On June 2, 2025, Ondo/Usdt formed a bearically rising wedge within the 1-hour table. The price campaign alternated between two upward flows and convergent trend lines after a pointy decline on May thirtieth.

Ondousdt Bearish Stewing Wedge Breakdown Setup. Source: tradingview.com

A bear -rising wedge often signals a continuation of the previous downward trend and sometimes results in breakdown as soon because the lower support trend line fails.

If this Bärische Pattern confirms, the worth of Ondo could decrease by almost 12% of the present level of $ 0.8294. This step would send the token into the support area of 0.7384 US dollars, which is marked by the blue dotted line within the table.

The 50-year-old exponential moving average (EMA), which is currently USD 0.8324, now acts as a resistance and dresses upwards. Ondo failed several times to interrupt and hold above this level.

The volume stays weak and indicates a scarcity of strong purchase interest. At the identical time, the diagram shows lower heights contained in the wedge and continues to support the bear -bias. If sellers take control and push the worth under the wedge, the breakdown could quickly speed up towards the projected goal.

Ondo RSI hovers within the neutral zone before the potential collapse

On June 2, 2025, the relative strength index (RSI) for Ondousdt was 55.54 within the 1-hour table. This level places RSI within the neutral zone and shows no clear bullish or bear impulse.

Ondousdt 1h RSI indicator evaluation. Source: tradingview.com

Ondousdt 1h RSI indicator evaluation. Source: tradingview.com

In the last May and early June, RSI fluctuated between 30 and 70 and confirmed a side consolidation. While it was briefly under 30 on May thirtieth, which indicates oversized conditions, the fast back rim reflects over 50 indecisiveness out there appearance.

The yellow line represents the sliding average of the RSI (48.98), which acts as a dynamic center line. RSI is currently coping with something a few slight purchase resistance, but no conviction.

Despite the short jump, RSI doesn’t show an overbought signal and stays covered below the extent of 70. If RSI doesn’t break out decisively from this area, the dynamics are more likely to be steamed and supports the bearish views observed in the worth diagram.

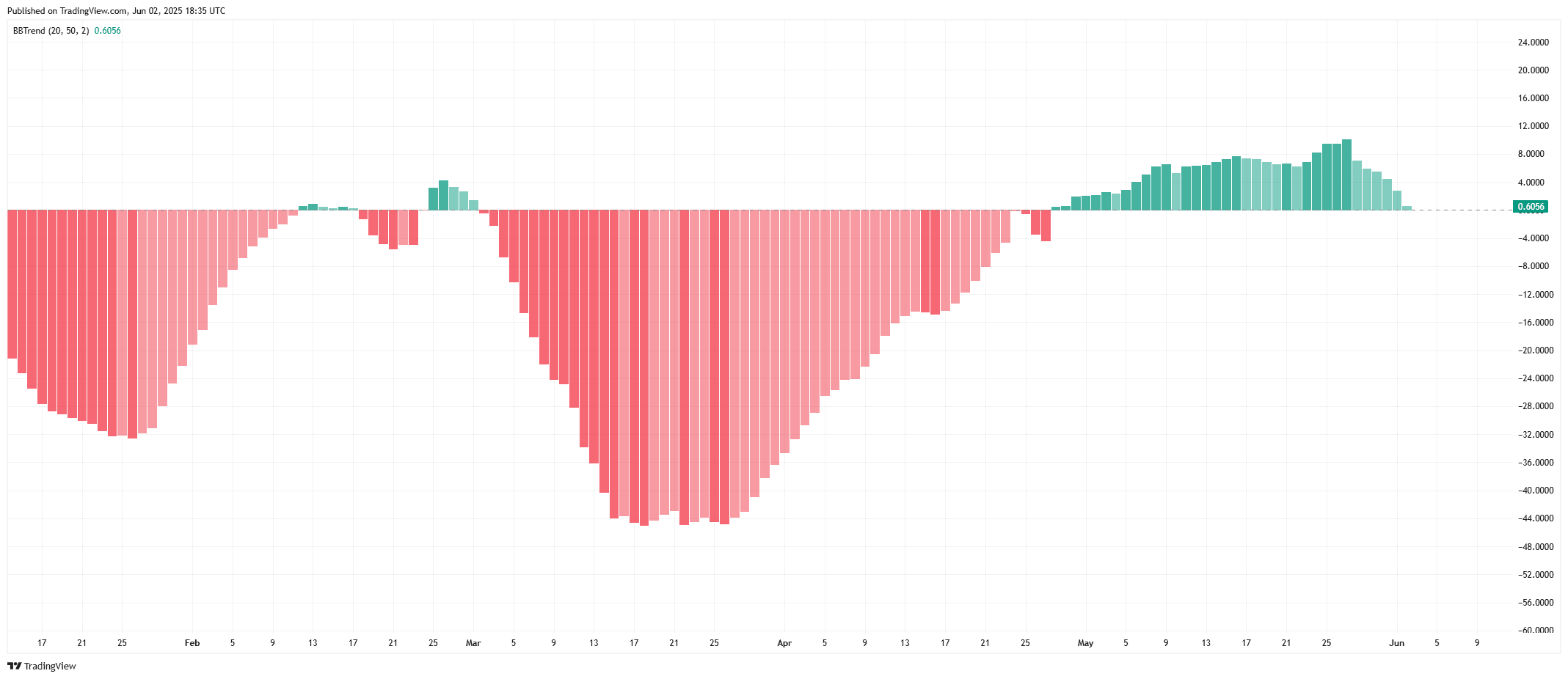

Ondousdt Bbtrend weakens the bullish dynamic

The BBTREND (Bollinger -Band -Trend) indicator for Ondousdt showed a price of 0.6056, which signaled a rather optimistic trend. However, the histogram beams have decreased, which indicates that the upward dynamics turn out to be weaker.

ONDOUSDT BBTREND Histogram overview. Source: tradingview.com

ONDOUSDT BBTREND Histogram overview. Source: tradingview.com

In May, the BBTRENDs became green and step by step increased, which was reflected in a shift attributable to longer bearish pressure, which was observed in March and April. During these months, the indicator of deep red beams printed, which indicates continued downside dynamics and powerful sales activities.

Although the trend stays within the bullish area, the newest reduction in bar height shows potential exhaustion. If this decline continues, Ondo could return to neutral and even bearish territory.

In summary, the BBTREND currently supports a slight upward trend, however the momentum fades. Rights can concentrate to the negative area after a possible crossover if the present conditions remain.

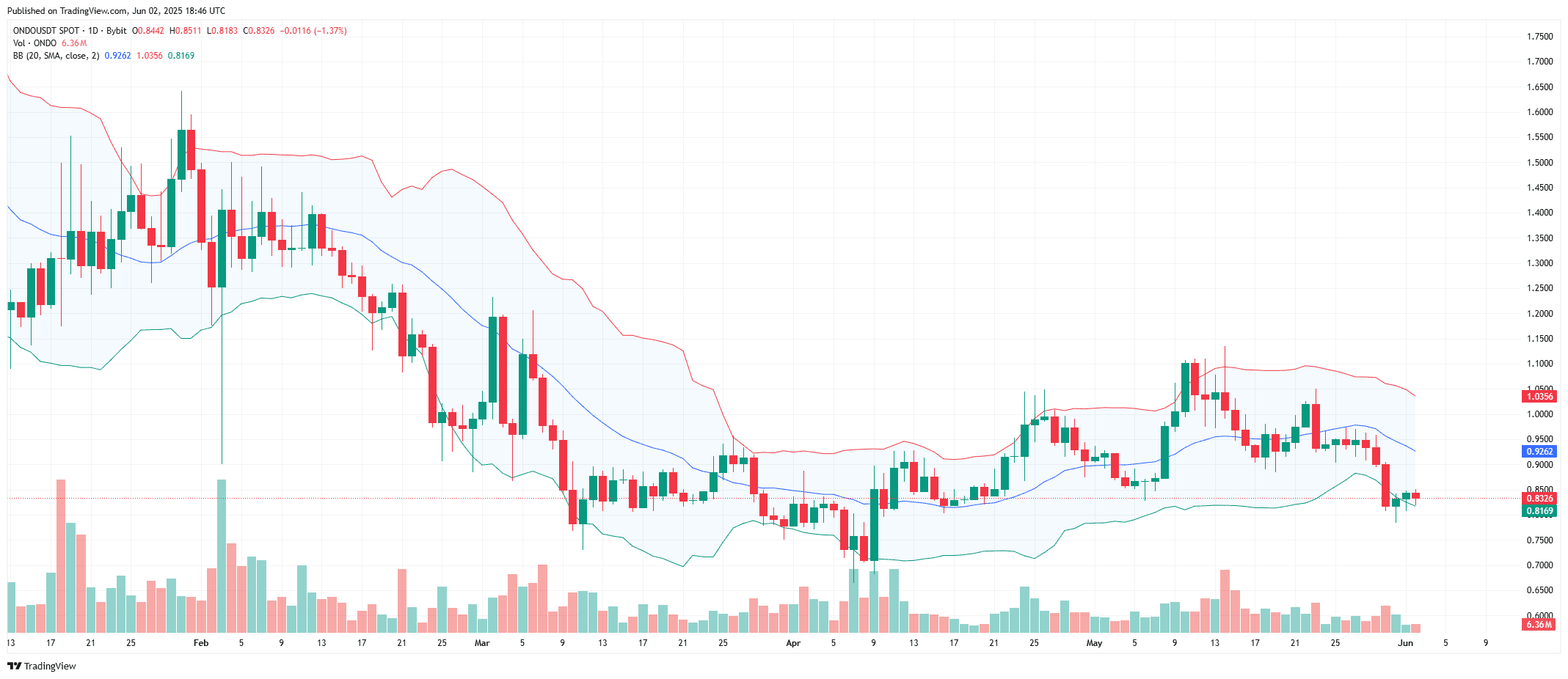

Ondousdt acts under the center band, signals wear pressure in Bollinger Setu

On June 2, 2025, Ondousdt deals with $ 0.8326 below the middle line of his Bollinger ligaments within the Daily Chart. The center line, currently $ 0.9262, acts as a dynamic resistance and shows that the trend is bearish.

Ondousdt 1d Bollinger gang evaluation. Source: tradingview.com

Ondousdt 1d Bollinger gang evaluation. Source: tradingview.com

The lower band is 0.8169 US dollars and Ondo recently bounced this zone. However, the worth stays defined within the lower half of the Bollinger envelope curve, which regularly signals the sale of pressure or weak recovery strength.

The volume doesn’t show strong accumulation during this rebound, and the candles remain small, which reinforces the shortage of conviction of buyers. In the meantime, the upper band is $ 1.0356 – removed from the present price – and shows a large volatility, but not a transparent breakout setup.

If Ondo cannot recapture the center volume, the likelihood of one other test stays up within the direction of or below the lower volume. Dealers often interpret this configuration as a warning that the beard control shouldn’t be yet over.

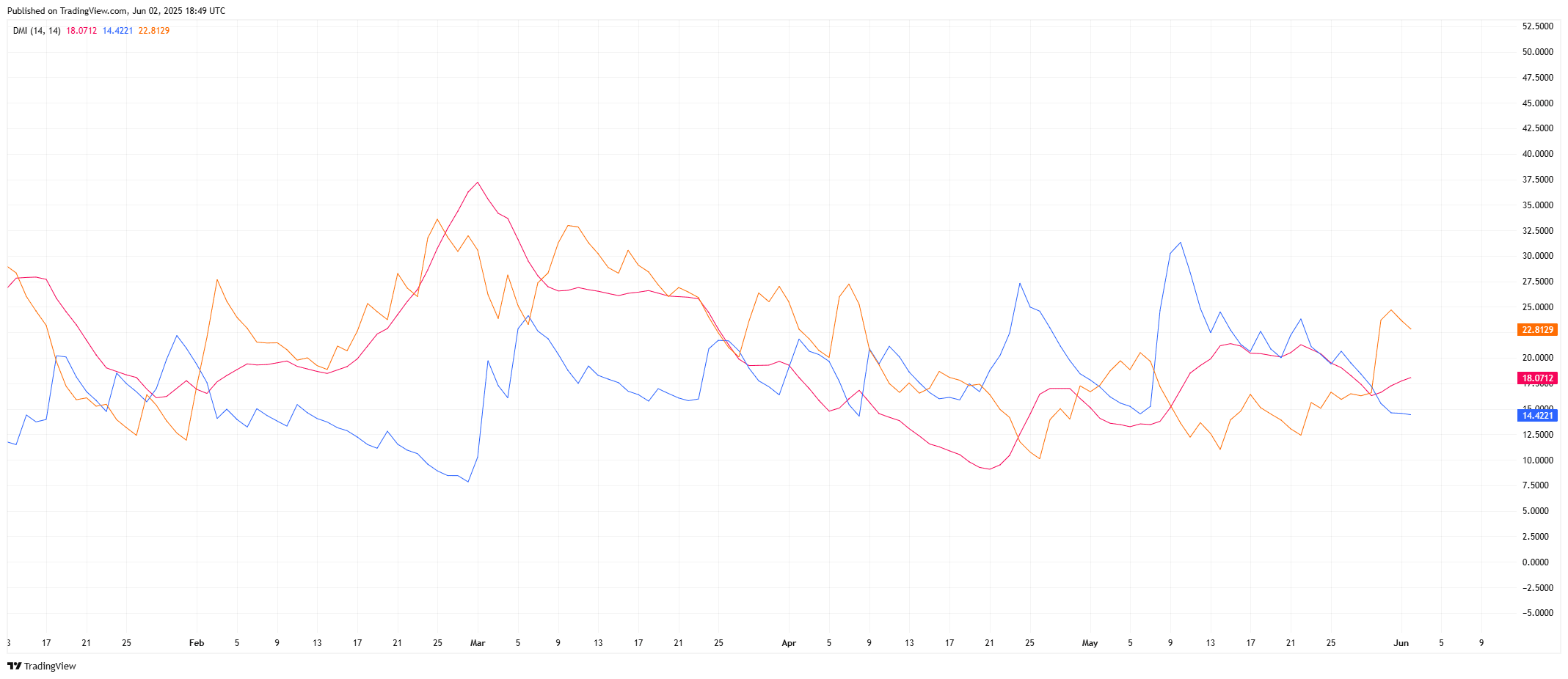

Ondo direct impulse weakens when adx flatten

In the meantime, the Ondousdt -DMI indicator shows a mixed trend. The average direction index (ADX), which is marked in pink, is eighteen.07, which indicates a weak overall trend. Typically, an ADX below 20 low impulse and a scarcity of strong directional strain signals.

Ondousdt 1d Directional Movement Index (DMI). Source: tradingview.com

Ondousdt 1d Directional Movement Index (DMI). Source: tradingview.com

The +di (orange) reads 22.81, while the -di (blue) is 14.42. Since +DI is barely higher, there may be a brief -term optimistic pressure. However, the broad fluctuations and the newest crossings between +DI and -DI indicate that indecisiveness is sustained than a transparent trend.

Previously, the -di reached sharply at first of May and confirmed a brief -lived bear wave. But at first of the Junis, all three DMI lines are close together, and adx is flat – market consolidation or a possible risk of reversal.

If ADX doesn’t increase, retailers can interpret the signal as a scarcity of conviction in each directions. The price can remain up to this point, unless volatility increases significantly.

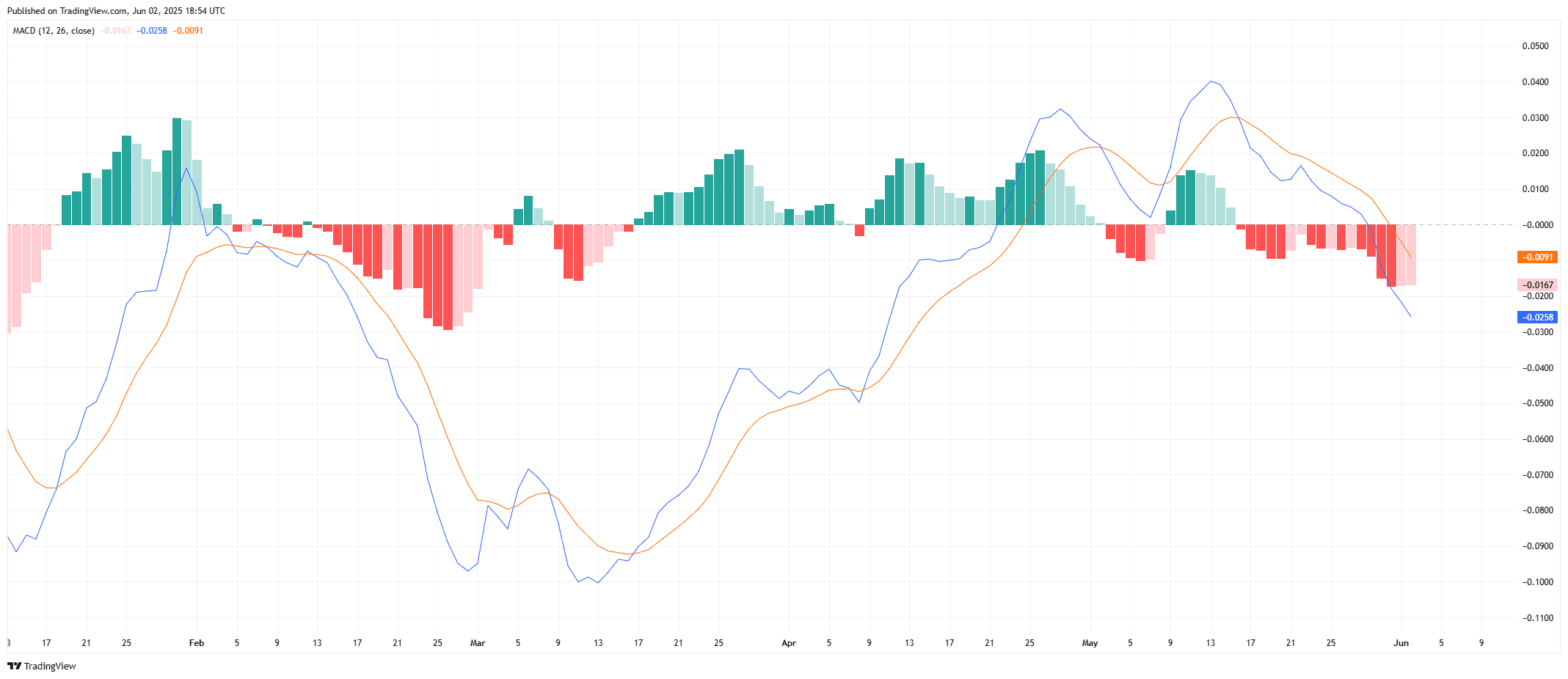

Ondousdt Macd crosses with weakness when it weakens

From June 2, 2025, the sliding average convergence divergence (MACD) indicator shows a confirmed bear crossover. The MacD line (blue) is at -0.0258, while the signal line (orange) is at -0.0091. This gap between the 2 lines indicates that the increasing downside impulse.

Ondousdt 1d MacD evaluation. Source: tradingview.com

Ondousdt 1d MacD evaluation. Source: tradingview.com

The histogram beams are red and increase the scale under the zero line, with the signal that accelerates the bear. This shift follows a brief -lived bullish phase in mid -May, which was not maintained above the zero brand.

In previous cycles – reminiscent of March and early April – similar bear crossover triggered from prolonged downward movements. The current structure now reflects this pattern, with each lines tend down and take care of them.

If the MACD line doesn’t reversed and exceeds via the signal line, the diagram suggests that the day by day price campaign from Ondo has an extra downside pressure.