On June 3, 2025, the 4-hour chart of the floki on Tether (Floki/USDT) formed a bullish flag pattern. After a robust upward movement, a bullish flag appears, followed by a brief consolidation in parallel, downwards. This pattern normally signals a continuation of the upward trend as soon as the worth breaks above the upper limit of the flag.

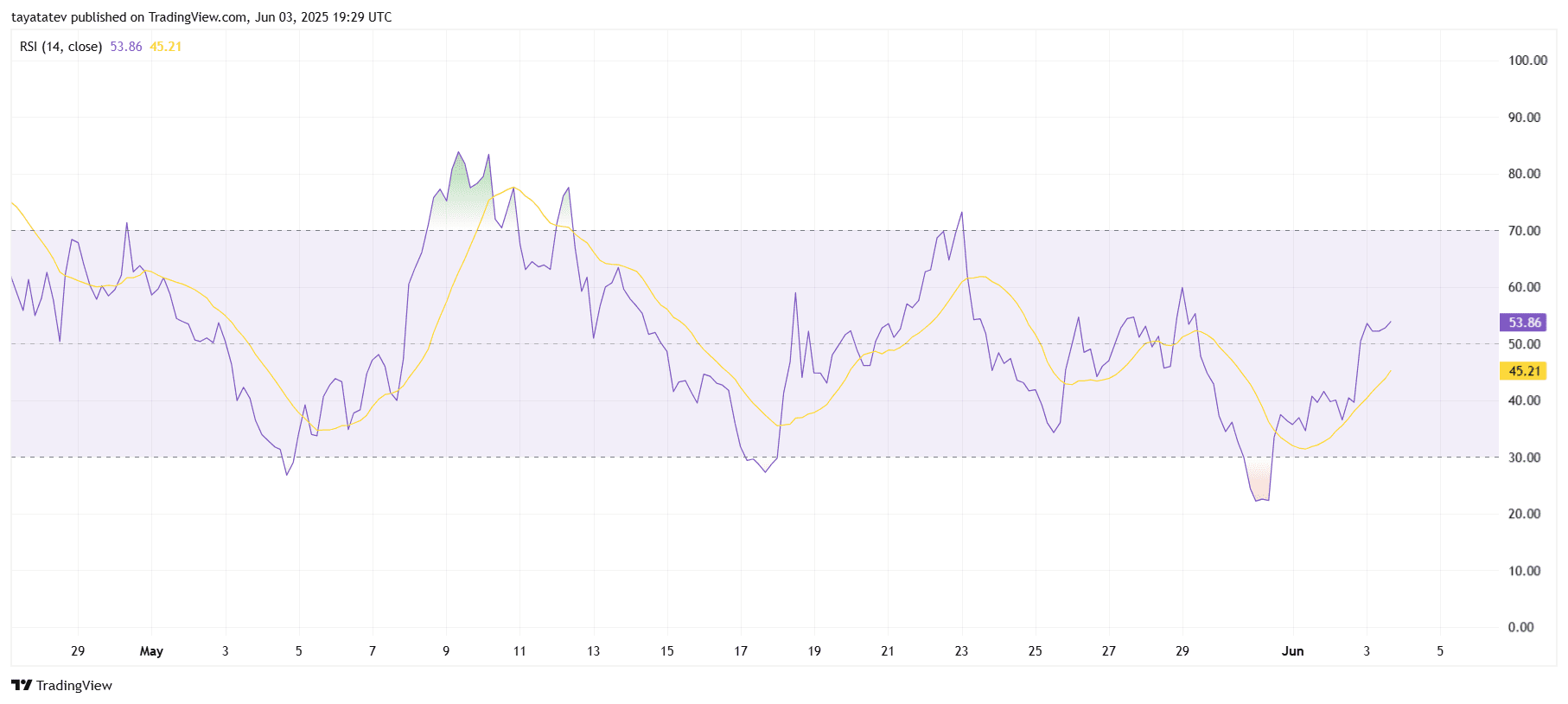

Floki RSI signals fresh impulse shift over 50 level floki annual return gaber.

Floki bullish flag pattern. Source: tradingview.com

If this bullish flag confirms, the worth can increase from the present level from 0.00008837 to around 0.00009103.

Floki is currently testing the resistance of the flag near $ 0.00009074, which also corresponds to the 50-period exponential sliding average. If the worth over this level closes with a robust volume, it will confirm the outbreak.

The volume shows a recent climb that supports bullish dynamics. The structure of the flag and the previous upward pulse suggests that buyers still have control. If the momentum continues, the worth can try to achieve the horizontal resistance near 0.00011750, as marked on the table.

The setup currently prefers the continuation of the onward result, provided that the outbreak confirms with strong candles and better trading volume.

Floki RSI signals fresh impulse shift over 50 levels

On 3 ..

Floki RSI Breakout signal. Source: tradingview.com

Floki RSI Breakout signal. Source: tradingview.com

The relative strength index measures the speed and alter of the worth movements, that are typically between 0 and 100. The measured values over 50 often indicate the growing bullish impulse, while values under 50 interpret that the pressure of the bear occurs.

In this case, Flokis RSI crossing over the 50 level signals a possible shift of the impulse to buyers. The RSI appeared near 25 on June 1st after which turned up sharply and voted with essentially the most recent prize, which was visible on the table.

The RSI curve has now broken through the oversized region and its moving average. This crossover, combined with a reading over 50, supports the potential of a bullish outbreak when the worth confirms the flag pattern.

During the development of dynamics, the further RSI strength over 60 would offer more confirmation of the trend landing within the direction of resistance in the quantity of $ 0,0001750.

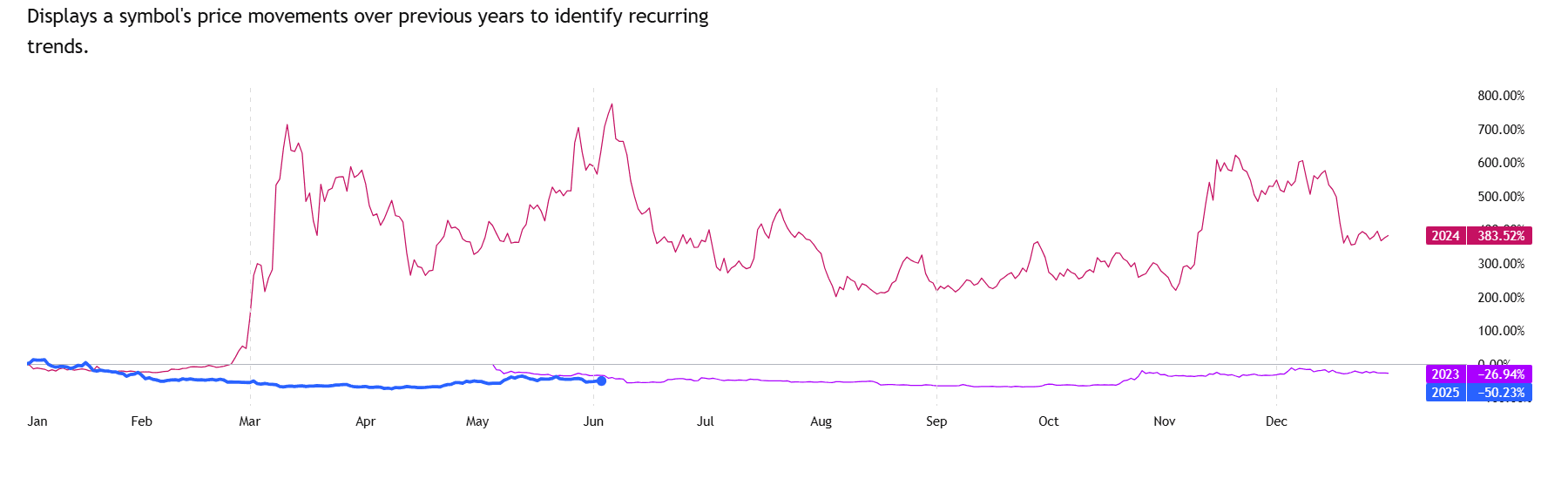

Flocki annual return gods shows a steep 2025 -under performance

At the start of June 2025, Floki fell by 50.23% for annual contracts which might be shown in blue. This is in a pointy contrast to the decline of 2023 of 26.94% in purple and 2024 strong rally of +383.52% in red.

Floki annual performance comparison.source: tradingView.com

Floki annual performance comparison.source: tradingView.com

In 2024, Floki saw his most aggressive climb between March and April, with the worth over 700% rose before cooling down in summer. In comparison, each in 2023 and 2025 have a consistent underperformance, without meaningful swinging pikes.

At the moment, the 2025 line stays flat near the bottom and shows no signs of a seasonal rest. This divergence of past bullish patterns indicates a weaker mood or an absence of catalyst in comparison with the previous yr.

If Floki repeated his behavior from 2024, historical trends indicate that potential benefits could begin in mid -June. However, the present path is more much like the Bear Trend of 2023, with losses in the primary half of the yr.

The comparison shows that the performance of Flokis 2025 in previous years stays significantly behind and shows the weakest structure thus far.