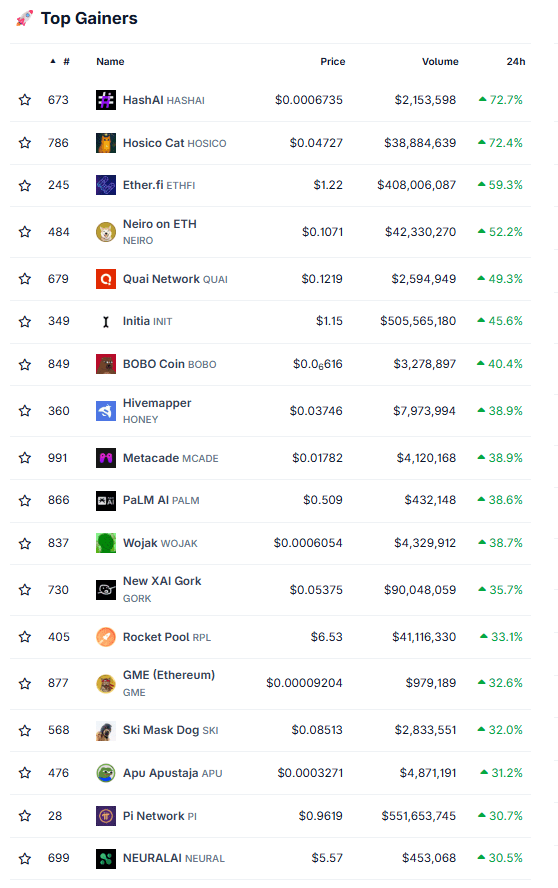

Pi Networks native token (PI) gathered strongly within the last three days and 68.12% between May 8 and May 11, 2025. The token rose from around $ 0.9883 on this route, based on data from the PiusDt -daily diagram on tradingView. The Spike brand the primary time that PI has been approaching the 1 dollar brand for the reason that starting of March.

The trading volume also increased significantly. Daily candles from May ninth to eleventh show growing bullish dynamics, with the quantity reaching a multi-weekly high on May tenth. The token broke over crucial resistance zones near $ 0.6761 and $ 0.80 and confirmed an upward development trend. The sliding 50-day average, which hovered around $ 0.60, was crucially became the support.

The PI network price jumps by 68%in 3 days. Source: Tradingview

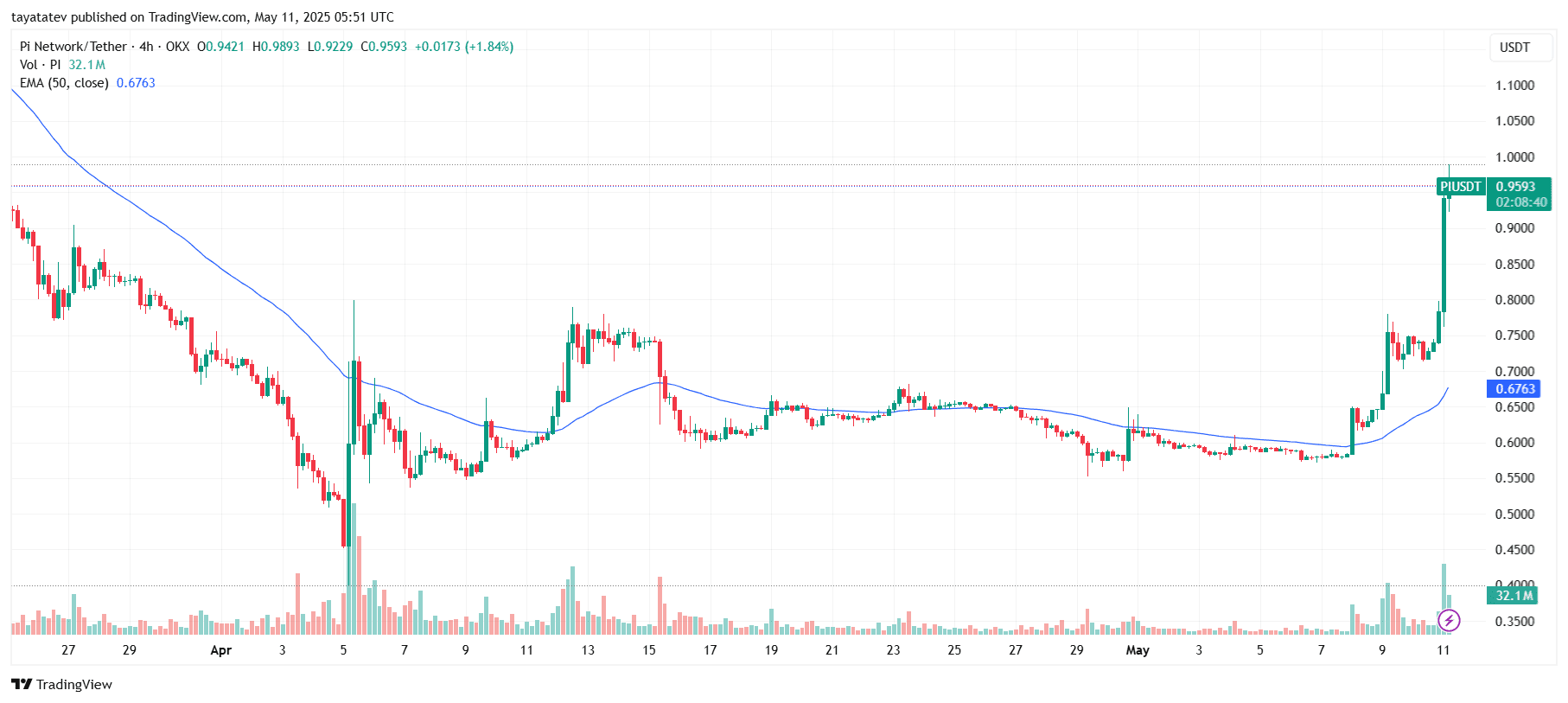

According to Coingecko, Pi became the highest win among the many 100 largest old coins after market capitalization on May eleventh. The move got here after months of sideways movements, by which the token was traded in a narrow area between $ 0.50 and 0.65. At the start of April, Pi had touched an all-time low of $ 0.40 after large token-free circuit and investor uncertainties.

Top -Altcoins on May eleventh: PI, ETHFI, Hash Surge. Source: Coingecko

Top -Altcoins on May eleventh: PI, ETHFI, Hash Surge. Source: Coingecko

Pi rebounds of a low point of $ 0.40

At the start of April 2025, the token (PI) fell from Pi Network to only 0.40 US dollars, which reflected the continued sales pressure, which was triggered by large token leisure and wider market skepticism. The 4-hour diagram of TradingView shows a steep downward trend that prolonged from the top of March to the primary week of April. This decline pulled PI under the 50-period exponential sliding average (EMA), which continued to act as dynamic resistance.

Piusdt 4h diagram. Source: Tradingview

Piusdt 4h diagram. Source: Tradingview

After the low of $ 0.40, Pi tried short-term leisure, but couldn’t cancel over the EMA, which indicates a scarcity of bullish impulse. The price consolidated in a narrow range between $ 0.50 and $ 0.60 from mid -April to early May. During this phase, the trading volume remained relatively flat and signaled the participation of investors.

The structure modified on May 8, when a robust Bullic candle formed, accompanied by a robust increase in volume. By May 9, Pi closed over the 50 EMA with $ 0.6763 over the 50 EMA and declined from $ 0.60 with a day by day profit of greater than 20%. This outbreak confirmed a reversal of the trend and turned the moving average right into a retaining zone. It also marked the start of a multi-day rally that pushed PI towards $ 1.

The rally didn’t slower. On May 11, Pi jumped by 35% and touched $ 1. The token has increased by about 64%weekly. Merchants from X and Telegram have identified the move as one of the crucial necessary altcoin outbreaks this month.

Speculation shows at Binance list or conference -hype

There is not any confirmed messages to elucidate the sudden increase. However, two necessary events can have contributed to cost dynamics. First, the PI network team is predicted to make a crucial announcement on May 14th. Speculation online points on a possible list of a big exchange, potentially bony.

Second, the co -founder Dr. Nicolas Kokkalis from May 14th to sixteenth speak on the Consensus Conference in Toronto.

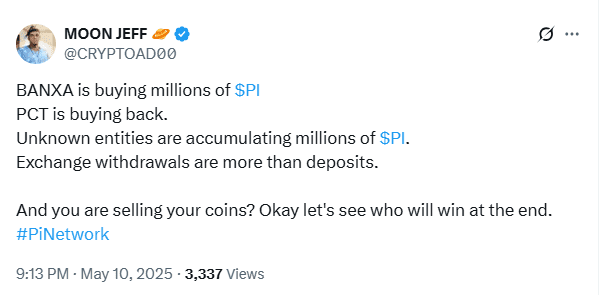

In the meantime, analyst Moon Jeff reported that several unidentified items – overall, have also collected the payment platform Banxa – Pi -token. He announced this information along with his followers on X, which indicates that the increasing demand from unknown firms could increase the worth higher. However, no official confirmation has supported his claims.

Moon Jeff claims a large $ PI accumulation. Source: X/@Cryptoad00

Moon Jeff claims a large $ PI accumulation. Source: X/@Cryptoad00

Despite the rally, Pi stays in a closed important network phase. The token has not yet began public blockchains or large centralized stock exchanges. Most shops are actually being found outside the chain, and the circulating offer isn’t fully accessible.

The PI network costs 1 US dollar: find out how to buy and sell PI coins

How to purchase Pi Coin (PI)

Step 1: Select a supported exchange

To buy Pi Coin, first select an exchange where it’s listed. From May 2025, PI is out there on several central platforms, including OKX, Mexc, Bitmart, Bitget, Kucoin and Bybit. These stock exchanges support trading pairs resembling PI/USDT, PI/ETH and PI/BTC.

Step 2: Register and complete the KYC

Create an account in your chosen platform. In most stock exchanges, users have to know a KYC process (KOYC). You must upload identification documents and check your identity before accessing complete trading functions.

Step 3: deposit funds

After registration, pay money into your Exchange account. Most platforms support bank transfers, card payments and crypto performances. As soon as your account is financed, you may place an order.

Step 4: Find PI coin and trade

Use the search bar on the trading platform to seek out “Pi” or “Pi coin”. Choose the relevant trading couple (e.g. PI/USDT). Then select the kind of order – Market Order for immediate execution at the present price or to the limited order to set your required purchase price.

Step 5: Secure your tokens

After buying PI, consider your tokens in a private crypto letter pocket to recuperate security. Activate the two-factor authentication (2FA) in your account to scale back the danger of an unauthorized access.

How to sell Pi Coin (PI)

Step 1: Complete Mainnet migration and KYC

Before the sale, be sure that that your PI tokens are on the Mainset. Use the PI browser -app to create a PI letter bag and complete the KYC check. Only users with verified Mainnet letters can transfer PI to the exchange.

Step 2: Create an Exchange account

Choose a serious exchange that supports PI and register. If vital, perform the KYC process. Avoid platforms that usually are not officially recognized by the PI network group because they might be risks for users.

Step 3: PI coins transfer to the exchange

Move your Mainnet Pi token out of your wallet to your Exchange account. Always check the item of the items of the items twice before the transaction is confirmed.

Step 4: surrender a sales order

Find the PI trading couple on the trading platform that you just prefer (e.g. PI/USDT or PI/BTC).

-

Market order: sells your PI immediately at the present price.

-

Limit order: Let yourself be set your required price. The order shall be accomplished as soon because the market has reached this level.

Step 5: Return or exchange funds

As soon because the sale of sales has been filled out, your credit is updated in the chosen currency – normally USDT or one other crypto. You can now:

-

Draw the funds on a crypto letter pocket,

-

Convert to Fiat currency or

-

Exchange the identical exchange for one more digital asset.

Tips for selecting the fitting exchange

-

Look for low trading fees: This helps to scale back your entire transaction costs.

-

Check the liquidity: The high trading volume ensures faster and more efficient trade.

-

Check Community Trust: Choose the exchange that the PI network community recognizes with a purpose to avoid not supported platforms or fraud.