Vaneck launched his first Realld Asset (RWA) tokenization Fund. The VBILL -TOKEN Fund introduced on May 13 offers institutional investors access to tokenized US financing calculations. The start is a component of a partnership with the seedization platform for securitation.

Vaneck Vbill token Fund Start Statement. Source: PR Newswire

According to the official explanation of Vaneck, the VBILL -TOKEN Fund is operated in Ethereum, Solana, BNB chain and avalanche. On three of those blockchains -Avalanche, Solana and BNB chain -minimum subscriptions start at 100,000 US dollars. For Ethereum, the minimum investment is 1 million US dollars.

The Vaneck RWA fund goals at institutions that need to assign funds for short-term debt of the US government via blockchain infrastructure. The fund offers one in every of the most important traditional asset classes which might be currently token.

Vbill token find to compete with black rock and Apollo

The Vaneck RWA fund enters a market that’s already managed by firms comparable to Blackrock and Franklin Templeton, each firms RWA funds called Buidl and Benji. In January 2025, Apollo began a personal loan tokenized fund that entered the identical category.

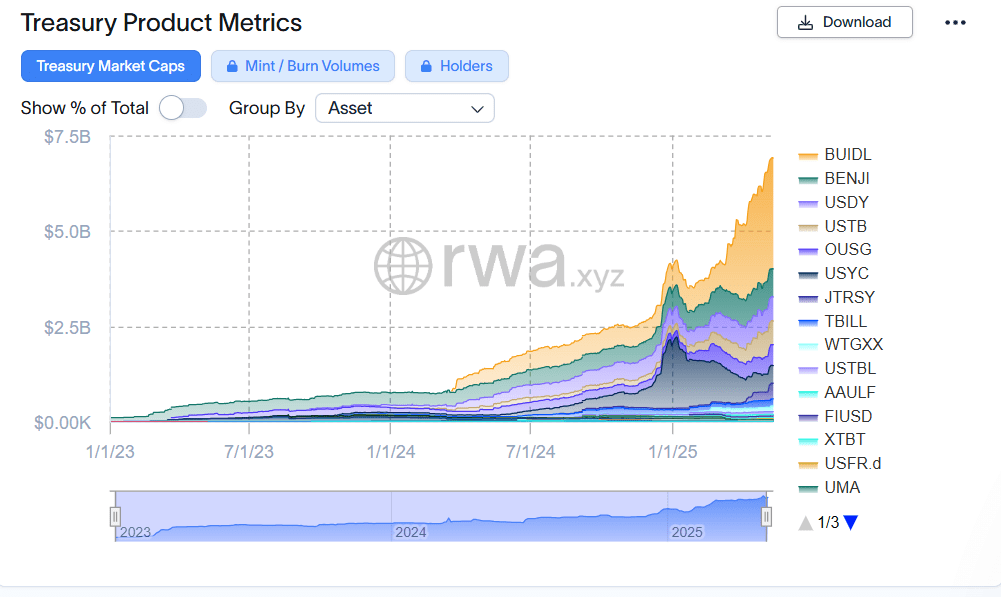

Token US financing has a market capitalization of 6.9 billion US dollars based on RWA.XYZ data. This makes them the second largest group throughout the RWA area behind private loan. The VBILL TOKEN FISS goals to make use of Smart Contract Systems and Digital Compliance Tools to supply institutional access to state coffers exposure.

Tokenized treasury market growth based on asset. Source: rwa.xyz

Tokenized treasury market growth based on asset. Source: rwa.xyz

The latest fund is expanding the existence of traditional financial institutions in blockchain-based markets. Other youngest participants are Franklin's loan offers from Benji and Apollo, each of whom are tailored for giant customers.

The certificate of the tokenization platform supports the VBILL infrastructure

The Sekenization platform for securitization runs your entire operation of the VBILL -TOKEN Fund from Vaneck. From May 2024, Securitice has token over 3.9 billion US dollars of over 3.9 billion US dollars over various structures over 3.9 billion US dollars. In the identical month, the corporate secured a round of 47 million US dollars in a round of Blackrock.

Security enables the regulated exhibition and persecution of digital securities. It helps Vaneck to operate the VBill token fund in all 4 blockchain networks. The platform ensures digital compliance and records for financial instruments in institutional quality.

The strategic partnership enables Vaneck access to the whole infrastructure of securitize for the management of tokenized assets. This includes smart contract provision, digital identity tests and blockchain-based reporting.

Paul Atkins from SEC compares the tokenization with digital music shift

At a round table of the US Securities and Exchange Commission on May 12, Paul Atkins, former SEC chairman, commented on the consequences of RWA tokenization. He said the method is comparable to the digital transition within the music industry.

“Just because the switch to the digital audio revolutionized the music industry, migration based on Onchain Securities has the potential to convert points of the securities market by completely latest methods for output, retail, ownership and use of securities.”

said Paul Atkins Sec.

He noted that the blockchain infrastructure could change the functioning of the securities functions and added that many existing SEC rules don’t address latest market structures which might be supported by tokenized assets.

The round table focused on legal and technical changes because more firms take onchain models for securities. Paul Atkins SEC emphasized that digital systems could soon introduce latest ways to oversee securities beyond the scope of the present regulations.