On May 30, 2025, the trading pair SUI to Tether (SUI/USDT) generated a descending sewer pattern within the 4-hour bony diagram.

SUI/USDT 4-hour diagram. Source: tradingview.com

A descending channel appears when the worth of a cryptocurrency moves between two parallel trend lines that fall down. This pattern often shows a short lived downward trend inside a wider bullish setup and typically signals a possible reversal when the worth breaks above the upper border.

The table shows that Suis price has been lower for the reason that starting of May. It hopped between the upper and lower red trend lines and formed lower heights and lower lows. During this era, the worth also fell below the 50-year exponential moving average, which is currently $ 3.6285. This shift below the typical showed that the short -term impulse became weaker.

Despite the decline, volume suggestions show during chosen sessions that buyers have remained lively on the lower levels. If Sui breaks over the upper red trend line of the descending channel, the worth could gather strongly. Based on the quantity of the initial upward bone of the pattern, SUI can increase from the present level of USD 3.44 to a projected goal near $ 5.02.

This possible movement would replace SUI through the most recent resistance zones and restore the bullish dynamics.

Sui RSI falls under the neutral zone and signals a weak impulse

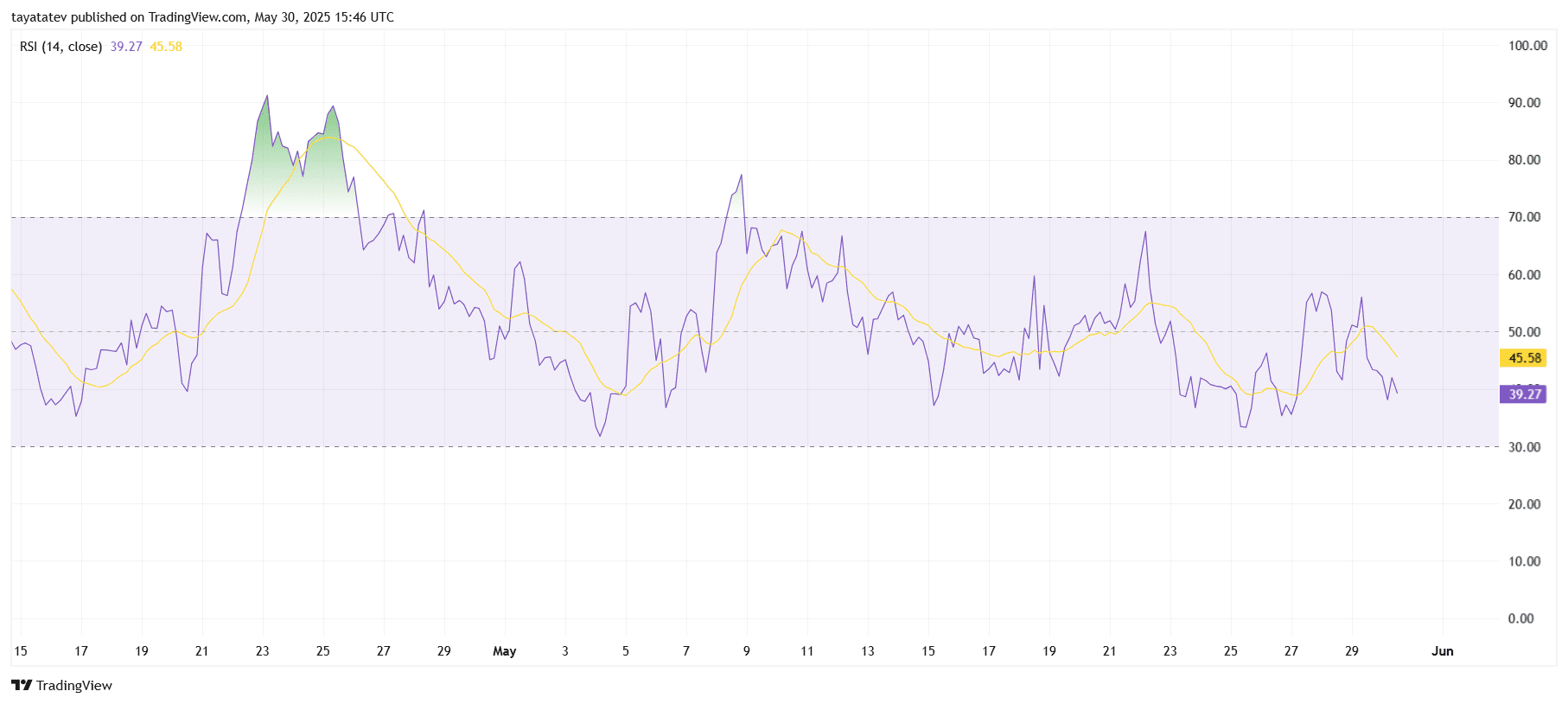

On May 30, 2025, the relative strength index (RSI) for SUI/USDT fell to 39.27 to 39.27 within the 4-hour table based on TradingView.

RSI (14), SUI/USDT 4-hour diagram. Source: tradingview.com

RSI (14), SUI/USDT 4-hour diagram. Source: tradingview.com

The RSI (relative strength index) is an impulse indicator that measures the speed and alter of price movements on a scale from 0 to 100. Values over 70 normally indicate oversized conditions, while values are below 30.

At the moment, the Suis RSI is moved below 50 and stays removed from the overbought zone. It can be below the moving average from 14 to a moving average of 45.58. This gap confirms the weak purchase impulse and an increased bear pressure.

The RSI curve has fluctuated under 50 for the reason that end of May and reflects a scarcity of strong dynamics. If RSI continues to remain below his moving average and doesn’t recuperate within the direction of the neutral 50 zone, the worth could have difficulty gaining strength from the descending channel without an outbreak.

Sui MacD becomes bear when the dynamic weakens

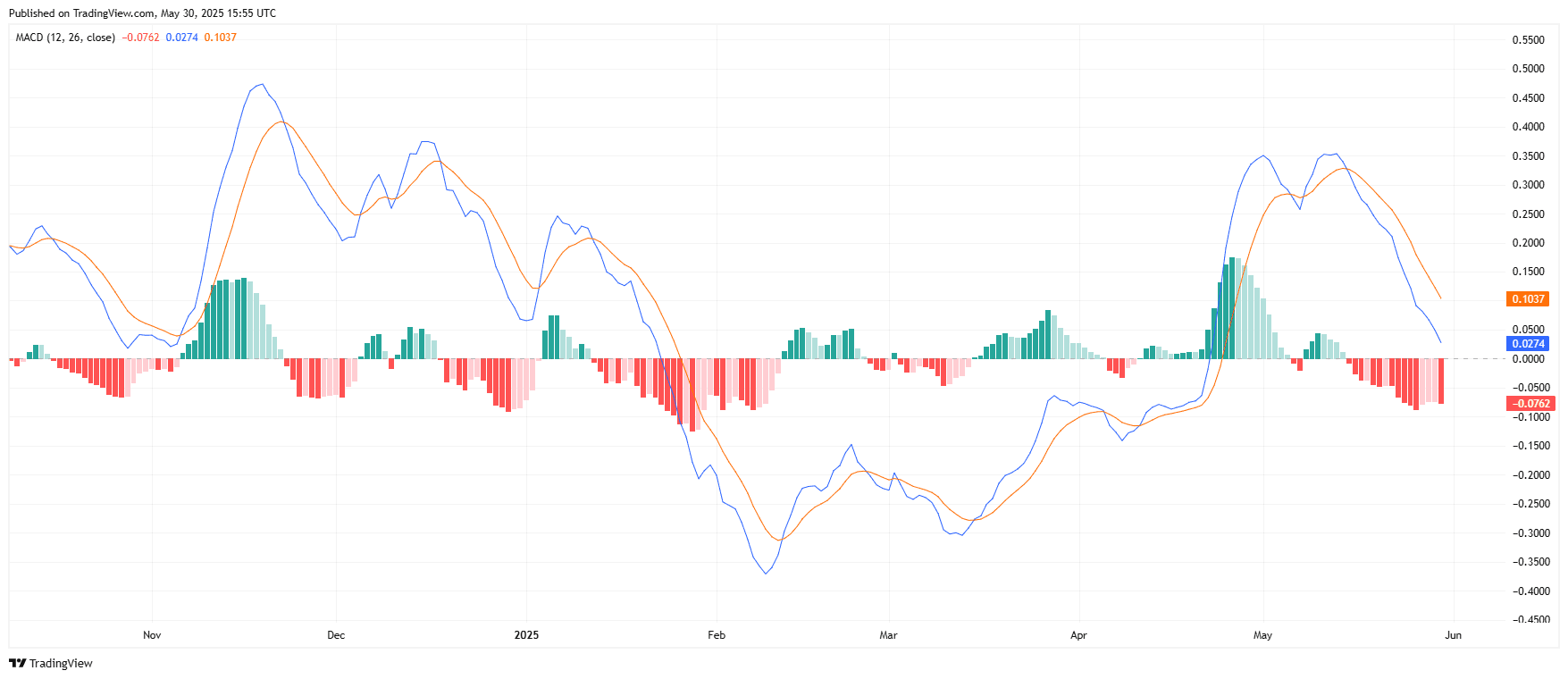

According to the TradingView, a Bärisches Signal on the every day diagram has inflated the brand average convergence -indicator (MACD) for SUI/USDT.

MACD (12,26,9), Sui/Usdt Daily Chart. Source: tradingview.com

MACD (12,26,9), Sui/Usdt Daily Chart. Source: tradingview.com

The MACD (sliding average convergence divergence) measures the connection between two exponential average values-normally of the 12-period and 26 period and helps to discover the trend direction and impulse resistance. When the MACD line crosses below the signal line, it often hits a possible downward trend.

The MACD line is now at –0.0762, while the signal line is 0.1037 higher. This intersection under the signal line confirms the baric divergence. At the identical time, the histogram expanding red beams shows and reflects the growing negative impulse.

The Blue MacD line has been right down to Suis since mid-May. The current setup shows the continued sales pressure, unless the MACD line rotates back on the signal line.

SUI direction indicator confirms the weak trend strength

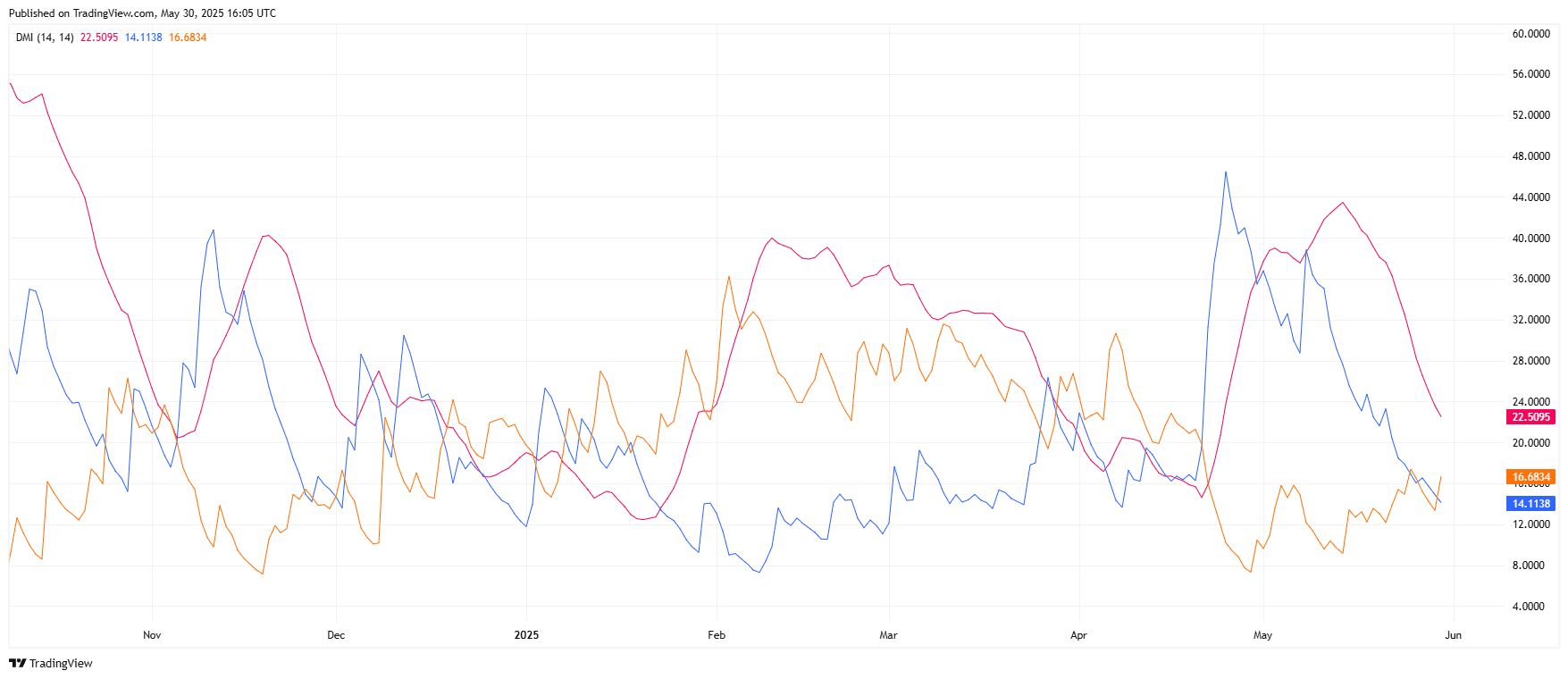

On May 30, 2025, the Directional Movement Index (DMI) for SUI/USDT signaled a weak trend strength within the every day diagram based on TradingView.

DMI (14), Sui/Usdt Daily Chart. Source: tradingview.com

DMI (14), Sui/Usdt Daily Chart. Source: tradingview.com

The DMI indicator comprises three components:

– +DI (positive directional indicator), which measures the pressure upwards

– –Di (negative directional indicator), which measures the downward pressure

– ADX (average direction index) that shows the general strength of the trend

At the time of the diagram, the +DI is 14.11, the –Di is 22.50 higher and the ADX reads 16.68. If the –di stays above the +DI, it confirms that sellers have control. In the meantime, an ADX under 20 suggests that the present trend – bullish or bear – gives a powerful dynamic.

The setup shows that bearish pressure predominates optimistic demand. However, the low ADX value signifies that the general trend stays weak with no major directional assessment. This explains the side movement in SUIS prize, even though it forms a descending channel.

Sui approves the repayment plan of $ 162 million based on Cetus Exploit

On May 29, 2025, the SUI Validators approved a governance proposal to publish $ 162 million at frozen funds which are connected to the most recent Cetus Exploit. The vote went in favor of 90.9%, 1.5%, which based on Suis doesn’t participate in official governance portal.

The decision was followed by a serious security violation on May 22, when the decentralized Exchange cetus lost over 220 million US dollars of digital assets. Shortly after the attack, Validators frozen 162 million US dollars of the compromised funds.

With the proposal now approved, the frozen assets are transferred to a wallet with several signatures. Sui explained in a contribution to X that the funds are kept in trust until they’re returned to users on the idea of the official recovery plan from Cetus.

SUI Validators approve the payment of the cetus. Source: SUI network on x

SUI Validators approve the payment of the cetus. Source: SUI network on x

This step triggered a brand new debate about decentralization. Some users questioned the flexibility of the validators to freeze assets, while others were vital to guard users from further losses.

The vote is an element of a broader recreational strategy. In addition to the 162 million US dollars, Cetus Fund will use its treasury and fall back on an emergency loan from the Sui Foundation to support the total repayment and relaunch operations.

Cetus shared his roadmap after the vote on May 29. First, SUI validators perform a series upgrade to transmit the frozen means. As soon as that is accomplished, Cetus prepares a recovery pool upgrade and begins to revive user data.

The protocol goals to finish the entire restoration and resume the operation inside every week. It was also confirmed that a brand new compensation contract is under development. The contract is checked before the beginning of external examiners.

After restarting, Cetus plans to return all affected providers liquidity. Users with non -invented funds can claim the remaining credit by the compensation contract as soon as he goes live.