On June 16, 2025, the US Court of Appeal will receive a very important update against Ripple in the present case. The Securities and Exchange Commission must present a comparison status report. If the agency doesn’t do that, Ripple will briefly present her answer and proceed to appeal the case. This legal procedure follows a joint application, which was submitted on June 12, during which each parties asked judges Analisa Torres to revise their final decision.

Ripple's request focuses on two specific changes: the ban on the XRP turnover to institutional investors and the reduction of the punishment of $ 125 million. If these changes were granted, these changes would solve the present symptoms and complete the legal dispute. The court can spend a second 60-day stay with a purpose to give judge Torres more time to review the applying.

Analysts discuss the probable answer from Richter Torres

Judge Torres rejected the primary joint application only one week after submitting. This quick decision raised questions on reply to the revised request. The Pro crypto lawyer Bill Morgan emphasized the rapid rejection of the sooner application as a possible signal:

“It only took 7 days before Richter Torres rejected the last joint application. Less than 7 days to come to a decision that the present joint application isn’t the most effective sign that it’s going to grant it.”

However, Morgan also recognized the strength of Ripple's latest argument. He emphasized that the change in the ultimate judgment was a needed a part of the broader settlement. If the agreement were approved, the agreement would end each the appeal and the appeal and reduce the burden on the court.

Nevertheless, Morgan noticed a critical weakness within the movement. He said Ripple and the SEC didn’t explain why exceptional circumstances justified this modification. Instead, each parties seem to advertise a resolution that takes over the agreement of the court:

“Ripple wanted more. The parties really imposed a performance on the pitch … it might not be surprising if [Torres] not [grant it]. “”

Ripple wants more, says Bill Morgan. Source: @Belisarius2020 on x

John E. Deaton, founding father of Cryptolaw and a outstanding Amicus Curiae, estimated the probability of approval at 70%.

XRP price recovers in the midst of the legal optimism

On June 15, the XRP rose by 1.18% to $ 2.1670 and exceeded the broader crypto market, which has increased by 0.43%. The increase ended a five-day loser strip and reflected the expectations of an inexpensive court ruling within the Ripple case.

XRPUSD Bearish Pennant pattern. Source: tradingview.com

XRPUSD Bearish Pennant pattern. Source: tradingview.com

XRP has formed a bearish pennant pattern, a structure that typically appears after a severe decline and signals the potential continuation when the worth breaks below the lower trend line. If this pattern confirms, XRP can fall from the present level by roughly 23%, which goals on the zone of USD 1.7405.

XRP now stands at $ 2.20 in comparison with resistance. A breakout above this level and a persistent movement resulting from the 50-day exponential moving average (EMA) at $ 2.2498 can open the solution to USD 2.50 and the height value of $ 2.6553 on May twelfth.

However, if the bears regain control and the worth goes back to the support of $ 2.15 with volume, the Bearish setup can transfer the XRP to 1.9299 US dollar and eventually USD 1.7405. The results of judge Torres's decision is predicted to play a very important role in determining the following director of XRP.

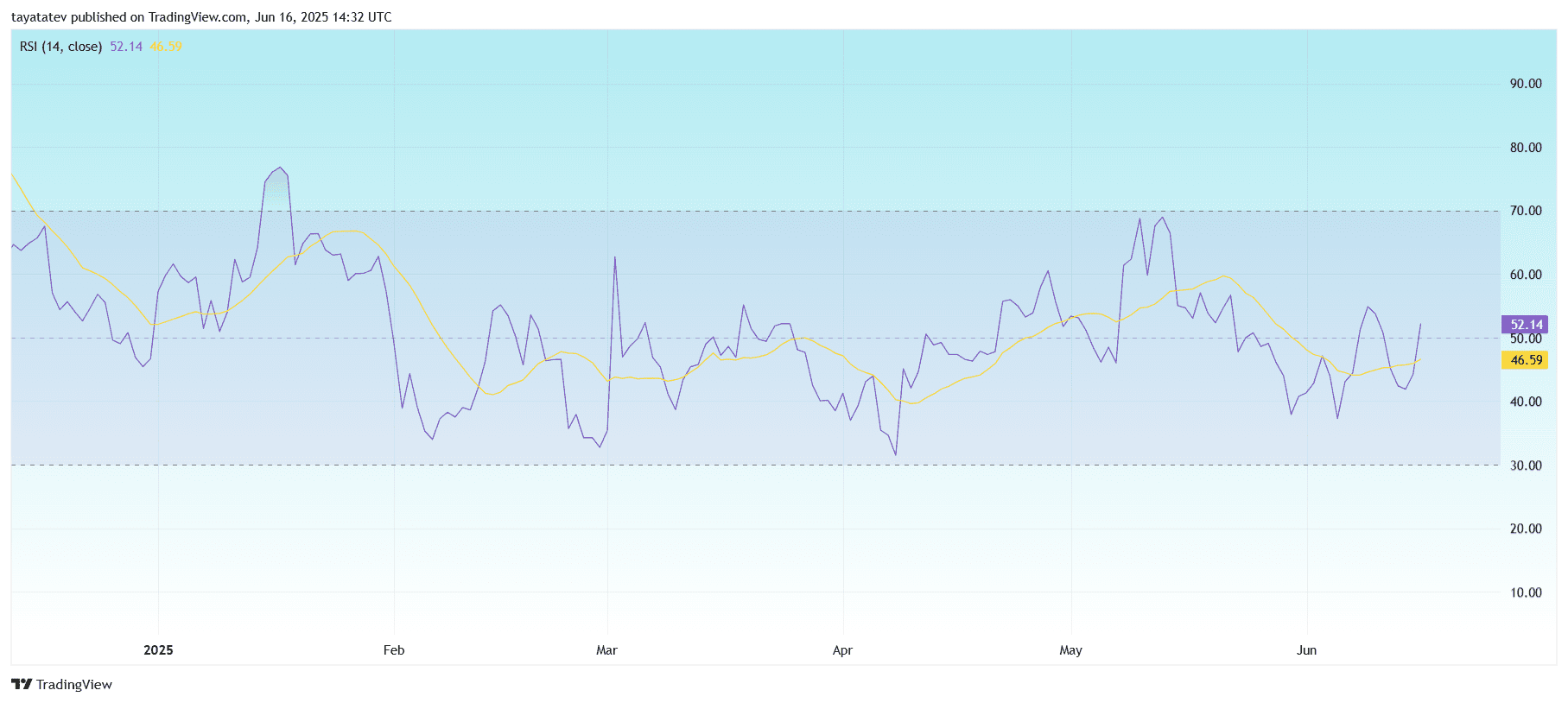

XRP RSI breaks over 50 as bullish impulse

From June 16, 2025, the relative strength index (RSI) for XRP within the every day table 52.14 and crosses via the neutral 50 brand, which regularly signals a shift towards bullish impulse. The RSI had traded most of June under 50, which reflected the weak purchase pressure.

XRPUSD DAILY RSI signals bullish crossover. Source: tradingview.com

XRPUSD DAILY RSI signals bullish crossover. Source: tradingview.com

The RSI -gliding average (yellow line) is currently 46.59, still below the RSI line, which indicates that the upward dynamics can maintain. This crossover can support short -term bullish behavior, especially whether it is paired with an increasing volume or an outbreak from the bear pattern visible within the essential price diagram.

If the RSI increases to 60–70, this could indicate a stronger purchase interest. However, if the RSI doesn’t last over 50, this could quite confirm a brief jump than an entire reversal.

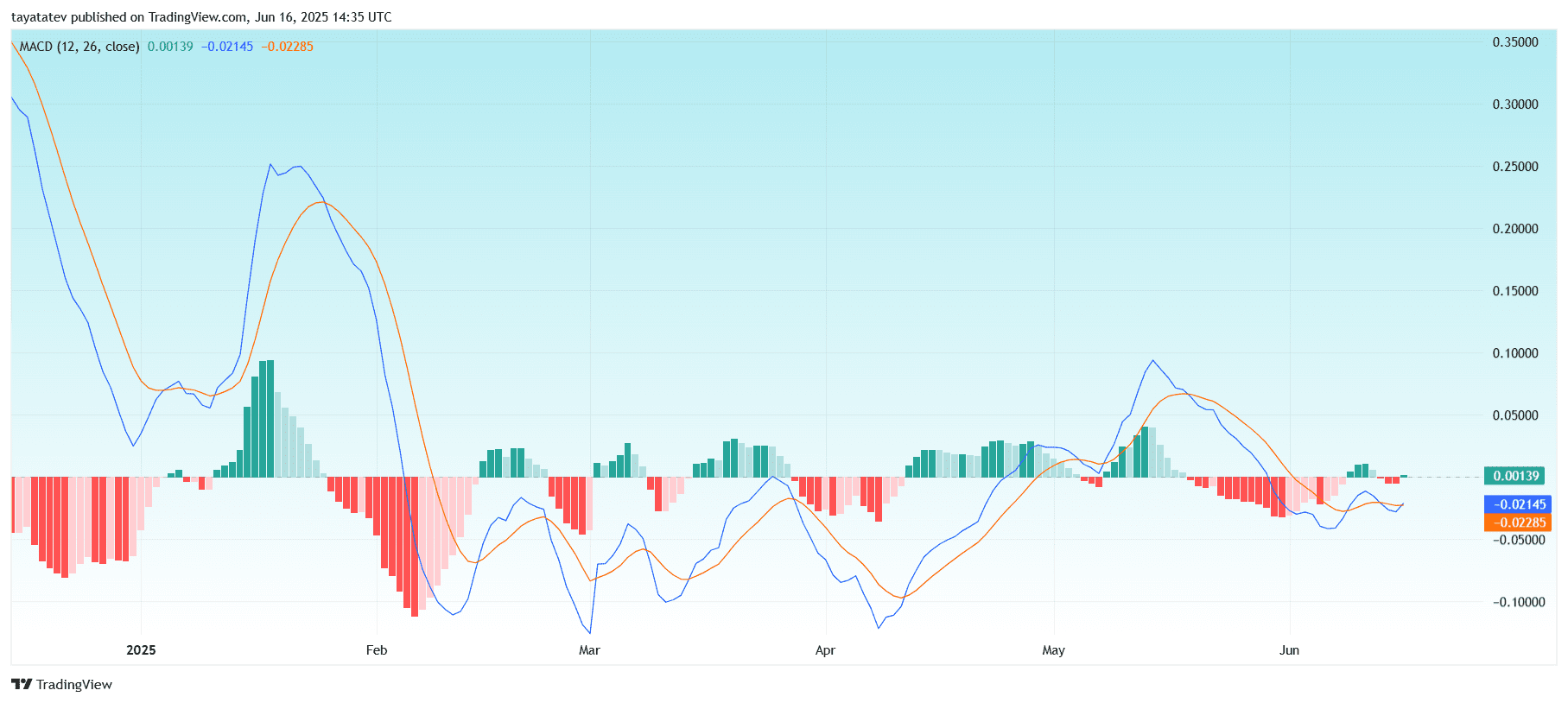

MacD signals possible bullish crossover for XRP

From June 16, 2025, the indicator of moving average convergence divergence (MACD) for XRP shows early signs of a bullish impulse. The MACD line (blue) is at -0.02145, just above the signal line (orange) at -0.02285, while the histogram has grow to be barely positive at 0.00139.

XRPUSD DAILY MACD is approaching Bullish Crossover. Source: tradingview.com

XRPUSD DAILY MACD is approaching Bullish Crossover. Source: tradingview.com

This setup proposes a possible bullish crossover, which regularly indicates the start of the upward price movement in the event that they are confirmed in the next sessions. However, the MACD remains to be in a negative area, which suggests that a signal stays temporary and might have additional confirmation of volume or price motion.

If the crossover strengthens and the histogram continues to grow over zero, it might support a brief -term rally. Otherwise, the failure to take care of this swing could fade further fading in the acquisition of pressure.

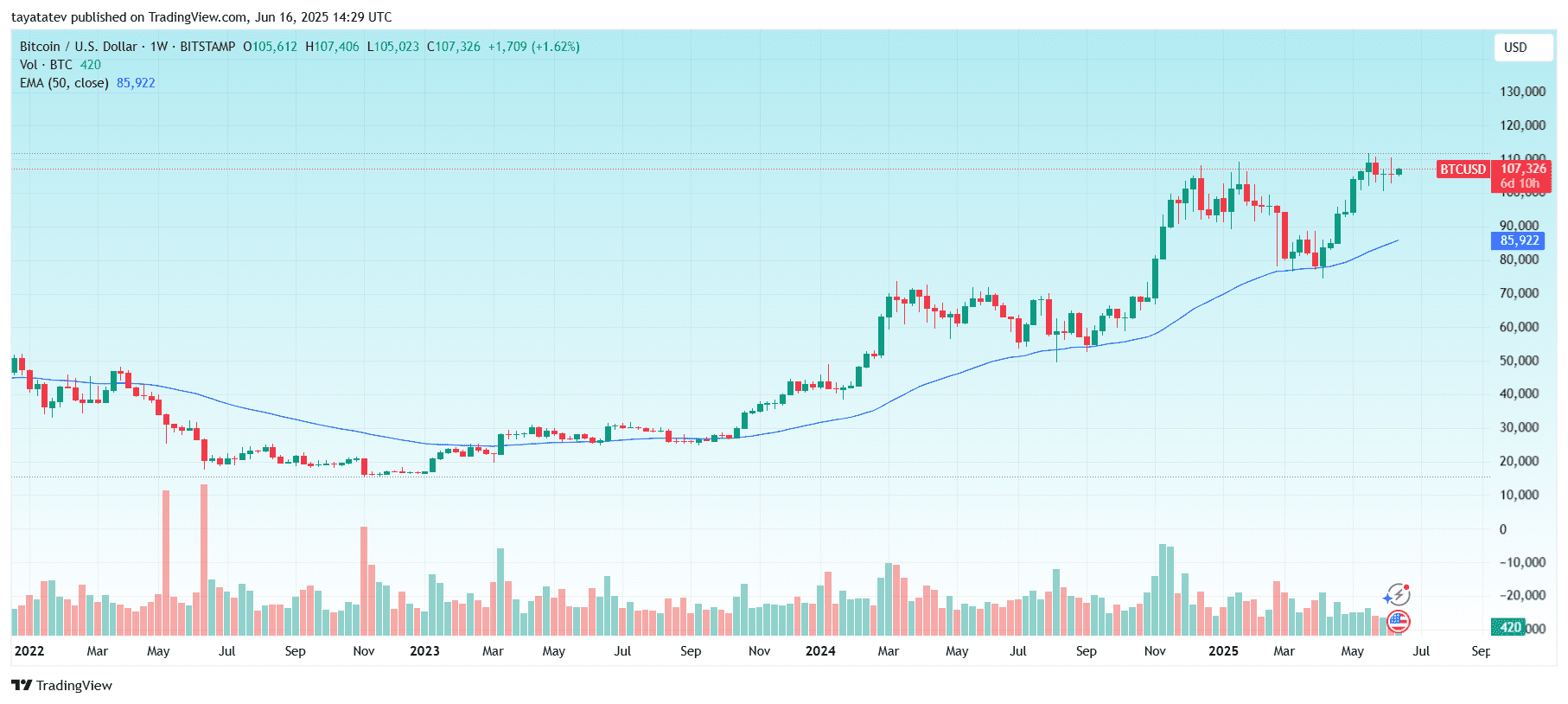

Bitcoin holds soil

While XRP won, Bitcoin also rose barely on June fifteenth. The ongoing Israel Iran conflict remained the dominant factor that promoted global risk mood. Iran's response to Israeli attacks on June 12 escalated the regional tensions, however the optimism of the late session for a ceasefire that supported the BTC price.

BTCUSD Weege Price card for USD 107,000. Source: tradingview.com

BTCUSD Weege Price card for USD 107,000. Source: tradingview.com

Until the start on June 16, the Nasdaq 100 -Futures rose by 51 points and reflected an improved mood. But uncertainty. Every prolonged conflict within the region could disturb the road of Hormuz, increase crude oil prices and possibly drive inflation higher.

Increasing energy costs would make the central banks' plans difficult to scale back rates of interest. If inflation peaks, the political decision -makers rate rates can have in mind a step that might steam economic growth and have an effect on recession concerns within the United States