On June 15, 2025, the PI/USDT diagram from PI Network on OKX showed an ascending sewer pattern within the 1-hour period. An ascending sewer pattern is a bearish technical formation during which the value between two parallel trend lines moves up before it often collapses.

Piusdt -price creeping risk. Source: Tradingview

The pattern was formed after a pointy price that picks up on the bottom from June thirteenth. PI/USDT has now touched the upper resistance of the channel near 0.616 US dollars and began to withdraw. The 50-hour exponential sliding average (EMA), which is currently $ 0.5996, is just under the lower trend line, which indicates a critical level of support.

When the value breaks under the channel and the EMA loses, the pattern implies a possible decrease of 12 percent in comparison with the present price of USD 0.6148. This step could bring the value towards the extent of $ 0.5370, because the projected drawback of the table shows.

The volume of the breakout spike and the follow-up promotion shows a weak purchase pressure. In addition, the bear wick signals on the most recent candle rejection from the highest trend line. If that is confirmed by breakdown below the lower trend line and EMA, the bear's Bärische goal of $ 0.5370 can soon come into play.

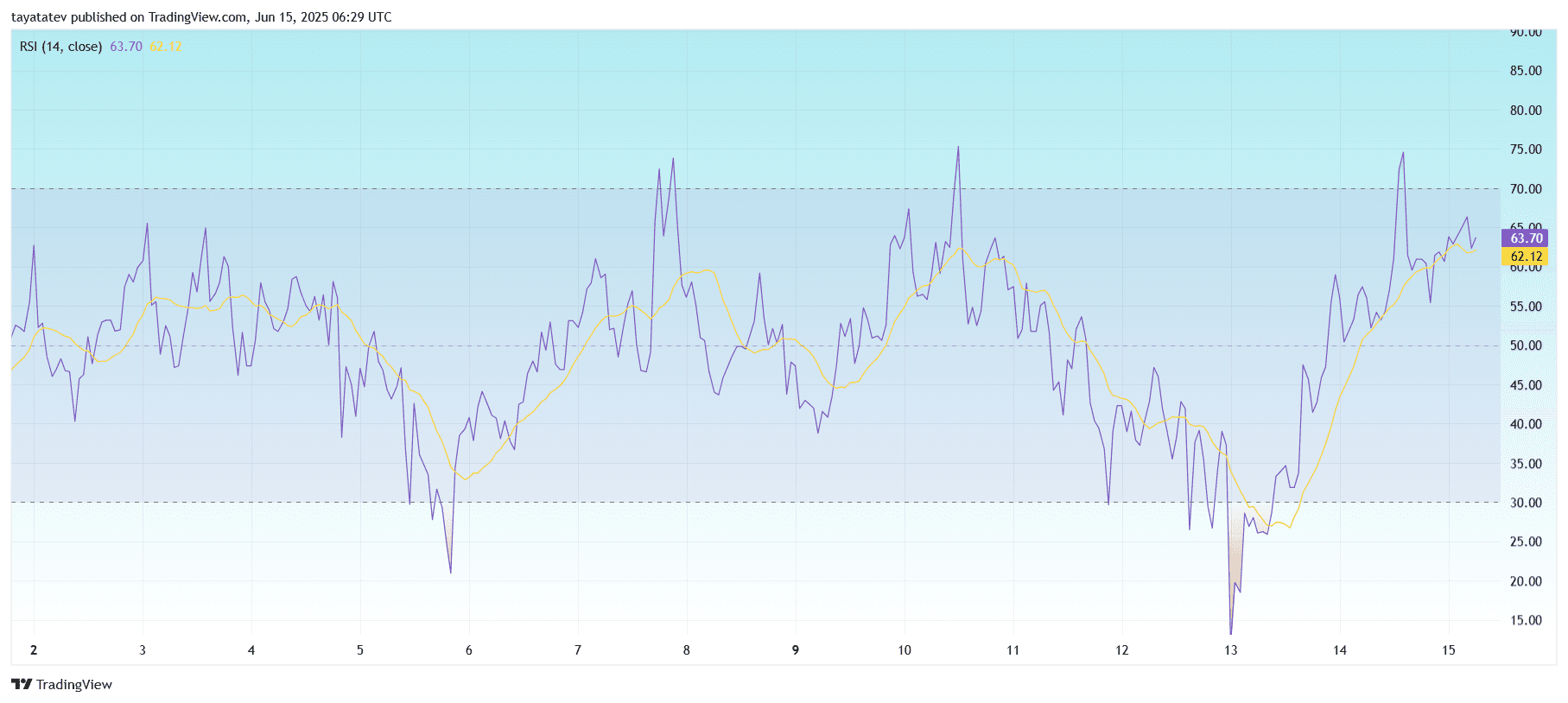

RSI meets an overbought zone in front of a possible Piusdt breakthrough

On June 15, 2025, the 4-hour relative strength index (RSI) for PI/USDT reached 63.70. The RSI measures the impulse and ranges from 0 to 100. Values over 70 normally signal overbought conditions, while values under 30 oversold zones show.

Piusdt 4h RSI evaluation. Source: Tradingview

Piusdt 4h RSI evaluation. Source: Tradingview

The RSI is currently near the overbought threshold. The sliding RSI average is 62.12 directly below the predominant line and shows that the acquisition dynamics slowed down but is robust. This level is aimed toward earlier peaks where the value was reversed.

In view of the broader context, the RSI recovered from a low 17 on June thirteenth and confirmed the value recovery from this date. However, the present upward trend is flattened, which frequently happens before a retreat.

If the RSI crosses below the sliding average and drops below 60, this may confirm a weak bullish impulse. In combination with the Bärish Ascending Channel Pattern in the value diagram, this RSI setup supports the danger of a decline of 12% towards the extent of $ 0.5370.

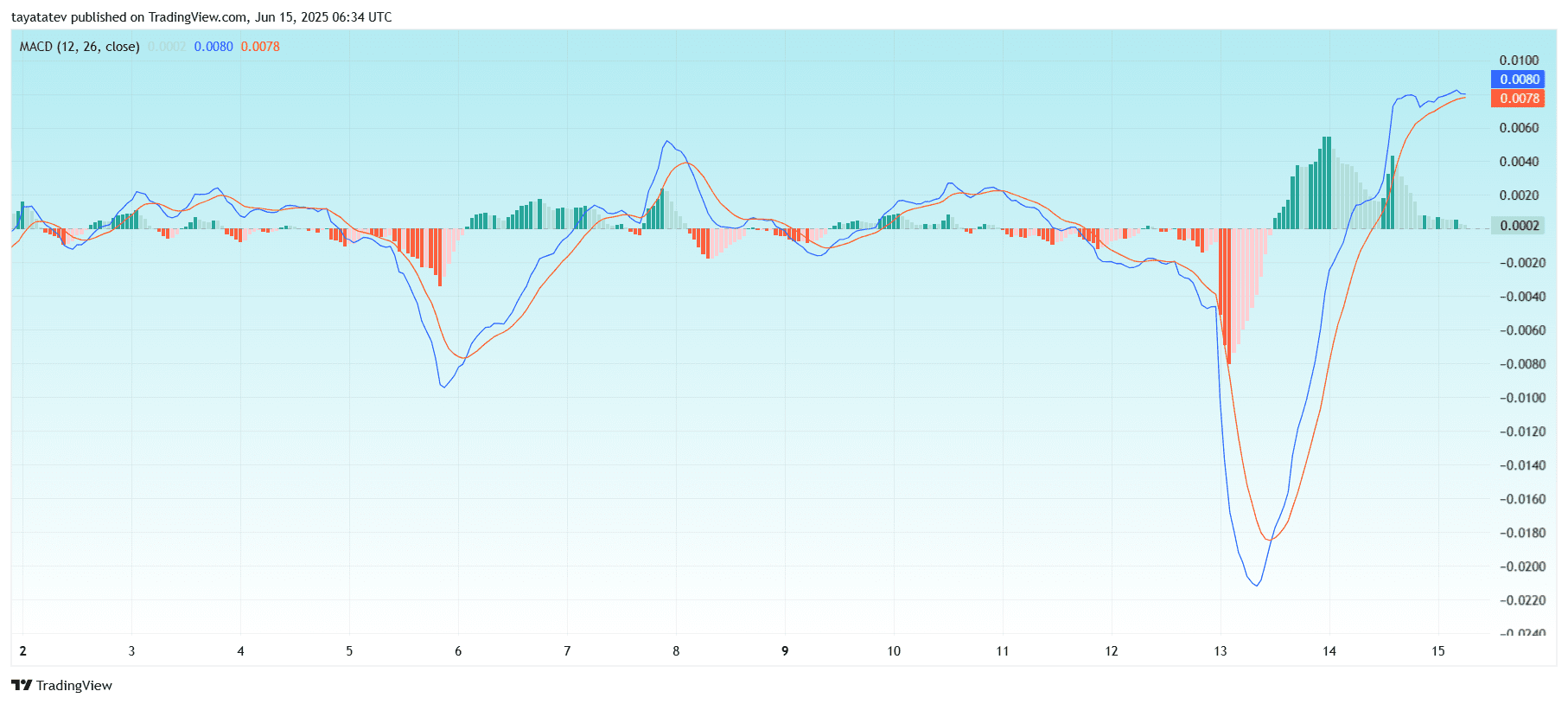

MacD shows a bullish impulse, however the flattening signal

In the meantime, the sliding average convergence divergence (MACD) forpi/USDT showed a bullish crossover. The MacD line (blue) is 0.0080, barely above the signal line (orange) at 0.0078. The MacD histogram remains to be printing green bars, however the bar height shrinks.

Piusdt MacD impulse shift. Source: Tradingview

Piusdt MacD impulse shift. Source: Tradingview

MACD (12, 26) uses two exponential movable average values-12 and 26 proiod to see changes within the impulse. A crossover above the signal line indicates a bullish impulse, while a down cross indicates a weak trend strength.

The MacD line crossed the signal line on June 13 and confirmed the value rally from that day. Since then, the histogram has shown regular growth, however the pace is slowing down now.

If the MACD histogram continues and the Blue MacD line decreases under the orange signal line, it could signal an impulse shift. This would support the Bearish case displayed in the value diagram and RSI, which can confirm the projected decline to USD 0.5370.

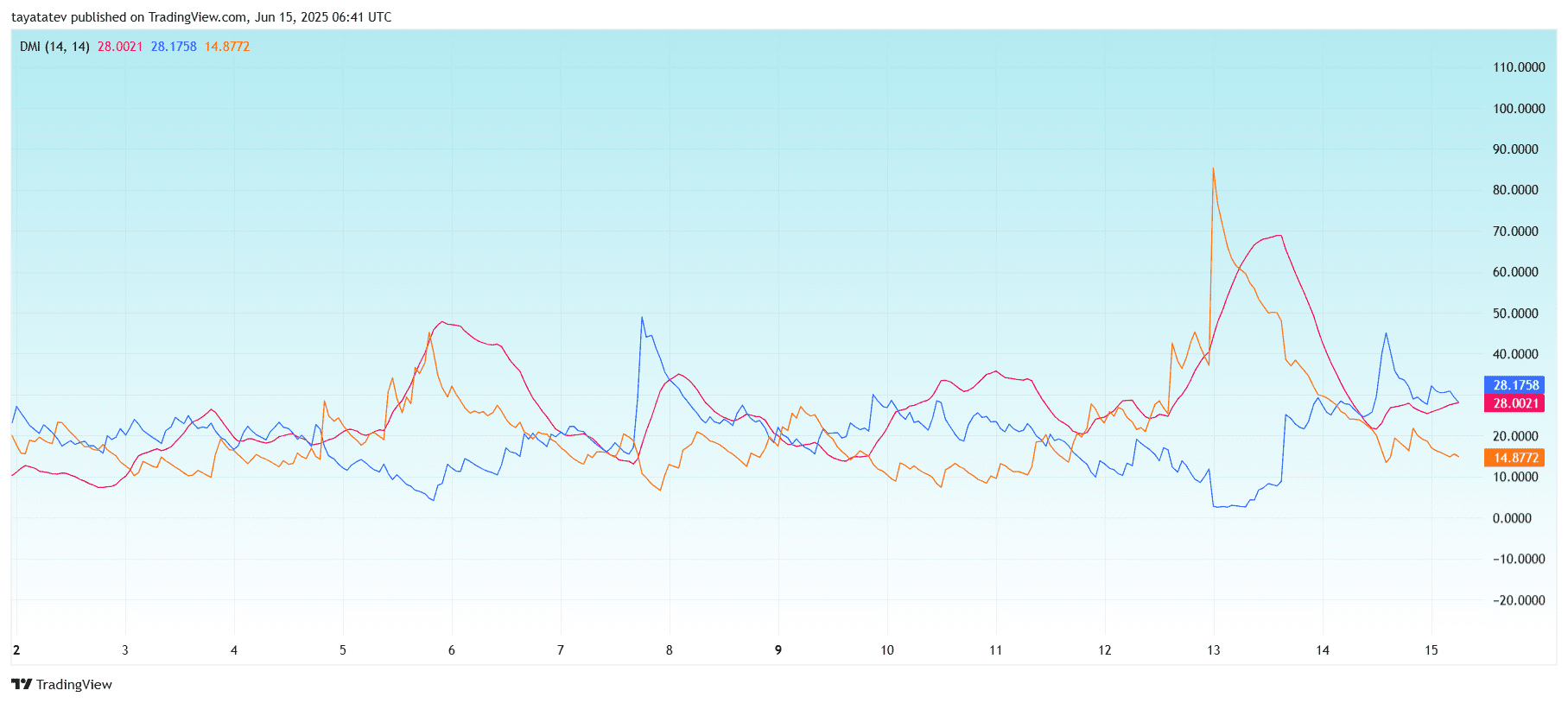

DMI flashes weaken the bullish signal on Piusdt

The directional movement index (DMI) for PI/USDT showed early signs of trend creation. The DMI indicator incorporates three lines:

– +from (blue): 28.17

– -i (orange): 14.87

– ADX (red): 28.00

The +DI line is situated above the –di line, which indicates a bullish strength. However, the 2 lines almost cross and the typical direction index (ADX) now not increases. The ADX measures the trend strength, and a falling ADX often signals that the trend weakens.

Piusdt Directional movement index (DMI) trend signal. Source: Tradingview

Piusdt Directional movement index (DMI) trend signal. Source: Tradingview

At the start of the diagram, the ADX rose over 70 in the course of the sharp revival on June thirteenth. Since then it has decreased considerably and is now being near 28. This shift confirms that the present upward trend has lost the dynamics.

If +Di under –di and ADX continues to diminish, this could confirm a bearish trend shift. This setup supports the previous breakdown risk, which is displayed on the Price-, RSI and MACD diagrams.

PI Network extends the auction of the .pi domains with recent app functions and statistics tools

On June 15, 2025, the PI Network core team announced two essential updates to extend the participation of the community in the present .PI -domain auction. The auction, which was announced for the primary time on PI day 2025, has already attracted over 200,000 offers, with greater than 100,000 being submitted inside the first week.

The .pi domain auction serves as a web3 native identification system, with which users, developers and firms can secure digital names for storage, apps and services. These domains act like conventional web addresses, but work within the PI browser and eventually in other Web3 money exchanges and browsers. The domains with the .pinet.com extension are accessible for chrome and safari users.

According to the team, these identifiers strengthen the presence of the PI network each in real trade and in decentralized apps. The proceeds from the auction will directly finance PI ecosystem initiatives, including developer events and support programs.

Update 1: real-time statistics dashboard

The first major update introduces a dedicated interface during which real-time auction data is displayed. Users can now pursue the preferred domains, the best bids and current trend auctions. This update improves transparency and enables the participants to observe the market activity at a look.

Update 2: Integration into the PI app

The second update adds the complete .pi domestic functionality on to the PI -app. Before that, users can now access recent functions equivalent to the Statistic dashboard and e -mail notification settings within the app themselves. This broader integration makes pioneers easier to cope with the auction of a single platform.

In addition to the 2 core updates, the core team has introduced several improvements. First they refined the bidder interface to enhance user -friendliness. Second, more users can access the auction, because the Mainnet letter pocket has recorded a “significant” access to the access. After all, pioneers can activate E -Mail warnings for certain domains by adjusting settings within the app.

Together, these updates aim to extend the visibility, user -friendliness and the participation of the community within the Initiative .PI domains, since PI network prepares for a broader web3 engagement.