The Genius Act, a draft law that focused on the regulation of stablecoin, was unable to drive within the US Senate on May 8, 2025. The official name of the draft law is the guiding and constructing of the national innovation for the US StableCoins Act.

Democratic legislators voted 49-0 against the bill, while 48 Republican senators supported this. The bill required 60 votes to advance in accordance with the foundations of the Senate. His failure ended a vital advance to manage stable coins on the federal level.

Several Democrats who had previously supported the Genius Act, including Ruben Gallego, Mark Warner, Lisa Blunt Rochester, Andy Kim, Kirsten Gillibrand and Angela, sobrooks, withdrew their support through the vote. This reversal played a central role in blocking the Bill progress.

Stablecoin Bill was criticized by AML and enforcement gaps

In a joint explanation, Gallego and other senators identified vital topics within the Genius Act. They said that the laws had not granted any strong rules for money laundering (anti-money laundering) (AML) and no adequate supervision of foreign stable coin issuers.

They also said that the enforcement tools contained within the invoice weren’t strong enough. The national risk of security and financial systems was certainly one of their other concerns.

“We recognize that the shortage of regulation makes consumers unprotected and at risk of predatory practices,” said the legislators.

“We have accepted this process constructively and openly, with the understanding that additional improvements within the invoice could be made.”

Genius act opposition declaration of the US senators. Source: rubengallego.house.gov

These legislators said that further changes were mandatory before they may support StableCoin laws.

In the meantime, the Republican Senator Pete Ricketts criticized the results of the vote. He said the opposition prevented the progress within the clarity of the regulation of stable coins.

The revised Genius Act adds StableCoin changes

After the failed vote, a revised version of the Genius Act appeared. It now supports 4 Republican senators: Bill Hagerty, Cynthia Lummis, Tim Scott and Dan Sullivan. The recent draft not lists the Democrats Kristen Gillibrand and Angela sobrooks as co-sponsors.

The updated genius law includes the prolonged US jurisdiction for foreign stable coin emitters equivalent to Tether who’re lively within the United States. It also updates the legal definitions of digital asset service providers and changes the foundations for the support of stable coins for reserve assets.

The Tether CEO Paolo Ardoino commented on the revised bill. He said the corporate supported the regulation and is looking forward to working with the US legislators.

“We recognize and appreciate the labor that the administration has done to support the legislative procedure in relation to this transformative technology. We sit up for the continual efforts of the federal government, in a way that promotes global dollar hegemony.”

Ardoino explained.

Stablecoin market effects and industry reactions

Matt Hougan, Chief Investment Officer from BitWise, reacted to the vote. He said that the failure to adopt the legislative laws laws could affect the event of the cryptom market. He also noted that old coins could possibly be exposed to more volatility if the legal framework stays unclear.

“When StableCoin and Market Structure laws drags to a standstill, it’ll be a protracted summer for non-Bitcoin crypto assets.”

Hougan wrote about X.

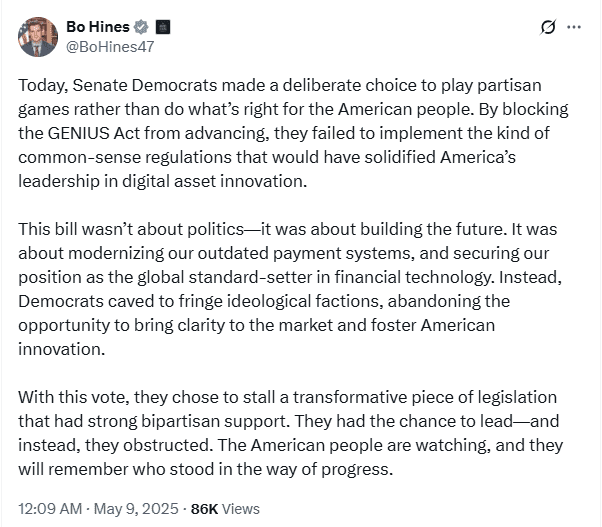

Bo Hines, executive director of the council of the President of the advisor for digital assets, also commented. He said the Senate missed the chance to bring structure to the digital financial space.

“This bill was not about politics – it was about constructing the longer term”, “

Hines wrote.

“It was about modernizing our outdated payment systems and securing our position as a worldwide standard setting in financial technology.”

Bo Hines beats Democrats about Genius Act Block. Source: X (@bohines47)

Bo Hines beats Democrats about Genius Act Block. Source: X (@bohines47)

The revised genius law continues to be checked. Legislators can proceed the discussions because they obtain an agreement on StableCoin supervision, AML requirements and enforcement authorities.