The XRP Ledger shows signs of weakening the user, although optimism over the approval of a spot XRP -TF grows. In January 2025, the variety of day by day lively addresses went from over 110,000 in June from over 110,000 to lower than 30,000 – a decrease of 75% over five months.

The XRP network activity returns to pre-rally levels

In January, the lively address of XRP has been on the best level for years. At that point, the assets had only exceeded 1.50 US dollars and, after the regulatory victories of Ripple and speculation, drove a wave of optimism over the broader institutional adoption. But five months later, the hype-on-chain faded.

The day by day address activity is now back at level firstly of 2023 – if XRP was still traded below $ 0.40. At the time of the pressure, nevertheless, the token continues to drift over 2 US dollars

XRP Ledger lively addresses. Source: Cryptoquant

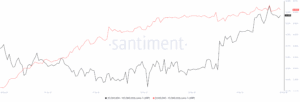

While the general activity has cooled down, great owners appear to position what could come next. Santime data show that item pockets between 10 and 100 million XRP increased their share of 10.4% to 12.2% to 12.2% in December.

Source: Santiment

Source: Santiment

In contrast, item pockets within the range from 1 m to 10 m have reduced their participations by over 3% in the identical period. This indicates that retail and medium-sized players step down, while Wale-Oft dipping risky-tolerant and more focused in the long run.

XRP -TF -Hype -Fahrpreis, not participation?

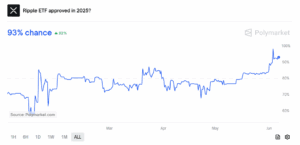

One reason why the value of XRP has remained resistant despite weaker on chain signals, the trust within the approval of a US spot XRP ETF is the trust within the approval of a US. According to Polymarket, the likelihood of ETF approval rose to 92% by the top of 2025, in comparison with 70% within the last month.

XRP ETF registration lodge reached 93%. Source: polymarket

XRP ETF registration lodge reached 93%. Source: polymarket

The increase in optimism follows quite a few developments. Financial managers, including bites, grayscale, Franklin Templeton and 21 Shares, have submitted XRP ETFs. The start of XRP futures through CME in mid-May added the narrative and Ripple through the regulatory progress-especially the licensing of RLUSD in Dubai-Baum to form the perception of legitimacy.

But feeling and use should not the identical. While ETF speculation is driving headlines, it has not translated to increased demand on chains. The decline in lively addresses shows this. And for the reason that price is currently on the mood moderately than usefulness, all delays or setbacks within the ETF process could uncover structural weakness.

Exchange activity stays stable

Exchange flow data provide more information on the commitment of the cooling market. Binances XRP inflows and drains have each declined since March. This slowdown of the activity matches the decline in network use and indicates that fewer retail participants act actively or move XRP – at the very least in the interim.

During the short rally of XRP over $ 3 firstly of this 12 months, each inflow-today, these rivers have stabilized, which indicates a waiting and monitoring position across the board.

XRP acts around $ 2.14 and is amongst a very powerful moving average values, including 20, 50, 100 and 200 EMA.

XRP/USD 4-hour price diagram. Source: Tradingview

XRP/USD 4-hour price diagram. Source: Tradingview

The relative strength index (RSI) stays near 41 and hovers just above the oversized area. The price campaign has flattened, the amount diluted and pulse indicators don’t signal a robust outbreak – but.

That doesn't necessarily indicate a collapse. In the absence of latest buyers or a fundamental increase in activity, nevertheless, it would be harder to justify, especially if the expectations in reference to ETF cool down.