On May 22, 2025, the 4-hour diagram for XRP/US dollar within the Bitstamp shows a falling wedge pattern between May 13 and May 21.

XRPUSD 4H FALE WEAL outbreak. Source: Tradingview

A falling wedge is a bullish pattern that’s formed by downward and converting trend lines. It often signals the weakening weak pressure and the possible reversal on the pinnacle.

XRP broke out of the wedge today and rose 3% from the outbreak. The price rose from about $ 2.34 to USD $ 2.41787 and moved over the 50Pro-exponential moving average (EMA), which is now $ 2.38740.

If the breakout applies, the goal is nearly $ 2.91720, which is a rise of 20% in comparison with the present level. This goal matches the peak of the wedge, which was added to the breakout level, a joint projection method within the diagram evaluation.

In the meantime, the relative strength index (RSI) has modified to 56.70 for a similar period, which indicates a light dark impulse. RSI over 50 supports Breakout and shows increasing buyer interest.

The volume in the course of the outbreak has reached 1.54 million, which supports the move. The next volume often confirms the outbreak strength.

The setup and the present conditions suggest that retailers react to the wedge outbreak as an alternative of waiting for wider market signals. XRP is now testing its short -term resistance zone between $ 2.45 and $ 2.50. A powerful step above this level can open up the projected path towards 2.91 US dollars.

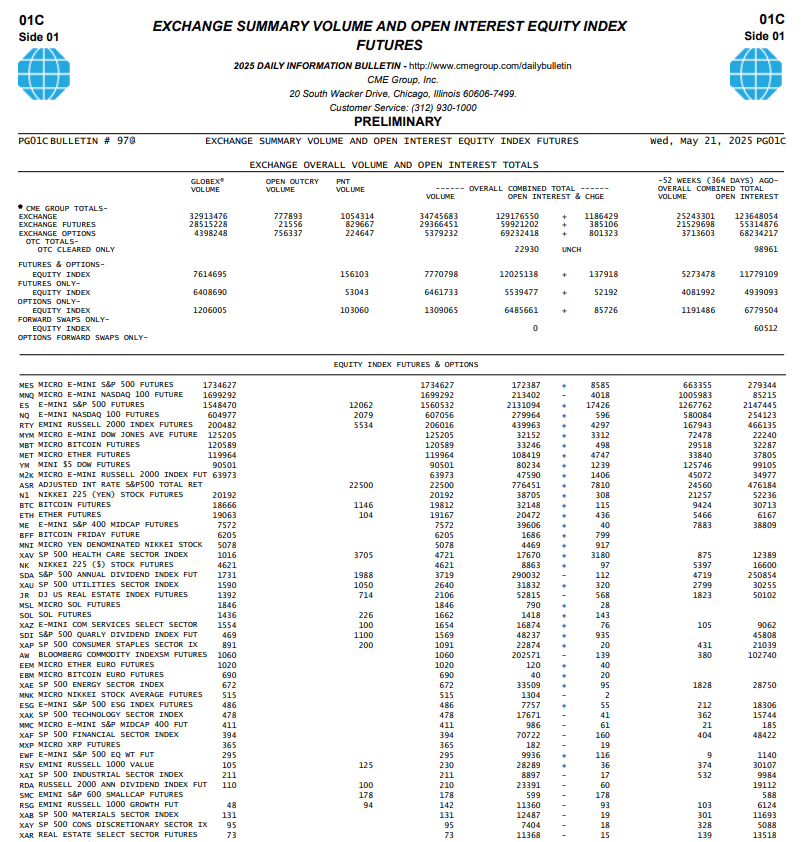

XRP -Futures Volume on CME meets $ 25.6 million in 48 hours

In the primary two trading hours, XRP Futures recorded 25.6 million US dollars on the CME Group. CME began the contracts on May 19 and offers contracts each Standard (50,000 XRP) and Micro (2,500 XRP).

CME XRP futures volume reaches $ 25.6 million in 2 days. Source: CME group

CME XRP futures volume reaches $ 25.6 million in 2 days. Source: CME group

On the primary day, the dealers exchanged 120 standard and 206 microphones. This activity was based on CME data for around 6.5 million XRP. The following day, one other 59 standard and 485 microphones were traded, which added 4.1 million XRP to the balance sheet.

With a spot price of $ 2.39, the whole variety of $ 25.6 million corresponds to fictional volume. These figures present XRP in front of Solanas CME FUTURES, which was opened in March 2025 with $ 12.3 million.

XRP CME FUTURES show no price gap from the Spot market

The XRP contracts for CME are Bash settled and confer with the CME CF XRP dollar rate, which is updated to the east day by day at 11:00 a.m. This design ensures that the futures price matches the Spot market.

There was no essential bonus or discount between XRP Futures and the Spot Prize of $ 2.39. This pattern suggests that traders don’t bet on sudden price changes.

The participants may use these contracts to secure the present XRP exposure as an alternative of speculating. This can indicate a cautious or balanced market outlook without pointing to Bullische or Bärische feeling.

The contracts offer a regulated strategy to suspend XRP, which incorporates market participants that need compliance security. The CME model supports this based on the well-established reference prices.

XRP OutpaCes Solana within the CME -Futures -Debüt handed over

Compared to other old coins, XRP made a stronger entrance. The Futures of Solana reached 12.3 million US dollars in fictional volume on the primary day. The two -day variety of XRP has greater than doubled.

Bitcoin (BTC) and Ethereum (ETH) began in 2017 and 2021 futures on CME. Their initial volumes were smaller, although each have turn out to be institutional investors usually since then.

The XRP list reflects the growing institutional interest in Altcoin derivatives. XRP contributes BTC and ETH because the only cryptocurrencies with regulated futures trading with CME.

This step also follows the recent regulatory clarity about Ripple, the issuer of XRP. This clarity could have contributed to strengthening institutional trust within the trade in XRP through regulated platforms similar to CME.

Ripple shift towards USDC

Ripple offered as much as 11 billion US dollars for the acquisition of Circle, the issuer of USDC, one among the most important stable coins after market capitalization. The move could move the Ripple from XRP to stable coins and at the identical time redesign the present account within the crypto sector.

Ripple has positioned itself as a cross -border payment solution with XRP for years. But now stable coins like USDC are gaining more soil in traditional funds. These coins offer price stability and robust introduction, which makes them suitable for payment systems that when highlighted the appliance of XRP.

Ripple to accumulate the circle signals a shift. By purchasing USDC, Ripple could handle XRP fights and depend on a widespread stable coin. The proposed deal follows the beginning of Ripple, StableCoin, Rlusd, which currently has a market capitalization of $ 310 million. In comparison, the market capitalization of USDC is 61 billion US dollars, which has way more influence on each crypto and traditional funds (tradfi).

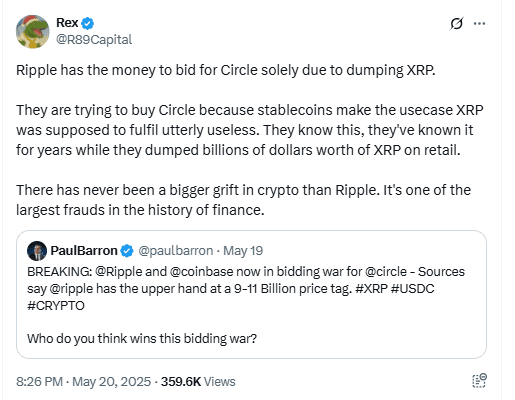

An X user, R89Capital, commented,

“You try to purchase a circle because stable coins should make the appliance -XRP application to be extremely useless.”

Ripple-Circle bid, which is criticized as an XRP dump accusation surfaces. Source: X/@R89Capital

Ripple-Circle bid, which is criticized as an XRP dump accusation surfaces. Source: X/@R89Capital

They also added that Ripple XRP has already “made billions of dollars for retail” and refers to the continued lawsuit between Ripple and the US Securities and Exchange Commission (Sec).

Critics see that XRP will fail

The possibility that Ripple could have USDC has triggered concern locally. Many fear that XRP could lose its role in Ripple's long -term strategy. Ripple could concentrate more on the combination of USDC in its service and reduce the necessity to promote or expand the XRP use.

Users also emphasized that USDC is already connected to large financial institutions. Through the acquisition, Ripple may gain advantage from Circle's partnerships and shift attention to tokens that dominates the already regulated digital payments.

Another X user, 0xshual, warned that this business could trigger “mass panic” on the crypto market. They fear that if it controls USDC, ripple could centralize stable coin operations and weaken trust in decentralized financing (defi).

In the meantime, the user Gwartygwart compared the acquisition with “Hooli purchase of pied piper”, whereby the TV show in Silicon Valley refers to explain the danger of transitioning in the corporate in a decentralized space.

Market effects and pushback

If Ripple is successful, it could win a robust position against other StableCoin emitters similar to Tether (USDT). However, the deal faces several hurdles. Circle has already rejected previous offers. And Coinbase, a stakeholder in a circle, can put pressure on the sale.

Despite the dimensions of the ripple offer, the deal raises questions on centralization, market control and the long-term way forward for XRP. The crypto community stays divided – some see them as a strategic business train, while others see them as a threat to the trust and openness of the sector.