On May 28, 2025, the 4-hour diagram was a bearish pennant pattern on Binance. After a robust downward train, a bearish pennant forms, followed by a brief consolidation inside two convergent trend lines and sometimes results in an extra decline.

Be RSI falls under the signal line, shows weak momentumeni -hits record tvl as an ETF interest and giga -start -build -impulse

Be Bearish Pennant Breakdown Setup. Source: tradingview.com

If this setup confirms, the SETOKEN can drop 19% of the present price of $ 0.2197 to the projected goal of $ 0.1766.

The pattern begins with a steep decline, which shaped the flagpole around May 16 to May 18. After that, the value briefly consolidated in a red symmetrical triangle. This formation typically represents a continuation of the previous downward trend.

The price is currently under the 50Pro-exponential moving average (EMA), which is $ 0.2269. This position increases the pressure down and acts as a dynamic resistance. In addition, the recent breakout attempt over the triangle failed and pressed back each below the upper trend line and the EMA.

The trading volume is 17.55 million and shows a slight increase. An increase in red volume sticks during a collapse would confirm the baric dynamics.

The next necessary support is $ 0.1766, which also corresponds to the projected breakdown goal of the Pennant. If it’s closing under the lower trend line with a robust volume, this waste can occur quickly.

Until then, dealers and analysts monitor the value for confirmation.

Be RSI falls under the signal line, shows a weak impulse

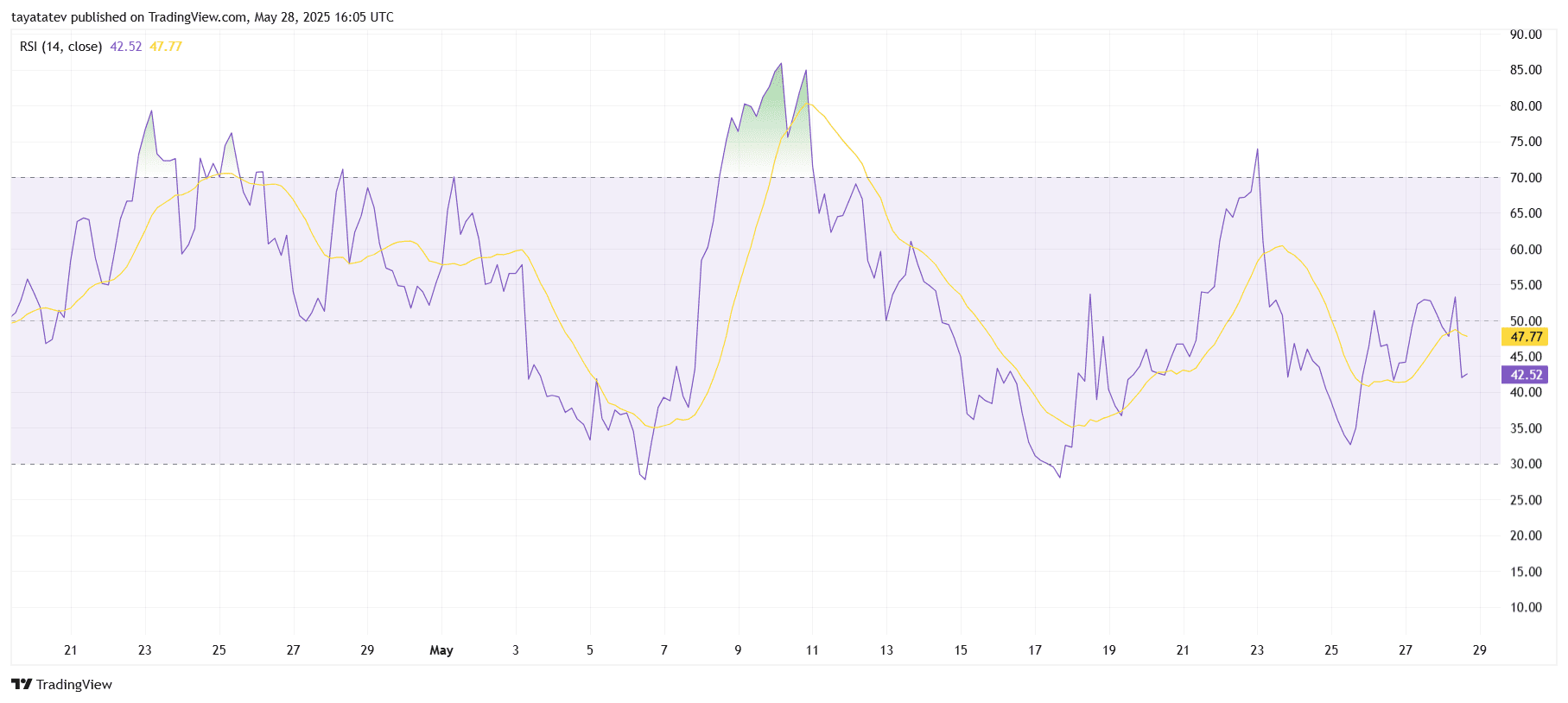

On May 28, 2025, the 4-hour diagram for relative strength index (RSI) for SEI/USDT shows a bearish signal. The RSI line (purple) is 42.52, while the sliding 14-period average (yellow) is 47.77.

Six RSI trend evaluation. Source: tradingview.com

Six RSI trend evaluation. Source: tradingview.com

Since the RSI has dropped below the 50 mark, this means that the weakening bullish impulse becomes weaker. In fact, the crossover confirms the short -term bear pressure under its moving average. This drop follows a failed try to stay over 50, which regularly acts as the middle of the impulse balance.

In addition, the RSI has not yet reached the oversized region, which begins at 30. Therefore there continues to be space for further disadvantages before a technical back rim.

Previously, the RSI reached a climax over 70 initially of May and signaled an overbought state. However, it quickly turned over and the present downward trend continues to reflect broader sales activities.

If this trend applies, this might further support the breakdown potential that may be seen within the major prize card.

Be Hits Record TVL as an ETF interest and giga -start -build -dynamic

On May 28, 2025, a brand new all-time value (TVL) reached and signaled a robust commitment in his ecosystem. This growth comes when the Canarian capital reports an ETF that is predicated on its performance and reflects the increasing institutional interest.

The total value blocked to $ 477.44 million. Source: Defillama

The total value blocked to $ 477.44 million. Source: Defillama

In the meantime, the upcoming Giga -token -Start, which could promote additional traction, is ready. The protocol expands its presence in decentralized funds by securing the trust of the users and growing liquidity.

Together, the ETF movement and the Giga rollout have reinforced the narrative of be on the broader market, even when the short-term price campaign stays under Bärische pressure.