Here are the newest updates of the continued tariffs of US President Donald Trump.

April 7, 2025: China plans incentive when the worldwide markets fight; Trump rejects recessions fears

The Chinese heads of state and government organized emergency meetings on the weekend to debate the right way to reply to the growing list of President Trump's tariffs. According to people who find themselves conversant in the matter, the most effective Chinese political decision -makers and financial regulators indicated that the stimulus are quickly pursued to stabilize the economy and increase domestic consumption.

Some of those stimulus measures were already in development before the US tariffs, but could also be accelerated to counteract the economic shock. No final decisions were announced publicly.

Trump rejects market concerns, requires trade deficit elimination

President Trump, who spoke on board the Air Force One on Sunday, resigned against the fears that tariffs would result in inflation or recession. He insisted that market volatility was only temporary and claimed that the United States would enter a brand new economic “boom”.

Trump also made it clear that he wouldn’t reduce the best tariffs, unless the United States has completely eliminated its trade deficit with certain countries.

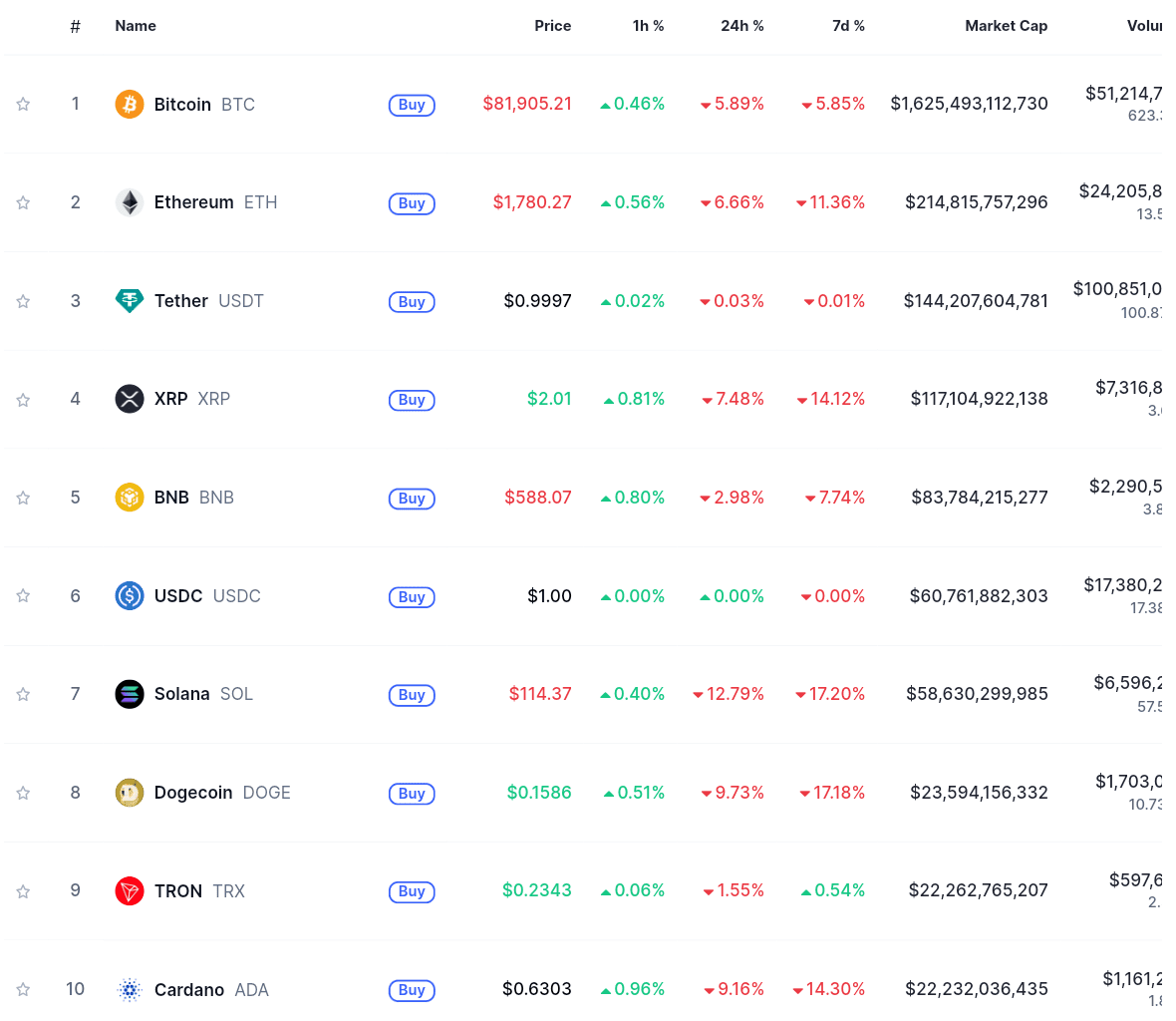

Crypto and stock -futures fall again

The global financial fallout continued when the US shares -futures opened lower open and cryptocurrencies recorded one other sharp decline. Today all top 10 cryptocurrencies have dropped after market capitalization. Bitcoin lost over 8% of its value and fell to around 76,210 US dollars. Ether decreased by greater than 16%and acted at $ 1,518. The overall capitalization of the crypto market fell by over 8%and reached 2.5 trillion dollars.

All top 10 cryptocurrencies after market capitalization have dropped. Source: Coinmarketcap

April 4, 2025: Trump revised tariffs, India targeted; Pharmaceutical crash

A brand new document of the White House published on April 4 shows that Trump's collective bargaining prices for a minimum of 14 countries, including India, were revised. India's tariff rate was first mentioned by 26%by Trump, but the brand new attachment initially listed 27%. The final document confirms that it was revised to 26%again.

The management of Trump also announced that pharmaceuticals and semiconductors are actually being checked in accordance with section 232 of the 1962 trade enlargement law. In this section, the US President Zölle can impose if imports are thought to be a threat to national security.

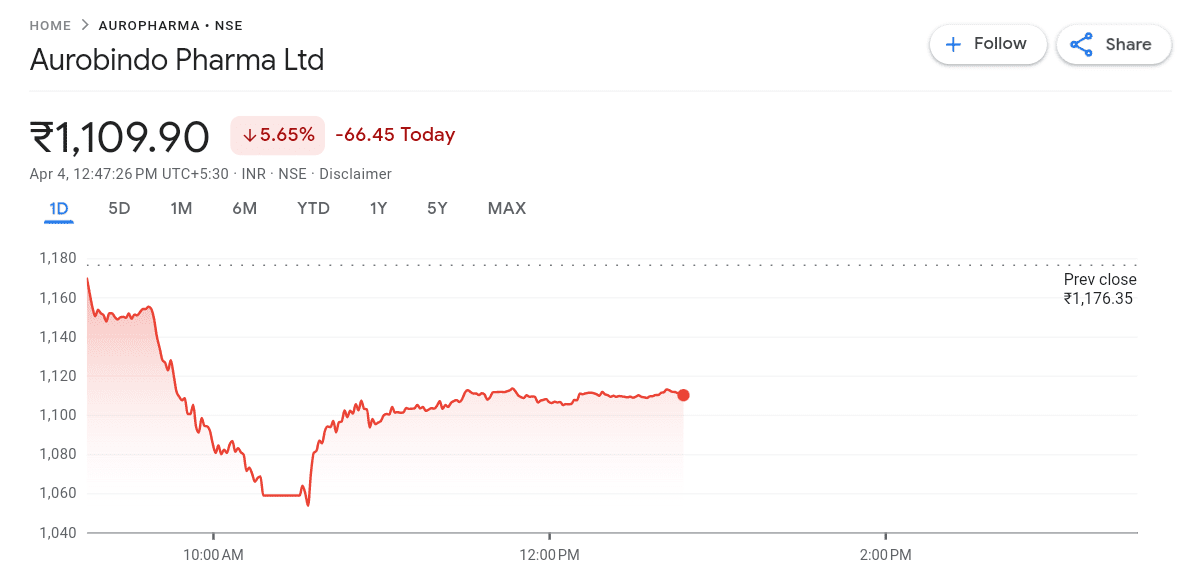

After this news, Indian pharmaceutical stocks made a tough hit:

Aurobindo Pharma stocks tank greater than 5%. Source: Google Finance

Aurobindo Pharma stocks tank greater than 5%. Source: Google Finance

April 3, 2025: US and crypto markets dump after tariff shock

The global financial markets reacted negatively to Trump's newly announced tariffs. The most vital financial indices recorded strong declines:

- The Dow Jones Industrial Average fell by over 1,500 points (3.6%).

- The S&P 500 decreased by 4%.

- The NASDAQ composite fell by almost 5%.

Bitcoin and other large cryptocurrencies recorded remarkable declines. Bitcoin fell by as much as 4%and reached around 82,000 US dollars in Singapore on Thursday morning. Other cryptocurrencies, including ether and XRP, also recorded declines when Solana fell by over 9% at one point.

Most cryptocurrencies have been reduced within the last 24 hours after the tariff of the liberation day on April 2. Source: Coinmarketcap

Most cryptocurrencies have been reduced within the last 24 hours after the tariff of the liberation day on April 2. Source: Coinmarketcap

April 2, 2025: Trump officially starts “Liberation Day” tariffs

President Trump officially announced the “Liberation Day” tariffs At this date. He called it a national emergency to guard American industry.

The details of the brand new tariffs were:

- A 10% basic tariff At all imports.

- A 34% tariff On goods from China.

- A 46% tariff On goods from Vietnam.

- A 20% tariff on goods from the European Union.

- A 10% tariff About imports from Great Britain, Australia and other Allied countries.

Trump said these tariffs would rebuild the American economy, bring jobs back and reduce taxes. But many countries criticized the move. The European Union and Australia expressed severe concerns and said that tariffs would damage world trade.

Trump's trade war 2.0: The background of the revered tariffs explained

After Donald Trump won the US presidential elections in November 2024 in November 2024, he returned to the White House with a transparent message: he desired to repair the America trade deficit and reduce the dependency on foreign goods. In addition, he promised to bring American production jobs back and to make the country less to countries like China.

On February 1, 2025, Trump signed his first large trading campaign for his second term just a couple of weeks after taking office. He imposed recent tariffs for imports from China, Canada and Mexico. The tariffs were:

- A 25% tariff for goods from Canada and Mexico,

- A ten% tariff for goods imported from China.

These tariffs officially got here into force on February 4th. Trump said these tariffs protect the US industries, secure jobs and compensate for trade. However, this decision immediately led to tensions with the highest trading partners of America. Canada, Mexico and China all expressed concerns and warned that they may reciprocate.

Remarkably, the situation deteriorated in February and March 2025. More tariffs followed to certain countries. In particular, China and Vietnam were accused of manipulating their currencies and adding unfair subsidies to their exporters. Trump and his team used this to justify even higher tariffs in these countries.

When the tariff war heated up, the financial markets began to react. In particular, firms, especially people who depend on imports or sell to international markets, began to suffer. Above all, investors are concerned that the tariff fight may lead to a trade war or perhaps a recession.