XRP is steadily acting over $ 2.10, and a few signs indicate that the worth could soon rise higher. One of an important signals results from a recent decline within the exchange reserves. On-chain data show that the quantity of XRP, which was kept on Binance, has reached the bottom level for several months. This decline often signifies that fewer persons are willing to sell their XRP, which may reduce the pressure on the worth.

The Exchange offer shrinks while owners move token from BinanceXRP

The exchange is shrinked when owners move token from Binance

Exchange reserves relate to the variety of tokens which are held on trading platforms corresponding to bony. If these reserves fall, which means more investors bring their XRP to non-public wallets or cooling stores. This is usually an indication that individuals annel their token in the long run as an alternative of selling them. By April 14, Binance held around 2.76 billion XRP. This is a severe decline in comparison with the start of this 12 months when the reserves were well over 3 billion XRP. A lower offer offered on the exchange makes it difficult for big sales processes to assist support the worth.

The Exchange Reserve of XRP falls. Source: Cryptoquant

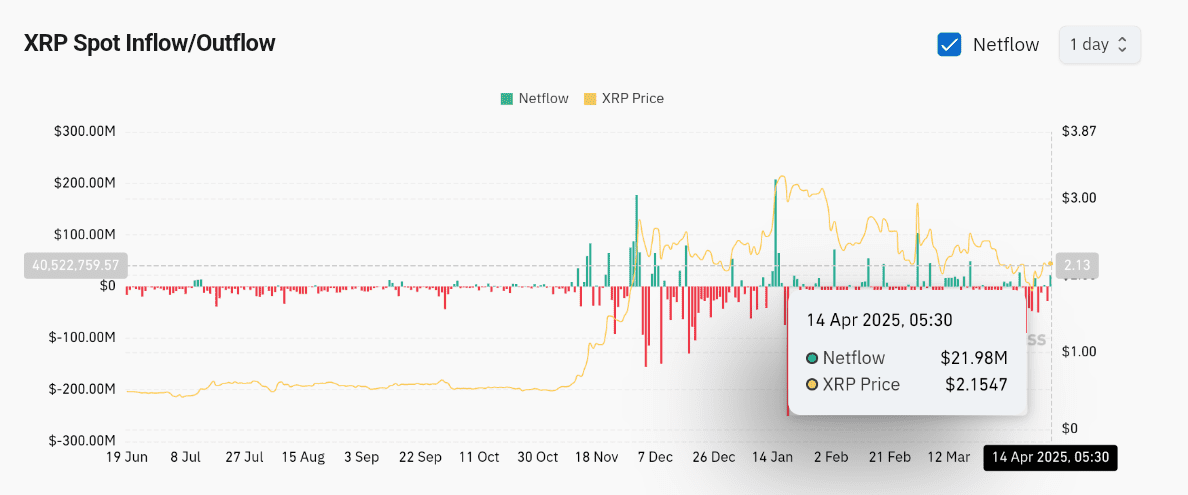

In addition, on April 14th, a net inflow of virtually 20 million US dollars recorded in spot markets. In the spot markets, buy and sell dealers crypto for immediate billing. A net inflow signifies that extra money comes onto the market to purchase XRP than left.

XRP -Spot inflows show energetic accumulation. Source: Coinglass

XRP -Spot inflows show energetic accumulation. Source: Coinglass

While inflows sometimes indicate that retailers are preparing for the sale, the context here suggests something else. Since the exchange reserves are falling and keeping it steadily, it is probably going that this latest capital will probably be used to purchase and keep XRP, to not drop them.

This form of accumulation was also observed before large rallies. If this trend continues, it could drive the costs even higher.

You may prefer it: Ripple is pushing for a effective of $ 50 million in XRP, for the reason that settlement approaches within the last stage

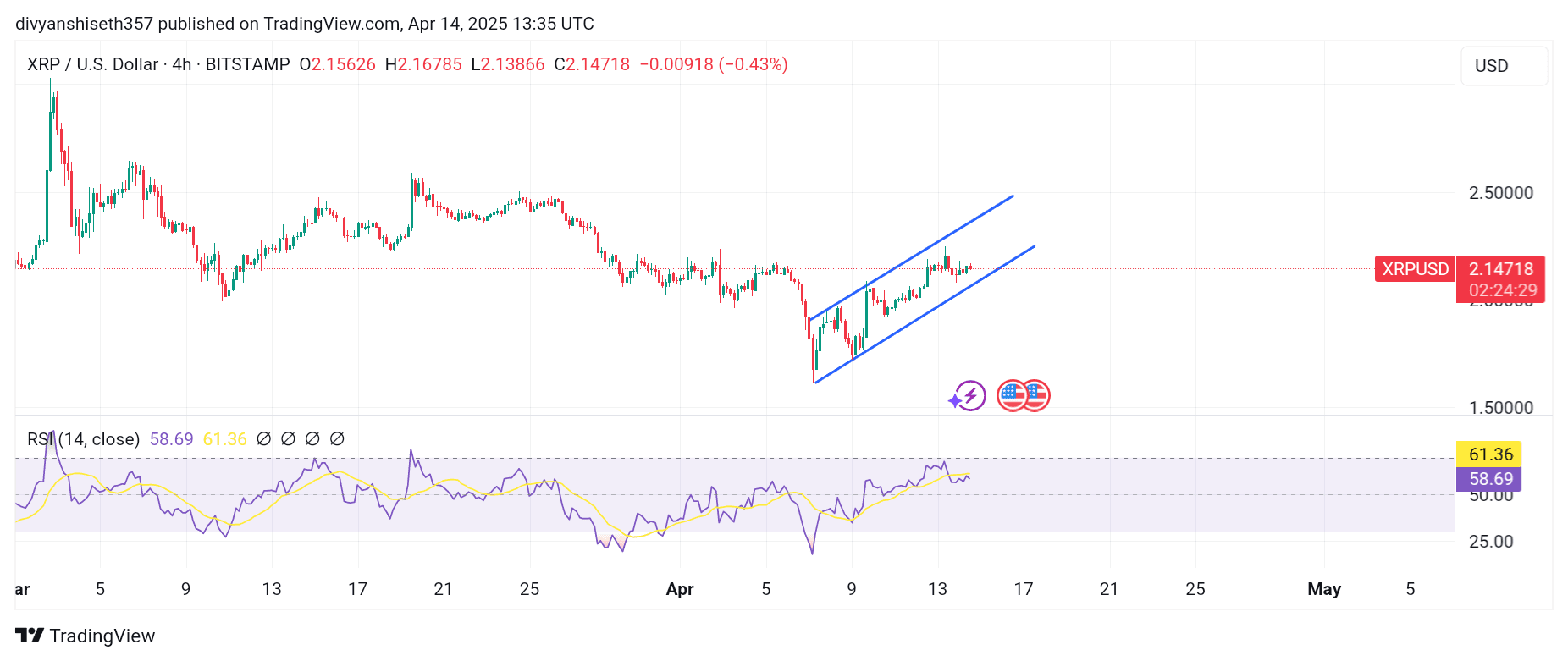

XRP acts in a bullish channel

With a view to the worth diagram, XRP has formed an ascending channel. The current price is $ 2.14, which is near the center of this channel. As long because the token stays on this rising channel, the trend stays optimistic.

XRP is currently within the rising channel. Source: Tradingview

XRP is currently within the rising channel. Source: Tradingview

Tokens RSI is currently 58 years. This is a healthy level and suggests that the worth still has space before it’s overbought.

The next resistance is between 2.30 and a pair of.50 US dollars. If the worth drops above the upper border of the canal and exceeds over 2.30 US dollars, this might make a powerful movement towards 2.50 US dollars. This level is vital because XRP didn’t cross the start of this 12 months. If it could actually break through this time, this will lead to a different rally.

However, if the worth doesn’t stay within the canal or falls under the support of USD 2.10, the bullish view could weaken. In this case, XRP could fall to USD 1.90 and even lower.