XRP Futures dealers position on a possible drop in price, as shown from vital on chain metrics of Cryptoquant.

Charter title: XRP Ledger: Taker Buy Sell ratio – All stock exchanges. Source: Cryptoquant

In the past two weeks, the Taker purchase/sales rates of XRP have remained under 0.92 on June 1, 2025, which suggests that sales orders proceed to outweigh buy orders on the token market market.

A taker purchase/sales ratio below 1 indicates increased pressure on the sales page. This metric compares the quantity of aggressive purchase orders (Taker Buys) with aggressive sales orders (Taker Sells). If the ratio stays below 1 over an extended time period, it often signals that dealers close long positions or enter shorts.

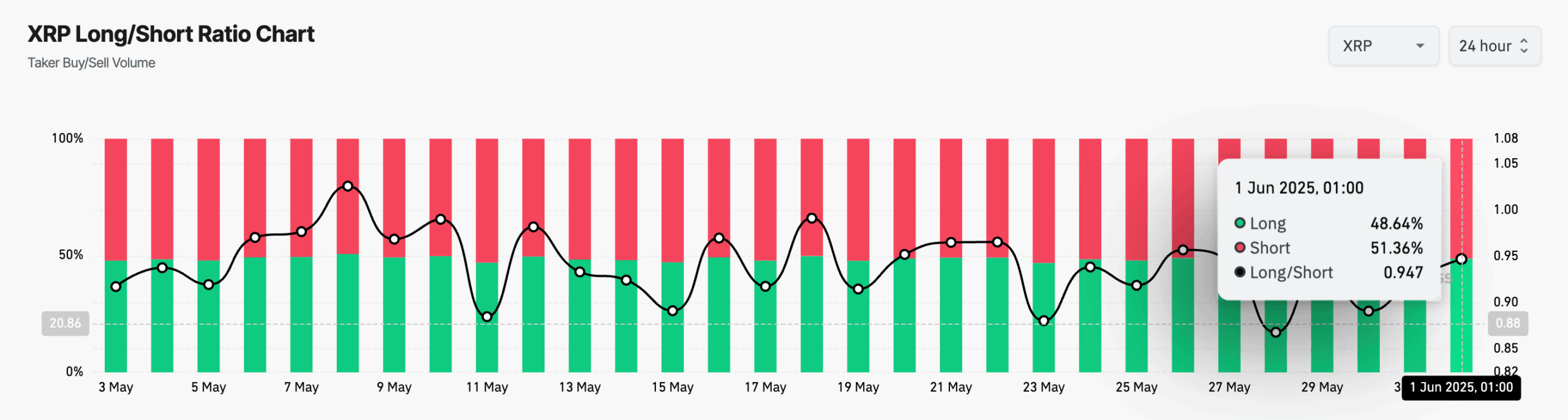

XRP -Futures dealers have a bearish bias because short positions have dominated since May eighth

Another bear indicator is the long/short ratio of XRP, currently at 0.94. This shows that more dealers have short positions and expect the worth to drop.

The data indicates a consistent sales pressure from Derivathändlers, which relies on the most recent negative dynamics in regards to the XRP market.

XRP Long/Short ratio diagram. Source: Coinglass

XRP Long/Short ratio diagram. Source: Coinglass

Since May 8, 2025, the Long/Short ratio of XRP has remained consistently under 1. The latest reading on June 1 shows a ratio of 0.947, whereby 51.36% of the positions are short and only 48.64% long. This implies that more futures dealers depend on a decline than on a rise.

The persistent imbalance signals that the bearish mood will not be limited to short volatility pikes. Instead, it reflects a wider market outlook wherein the dealer expect XRP to proceed to drop. The trend has been in existence for nearly a month and shows that short positions proceed to dominate the futures activity.

This longer pressure matches the weakening price card and confirms that retailers haven’t shifted towards an optimistic attitude.

XRP creates descending channel patterns, eyes 33% on the pinnacle when Breakout confirms

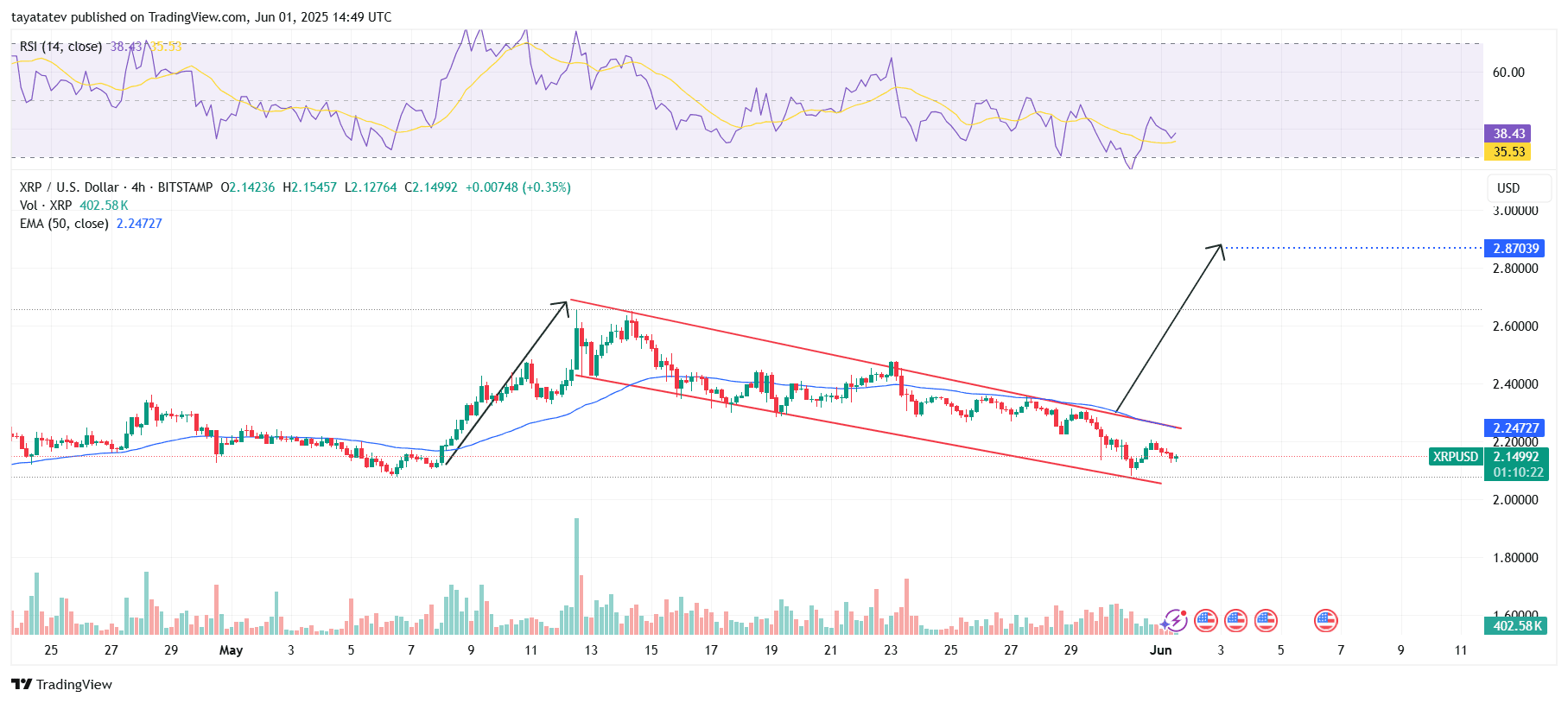

On June 1, 2025, the 4-hour diagram for XRP on US dollar (XRP/USD) formed a descending sewer pattern on Bitstamp.

XRP/USD 4-hour diagram. Source: Tradingview

XRP/USD 4-hour diagram. Source: Tradingview

A descending channel occurs when the worth between two parallel parallel trend lines moves and sometimes signals controlled sales pressure with the potential for a bullish outbreak.

XRP currently acts at USD $ 2.14992 and is situated near the lower border of the canal. If buyers push the worth over the upper red trend line, this pattern would confirm. Based on the quantity of the previous upward train, XRP could gather by its current level by 33% with the intention to achieve the projected goal of $ 2.87039.

At the moment, XRP stays below the 50-period exponential sliding average (EMA), which is $ 2.24727. This indicates short -term bear impulse. However, the worth campaign near the lower trend line and an increasing relative strength index (RSI) from the oversized area indicate a possible reversal.

The RSI value is 38.43 and rises at 35.53 over its signal line. This crossover often indicates the growing bullish dynamics. The volume also shows short discounts, which indicates that buyers may occur on the lower levels.

If the breakout is confirmed and XRP rejected, the swing could turn around, whereby the extent of $ 2.87039 acts as the subsequent key destination.

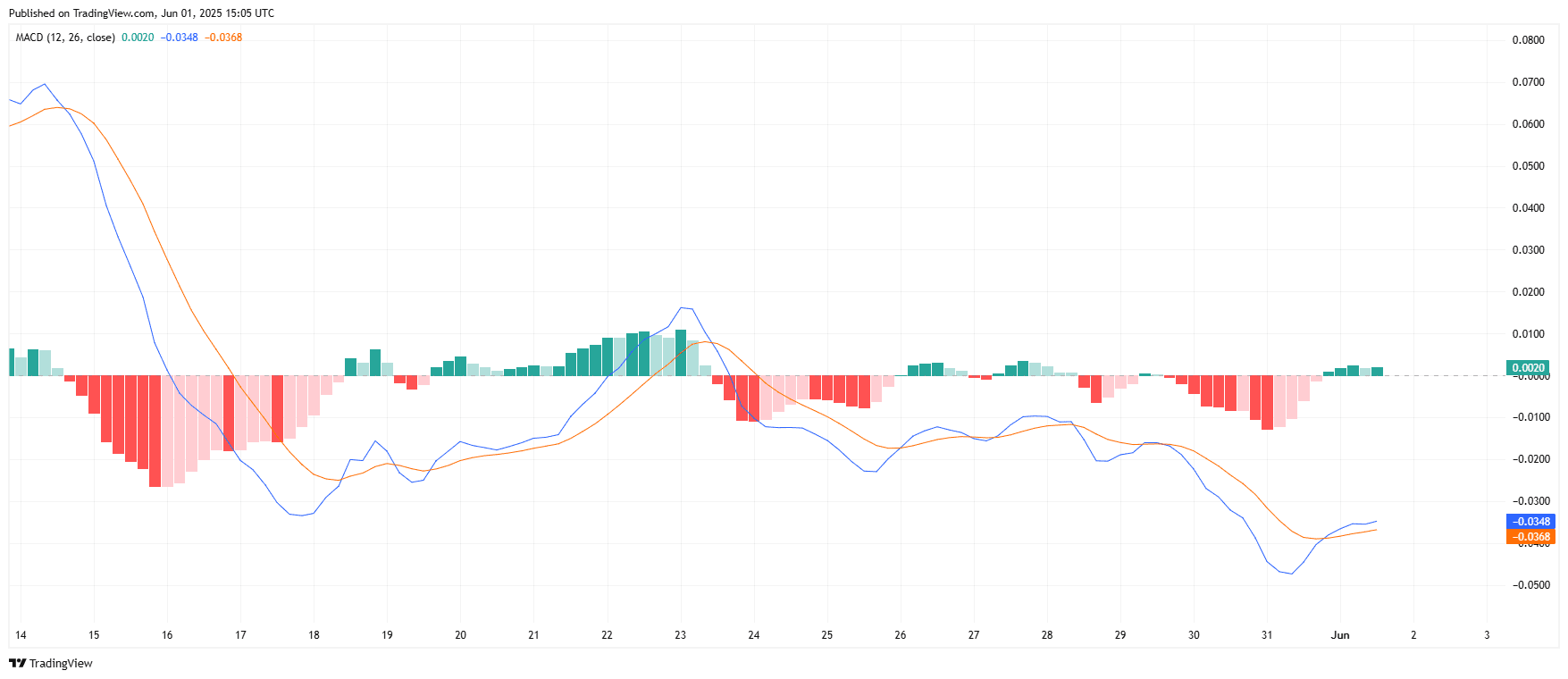

XRP MacD flashes an early bullish signal after the prolonged downward trend

On June 1, 2025, the indicator of moving average convergence (MACD) for XRP/USDT showed the primary bullish sign up days. The MacD line (blue) now trends upwards towards the signal line (orange), whereby a histogram value of +0,0020 incorporates a return after an prolonged red phase.

XRP/USDT MACD ad diagram. Source: Tradingview

XRP/USDT MACD ad diagram. Source: Tradingview

The MacD line is –0,0348, while the signal line is at –0,0368. Although each remain within the negative area, the narrowing gap shows that the sale of dynamics fades. The histogram also turned green for the primary time since May twenty fourth, which indicates that the barical impulse can change into weaker.

If the MACD line exceeds the signal line within the upcoming sessions, it could typically confirm a bullish crossover – an indication that the upward dynamics could follow. This displacement is similar with the present chart support levels and corresponds to the minor recovery in the info of the quantity and the relative starch index (RSI).

In summary, the MACD shows early signs of a possible trend reversal, however the confirmation is dependent upon the crossover and the continuing histogram growth.

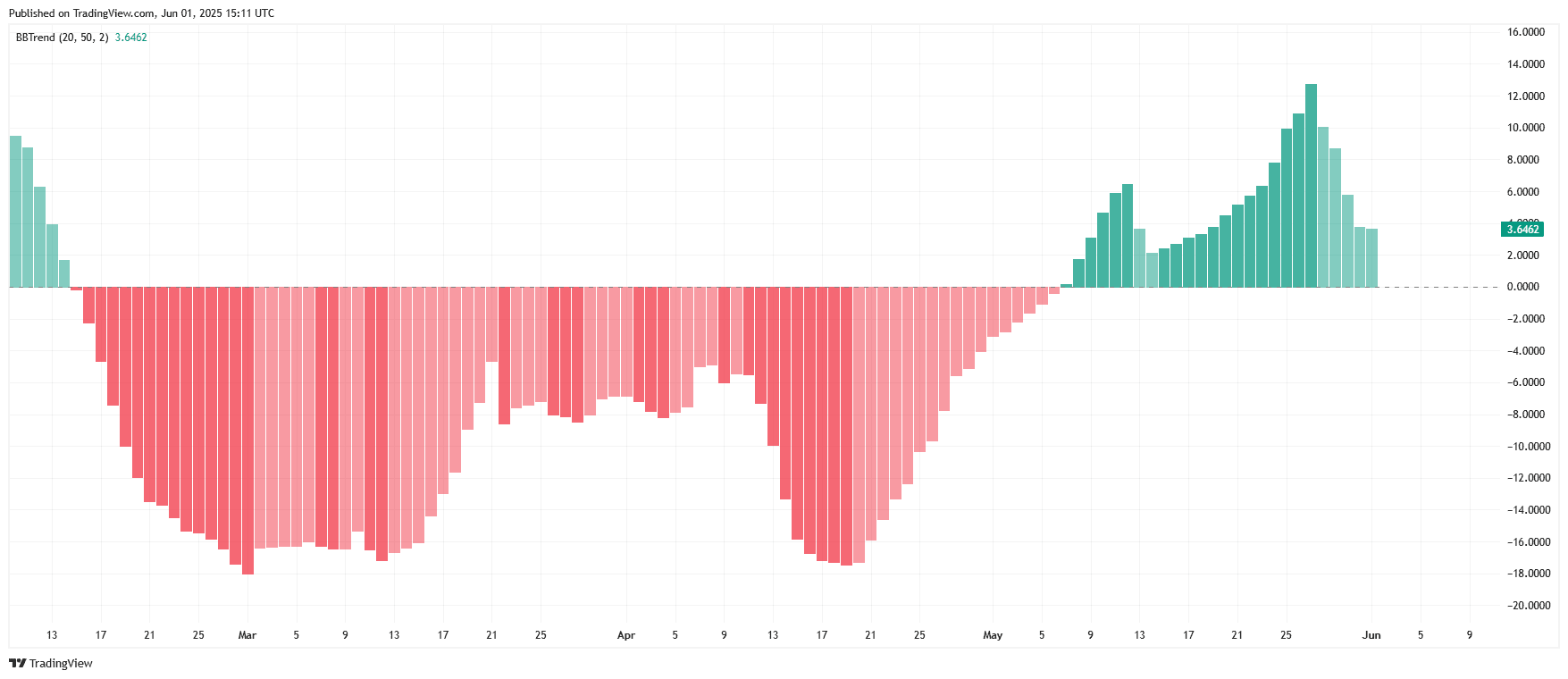

XRP BBTREND -indicator stays positive despite the retreat

On June 1, 2025, the BBTREND (Bollinger Band Trend) achieved an indicator of three,6462, which remained in a positive area after reaching an area peak at the top of May.

XRP/USDT BBTREND indicator diagram. Source: Tradingview

XRP/USDT BBTREND indicator diagram. Source: Tradingview

The BBTREND measures the main target and impulse. Positive values, especially over 1.0, typically confirm the presence of a bullish trend. In the case of XRP, the indicator has remained over zero because the starting of May, which shows that there are price fluctuations despite the most recent price fluctuations.

While the histogram beams were shortened within the last sessions, which indicates a reduced trend strength, the positive climb suggests that the upward trend remains to be intact. However, a continued decline within the stick height can signal weaker weakening prematurely.

In summary, it will probably be said that the BBTREND of XRP lies above the baseline and supports a bullish distortion, but the present delay suggests that retailers should observe exactly on the resumption or reversal of the trend or reversal.

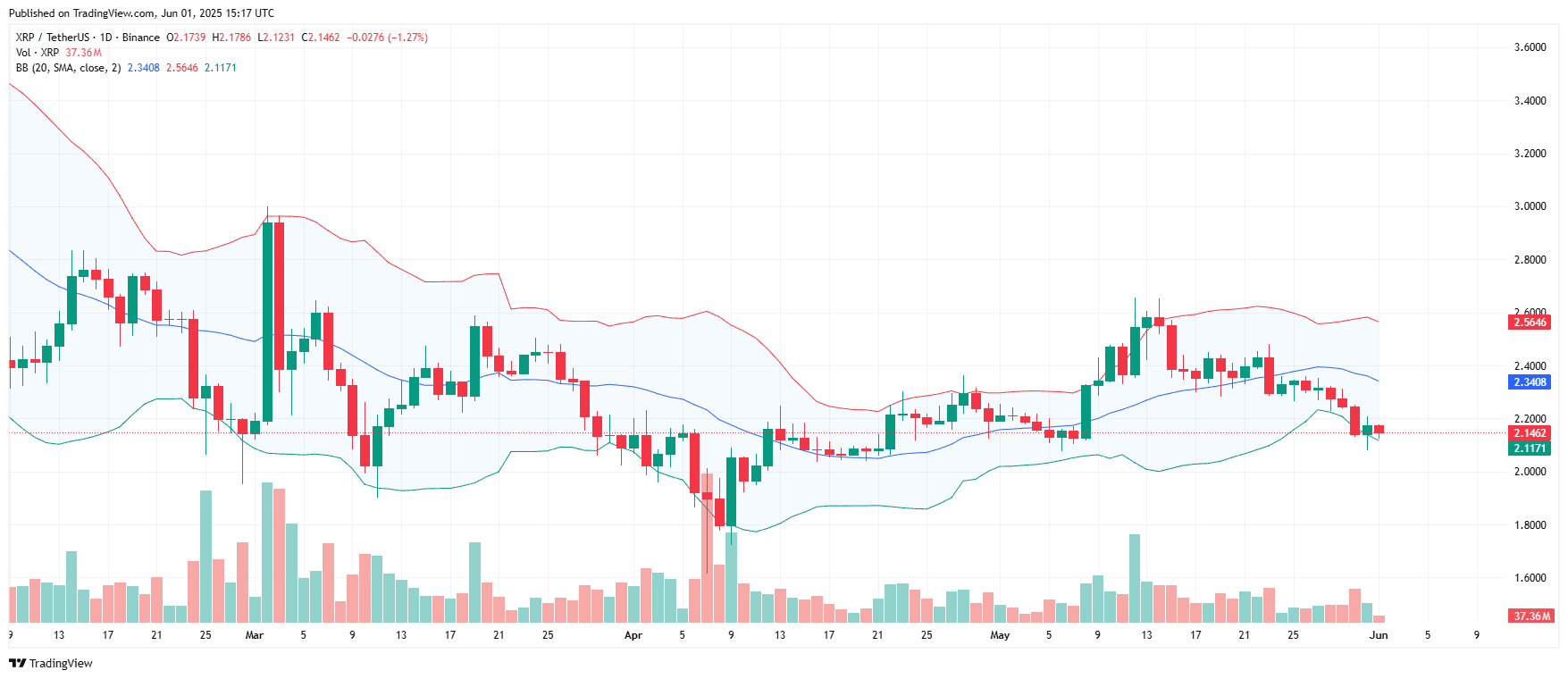

XRP falls under the medium band support on Bollinger-Band-Charts

The each day XRP-to-Tether diagram (XRP/USDT) in Binance showed that the worth fell under the center Bollinger band, the 20-day-free moving average (SMA), which is currently USD 2.3408.

XRP/USDT Bollinger tapes diagram

XRP/USDT Bollinger tapes diagram

Source: Tradingview

The indicator of the Bollinger ligaments consists of a medium SMA line and two outdoor straps – opper and lower – two standard deviations. These ligaments help measure the worth volatility and possible reverse zones.

At the time of the diagram, XRP acts with USD $ 2.1462, with the lower band at $ 2.1171 and the upper band is $ 2.5646. The price is now near the lower Bollinger band, which indicates that it has entered an oversized area.

The volume is 37.36 million and barely increased through the recent decline, which signals lively participation within the sale.

If XRP is above the lower band and the hip, the step could act as a brief -term level of support. However, the failure to win back the center band at $ 2.3408 can keep the bearish swing intact.