XRP is down around 1.6% within the last 24 hours. On the weekly chart, it stays one in every of the weaker large-cap stocks and is down about 16% from last month's level. Most price motion occurs at the underside of a descending triangle pattern, a structure that usually results in continuation moves.

This doesn’t yet confirm a collapse, but three market signals are emerging that suggest traders ought to be cautious in the ultimate days of 2025.

Private investors and long-term holders follow the identical path

XRP continues to be stuck in a descending triangle and trading flat near the lower trendline. The price trended upward between December 18th and twenty seventh, however the Money Flow Index (MFI) moved in the wrong way throughout the same period.

MFI tracks money getting into or out of the asset. A lower MFI low when prices are rising suggests that retailers are selling quite than accumulating on any upswing.

This pressure keeps XRP price stuck on the lower boundary of the pattern as a substitute of testing the upper line.

Weak retail participation: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya's every day crypto newsletter here.

Concern grows once we concentrate on long-term holders.

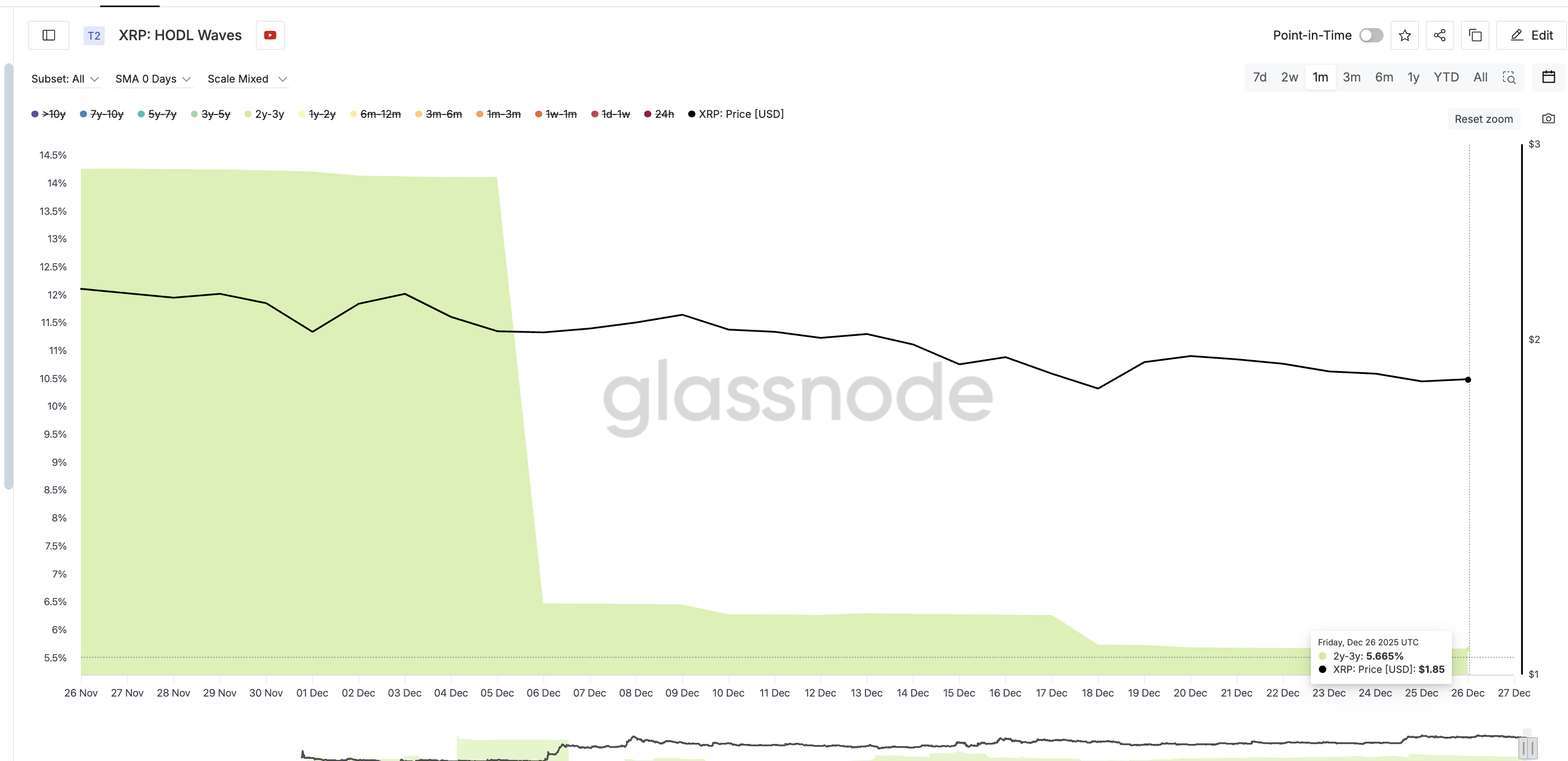

According to HODL Waves, which visualizes how much supply each age group owns, wallets holding XRP for 2 to 3 years fell from 14.26% of supply on November twenty sixth to about 5.66% on December twenty sixth.

These are long-term believers whose sale will lose some market support. The weakness in retail is normal. At the identical time, there isn’t a long-term weakness.

Holders dumping XRP: Glassnode

This creates a situation where each short-term and long-term behavior trend in the identical direction: out of XRP.

Capital flow shows declining demand

As retail and long-term conviction weakens, the subsequent check is capital flow, the third key sign.

Even the Chaikin Money Flow (CMF) doesn’t bring any relief. CMF tracks buying and selling pressure based on volume and price movements. The major money flow indicator stays negative for XRP and is sliding along a descending support trendline.

In simpler terms, even when the worth is stagnant, the massive capital entering the asset becomes less and fewer and the market tends for supply to outweigh demand. Since the CMF has not yet recovered, the market loses one other potential safety net.

This is why XRP price remained flat as a substitute of recovering.

The XRP price level will determine whether a collapse actually occurs

Currently, XRP is between $1.90 and $1.81. On December twenty second, it lost the $1.90 mark and has not been capable of reach it since. Reclaiming $1.90 after which rising to $1.99 can be the primary sign of strength.

That would also mean a move beyond the upper boundary of the triangle and provides the bulls something to work with.

However, the bearish case is currently clearer than the bullish one.

If $1.81 is broken, XRP could fall out of the descending triangle pattern, which might represent a confirmed breakdown. This loss could open up room towards $1.68, where the structure fails completely, and even $1.52 if selling accelerates.

This shouldn’t be yet a given, however the market has not yet shown any counter-signal. As long as retail sales, long-term distribution and weakening capital inflows remain in line, XRP price can have to struggle to take care of the range.

The post: Is XRP vulnerable to collapse before the beginning of 2026? Three Metrics Hint at Trouble appeared first on BeInCrypto.

Article source: beincrypto.com

The post: Is XRP vulnerable to collapse before the beginning of 2026? Three Metrics Hint at Trouble appeared first on Crypto Adventure.