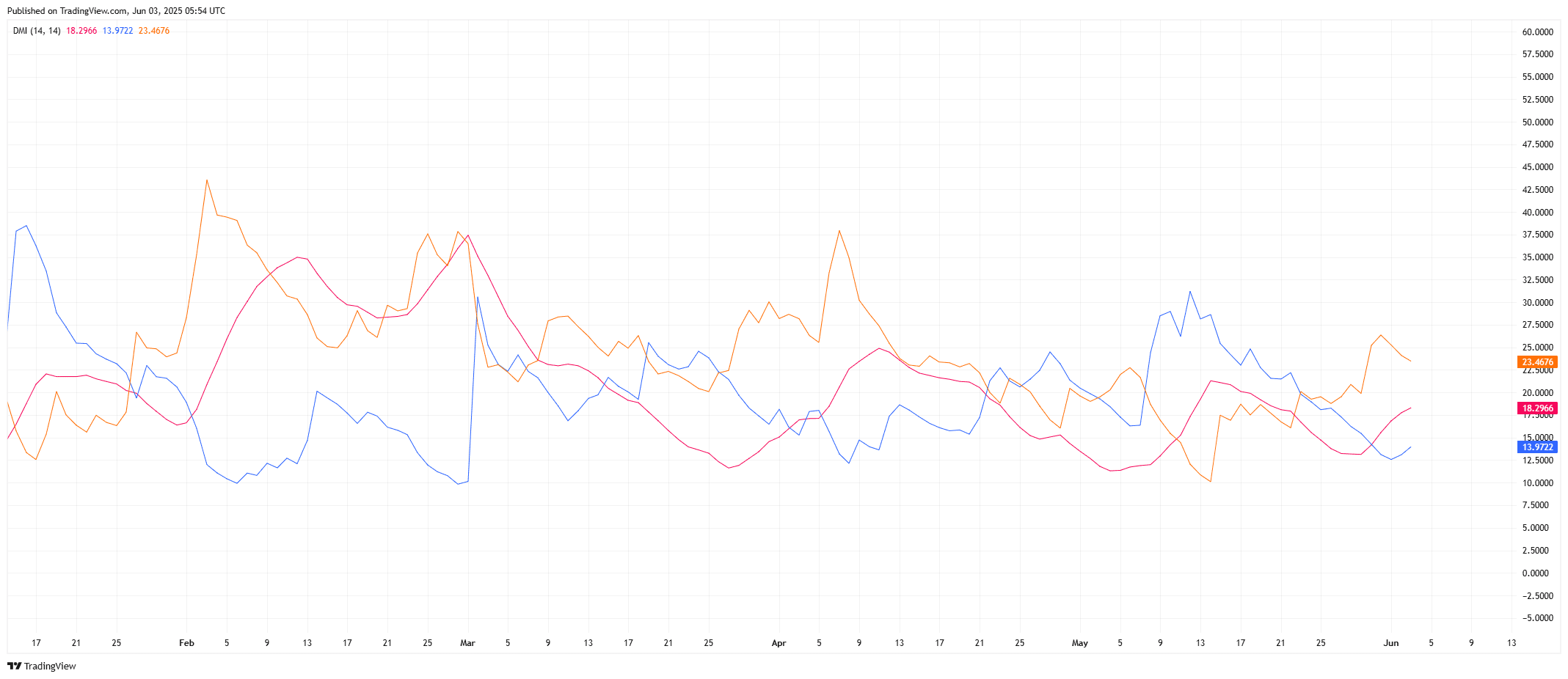

XRP directional movement index confirms a weak trend, signals potential turnaround

On June 3, 2025, the directional movement index (DMI) showed mixed signals for XRP for US dollars (XRP/USDT). The DMI consists of three key components:

-

+DI (positive direction indicator) in blue: 13.97

-

−di (negative direction indicator) in red: 18.29

-

ADX (average direction index) in orange: 23.47

The negative directional indicator stays barely higher than the positive, which indicates that the bear's pressure remains to be present. However, the gap between them narrowed and shows that the sale of sales is step by step built up when buying the pressure.

XRP/USDT – DMI evaluation (Directional Movement Index). Source: tradingview.com

XRP/USDT – DMI evaluation (Directional Movement Index). Source: tradingview.com

The average direction index is just over 23, which indicates a weak but possibly reinforced trend. ADX values over 25 typically confirm a robust directional movement, while values below, the consolidation or trend of decides.

If the +DI continues to rise and crossed via −di, paired with an increasing ADX, this may confirm a bullish reversal. At the moment, XRP shows early signs of a trend change, however the confirmation will depend on whether bulls can press over the present level of resistance.

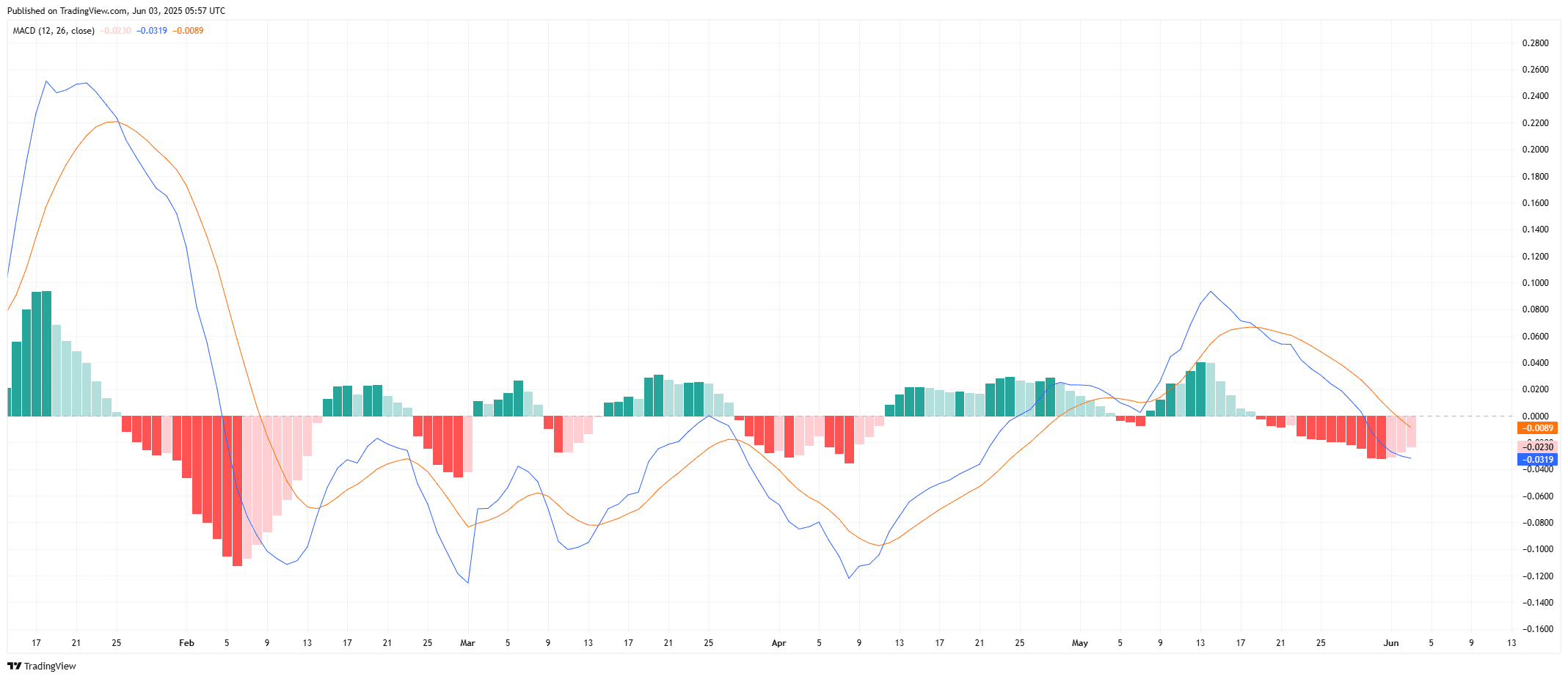

XRP MACD signals fade the bear dynamics before possible reversal

The sliding average convergence divergence diagram for XRP to US dollar showed that the bear impulse becomes weaker. The MACD line deals under the signal line, which still confirms a bearish trend. However, the histogram beams have grow to be shorter, which indicates a reduced sales force.

XRP/USDT – MACD impulse evaluation. Source: tradingview.com

XRP/USDT – MACD impulse evaluation. Source: tradingview.com

The MacD and signal lines are actually close together and show that the downward trend loses the strength. If the MACD line crosses over the signal line, it will signal a bullish reversal. The histogram, which reflects the gap between these two lines, approaches the zero level. This signifies that the momentum is sort of flat and will soon shift in favor of buyers.

XRP needs a crossover to substantiate a outbreak from the descending channel pattern in the worth diagram. At the moment the momentum appears to be postponed from bear to neutral.

XRP receives a requirement for 100 million US

On June 2, 2025, the legal dispute between the US Securities and Exchange Commission and Ripple faded out of focus for a moment. Instead, investors shifted to a big institutional step: Bitgo and Vivipower confirmed a strategic partnership with an XRP acquisition of $ 100 million for the usage of treasury. This announcement triggered the brand new demand for tokens.

Attorney John Deaton, known for his role as Amicus Curiae within the Theripple case, commented on the event. He said that firms reflect Michael Saylors Bitcoin strategy and use digital assets as corporate treasury tools.

“I also said that what Michael Saylor did with Bitcoin would probably be added to certain altcoins, including ETH, XRP and SOL.”

Deaton noticed.

The growing interest of the buyers of firms could shift the offer actor dynamics from XRP of their favor.

Nevertheless, the ripple lawsuit for the long-term trajectory of XRP stays of central importance. A final settlement along with the answer of Ripple and the connection of the SEC could open the door to an XRP spot exchange fund.

If the SEC approves one among the pending XRP -Spot -Tf applications, XRP could resemble rivers which are just like the Bitcoin -Spot -Tf registrations at first of this yr.

Deaton spoke on to the ETF views and explained:

“After the Bitcoin Spot ETF was finally granted … I said that I had no doubts about old coin ETFs that finally only follow ETFs, but XRP, Sol and others.”

Several asset managers are waiting for SEC decisions, including 21 Shares, Bitwise Invest, Canary Funds, Franklin Templeton, Grayscale and Wisdomtree.