Tron StableCoin transfers amounted to $ 694.54 billion in May 2025. Whale money exchanges, which were defined as people who were broadcasting transactions over 1 million US dollars, made 59% of the monthly volume, in response to Cryptoquant, $ 411.2 billion.

USDT transmission volume on Tron. Source: Cryptoquant

The network now processes over 2.4 million USD transfers each day and reflects the increased use by high-quality accounts. The USDT activity of Tron exceeded Ethereum each in volume and in 2025.

Tron StableCoin supply sticks to USD 79 billion

Usdt's offer to Tron rose from 58 billion US dollars to $ 79 billion in six months. In May, the typical day by day USDT volume reached 23.7 billion US dollars. The increase in volume and offer reflects the increased demand for large-scale stable coin payments in blockchain systems.

Kryptoquant Analyst yes Market-Say:

“Stable coins turn into an important a part of the crypto acceptance. On-chain data also show that whales use stablecoins actively.”

Diagrams from the cryptoquant highlight consequence of the monthly crossing in USDT transmission of Tron.

TRX transfer volume Tops $ 121 billion in May

In parallel to StableCoin growth, the monthly TRX transfer volume reached 490.3 billion tokens price $ 121.2 billion. This increase reflects the broader use of TRX for facilitating transmissions with a high throughput within the network.

TRX supports the transaction layer on Tron, which enables high-frequency and Fee-anddt movements. The increase within the TRX volume indicates higher use in decentralized applications and services.

Tron now leads USt broadcasts across all chains

From May 2025, Tron has the most important proportion of USDT supply and transaction volume under blockchains. Waltransfers and high frequency activities have made the network to the upper channel for stablecoin flow.

Cryptoquant metrics confirm Trons lead in the worldwide stablecoin cycle. Tron StableCoin transfers proceed to dominate day by day volumes and huge value settlements.

Stablecoin Market forecast 2 trillion dollars

A forecast of the US Ministry of Finance estimates that the StableCoin market could achieve 2 billion dollars by 2028, which is attributable to tokenized assets, institutional use and wider payment obligation.

Trons increasing activity shows how the StableCoin infrastructure is scaled. With whales which can be transmitted over $ 400 billion in a single month, and day by day transactions of greater than 2 million, Tron stays of central importance for financial systems in stablecoin.

Tron Price forms symmetrical triangle, Bärische Breakdown targets $ 0.2434

June 14, 2025-tron (TRX) formed a symmetrical triangle pattern on the 1-hour diagram after a severe decline to start with of this week. The price is now traded at $ 0.2704, somewhat below the exponential moving average from 50 period (EMA) to $ 0.2723.

Trx symmetrical triangle breakdown signal. Source: Tradingview

Trx symmetrical triangle breakdown signal. Source: Tradingview

After an ideal decline on June eleventh, the symmetrical triangle began to form, the worth compressed to narrower heights and depths. This diagram pattern signals the market notification and frequently precedes an outbreak towards the previous movement – on this case down.

A confirmed break below the lower carrier of the triangle could push Trx down by about 10%and place the subsequent destination near USD 0.2434. This level corresponds to the previous support from the start of June, characterised by higher volume and historical consolidation.

The trading volume has remained low through the formation of the triangle, which regularly results in an outbreak as soon because the momentum returns. The bear structure stays valid so long as TRX holds below the EMA and doesn’t close above the upper resistance of the triangle.

If the sellers regain control and speed up the impulse under the support line, a movement towards $ 0.2434 stays likely.

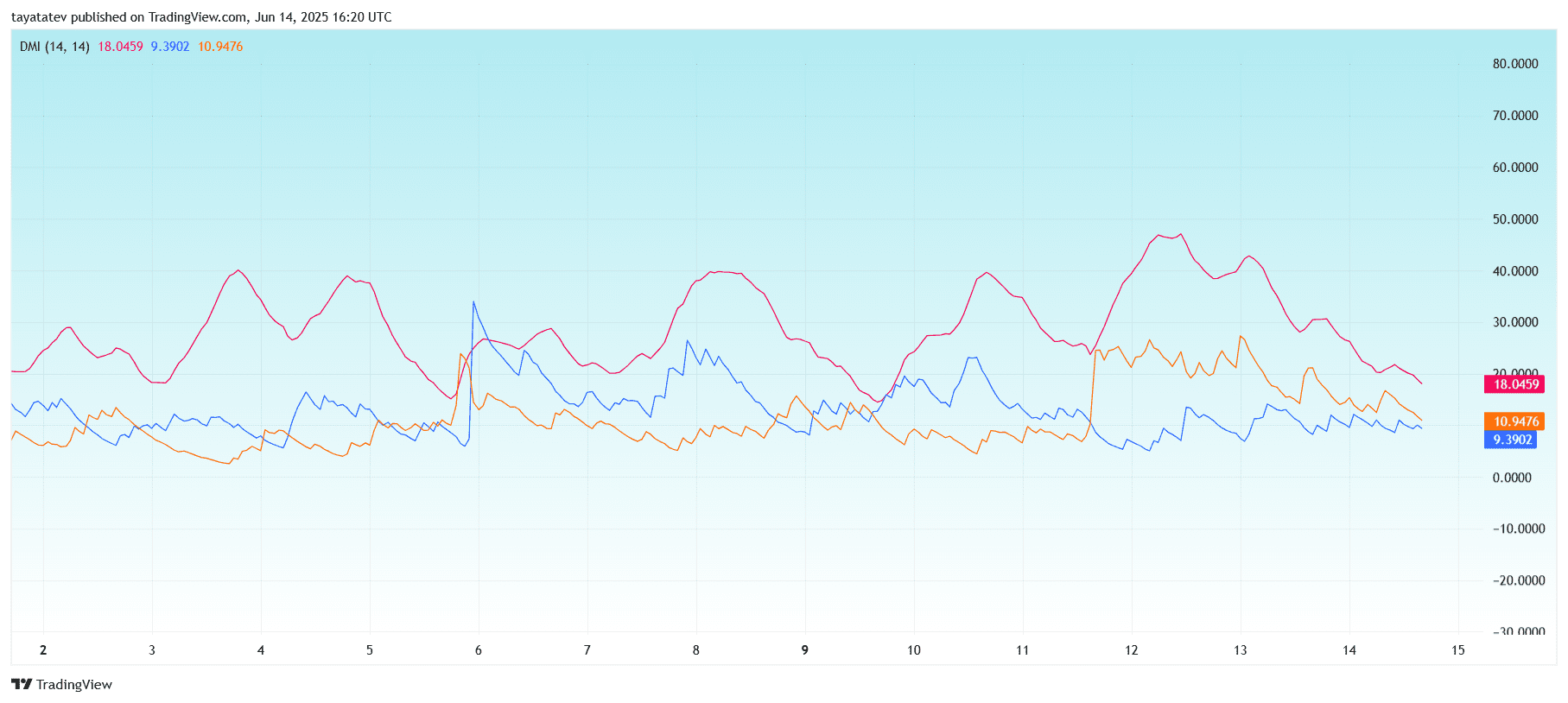

Tron DMI indicator shows a weak trend strength before the potential collapse

June 14, 2025-the directional movement index (DMI) within the 1-hour diagram of Tron (TRX) shows a falling trend strength. The average direction index (ADX) shown in red has fallen to 18.04 and signals a weak and fading trend.

TRON DMI trend signal on 1h diagram. Source: Tradingview

TRON DMI trend signal on 1h diagram. Source: Tradingview

The +DI line (orange), currently at 10.94, is barely above the –di line (blue), which is 9.39. The tight gap between the judicial indicators reflects the indecisiveness between buyers and sellers. This comes when TRX is traded below the 50-period exponential moving average (EMA) and stays in a symmetrical triangle pattern.

At the start of this month, a stronger ADX reading confirmed over 40 trend impulses. However, the newest decline under 20 indicates that the trend loses the strength. If the ADX falls under 20, the worth campaign is usually certain inside range or prepares for a breakout from consolidation.

This weakening trend strength matches the triangular formation in the worth diagram. If the –di line goes back above the +DI line, while the ADX rises again, this will confirm the downward pressure.

TRX continues to be the danger of a information within the direction of 0.2434 US dollars, especially if the direction of direction increases to sellers and the quantity increases.

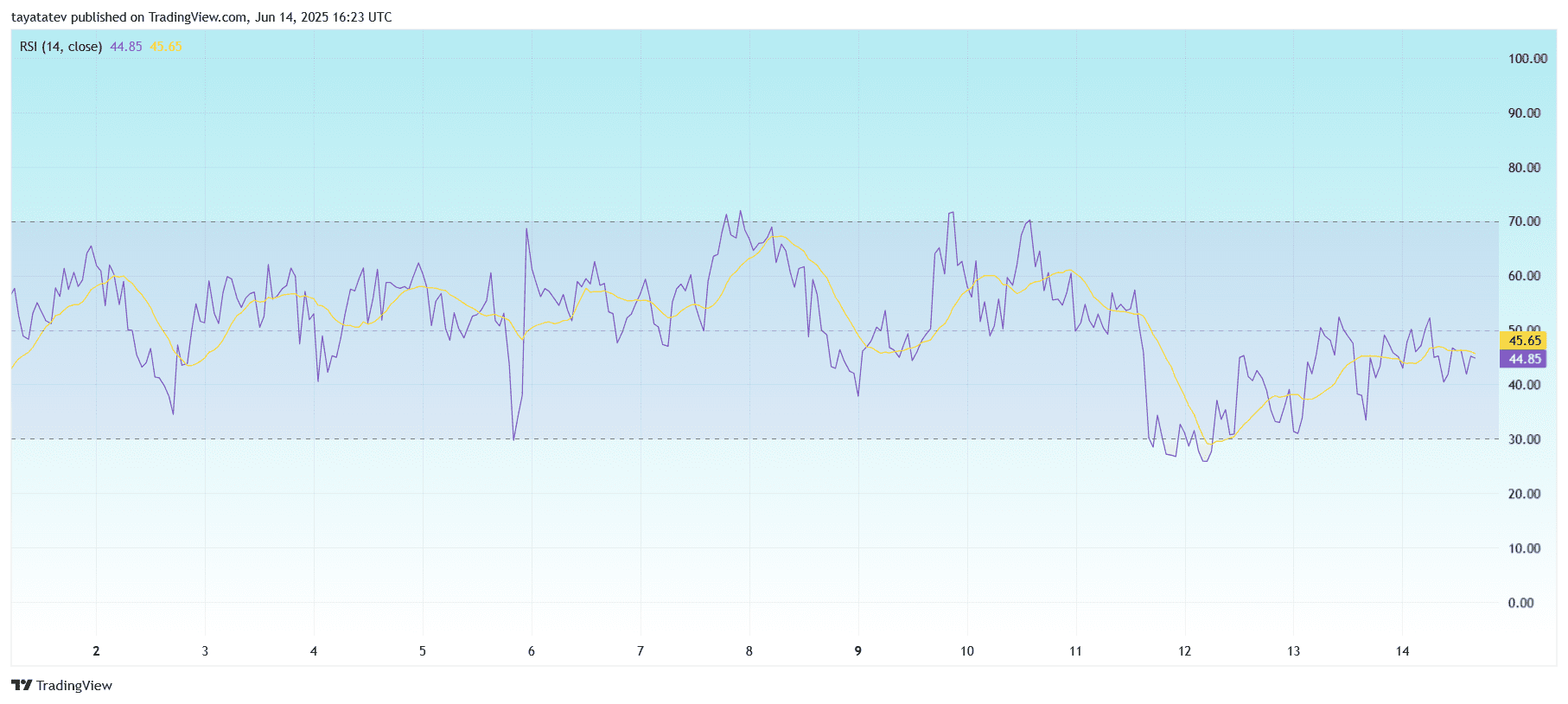

Tron RSI parks under 50 since the impulse stays weak

The relative strength index (TRX) of Tron (RSI) within the 1-hour diagram stays neutral to storage and hovers at 45.65 at 44.85. This level indicates a weak dynamic, although the buyers should not have to regulate after the recent drop in price.

Tron RSI signals weak impulse under 50. Source: Tradingview

Tron RSI signals weak impulse under 50. Source: Tradingview

The RSI has not stopped it over the center of the 50 level of fifty since June 11, after a severe decline that pressed the indicator near the oversized territory. The attempts to revive remained under the neutral line and signal a scarcity of strong optimistic pressure.

The lateral movement near the 45 area, combined with rejection of fifty levels, reflects hesitation available on the market. Trx can remain rigorously or slimmer Bearish, unless the RSI increases over 50 with increasing volume.

If the worth drops under the symmetrical triangular support observed in earlier diagrams, RSI could quickly fall into the oversold threshold at 30, which indicates one other down risk.