On May 31, 2025, XRP/Usdt created a descending sewer pattern within the 4-hour diagram.

XRP/USDT 4-hour diagram. Source: tradingview.com

A descending channel is formed when the worth is moved between two parallel lines, which is predicated on two downs, which indicates controlled sale with potential for breakout.

XRP currently acts with USD $ 2.133. The token hops near the lower border of the canal and sits under the 50-perioda at $ 2.2795. If the pattern confirms with an outbreak above the upper red trend line, the worth can gather 34% from the present level.

This would press XRP into the two.870 dollar zone as marked within the table.

The volume stays constant, while RSI is 30.88 near the oversized zone, which indicates a possible bullish reversal pressure. The RSI also shows signs of a deviation from the falling price trend.

So far, the channel has led lower heights and lower lows since May thirteenth. However, XRP supported low at every cycle. If buyers regain the strength and violate the upper limit, the impulse can flee up sharply.

XRP trend impulse strengthens when ADX climbs over 27

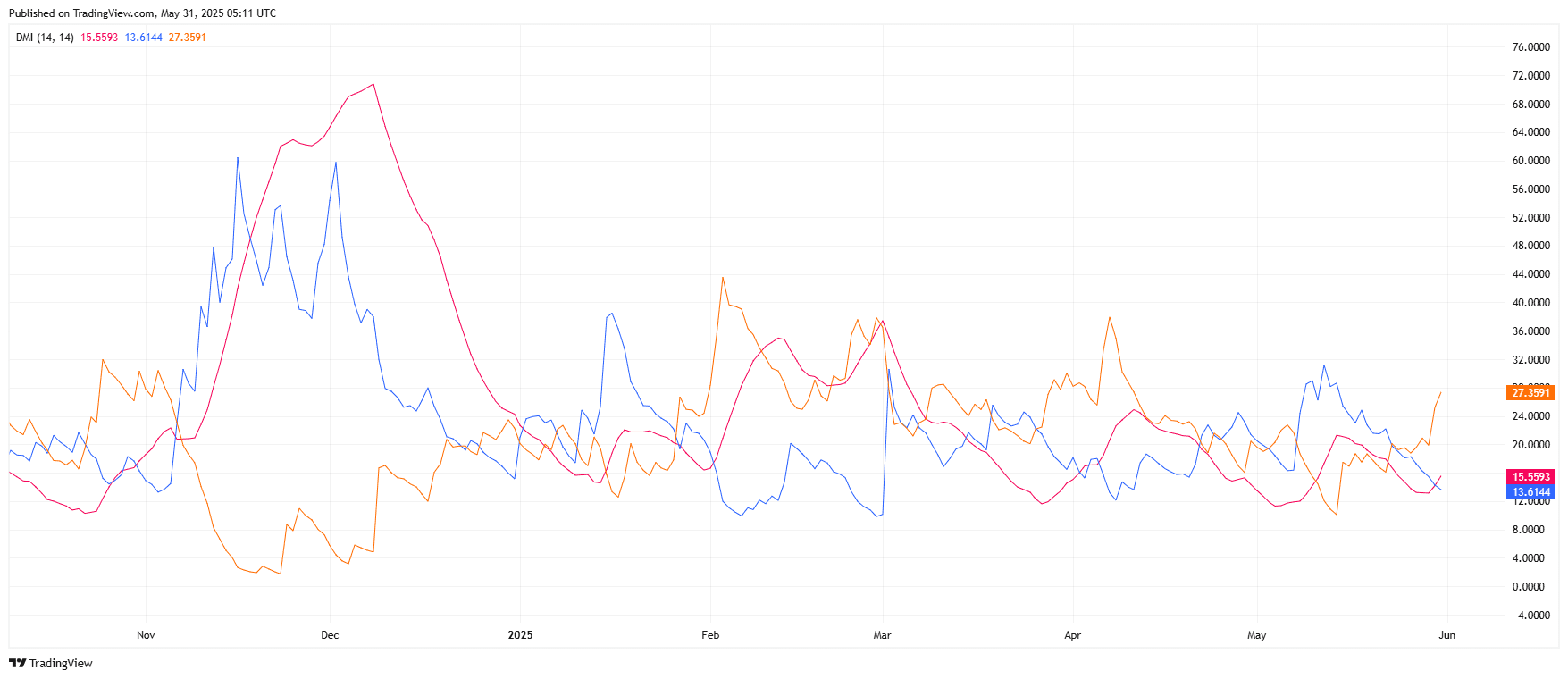

On May 31, 2025, the trend strength of XRP rose again, in accordance with the directorate (DMI) within the every day table.

XRP/USDT DIMI DMI diagram. Source: tradingview.com

XRP/USDT DIMI DMI diagram. Source: tradingview.com

The average direction index (ADX) is now 27.3591 and rises above the 25 threshold value that signals a strengthening trend. The positive directional indicator (+DI) is 13,6144, while the negative direction indicator (−di) is barely higher at 15.5593 and shows that bears still check barely.

However, the upward inclination of the ADX confirms that the dynamics are structured. During probably the most a part of Mai, XRP acted under the conditions with a low moment, because the ADX remained below 25. This latest breakout suggests that the market will enter a more determined phase.

If +DI exceeds −di within the upcoming sessions, while the ADX continues to extend, this might mark the start of a stronger bullish trend. Until then, the token stays at a turning point with a growing pressure, but still with no clear eruption.

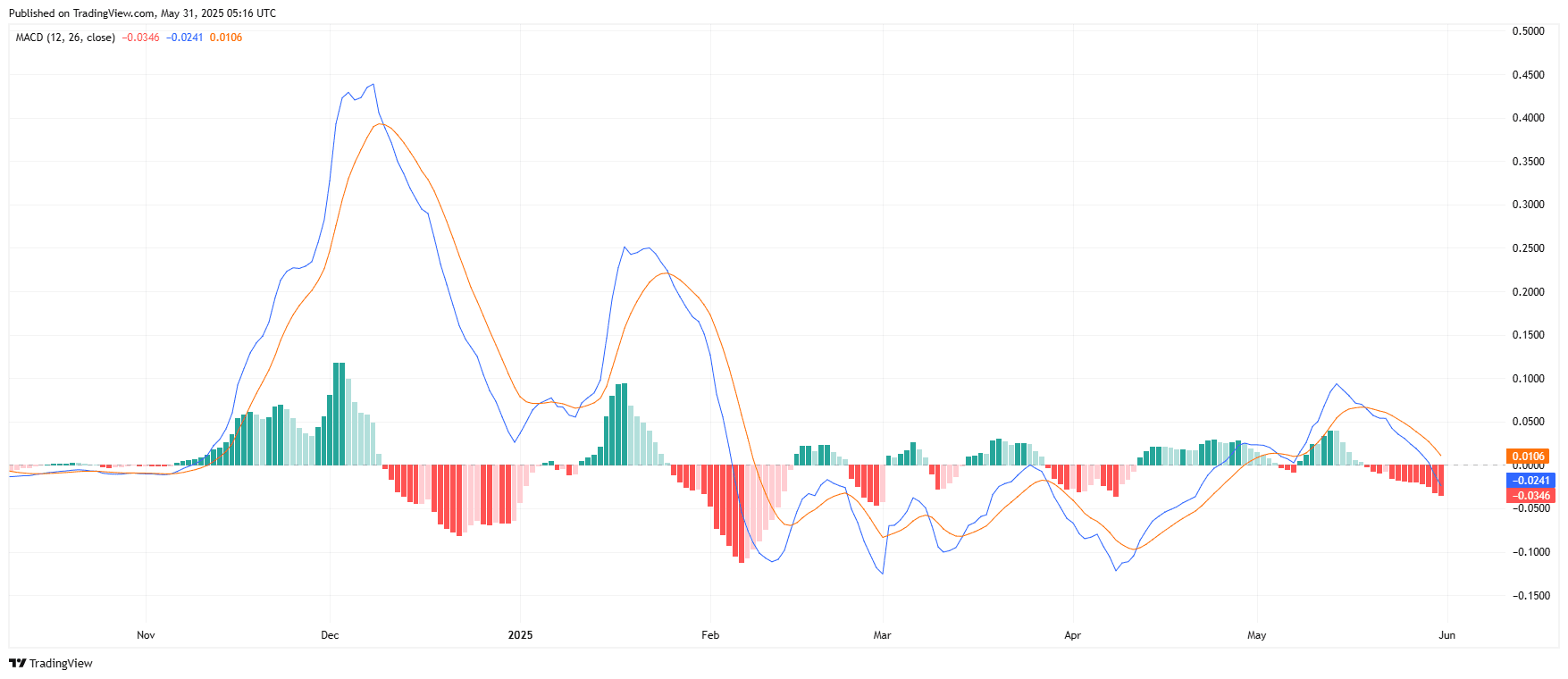

XRP MACD flips bear when the signal line crossing confirms the weak impulse

On May 31, 2025, the sliding average convergence divergence (MACD) for XRP/USDT confirmed a bearish crossover within the every day table.

XRP/Usdt Daily MacD diagram. Source: tradingview.com

XRP/Usdt Daily MacD diagram. Source: tradingview.com

The MacD line (blue) fell under the signal line (orange), whereby the ability values MACD at -0.0346 and signal show at -0.0241. The histogram also modified in deeper red and reflected the growing bear impulse.

This crossover signals a change within the short -term direction of trend. The MacD had stayed over the signal line because the starting of May and supported a light bullish tendency. However, the reversal indicates that the upward printing has faded.

In addition, the declining histogram beams indicate increasing sales pressure. If the bear -in divergence is sustained, XRP can see an additional drawback before a recovery attempt.

The electricity position of the indicator below the zero line also increases the negative trend.

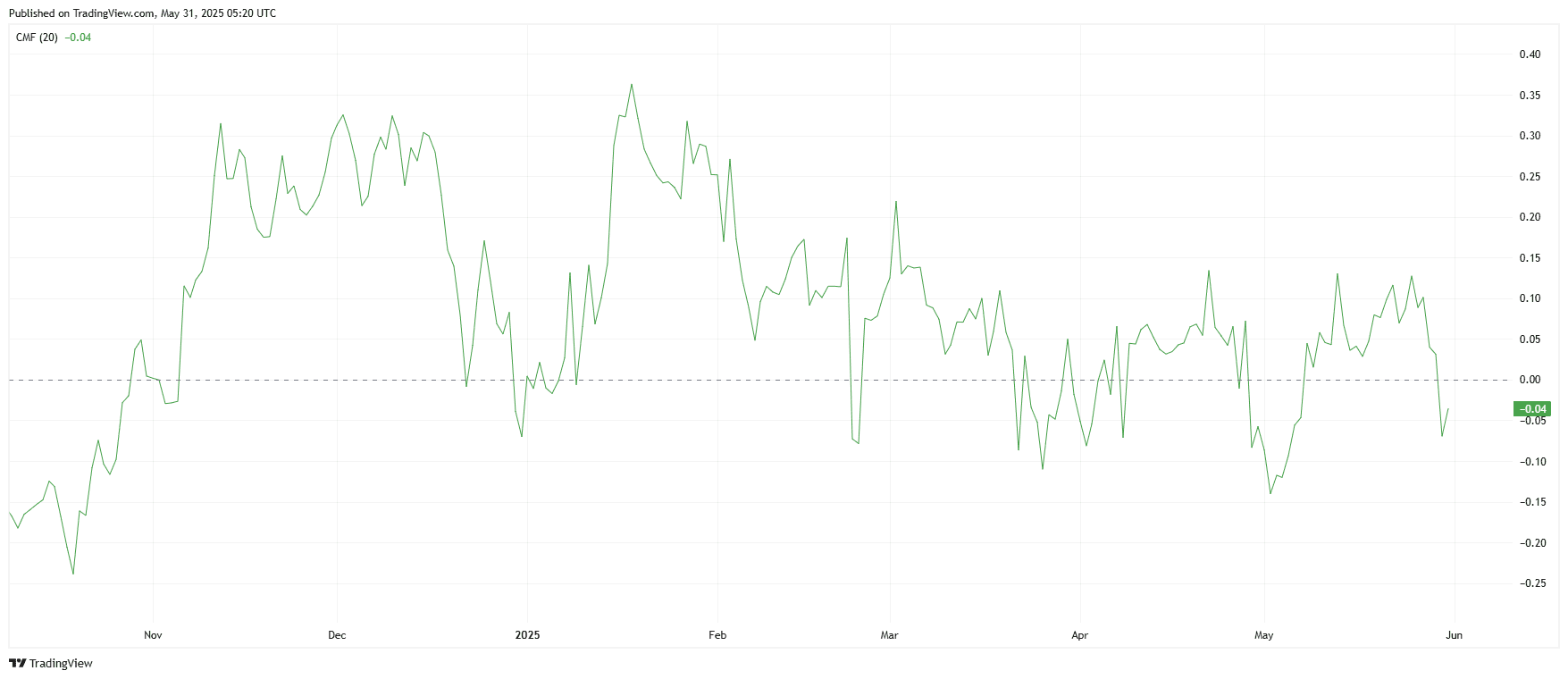

XRP looks a weak purchase pressure because CMF becomes negative

On May 31, 2025, the Chaikin Money Flow (CMF) fell to –0.04 for XRP/USDT and slipped under the neutral zero line.

XRP/Usdt Daily CMF diagram. Source: tradingview.com

XRP/Usdt Daily CMF diagram. Source: tradingview.com

The CMF measures the acquisition and sale of printing each price and volume. Values over zero signal accumulation, while measured values display the distribution below zero. XRP now shows a slight outflow of capital and confirms the baric mood.

During the biggest a part of Mai, CMF stayed over zero and showed a certain collection. However, the recent decline within the negative areas signals that sellers regain control.

If CMF stays below zero and continues to drop, XRP could remain under pressure and restrict short -term revenue tests.