Pi Networks Native Token Pi continues to dissolve and falls to 0.63 US dollars after a decrease of 14% last week. The decline shows that the pressure on a project remains to be struggling to prove the worth of the actual world. Fruity Pi, a blockchain-based game that’s integrated into Pi's Wallet and Ad Network, has attracted users' attention.

The PI network is up with tokens, declining owners and the PI2 -day -day speculation -resistance values as a bear impulse

The game developed by a studio, which has worked with Nintendo and Disney, is promoted as a vital driver for ecosystem activity.

The variety of PI -Network coil holders decreases.

However, the timing raises questions. Despite the rollout of the sport, on-chain data show a gradual drainage of householders. The persecution of wallpocks shows a continuing net decline within the PI property, with the each day losses 45,000 US dollars in value. PIS self -declared 47 million user claims are not any longer visible on his website or on the community materials, which causes doubt about commitment and commitment.

Commercial activity also reflects the weakness. The overall market capitalization of the network has eroded itself and the view has increased that early believers pull out.

In the meantime, optimism will probably be redirected on June 28 towards Pi2day-a event driven by the municipality, which was previously used to record larger updates. The poor performance of the token and the longer silence of the team could marry the consequences of the day on the PI -Munich price effect of the day.

Fruity PI is a breakthrough and greater than distraction on this environment. Anything but a final update in the approaching days wouldn’t help the project.

The PI network is confronted with token rest, declining owners and Pi2day speculations

The PI network is exposed to a direct systemic risk through an upcoming supply shock. A planned unlocking of 335.2 million PI coins in the subsequent 30 days will face an already saturated market. With the trade with PI last week, almost 0.63 USD after a decline of 14% last week.

Unlock them– Approaching to the reward of early users – now the function as a liabilities, in circulation, without corresponding to the demand or the profit and to serve severe stress for price stability.

At the identical time, the project is experiencing a pointy contraction of its own -based base. Erosion signals greater than the short -term exit liquidity; It indicates a structural weakening of the network participation. If the bottom of the long -term owners shrinks, the transaction speed decreases, the demand for tokens and the undermining of price resilience reduces.

PI Network fans expect great announcements on PI2 Day, however the core team has thus far been silent.

PI Network fans expect great announcements on PI2 Day, however the core team has thus far been silent.

Market capitalization continues to follow this downward path and reflects PI's inability to maintain trust within the increasing offer. THese developments develop before Pi2day, planned for June twenty eighth. Despite online speculations on potential Main network Operating or ecosystem upgrades, the PI Core team has not offered a verifiable roadmap or schedule.

In previous cycles, such events have given little beyond the aspiration messages. Market participants could prepare for disappointment.

Every failure to offer concrete progress, reminiscent of B. confirmed exchange lists, Dapp Integrations or the like, Could arrange aggressive short shortening activities. In this scenario, impulse dealers and Leveraged positions can proceed to drop the worth. This ecosystem is just not held together without executionR.

The level of resistance were considered a bearish impulse

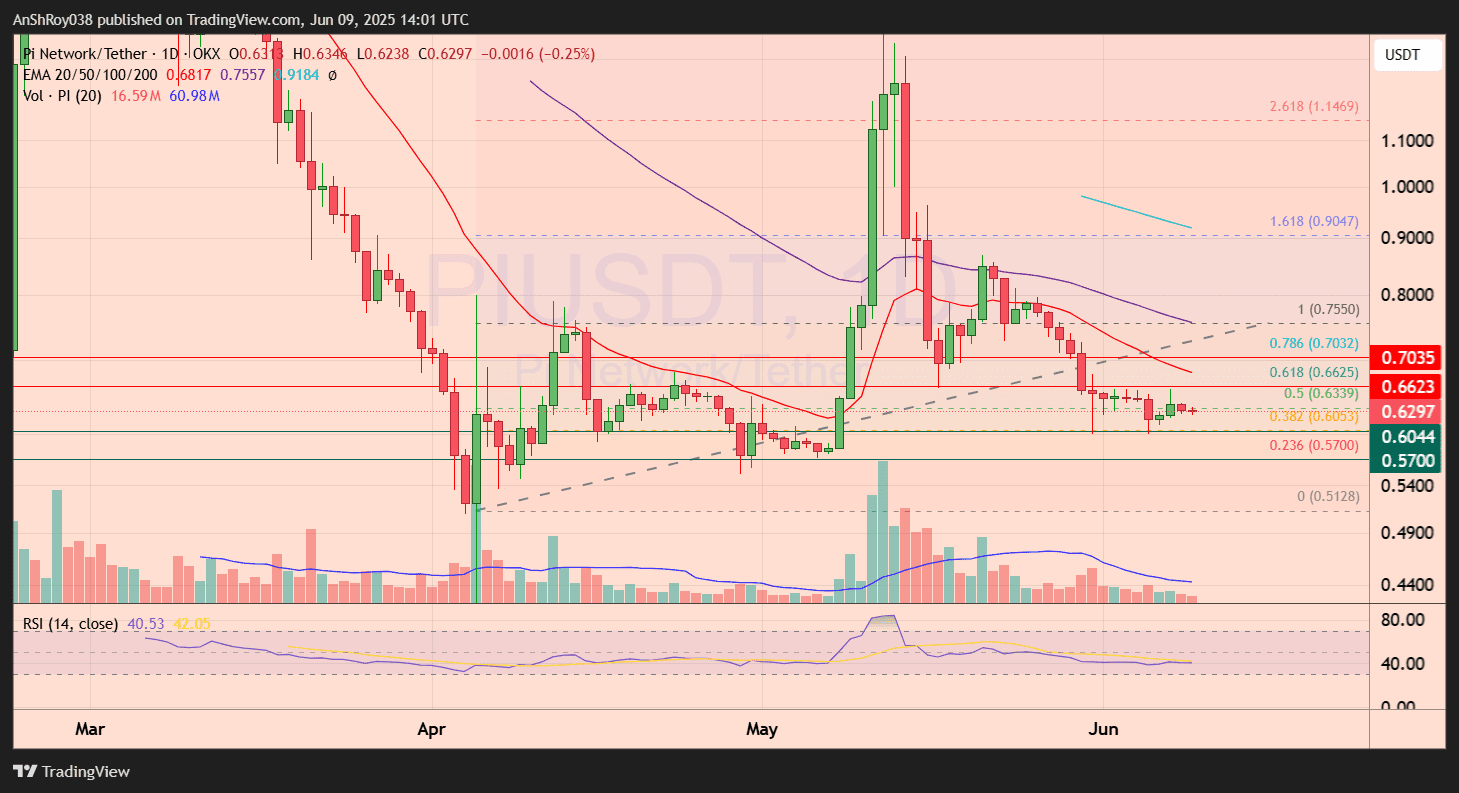

PI/USDT continues to hovers near $ 0.63 and is aligned down below a vital confluence zone. The price campaign is suppressed, with the token under the immediate resistance being caught near $ 0.66. Attempts to regain this level have failed, which indicates that a weak, bullish conviction and a persistent overhead supply occur.

The 20-day EMA, which drops down and acts under the 50 and 100-day emas, reinforces the prevailing bear trend. The volume has also declined steadily and confirms that a scarcity of buyers lack the present level. If Bullen manage to regain 0.66 US dollars, the subsequent resistance is near USD 0.70, a zone through which previous rallies have vice versa. The failure of breaking this band would consider the PI Prize of PI coins vulnerable to further disadvantages.

Pi usdt Daily Price Chart with RSI. Source: Tradingview

Pi usdt Daily Price Chart with RSI. Source: Tradingview

On the opposite hand, immediate support is resting near $ 0.60. This level has provided temporary pedestals, but impulse indicators show a limited strength. The RSI hovers near 40 and reflects the subdued demand and no signs of a bullish divergence. A violation of the 0.60 dollar -Sock would suspend the token with a deeper drawdown with the subsequent support of USD 0.57.

In view of the weakening structure and the dearth of strong recreation signals, any jump towards resistance zones could arouse a brief interest. Until the worth with volume support over 0.66 US dollars recaptured and is, the trail of the slightest resistance stays down. The risk of cascading stop losses below $ 0.60 stays since the mood deteriorates and market liquidity has more extensive market liquidity.