On March 26, the Blockchain Tracking platform Lookonchain reported that Pump.fun 104.120 SOL value around 15 million US dollars. This transmission complements the growing list of the transactions sure with pump.fun, which has now shifted over 2.73 million SOL value 526 million US dollars for the exchange. The sudden shift of enormous volumes for a public exchange is commonly interpreted as a preparation for a possible sale.

On-chain-netflow data confirm that the sale of pressesolana pursues the downward trends, but faces resistance

Pump.fun handed $ 15 million in Sol to octopuses. Source: Lookonchain on X

Pump.fun is a meme coin launchpad based in Solana, with which users can quickly create and act token. The success of the project was followed by the buildup of Sol, presumably from liquidity and operational purposes. However, the repeated Sol broadcasts from Sol to Kraken suggest that Pump.fun may convert stocks into stable coins or Fiat to attain profits or finance operations.

According to Lookonchain, Pump.fun has already sold 264,373 SOL for $ 41.64 million in USDC at a median price of $ 158. These sales represent a remarkable reduction in stocks, and there could possibly be more transfers on the best way if the trend continues.

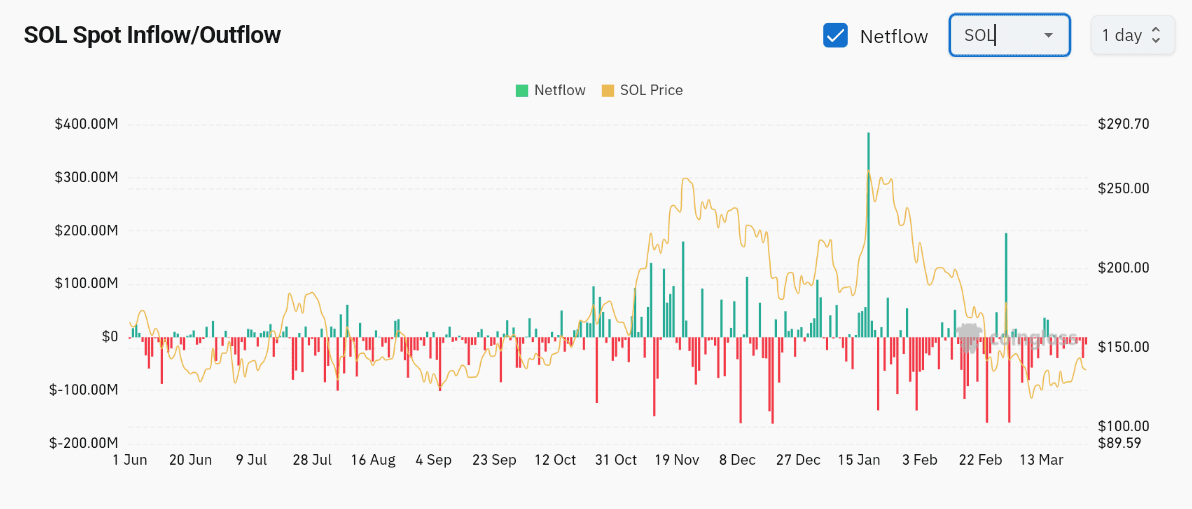

On-chain netflow data confirm sales pressure

On-chain analyzes provide additional information on an attachment. A recently carried out movement of Netflow -Chart -tracking from SO and From the exchange shows a rise within the positive netflow -the characteristic of more Sol enters the stock exchanges than to go.

Sol Netflow data show a recent increase in exchanges of exchange. Source: Coinglass

Sol Netflow data show a recent increase in exchanges of exchange. Source: Coinglass

These data support the concept whales prepare on the market. The green beams on the table, especially those that observed in the center to the tip of March, reflect increased deposits from SOL to the exchange. These inflows are directed with pumps. The FUTS stated that they were transferred to octopuses and could possibly be on account of the profit by large owners.

If Netflows remain positive, short-term prices could possibly be exposed to resistance on account of the growing sell-side liquidity of exchanges.

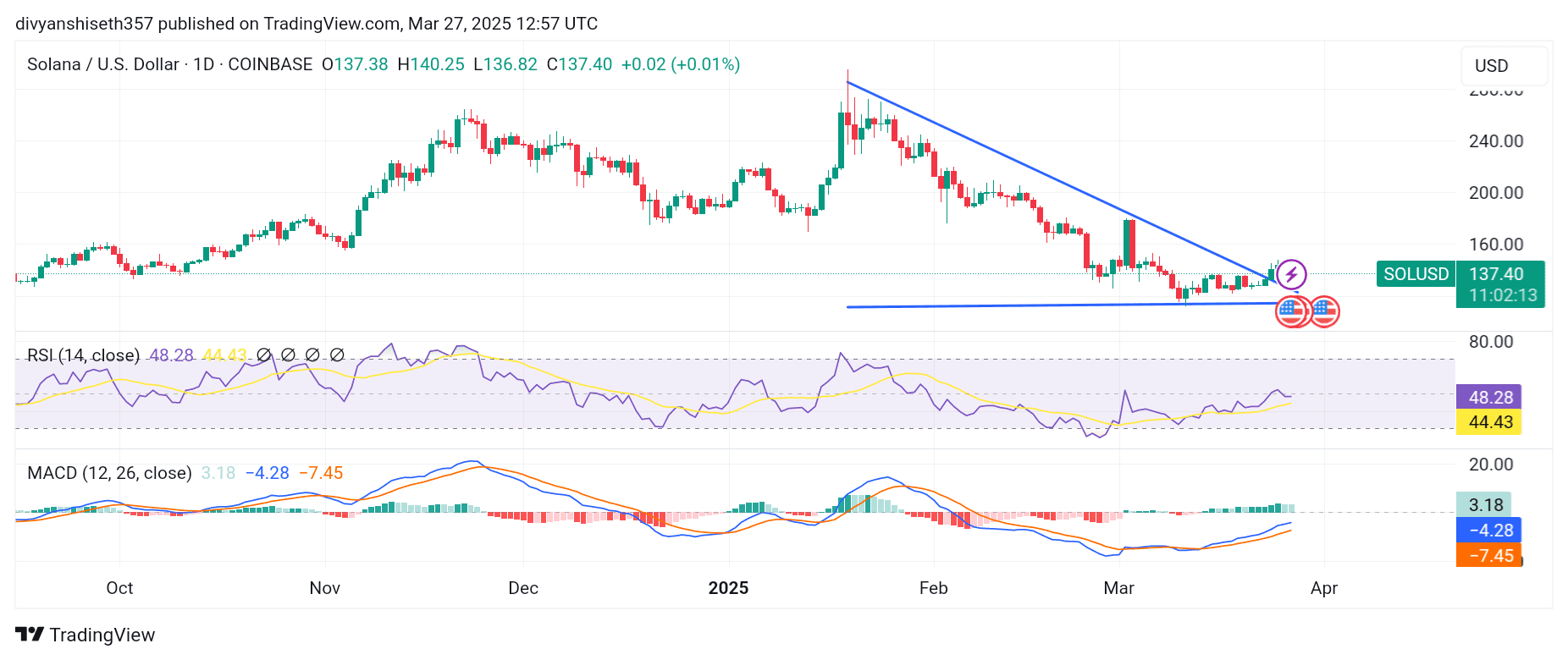

Solana breaks downwards, but looks like resistance

Despite the whale movement, Solana's technical diagram shows signs of possible recovery. In the each day table, Sol broke out of a descending triangle pattern, which is mostly a bullish indicator. The outbreak occurred above the long -term resistance line that had limited prices since February.

Solana (sol) breaks out of a descending triangle pattern. Source: Tradingview

Solana (sol) breaks out of a descending triangle pattern. Source: Tradingview

The MacD (sliding average convergence divergence), a vital impulse indicator, shows a bullish crossover. The MacD line has moved via the signal line, which indicates that the heart beat grows upwards. At the identical time, the RSI (relative strength index) is 48.28, which indicates the neutral strength in the marketplace. It is just not yet within the overbought area that leaves space for the value increase – if the acquisition volume is sustained.

The price is currently $ 137.40. A powerful support zone has formed across the region from 125 to 1330 US dollars. If this zone applies, Solana can attempt to push the range from 150 to 160 US dollars at short notice. However, if the sale of whale sales is intensified, the value could repeat lower levels.

You may prefer it: Will the Solana ETF be approved in 2025? Industry leaders weigh

The direction that Solana takes next depends upon whether the pump and other large owners proceed to unload their tokens on the stock exchanges. While the breakout gives the dealers a certain self -confidence, the threat creates a counterweight of the optimistic expectations on account of the pressure from the sales representations from large deposits.