On May 29, 2025, the 4-hour diagram of PI Network (PI/USDT) created a bearish Pennant pattern on OKX.

RSI drops near the oversized zone, for the reason that sales pressure BauGate.io Pi -Netzwerk -Netto -Netto -Netlüsen as CEX letter pockets leads over 2.6 million tokens

PI network (PI/USDT) 4-hour diagram-bearish Pennant pattern. Source: tradingview.com

After a pointy drop in price, a bearish pennant pattern forms, followed by a brief consolidation in converging trend lines, and typically signals further downward movements.

The token has already dropped 7% in comparison with the present price of $ 0.7034. If the pattern confirms, the worth from the present level can drop by 91% to around 0.0616.

This setup began between May 14 and 17 with a steep fall of over $ 1.60 and formed the flagpole. Then the worth moved in a narrowed triangle with a decreasing volume and shaped the pennant.

The price is currently under the 50-period exponential moving average (EMA), which is $ 0.7596. This moving average gives the most recent prices more weight and acts as a dynamic resistance. The volume within the table shows a lower activity during consolidation, which is common before an outbreak.

If the worth breaks under the lower red trend line with increased volume, this is able to confirm the bearish pennant. This step would probably open the best way for the further decline of the projected goal.

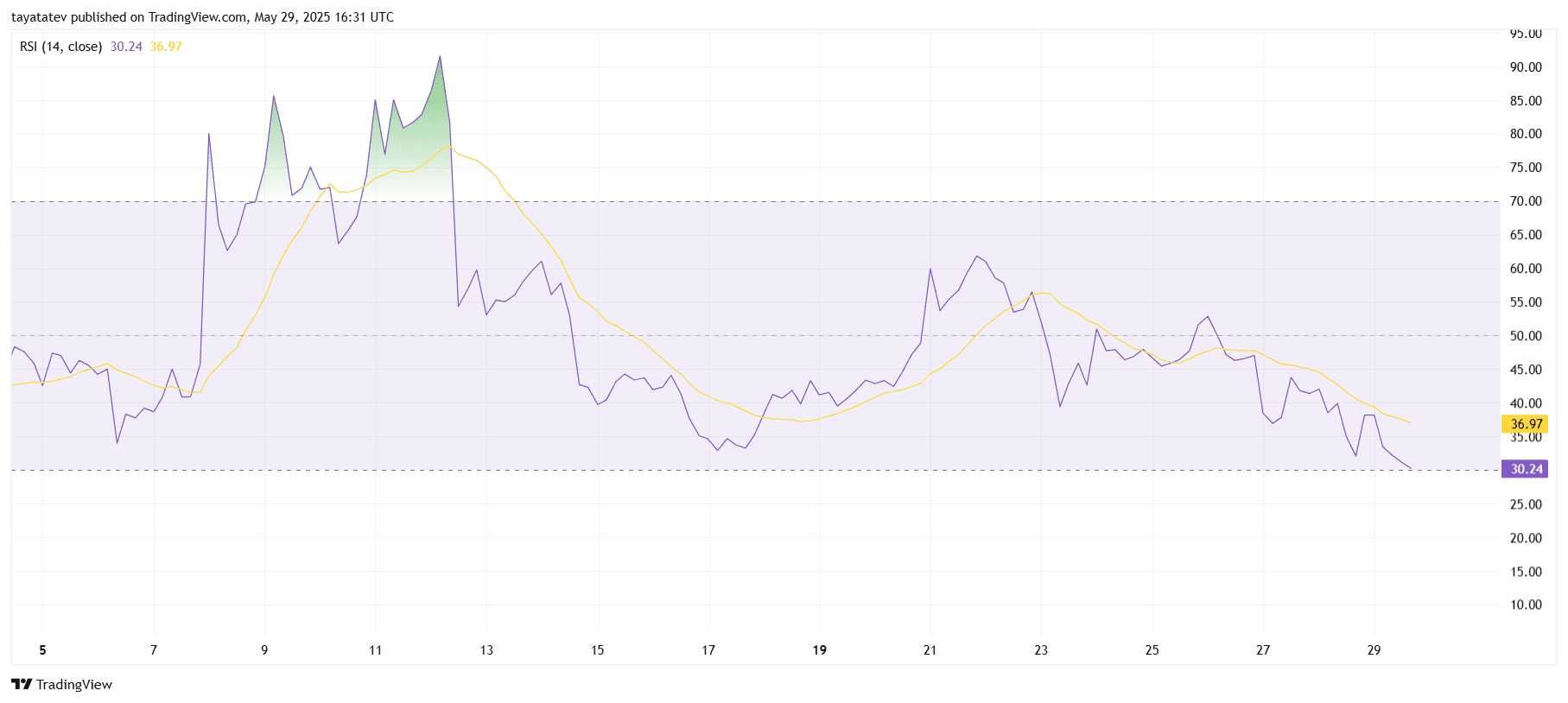

RSI falls near the oversold zone, while the sales pressure is built up

On May 29, 2025, the 14-period relative strength index (RSI) for the PI network reached 30.24 with its sliding average at 36.97. The RSI measures the market dynamics and shows whether a token is overbought or oversized. If the worth 30 approaches, it signals potential oversold conditions and growing downward pressure.

PI -Netzwerk -rsi (14) indicator. Source: tradingview.com

PI -Netzwerk -rsi (14) indicator. Source: tradingview.com

The RSI has consistently reduced since May thirteenth and is now below its own average. This confirms that sellers proceed to dominate. Any try and push the RSI over 50 previously two weeks has failed previously two weeks, which shows that buyers couldn’t regain control.

The RSI trend supports the previous Bärische Pennant pattern on the worth card. Together, these signals indicate an increasing weakness of the market pulse and the opportunity of further declines.

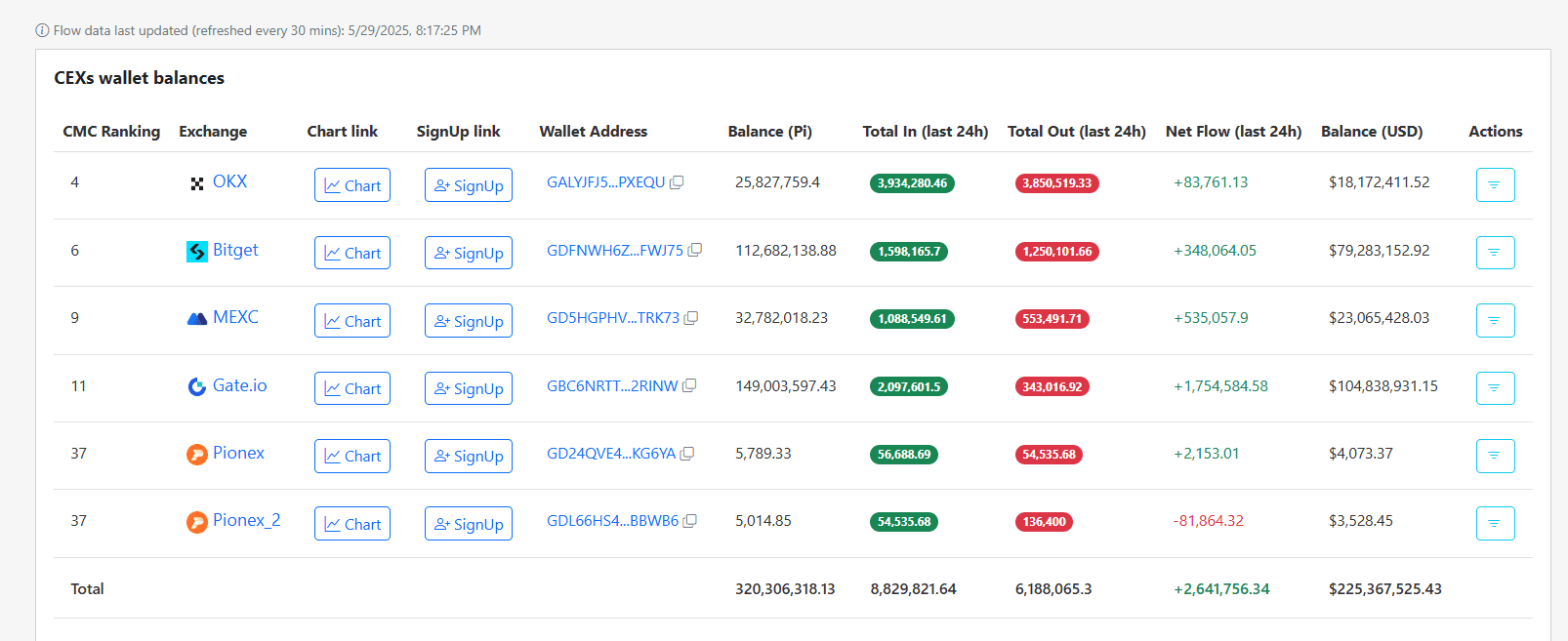

Gate.io leads pi -network -netto -inflows when CEX added pockets add over 2.6 million token

On May 29, 2025, central wallets (Centralized Exchange (CEX)) held a complete of 320.3 million PI tokens on six persecuted platforms. Gate.io showed the strongest inflow and received over 2 million PI, while only 343,016 tokens were recorded in drains. This gave him the very best net profit of the day – greater than 1.75 million PI tokens.

Pi Network Cex Wallet inflows and balances. Source: Pi Block Explorer

Pi Network Cex Wallet inflows and balances. Source: Pi Block Explorer

Other primary exchanges also recorded positive rivers. Mexc added 535,057 Pi to his stocks, Bitget achieved 348,064 and OKX recorded a net inflow of 83,761 token. Pionex had mixed results – IT primary pocket recorded a net profit of two,153 PI, while one other wallet recorded an outflow of 81,864 token.

The combined net inflow reached a complete of two.64 million PI in 24 hours. The total inflows were 8.82 million PI, while the drains were 6.18 million. The total amount of USD of those wallets achieved $ 225.36 million, with Gate.io the very best at $ 104.8 million.

This activity reflects a gradual accumulation of greater exchange throughout the ongoing price consolidation.