HBAR price is under pressure again. The token is down about 17% within the last seven days and nearly 24% month-on-month, continuing a gradual downward trend.

The recent decline is significant because a key technical goal has now been reached. What comes next is determined by whether this level is maintained or weakens.

The price barely reaches its goal

On November thirteenth, HBAR confirmed a head and shoulders breakout on the every day chart. The pattern predicted a downward move of about 28% from the neck line.

This goal was achieved on December fifteenth when the value reached the $0.113 area. Since then, HBAR has stalled and moved sideways. This is significant because the precise breakout goal now serves as short-term support.

Price goal reached: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya's every day crypto newsletter here.

Technically, that is the primary moment when sellers stop and reevaluate. A transparent break below this level would confirm the continuation of the trend. Holding it, a minimum of temporarily, opens the door to a brief jump. The diagram served its purpose. Now the symptoms determine whether the move is complete.

On-chain and flow data still suggest weak demand

The problem is that money flow metrics don’t yet support a sustained recovery.

The Chaikin Money Flow (CMF) has fallen to around -0.32, its lowest level in a few 12 months. CMF tracks whether lots of money is coming in or going out. Deeply negative values mean that capital is leaving Hedera (HBAR) even when the value trades against the support line.

CMF falls to yearly low: TradingView

This shows us that the recent break isn’t as a result of strong buyers. Big money, possibly whales, continues to be stepping back.

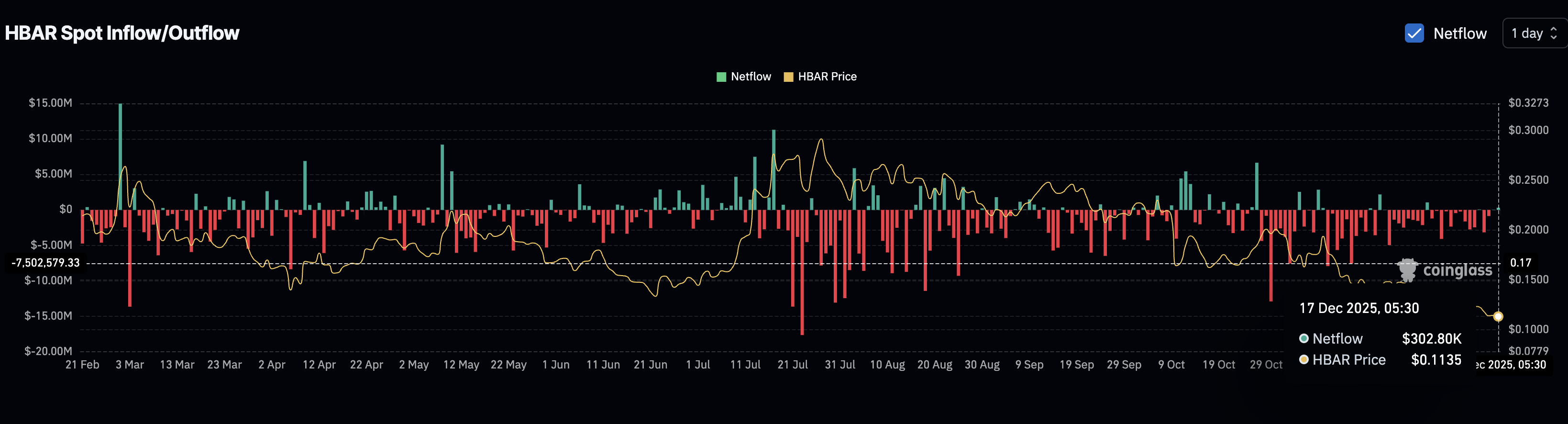

Spot flow data adds one other vulnerability. On December 14, HBAR recorded net outflows of roughly $3.16 million, meaning tokens are migrating from exchanges. This normally indicates a short-term buying intention or a reduced selling intention.

However, this support didn’t last. In the last 48-72 hours, inflows have turned back into net inflows, although the number is small, around $0.30 million. Direction is more essential than size. It shows that the previous buying pressure has eased and coins are beginning to move towards exchanges again.

To put it simply, buying interest quickly waned. Large shareholders are still missing and short-term buyers have withdrawn.

HBAR price levels that determine recovery or collapse

With the breakout goal achieved, the chart is now opening up, much more in order indifference to big money and retail has already been established earlier.

If HBAR price declines by $0.113, the subsequent support lies at $0.107. A transparent break there exposes $0.095, which might mark an extra 16% decline from current levels.

On the positive side, any recovery will remain corrective unless the value recovers to $0.155 on a every day close. This level coincides with previous support and the underside of the previous range. Without them, rebounding will likely decline.

For now, HBAR has done what the collapse predicted. The query isn’t whether the pattern worked. It did. The real query is whether or not weak demand will convert this pause into the subsequent phase of decline. All signs point to a decline, a minimum of for now.

The post HBAR price hits breakout goal – will it get better now or fall again by 16%? appeared first on BeInCrypto.

Article source: beincrypto.com

The post HBAR price hits breakout goal – will it get better now or fall again by 16%? appeared first on Crypto Adventure.