Metaplanet's shares rose over 25%on June 16 within the intraday trade after the corporate announced that its Bitcoin -Holdings had exceeded 10,000 BTC. The move has expanded a broader rally within the stock, which this 12 months exceeded most Japanese stocks given the keenness of investors for crypto-oriented corporate strategies.

The 12-year-old meets MetaPlanet, while Crypto Treasury Batta pays offbitcoin purchases

The latest profit follows a lot of Bitcoin purchases last 12 months, but the corporate has offered only a number of latest details that were drawn beyond confirmation of accelerating its original timeline. While the milestone was vital, he only added fuel to an existing story – public corporations that use digital assets, while the alternatives to government bonds attract oversized market attention.

This narrative grows quickly. In the past few weeks, several corporations have added cryptocurrencies to their balance sheets. Sharplink applied for a big reserve by Ethereum Treasury after Consensys in the quantity of $ 425 million. Gamestop announced that it had acquired 4,710 BTC as a part of his revised capital allocation strategy.

Even smaller technology corporations akin to Oblong change towards reserves on chains and announce the Tao Treasury Holdings, that are aligned with the decentralized AI platform from the Bittensor. The institutional mood relies on long -term assets and programmable value storage. Afterwards, more corporations appear to be able to treat crypto as speculation, but strategy.

Metaplanet's rally is remarkable, but it could possibly be a part of a much wider repication.

The MetaPlanet shares have shot greater than 10,000% since April 2024. This has brought the share to the extent for the last 12 months 2013. The price rose by greater than 25%on June 16. He closed $ 13.15 because the corporate confirmed that it had reached 10,000 BTC in its treasure.

Metaplanets of long-term stocks in your complete BTC accumulation source: tradingview

The latest step brings the stock closer to a vital technical barrier. An continued increase would force a test of the immediate resistance near $ 15.05. Turning this level would bring the following upward destination near 19 US dollars. This increases the optimistic inclination of the market to corporations that bring their promise of value together to digital assets. The current trend stays steeply vertical and is supported by the expansion of the amount and the positive impulse.

On the opposite hand, the share shows support of $ 9.4. This threshold acted as a consolidation zone during her recent progress. The violation of this level would increase the chance of a correction train towards lower support of 5.9 US dollars before DIP buyers attempt to stabilize the worth. The RSI stays over 76 and signals overheated conditions, but still has to trigger a remarkable reverse pattern.

Metaplanets diagram tells a transparent story: crypto-oriented treasure maker draw the stock market flow in an unprecedented level. Since the worth campaign is urging a ten-year territory, the volatility will probably increase-but also the investor focus.

Bitcoin purchase promotes explosive growth

MetaPlanet's latest share thrust reflects an increasingly aggressive Bitcoin battery strategy that has redesigned its market profile. The company made its first Bitcoin purchase on April 8, 2024, began about 6.5 million US dollars and triggered an instantaneous increase within the share price of 90%.

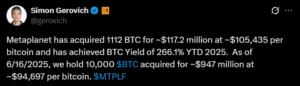

Simon Gerovich, CEO of MetaPlanet, declares BTC purchase source: X

Simon Gerovich, CEO of MetaPlanet, declares BTC purchase source: X

Since then, no less than 17 additional acquisitions have been carried out-20 BTC in July, 620 BTC in December, and in May 555 BTC bonds of zero coupon and stock exhibitions to finance every tranche.

Metaplanet reached 10,000 BTC in Treasury Holdings by June 2025. The extent of the buildup has intensified over time. Between April and July 2024 it added 140 BTC. In March 2025 alone, the corporate acquired 1,655 BTC, followed by one other 794 BTC in April. Another acquisition of 1,004 BTC in mid -May brought its total amount to 7,800 BTC. The latest 1,112 BTC purchase ended the ten,000 BTC milestone.

Each announcement has consistently driven large price reactions, often between 10% and 25%. The financing approach – used balance sheet instruments for the buildup of Bitcoin – converted the corporate right into a speculative vehicle for crypto exposure. Since MetaPlanet will aim to 210,000 BTC by 2027, its equity will probably pursue the expansion of the Ministry of Finance with high volatility and increased upward potential.

Simon Gerovich, CEO of MetaPlanet, announced that the corporate would really like to amass 210,000 BTC by 2027, which the corporate would place because the second largest Bitcoin owner behind Michael Saylor's strategy.