BNB has been certainly one of the best-performing Layer 1 altcoins in the marketplace over the past yr. BNB can proceed to take care of this performance because of its ecosystem that’s closely connected to the massive user base of the world's leading crypto exchange.

Several on-chain indicators and trading data suggest that BNB is unlikely to see a pointy decline even within the event of market corrections.

Three strong demand drivers supporting BNB price in 2026

First, the common spot order size is one of the vital essential indicators of BNB price stability.

According to CryptoQuant, the common order size stays relatively large.

Average BNB spot order size. Source: CryptoQuant

The chart shows that the value zones are mostly characterised by orders starting from normal size to whale sizes. This reflects the continued participation of major investors.

“Average spot order sizes remain relatively large, indicating regular participation from supply-oriented or larger holders fairly than speculative retail flows,” said CryptoQuant analyst XWIN Research Japan.

At this level of liquidity, BNB advantages from strong bearish support from whale orders during price declines. This makes BNB higher able to take care of its value in difficult market conditions.

Retail investors seem like less visible within the spot market data. However, they continue to be actively involved within the BNB chain ecosystem. This activity has helped BNB Chain maintain its lead in weekly energetic users.

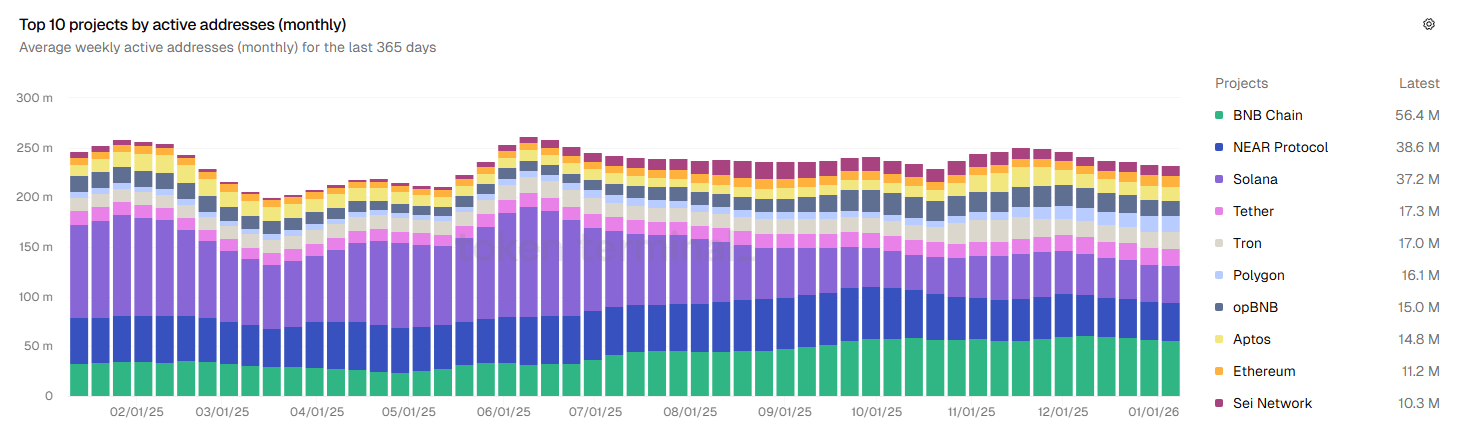

TOP 10 chains by energetic address. Source: Token Terminal

According to Token Terminal, BNB Chain recorded a median of 56.4 million weekly energetic addresses in the beginning of 2026. This number significantly exceeds that of competitors equivalent to NEAR Protocol (38.6 million), Solana (37.2 million) and Ethereum (11.2 million).

The chart shows a gentle upward trend since last yr, highlighted in green. This trend suggests that retailers are increasingly in search of opportunities inside the ecosystem. This dynamic contributes to BNB price stability and limits the chance of a pointy decline.

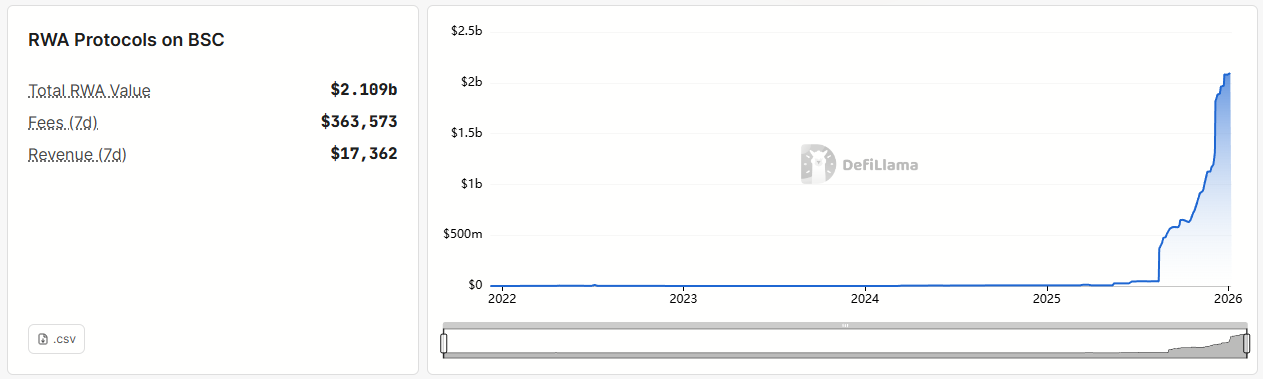

Additionally, the expansion of Real World Asset (RWA) protocols on Binance Smart Chain (BSC) has reached recent highs when it comes to Total Value Lock (TVL). This trend reflects increasing institutional demand.

According to DeFiLlama, the RWA TVL on BSC has exceeded $2.1 billion. The graph shows a robust expansion from the center of last yr to today. The majority of this value is represented by tokenized US treasuries from Hashnote, BlackRock and VanEck.

With demand supported by whale trading activity, retailer participation on the BNB chain, and the introduction of institutional RWA, many analysts expect BNB to succeed in $1,000 again within the near future.

The post Why is BNB unlikely to see a pointy decline in 2026? appeared first on BeInCrypto.

Article source: beincrypto.com

The post Why is BNB unlikely to see a pointy decline in 2026? appeared first on Crypto Adventure.