On June 5, 2025, the RVN/USDT pair rose by 152.52% in only someday and rose from around $ 0.011 to a maximum of $ 0.0278. The spike was 6.73 billion with a trading volume. However, the worth withdrew quickly the subsequent day and is now dealing near $ 0.01446, which gave up greater than half of the profits.

Rvn/usdt day by day chart. Source: Tradingview

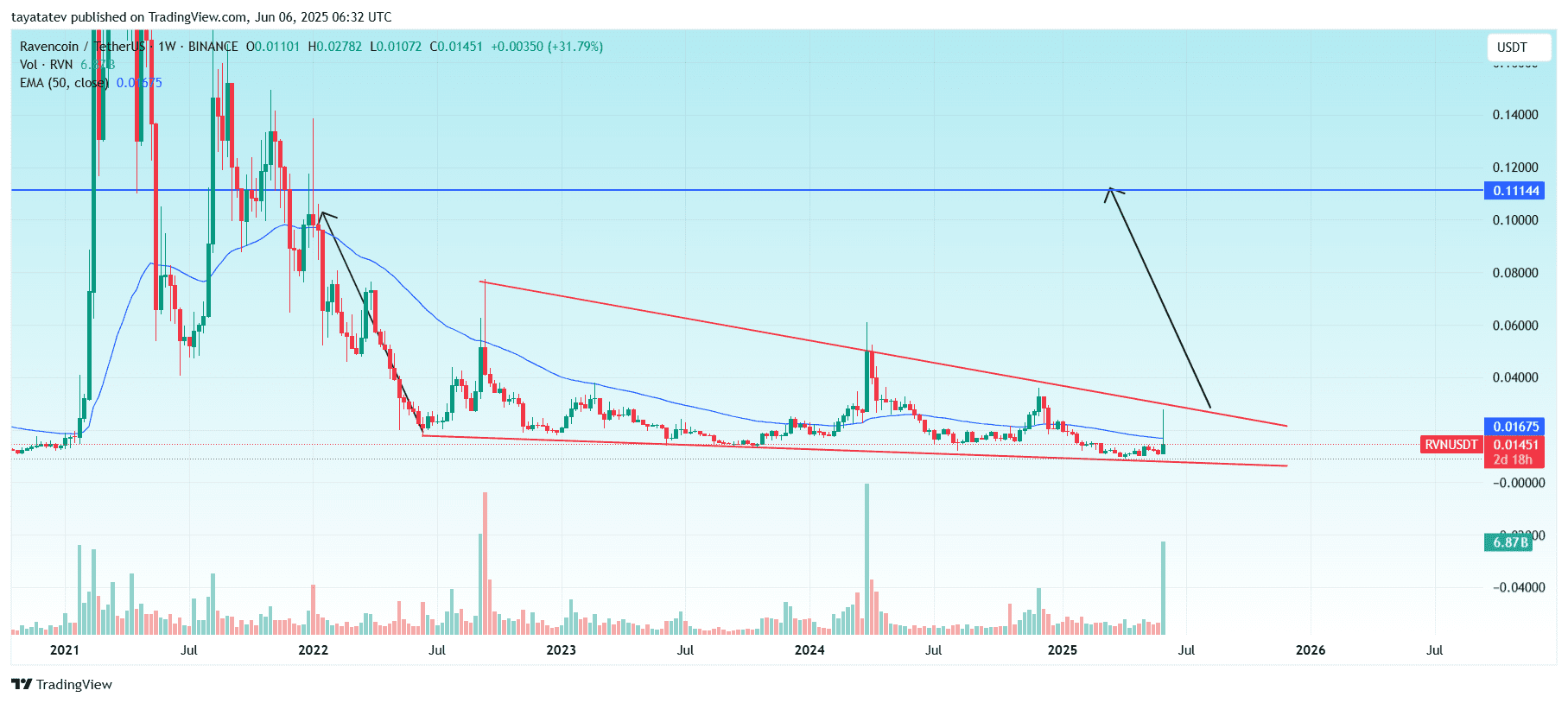

RVN/USDT breaks out from a bullish falling wedge, eyes 657% rally

On June 6, 2025, the RVN/USDT Weekly diagram created a bullish -falling wedge pattern.

Diagram name: RVN/USDT Weekly diagram. Source: Tradingview.

Diagram name: RVN/USDT Weekly diagram. Source: Tradingview.

A bullish falling wedge is a diagram pattern that’s formed by convergent downward lines and typically signals a possible trend reversal on the pinnacle.

If this pattern confirms, the RVN/USDT price can increase by 657% from the present level of $ 0.01451 to the projected goal of around 0.11144 US dollars.

This pattern developed after a protracted downward trend of its 2021 heights. The size of the wedge marked in red has been touched several times prior to now two years. The most up-to-date breakout attempt was with a weekly volume increase, which rose to six.87 billion RVN, which indicates a robust purchase pressure.

In addition, the worth has been closed for the primary time because the starting of 2023 over the 50-week exponential sliding average (EMA), which is currently near USD 0.01675. This outbreak via EMA and wedge resistance strengthens the case for a possible bullish reversal.

If the worth is above this area and gains dynamics, a rally to the projected goal of the wedge stays possible.

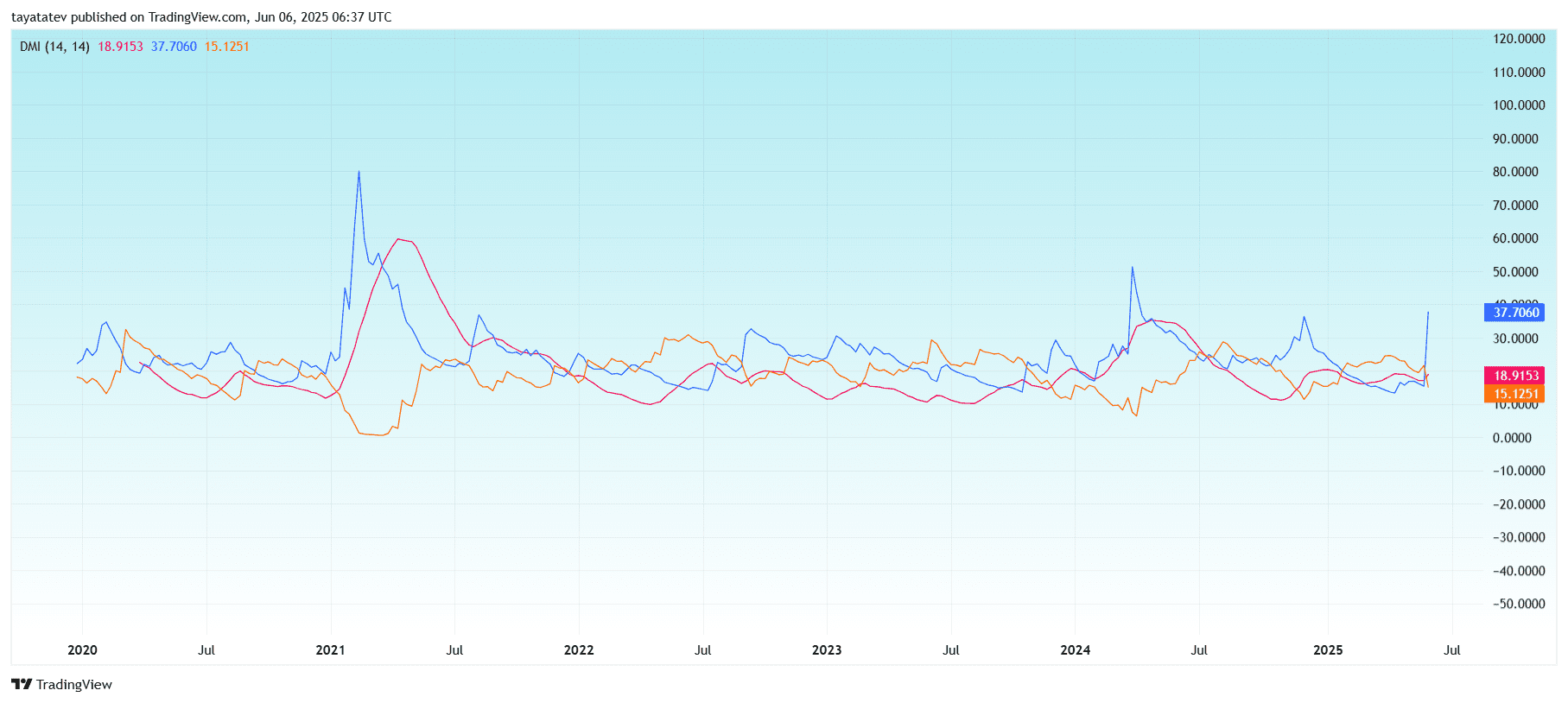

RVN/USDT DMI flashes a robust trend signal as an ADX increase

The RVN/USDT direction movement index (DMI) showed a transparent trend reversal signal for the weekly time-frame.

RVN/USDT Weekly DMI diagram. Source: Tradingview

RVN/USDT Weekly DMI diagram. Source: Tradingview

The average direction index (ADX), which was marked blue, rose to 37.71 and crossed the important thing 25. This movement signals a robust trend. The ADX measures the trend strength whatever the direction. A reading over 25 confirms a sound trend.

The +DI (positive direction index) shown in orange is 15.13, while the red shown – di (negative direction index) is eighteen.92 higher. This setup signifies that sellers still dominate barely with regard to the direction of direction, however the strong ADX increase shows that a severe trend shift may very well be underway if +Di exceeds above DI -DI.

During 2024 and early 2025, the ADX was largely flat and reflected a side market. But the sharp vertical increase now matches the outbreak on the worth card and confirms that the dynamic is structured.

If +DI overtakes in the approaching weeks and the ADX continues to extend, it’s going to confirm a persistent bullish change in RVN/USDT.

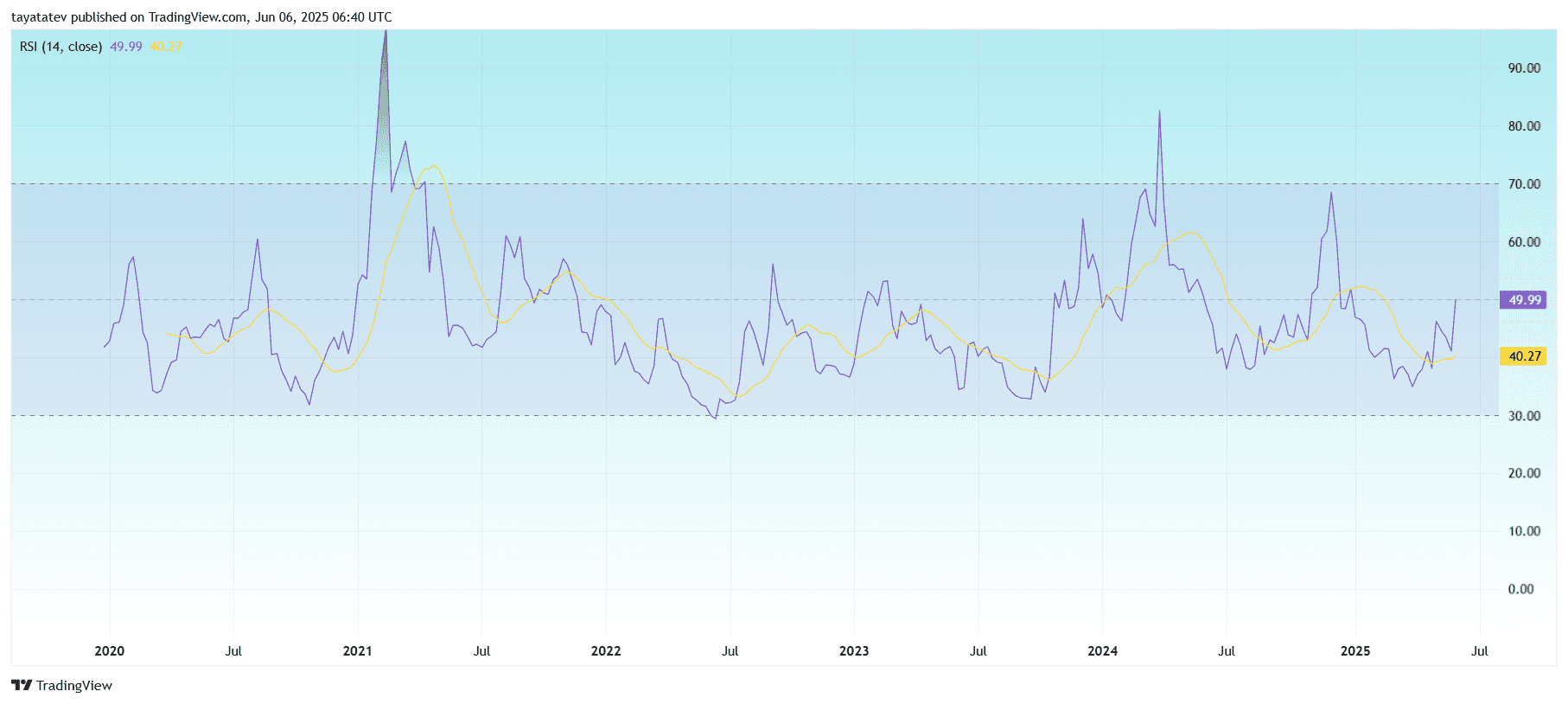

The focus is on rvn/usdt RSI, while the dynamics are constructing

On June 6, 2025, the relative strength of index (RSI) for RVN/USDT was printed within the weekly table 49.99, while the sliding RSI-based sliding average was 40.27.

RVN/USDT Weekly RSI diagram. Source: Tradingview.

RVN/USDT Weekly RSI diagram. Source: Tradingview.

The RSI measures the speed and alter of the worth movements on a scale from 0 to 100. A reading below 30 signals oversized conditions, while a reading overbives over 70 signals. A level near 50 shows a neutral impulse with a possible shift, depending on the worth direction.

At the moment, the RSI has come over its own moving average, which indicates a brief -term impulse shift on the pinnacle. It also approached the middle (50), which frequently acts as a pivot between bear and bullish zones.

This crossover follows a protracted consolidation period with several failed attempts to interrupt out in 2024 and early 2025. The latest RSI inclination upwards was aligned with the falling stretch outbreak and the high volume tip within the weekly price card.

If the RSI lasts over 50 in the approaching weeks, this will form a stronger bullish trend.

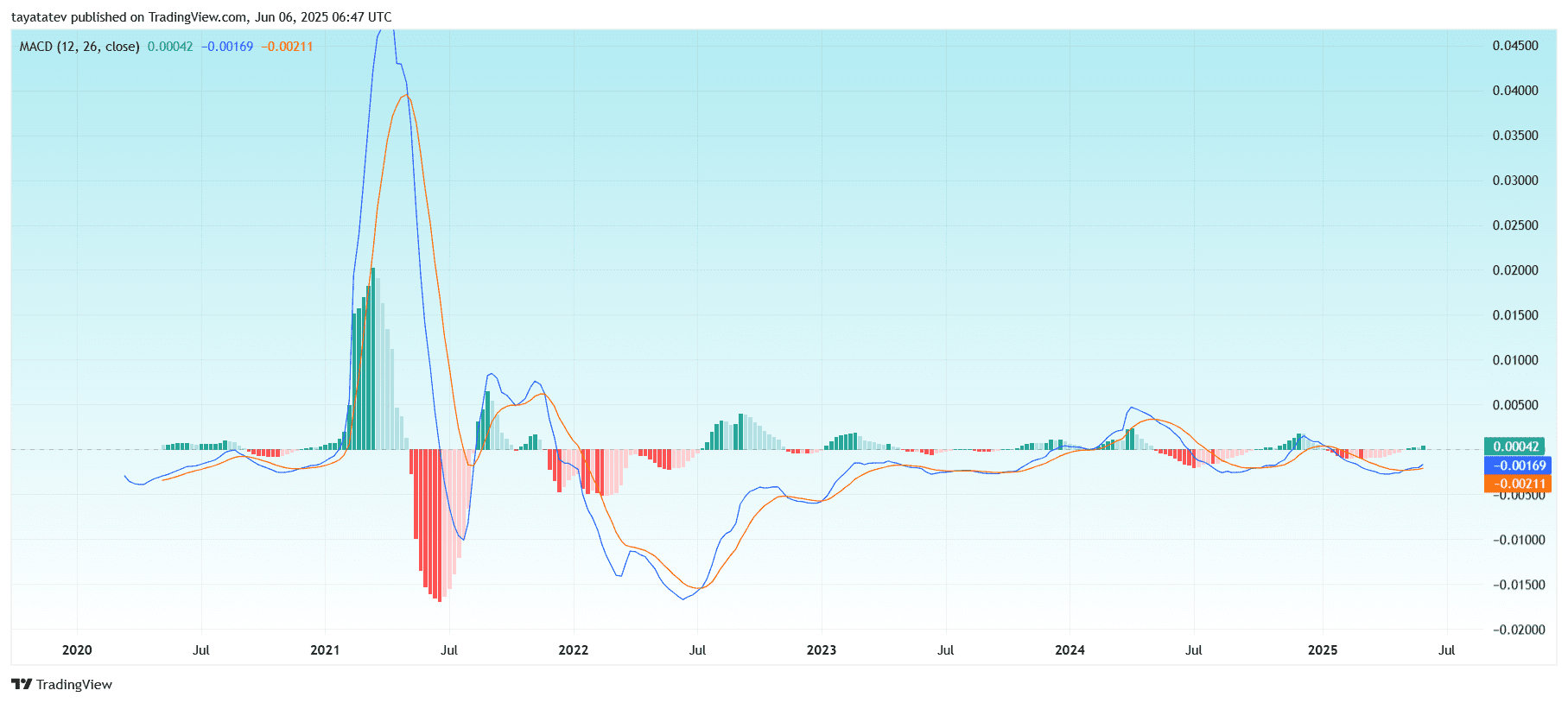

RVN/USDT MACD approaches

On June 6, 2025, the RVN/Usdt Weekly Moving Average Convergence Diversity (MACD) indicator showed early signs of potential bullish shift.

RVN/USDT Weekly MacD diagram. Source: Tradingview

RVN/USDT Weekly MacD diagram. Source: Tradingview

The MacD line (blue) is now at –0.00169, while the signal line (orange) is at –0.00211. Although each values remain below the zero line, the MacD line has crossed the signal line for the primary time in months. This crossover shows an early bullish pulse signal.

At the identical time, the MacD histogram has turn out to be barely positive and is currently printing +0,00042. A green histogram above the zero level confirms the crossover and supports a possible trend reversal.

Historically speaking, severe macd crossovers and green histograms have been followed within the historically. Former bullish waves in 2021 and early 2023 began with similar crossings.

If the MACD continues to rise and the neutral zero line exceeds, this is able to further confirm an impulse shift to a full Bullisches cycle.

RVN/USDT Weekly Smi withdraws after a pointy rebound

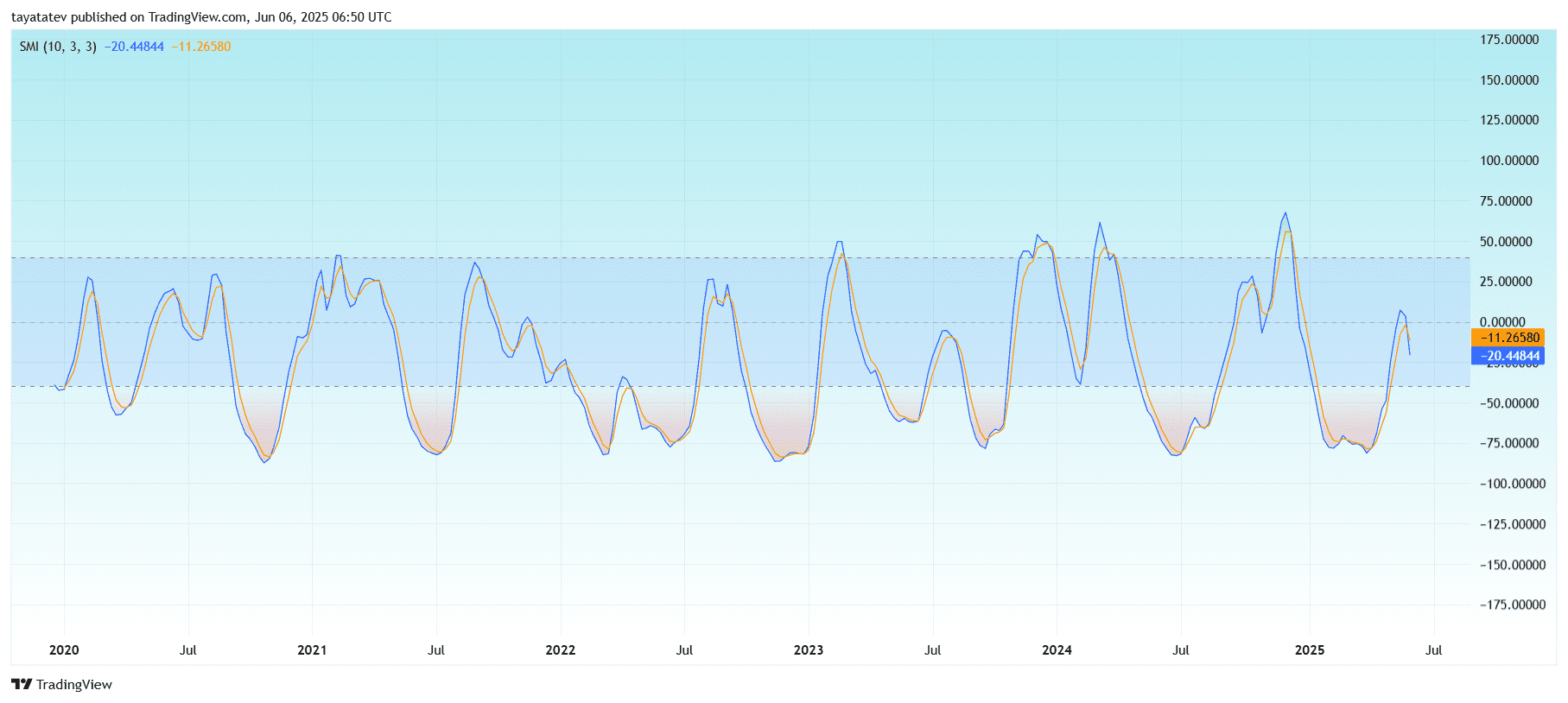

In the meantime, the Stochastic Impulse Index (SMI) for RVN/USDT showed a straightforward withdrawal after a robust recovery from the oversized area.

RVN/USDT Weekly Smi diagram. Source: Tradingview

RVN/USDT Weekly Smi diagram. Source: Tradingview

The Smi Blue Line is currently 20.45, while the orange signal line is –11.27. Both lines turned down after a steep climb, which indicates a brief lack of dynamic after the worth spike at the start of this week.

The SMI measures the closure price impulse relative to the median of the high/low area and is more sophisticated than the standard stochastic oscillator. Values over +40 suggest a robust upward impulse, while values under –40 display a robust downward impulse.

Previously, RVN/USDTS SMI had crossed over –40 and moved to the zero line and initially showed bullish impulse. However, the most recent dip indicates consolidation or hesitation of buyers. To proceed the trend, the blue line must turn up and break again via the signal line.

This short SMI rejection reflects the short-term price recording after 152% Breakout from RVN.