Cardano (ADA) has dropped to $ 0.6328 and has dropped by 1.73% within the last 24 hours. Autumn follows whale sales, a technical collapse and a continued market rotation in Bitcoin.

The decline comes when the Cardano community discusses a proposal for the liquidity of the Ministry of Finance, which might convert 140 million ADA into stable coins with around 88.6 million dollars. The aim is to assign funds for the event of ecosystems.

Source: Charles Hoskinson on X

The founder Charles Hoskinson made it clear that the sale could be carried out by over -the -counter (OTC) or algorithmic methods with a purpose to avoid the results on the open market prices. However, retailers appear to have been sold at short notice, with ADA fell by 9.22% last week.

The most significant support levels break down in the midst of the downward

Cardano broke under a very important fibonacci support level at $ 0.662. The next support is near 0.615 US dollars, which was briefly tested on June 16.

ADA/USD 4-hour price diagram. Source: Tradingview

ADA/USD 4-hour price diagram. Source: Tradingview

The MacD histogram is at -0.0046, which indicates a stronger bear trend. RSI is currently 37.98 and is approaching the conditions oversold, but just isn’t yet low enough to suggest a reversal. ADA stays amongst its most significant moving average values of the 50-day SMA at 0.718 USD and the 200-day SMA is 0.813 USD-sine prospects.

ADA has also broken under the middle line of a descending channel that has defined prices because the end of 2024. This departure shows an increased downward risk, with the lower channel boundary being almost 0.60 US dollars.

The data from Onkain derivatives also show an increasing bearish mood. The financing rates through large stock exchanges are still negative, which indicates that retailers pay a premium to stay short. The open interest has decreased to 317 million US dollars, which indicates a reduced trust and a falling speculative activity around ADA.

You can also prefer it: Cardanos Charles Hoskinson publicizes Glacier Airdrop to 37 million bridles

Whales invite a whole bunch of thousands and thousands in Ada

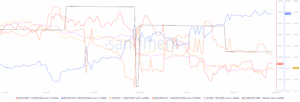

Wal addresses sold about 270 million ADA last week. Despite a rise within the 24-hour trade volume from $ 739 million, Santime data show that this increase is resulting from the distribution and never by accumulation.

Wal distribution diagram. Source: Santiment

Wal distribution diagram. Source: Santiment

Large transactions of greater than 100,000 US dollars have dropped greatly. Wal transaction fake control of transmission of over $ 1 million is sunk to multi-stage lows, which highlights the withdrawal of high-quality investors.

At the macro level, the Bitcoin dominance rose to 63.96 last day, by 0.13%. This shows a rotation of the capital of old coins in Bitcoin. In addition, ADA and similar token were confronted with reduced tributaries, since retailers in the midst of a neutral market mood result in relatively stable assets.

The development ecosystem expands, but cannot compensate for the pressure

Cardano recently published the weekly development report on June thirteenth. According to the report, the blockchain now houses over 2,004 decentralized applications. The variety of local assets has reached 10.83 million, and intelligent contract provisions – including Plutus and Aiken scripts – approaches 140,000.

Cardano's weekly development report on June thirteenth. Source: Cardano

Cardano's weekly development report on June thirteenth. Source: Cardano

Remarkably, Minswap stays with $ 79 million within the 30-day trading volume of Cardano's largest decentralized exchange. In addition, the loan protocol LIQWID holds $ 80.9 million in total value (TVL). However, these developments weren’t sufficient to compensate for the sales pressure triggered by macro and structural aspects at short notice.