The Bitcoin dominance fell from over 65% to 63.89% in early May 2025, based on DATINGVIEW. The decline occurred shortly after Bitcoin exceeded 100,000 US dollars for the primary time since February 3.

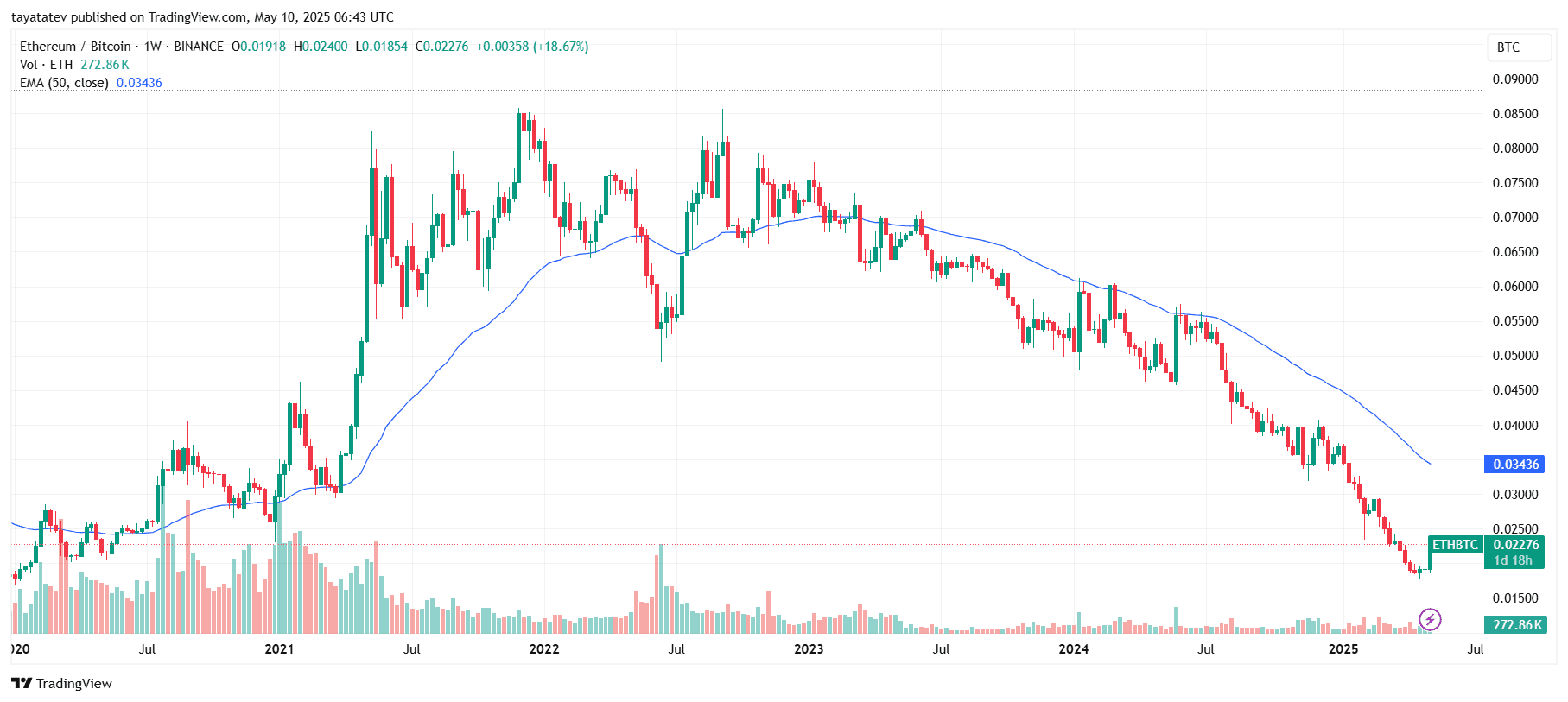

The ETH/BTC ratio increases after the hit of 2020 -Lowytyt

The Bitcoin dominance breaks under EMA. Source: Tradingview

Ethereum (ETH) rose by 13%within the last 24 hours. Solana (Sol), Dogecoin (Doge) and Cardano (ADA) received greater than 6%. The increase in Altcoin prices followed for months when Bitcoin exceeded the broader crypto market.

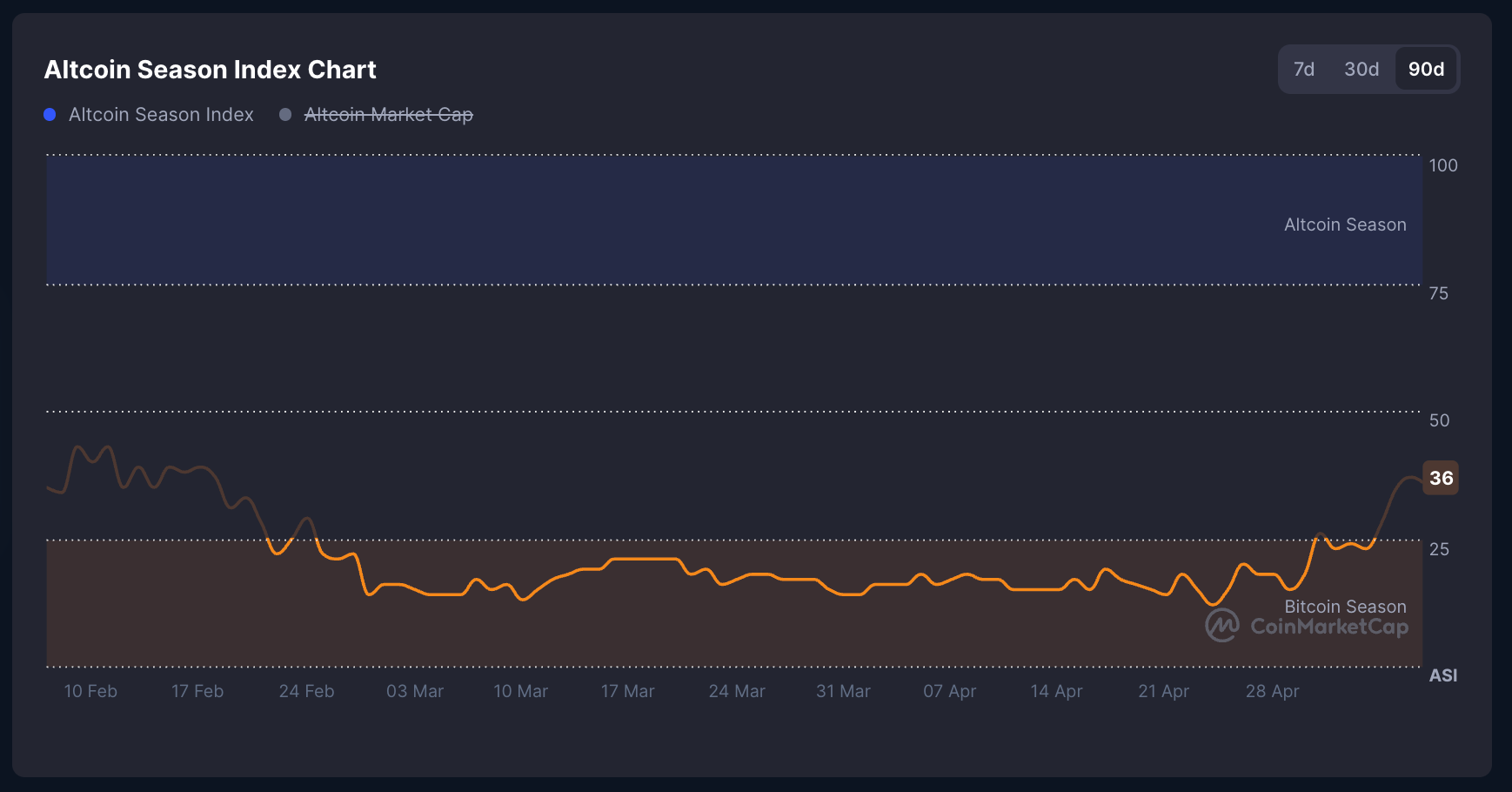

The Bitcoin dominance will decrease after it has reached its highest level since January 2021. This shift shows that the capital may pass from Bitcoin to other cryptocurrencies. The Altcoin season index from Coinmarketcap also rose and identified an increased interest in old coins.

The Altcoin season index increases to 36. Source: Coinmarketcap in May 2025

The Altcoin season index increases to 36. Source: Coinmarketcap in May 2025

The Altcoin season index rose between May 5 and 9, 2025 from 23 to 36. It excludes stable coins and tokenized assets akin to WBTC and Steth.

One rating under 25 signals “Bitcoin Season”, while a rating of 75 points “Altcoin Season”. The current level occupies the market in a neutral state. In April the index fell to 12, its lowest point since December. It had previously reached 87, an annual high.

The jump to 36 reflects a stronger old coin performance in early May. The index stays below the 75 brand that’s obligatory to verify a whole altcoin season. However, it shows a shift from the deep Bitcoin phase in April.

The ETH/BTC ratio increases after lows have been hit in 2020

The ETH/BTC ratio has recently touched its lowest level since 2020. The drop showed that Ethereum continued under -performance against Bitcoin. The ratio then fell off and signaled a possible structural rotation.

ETH/BTC ratio recovers from 2020 lows. Source: Tradingview

ETH/BTC ratio recovers from 2020 lows. Source: Tradingview

Data from TradingView show that this step occurred roughly at the identical time when Bitcoin's dominance decreased. Ethereum's profit of just about 13% in at some point contributed to the recovery of the connection.

Ki Young Ju, CEO of Cryptoquant, commented on this trend. “The Bitcoin cycle -theory is old-fashioned”, which indicates changes in the best way the capital moves through the market. This statement followed the back rash from Ethereum and increased the trade with altcoin.

YTD data show that Bitcoin still leads in 2025

According to Mesari, Bitcoin increased by 10% by 10% in 2025. Most old coins stay below. Ethereum has dropped by 30% YTD. Other essential tokens akin to Dotecoin (Doge), Chainlink (Link), Avalanche (Avax) and Shiba Inu (Shib) have also dropped by over 20%.

Top 18 crypto assets from YTD performance in 2025. Source: Messari

Top 18 crypto assets from YTD performance in 2025. Source: Messari

XRP is the one top altcoin that exceeds Bitcoin this 12 months. It has won greater than 12% YTD. The remainder of the Altcoin market has not yet recovered from earlier losses.

Despite the poor performance all year long, old coins began with profits in May. The rise of Ethereum along with Sol, Doge and ADA shows that after months of focus, capital returns to old coins on Bitcoin.