Litecoin (LTC), once often called “Silver to Bitcoin's Gold”, has had the broader Altcoin market poorly below average since 2018. While the LTC has increased by over 300% up to now seven years, this fades in comparison with Ethereum and XRP, which increased greater than 3,300% or 750% in the identical period.

Litecoin leads the Altcoin -ETF race with a 90% approval rate of the award winner.

Source: cryptosurf

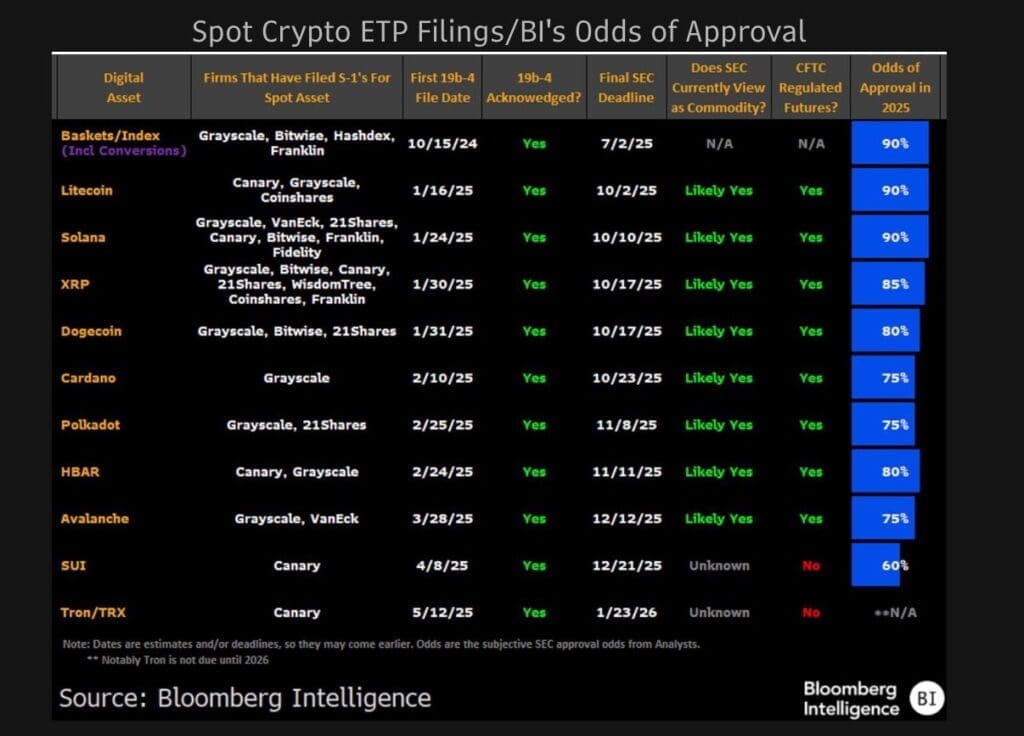

Well, that may change. A brand new Bloomberg Intelligence Update shows that Litecoin has the best probability of gaining Spot ETF approval for giant altcoins-as possible, in interest in one among the longest upcoming assets from Crypto.

Litecoin leads the Altcoin -ETF race with 90% probability of admission

LTC, Solana (SOL), has a 90% probability of gaining ETF approval within the USA along with the Layer 1 Blockchain, Solana (SOL), in response to the Bloomberg Intelligence. As a result, they stand in front of XRP (85%), Dotecoin (80%), Cardano (75%) and Polkadot (75%).

Spot Crypto ETP registrations and your opportunities for approval. Source: Bloomberg Intelligence

Spot Crypto ETP registrations and your opportunities for approval. Source: Bloomberg Intelligence

Litecoin enjoys a regulatory edge. The SEC probably classifies it as a goods based on a proof-of work consensus mechanism equivalent to Bitcoin, and the CFTC is already regulating its future. These key aspects simplify the trail right into a spot -Tf.

Graustufen, Canaria and Coinshares have submitted all applications, whereby the SEC should determine until October 2, 2025.

Although it has the identical probability of approval of 90%, Solana has a more complicated process. CFTC-regulated futures is missing and the SEC has not received a transparent name.

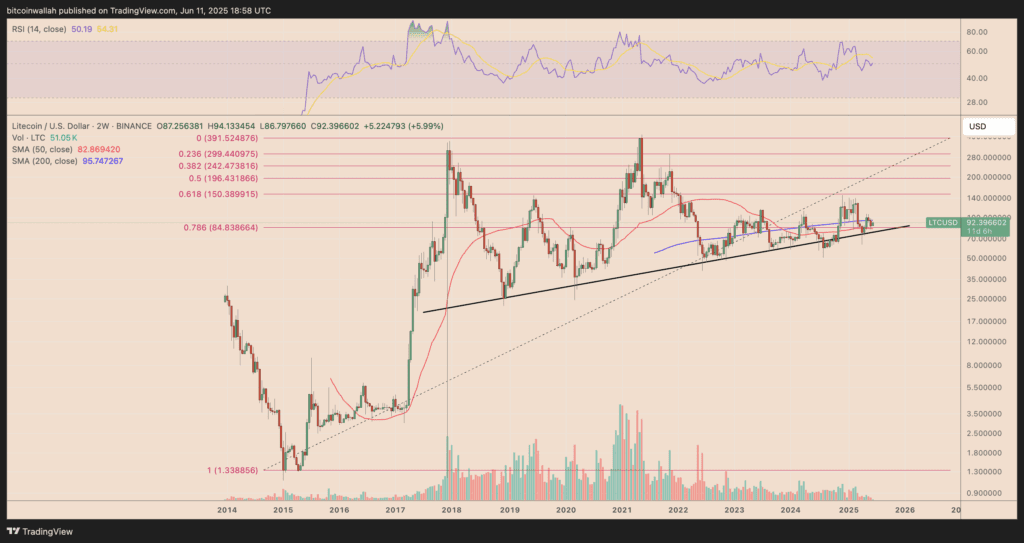

LTC Price holds vital support, eyes $ 150 as the following destination

Litecoin shows early signs of a bullish reversal after defending a critical multi -year support. The most up-to-date bounce was also directly above the 0.786 Fibonacci retreat level (~ 84.83 USD), which increased this zone as a robust battery area.

LTC/USD Weekly Price Chart. Source: Tradingview

LTC/USD Weekly Price Chart. Source: Tradingview

If the trend line applies, LTC could arrange a movement within the direction of local transport of 0.618 FIB $ 150Which also coincides with an earlier resistance area from mid -2023. This would mark a profit of around 60% in comparison with the present price level near $ 92.

The 50-week and 200-week relocation of average values near $ 83 or $ 95 converge and form a long-term decision-making point. An important outbreak over this compression zone could cheer on a bigger upward puzzle, especially if ETF speculation is intensified in Q3.

The relative strength index (RSI) within the two -week table stays around 50 neutral, which indicates space for the expansion of price without triggering over covered conditions.