Ethereum price fell nearly 6% within the last 24 hours and nearly 13% in two days, extending a choppy January decline. The price briefly fell below key levels, raising recent doubts about whether buyers can regain control.

But beneath the surface, large holders intervened aggressively. Whales have collected around $360 million price of ETH near the valley. The rebound case looks tempting, but smart money (informed traders) isn’t yet fully convinced.

Triangle patterns and bullish divergence face a powerful supply cluster

Ethereum is trading inside a symmetrical triangle on the each day chart. Sellers rejected the value near the upper trendline earlier, around January 14th. Now the value is testing the lower limit. But can buyers salvage the glitch now?

Momentum provides a very important clue. Between November 4th and January twentieth, Ethereum made a lower low while the RSI made the next low. The RSI measures momentum by comparing recent gains and losses. This bullish divergence suggests that selling pressure is easing, although price tests support it.

This style of signal has been vital before. In early January, the recent decline was preceded by a bearish RSI divergence. Now the alternative scenario is emerging, suggesting a possible reversal relatively than a continuation.

Price reversal note: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya's each day crypto newsletter here.

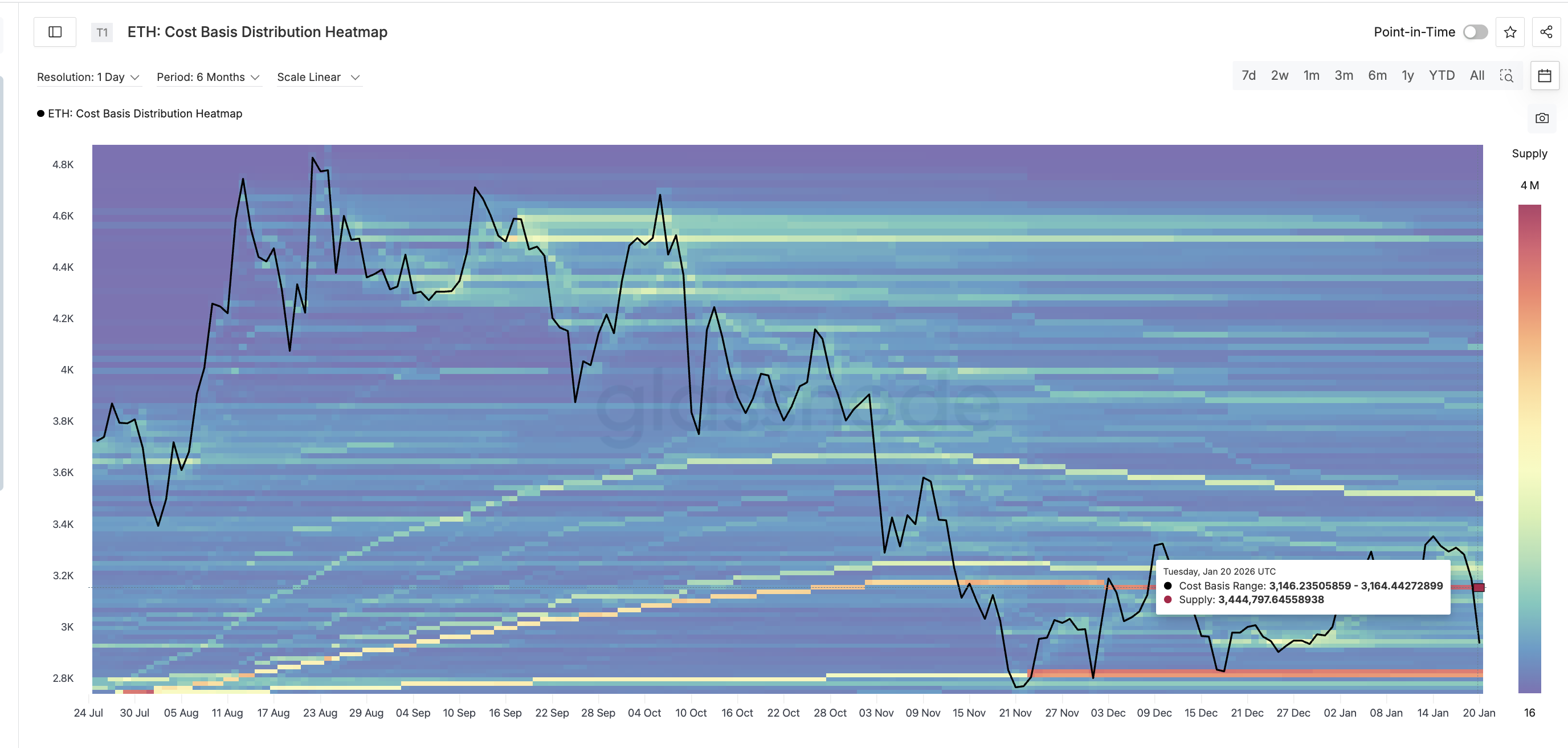

However, there’s a transparent obstacle to the potential recovery. Cost baseline data shows a dense cluster of offers between roughly $3,146 and $3,164. About 3.44 million ETH have been collected on this zone.

Major supply cluster: Glassnode

Many owners are near breaking even. This often creates strong resistance in the realm. Any upswing must overcome this cluster to exhibit strength and end in a reversal, because the RSI suggests.

Whales are buying the dip, but smart money is waiting

Whales trade with conviction. When Ethereum fell by around 13% (between January nineteenth and twenty first), whale holdings increased from around 103.42 million ETH to around 103.71 million ETH. This increase represents an accumulation of virtually $360 million at current prices. This isn’t recent behavior.

Similar whale buying occurred around January 14th, just before a powerful rally. Additionally, Ethereum whales have began increasing their supply again in the previous few hours.

This regular accumulation signals confidence that downside potential is restricted near current levels. Whales are willing to take up supply during times of weakness.

Smart money tells a distinct story.

The Smart Money Index, which follows informed positioning, stays below its signal line. Smart money tends to maneuver early and aggressively before sustained rallies. When this indicator rose above the signal line in December, Ethereum rose by around 26% in ten days. An identical move in late December was preceded by a 16% increase by mid-January.

Such confirmation is now missing. Smart money appears to be waiting for proof that resistance is being eliminated. The high cost base above the ETH price probably explains the reluctance. It is sensible to be patient until the provision runs out.

Ethereum price levels reveal key zone

Everything is now spread across a narrow range of levels.

The first level to be reclaimed is $3,050. Ethereum lost this multi-touchpoint support throughout the recent sell-off. A each day closing price above this again would signal initial stabilization.

Furthermore, all eyes are on the $3,160 area. This level has multiple touchpoints and aligns with the price base care cluster. A clean each day close above this is able to represent a change of about 6% from current prices. More importantly, it might break strong resistance and invite smart a refund in. After that, the reversal situation can take shape.

If that happens, the momentum could speed up quickly. A confirmed breakout opens the trail towards $3,390, where a broader bullish reversal would take shape.

On the opposite hand, the lack of the lower triangle support near $2,910 weakens the recovery thesis. A sustained break there’ll expose $2,610 as the following major support.

Ethereum sellers can have won the recent battle, however the war continues. Whales are already preparing for an upswing. Smart money waits for evidence. If Ethereum can clear the $3,160 supply barrier, hesitation could quickly turn into momentum.

The Post: Ethereum's 13% Drop Attracts $360 Million in Whale Buying – But Why Is Smart Money Hesitating? appeared first on BeInCrypto.

Article source: beincrypto.com

The Post: Ethereum's 13% Drop Attracts $360 Million in Whale Buying – But Why Is Smart Money Hesitating? appeared first on Crypto Adventure.