On May 26, 2025, the 4-hour diagram SUI/USDT formed a bullish flag pattern. It appears on a bullish flag when a pointy upward movement follows from a downward channel that typically signals the potential continuation of the upward trend.

Sui Bullish Flag sample projection. Source: tradingview.com

If this optimistic flag confirms, the value of SUI could gather by the present level of USD 3.56 to the projected goal of $ 5.02 by 41%. The Breakout goal relies at the extent of the previous flag mast, measured by the underside of the initial rally to the start of consolidation.

In the meantime, the relative strength index (RSI), an impulse indicator, is 41.03, which stays below the neutral 50 level. This indicates that the token isn’t overbought, and there’s room for upward movements.

At the identical time, the exponential sliding average of fifty period (EMA), which is currently USD 3.72, acts as a dynamic resistance. A closure over this EMA and the upper red trend line would validate the breakout signal.

The volume has remained relatively constant, but a confirmed outbreak needs to be equipped with a robust increase within the buying volume to support the move. If the amount stays low, the pattern can fail or delay the outbreak.

In summary, the diagram setup indicates a possible bullish outbreak towards 5.02 US dollars when Sui breaks out with strong confirmation above the resistance line of the flag.

Cetus Protocol Exploit stops operations, triggers 223 million US dollars loss and Sui -token -Sales

Cetus Protocol, a decentralized stock exchange (Dex) within the SUI network, began on May 22, 2025 after a big exploit with Oracle manipulation. The attack caused an estimated lack of 223 million US dollars and triggered a severe decline within the token prices in the complete SUI ecosystem.

The Cetus protocol incorporates an intelligent contract after exploit announcement.

The Cetus protocol incorporates an intelligent contract after exploit announcement.

In a press release, Cetus confirmed the violation and announced that the attacker had stolen about 223 million US dollars. The team acted immediately to pause the intelligent contract and successfully freeze 162 million US dollars of the compromised funds.

“We have confirmed that an attacker from the Cetus protocol stole about USD 223 million.”

The team explained.

“We took immediate measures to dam our contract to forestall further middle theft. We work with the Sui Foundation and other members of the ecosystem to reclaim the remaining stolen means.”

Attack uses oracle manipulation, not external hack

The exploit appears to be attributable to a susceptibility to the inner price mechanism of Cetus protocol. The team initially denied a hack that was published on Discord that the platform “discovered an oracle error”.

The blockchain analytics company Lookonchain reported that the attacker was triggered over 260 million US dollars of assets, most of which were exchanged in USDC and bridged to Ethereum. Around 60 million USDC were already broadcast on the time of reporting.

Cetus Hacker converts 260 million US dollars Exploit in USDC via Ethereum Bridge.

Cetus Hacker converts 260 million US dollars Exploit in USDC via Ethereum Bridge.

Source: X/@Lookonchain

Alex Horlan, CTO at Hackenproof, explained that the attacker used injections with low liquid to govern pool conditions in order that they might extract SUI and USDC without achieving an actual value. He identified possible errors in key functions that take care of token conditions and curve.

Cetus Hacker converts 260 million US dollars Exploit in USDC via Ethereum Bridge. Source: X/@Lookonchain

Cetus Hacker converts 260 million US dollars Exploit in USDC via Ethereum Bridge. Source: X/@Lookonchain

Liquidity pools and oracle systems under control

The Cetus protocol carries out a dual oracle model. It uses internal on-chain oracles that were derived from concentrated liquidity pools and in addition integrates the decentralized Oracle Service Pyth Network. These systems are presupposed to reduce dependencies outside the chain and risks for price manipulations.

However, it stays unclear whether the susceptibility to security comes from the inner price logic of cetus or within the external oracle feed. From now on, Pyth Network has not made any explanation.

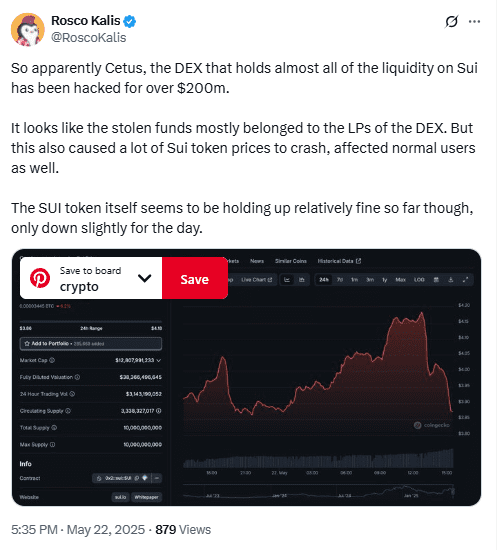

The exploit significantly influenced the broader Sui ecosystem. According to Defillama, the whole value of Cetus (TVL) fell over 200 million US dollars and has now taken up 75 million US dollars. Cetus' Native token Cetus fell by 24% to $ 0.15.

Seven of 11 by cryptoslate -based token which might be based by SUI also registered losses of no less than 5%. Despite the broader sale, the Sui -token itself only showed a slight decline.

Rosco Kalis, founding father of Revoke Cash, found that almost all stolen funds belonged to liquidity providers.

“This also meant that many SUI -token prices were delivered to the crash. The normal users also affected”

he said.

The SUI price reacts to Cetus Exploit because Dex loses over 200 million US dollars. Source: x/@roscocalis

The SUI price reacts to Cetus Exploit because Dex loses over 200 million US dollars. Source: x/@roscocalis

While the investigation continues to be the broader crypto community has began to offer support. The former CEO of Binance, Changpeng Zhao, said his team turned around Cetus.

Cetus has not yet shared a recovery plan. Further updates are expected as soon because the examination progresses.

Jackson.io starts the purpose system to SUI and increases 10 million US dollars in seed rounds

In addition, Jackson.io, a decentralized web3 gaming protocol based on the Sui blockchain, began its beta platform next to some extent system and confirmed a round of 10 million US dollars. The investment led by SSSSSSSSSSSSSSSSSSSSSSSSSSSS will support platform development and global user growth.

The Jackson.io platform provides a Gamefi structure by which TOKEN -Takers receive a share of platform income. The team includes experts from the Fintech and Gaming industry with backgrounds in publicly listed technology firms and controlled financial institutions.

Since the beginning of the Beta start, Jackson.io has published three test games and generated over 700,000 US dollars within the betting volume. The platform now has greater than 2,000 competitors and 800 liquidity stakers and signals an early introduction of your model for income participation.

The Sharkz NFT campaign from Jackson.io presented a brand new airdrop format by which the participants must upload a selfie with a “j gestures”. This method has contributed to checking human users and reducing the bot interference. The campaign attracted over 10,000 participants with 3,000 verified gestures and almost 8,000 unique NFT owners.

Jackson.io recently organized two community missions that distributed over 5,000 SUI tokens. Thousands of users took part within the events and helped to convert the community's commitment into the activity of on chains.