Ripple (XRP) Prize, which was traded near $ 2.33 on May 27, after a modest increase of 4% to a each day high of $ 2.354. The step was followed by a pointy rejection of the zone of $ 2.65 at the start of this month, which imposed a better punishment attributable to the failed application of the SEC to Ripple.

McGregors XRP Post Raynites debate as institutional rivers Weg technology Setup forces forces crab movements

Since then, the worth of XRP has consolidated between 2.29 and a couple of.47 US dollars, with Bulls having difficulty winning the upward trend. In contrast, Bitcoin continued to dominate the market mood and held over $ 110,000 after he had set a brand new all-time high early this week. Ethereum has stayed behind and hardly clings to the extent of $ 2,600.

Wider crypto flows indicate a rotation to large caps, but XRP doesn’t yet must free itself from its legal overhang. The capital is cautious about critical legal developments that might are inclined to balance.

Ripple's ongoing fight with the US Securities and Exchange Commission is entering a vital phase this week. A SEC meeting with closed doors on May 29 could influence the trajectory of the case. It is much more necessary that the judicial deadline for a standing update takes into consideration comparative talks on June ninth. If no agreement occurs, the SEC can enter into its appointment by June 15. On each date, the potential to ignite the volatility of the XRP markets relies on the official information or a shift in Ripple's legal foos.

In addition to the momentum, UFC symbol Conor McGregor posted over XRP over the weekend and introduced a brand new dose of speculative interest within the asset.

McGregor's XRP -Post causes the controversy when the institutional streams move away

Conor McGregor's X -Post rocked the crypto twitter awake on May 26, triggered over 1,000,000 views and inflamed the controversy in regards to the decentralization of XRP when the capital flows are shifted sharply. McGregor reacted to Donald Trump's earlier assertion a few US crypto reserve that might include XRP, Solana and Cardano.

McGregor drove with the decentralization claims from Crypto tokens, including XRP and other old coins.

The martial artist questioned the admission of token: “Many people tell me that they are usually not really decentralized.” His comment, skeptical and yet open, triggered a flood of answers from the community, with influencers, developers and validators hurried to defend their ecosystems.

While the XRP Prize didn’t show a direct increase, attention renewed the discourse on its suitability for sovereign or institutional stocks. The influence of Ripple Lobbyist Brian Ballard on the US -Political decision has added the inclusion of XRP weight, although the reserves of the reserve beyond Bitcoin remain unconfirmed.

Industry voices akin to Panos Mecras defended the decentralization of XRP by highlighting current XRP -Ledger -Upgrades and their layer -1 functionality. Others argued that Bitcoin and Ethereum remain the one really decentralized options. In the meantime, Cardano supporters referred to his governance model on chains, and Ethereum supported the usefulness of strict decentralization.

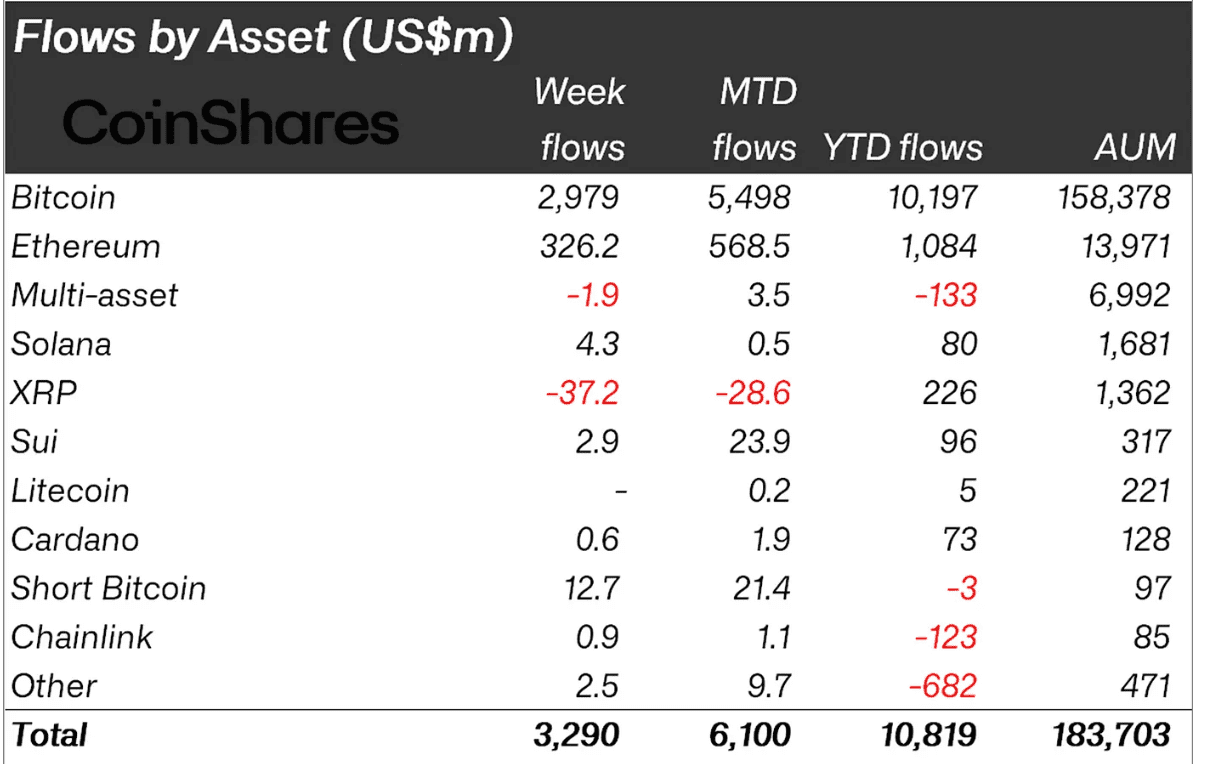

However, the timing couldn’t have been more critical for XRP. According to Coinshares – the primary weekly net drain for 80 weeks – the asset recorded a weekly record drainage of 37.2 million US dollars from institutional products.

XRP Investment Vehicles led the drains this week.

XRP Investment Vehicles led the drains this week.

Monthly drains at the moment are $ 28.6 million, although XRP holds cumulative tributaries of $ 226 million for the yr. Conversely, Bitcoin has recorded almost 3 billion US dollars. Therefore, XRPS Retreat signals a growing preference for agility and clarity within the project direction.

Solana, Sui and Cardano – also mentioned by McGregor – are modest but positive inflows in the identical period. Their perceived dynamics and simpler regulatory stories can advance fresh capital rotation, especially if the legal risks and the stagnating ecosystem of the XRP put a strain on the mood of investors.

Whether McGregor's influence triggered the displacement directly or just reflected doubtful, his post increased a decisive turning point: XRP is confronted with a declining institutional trust and an increasingly vocal challenge for his public perception.

Technical setup fakeout forces crab movements

XRP tried an outbreak from its falling wedge structure on May 12, but was not capable of transmit above the upper limit of the pattern. The price had been withdrawn into the wedge until May 15 and confirmed a powerful bear pressure near the immediate resistance at $ 2.58. The rejection increased the validity of the descending trend line of the pattern, which continues to finish bullish experiments.

Two converting down flows define the pattern. The falling wedge typically signals a possible bullish reversal. Dealers calculate the worth goal of the pattern by measuring the widest section of the pattern and projecting this height from the outbreak point. Without a decisive outbreak, nevertheless, this projection stays speculative.

XRP USD each day price diagram with RSI. Source: Tradingview

XRP USD each day price diagram with RSI. Source: Tradingview

XRP is currently acting directly above the 100-day EMAS (blue) and 50 days (purple), which form the support of the confluence. Bulls actively appear to defend the dynamic support of the confluence of the EMAS. The 20-dayema (red), which now acts as resistance, contributes to overhead printing. The RSI hovers across the neutral 50 level and doesn’t offer a transparent distorting distortion, but confirms ongoing consolidation.

The failure of the XRP to interrupt over the upper border of the wedge and to regain the resistance of $ 2.58 reflects continuing uncertainty. The next night test is 2.18 US dollars. Reflection below this level could invalidate the moans and force the XRP price to check the support near the support.

In the meantime, a confirmed outbreak could help the Ripple -token -Prize to realize immediate resistance and to query 2.88 US dollars. Until then, XRP stays trapped in a narrowing area, trapped between structural resistance and important short -term support.