Ethereum acted under the resistance level of $ 2,681 over a month. Nevertheless, its price has remained stable and showed little volatility.

Large investors collect Ethereum

Investors have increased in Ethereum because the starting of June. Data show that investors have bought greater than 300,000 ETH, which has bought a price of around 778 million US dollars value around 778 million US dollars. This marks a transparent shift from the consistent sale observed until the top of May.

ConsSys -Teth purchase. Source: Arkham

A significant contribution to this trend is Consensys, who, in accordance with Arkham, reports ETH from Galaxy Digital value over 300 million US dollars. This step signals strong trust within the long -term value of Ethereum. Since more large investors resembling Consensys enter the market, it increases general confidence in ETH.

Exchange data confirm the growing demand

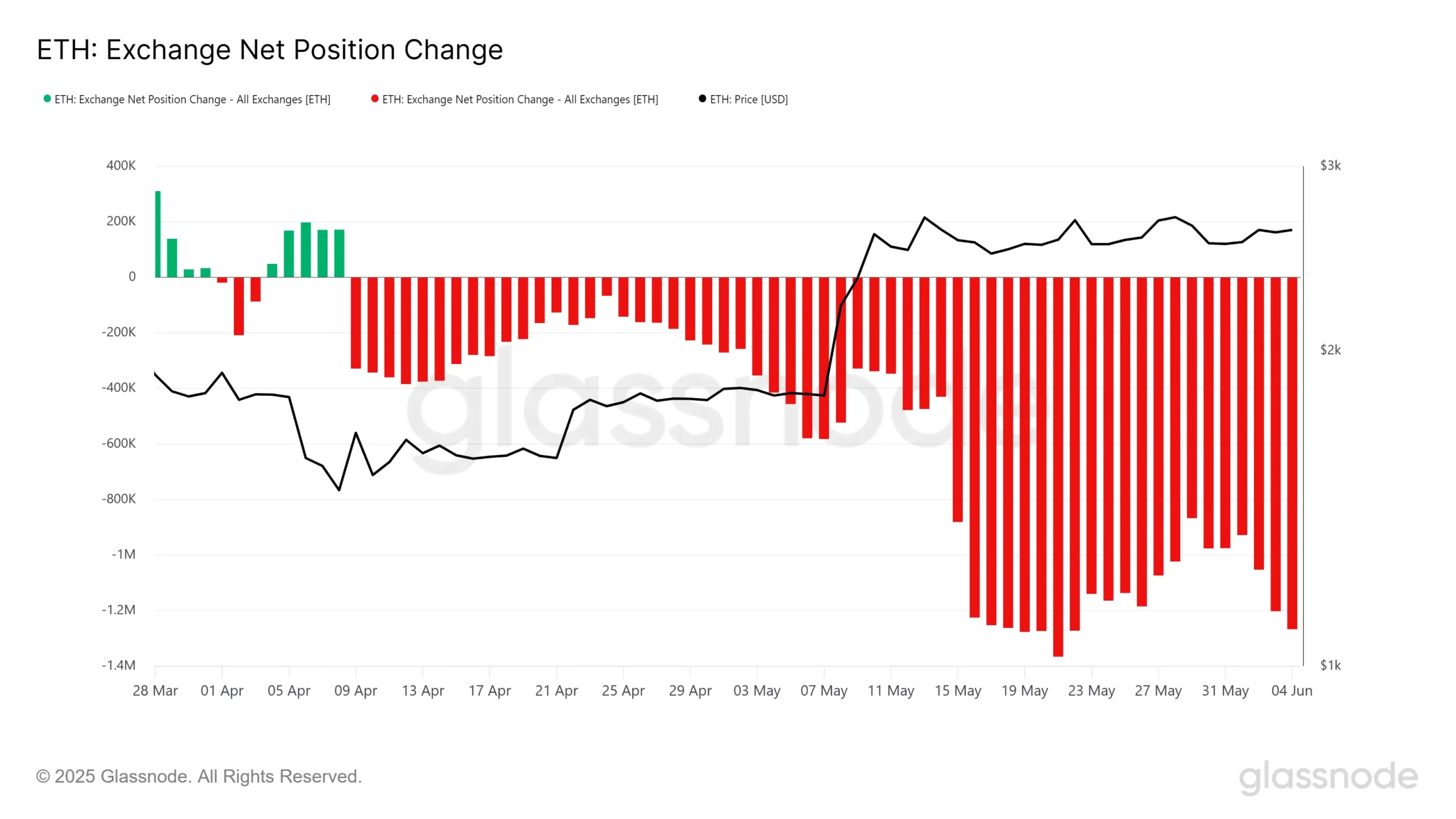

According to Glassnode, the change of exchange from Ethereum became positive in early June after a protracted time of negative readings. This implies that more ETH leaves the exchange than entering. The red beams can show heavy drains in May and signal a persistent accumulation by investors.

The return to positive values in June suggests that the sales pressure can have decreased. When ETH changes to personal wallets, it’s quickly sold quickly and reduces the provision of the exchange. This behavior normally reflects long -term holding strategies and the growing trust of investors within the prospects of costs from Ethereum.

ETH exchange -Netto change change. Source: Glasnode

ETH exchange -Netto change change. Source: Glasnode

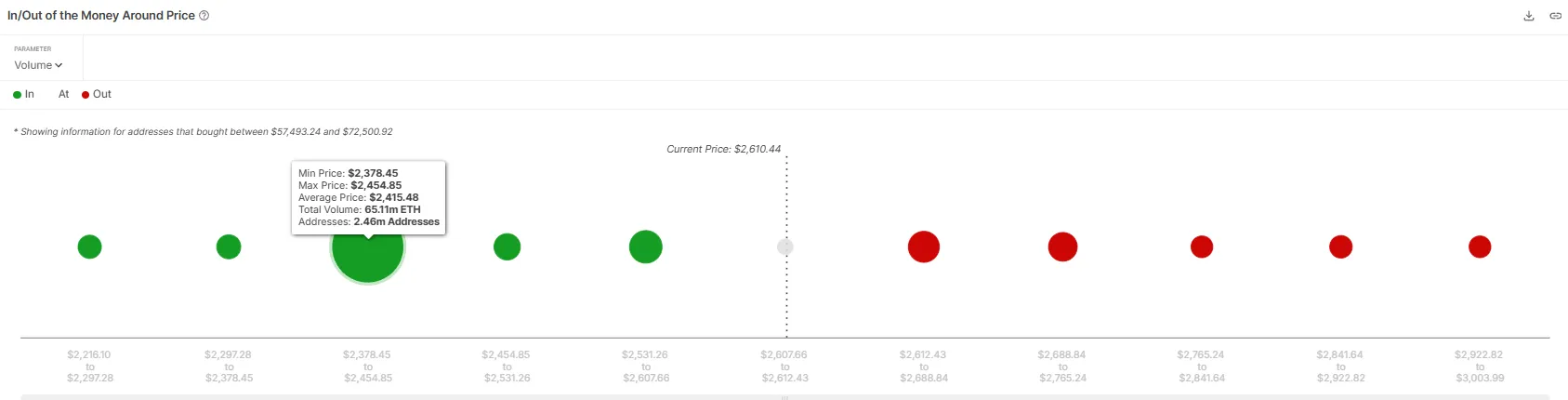

Intotheblock on-chain data show a powerful demand for between $ 2,378.45 and USD $ 2,454.85. In this price range, over 65.11 million ETH is held with around 2.46 million addresses. This cluster forms a powerful level of support below the present price of $ 2,610.44. The large green bladder on the map confirms a powerful positioning of investors on this area.

Ethereum iOMAP support zone. Source: Intotheblock

Ethereum iOMAP support zone. Source: Intotheblock

Since a lot ETH was bought on this zone, many homeowners are still profitable. This reduces the likelihood that the value might be panicked when the value decreases barely. As a result, this zero acts as a buffer against downward pressure and helps to stabilize the value campaign of Ethereum.

The iOMAP table shows that only a few owners will sell on this demand zone. For this reason, Ethereum is exposed to a limited downward pressure. As long as the buildup continues and the sellers remain inactive, the value of Ethereum could soon break out of its consolidation span.

In summary, it could actually be said that Ethereum's stable price, strong support zone and increased accumulation by large players signal a shift towards bullish impulse.

Ethereum Fors Ascending Channel, goals at 47% rally on 3,619 US dollars in accordance with Trump -Musk -Clash

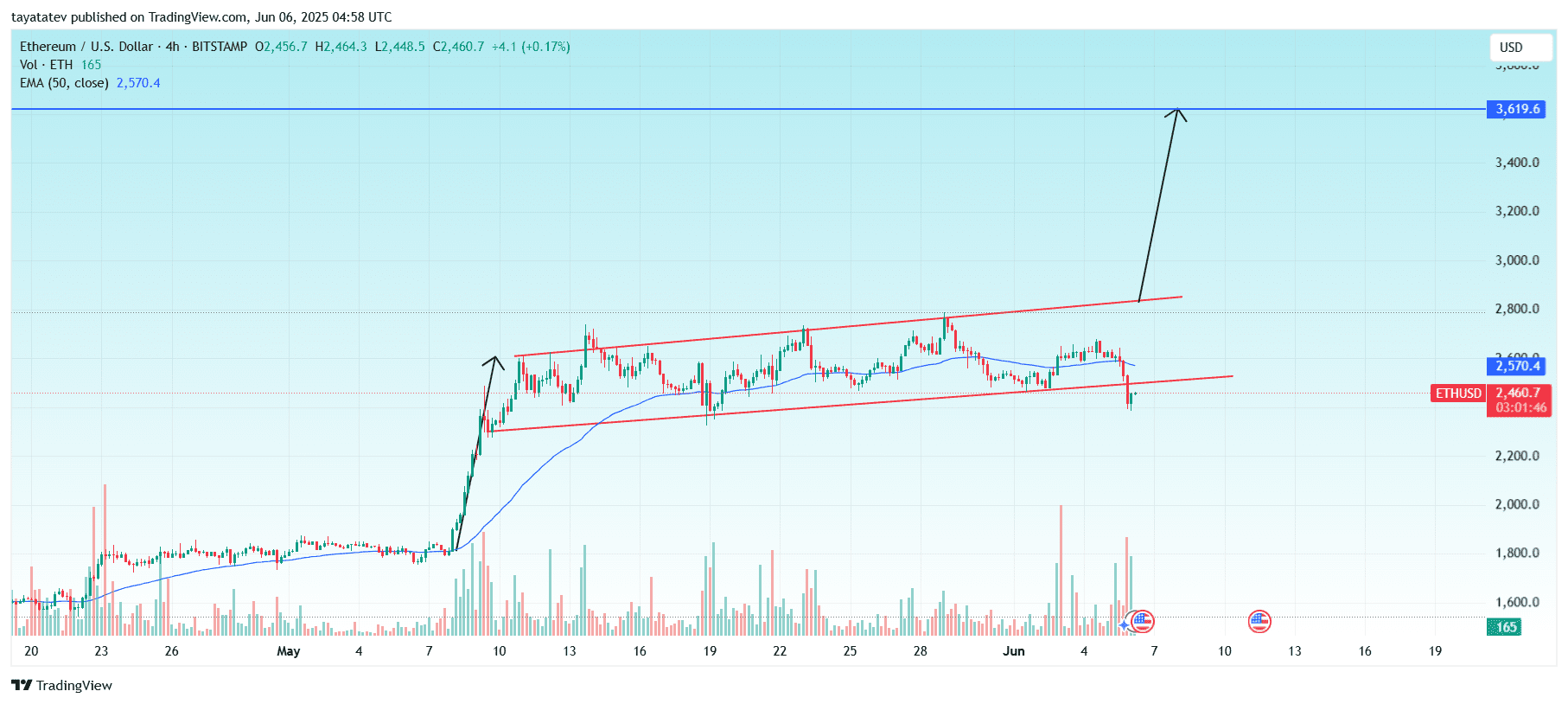

On June 6, 2025, the couple from Ethereum to Us Dollar (ETH/USD) formed an ascending sewer pattern on the 4-hour diagram. An ascending channel appears when the value between two parallel trend lines that lowered upwards and frequently signals a bullish sequel.

ETH/USD Ascending Channel pattern. Source: Tradingview

ETH/USD Ascending Channel pattern. Source: Tradingview

If the pattern confirms, the value of Ethereum could exceed 47 percent from the present level of USD $ 2.460 to the projected goal of three,619 US dollars. This goal corresponds to the horizontal resistance, which is marked in blue within the table.

ETH earlier today ETH fell 5 percent below the border of the lower channel, but quickly recovered by 3 percent. The sudden dip probably followed the conflict between Trump and Musk after Donald Trump threatened Elon Musk's state subsidies. The explanation frightened the markets and triggered sharp downward movements in large crypto -assets, including Bitcoin.

Nevertheless, Ethereum quickly recovered and showed a powerful interest in purchase. It now acts just under the 50-pro-exponential moving average (EMA) at $ 2,570.4. If bulls press the value over this line with higher volume, this will confirm the breakout setup.

The trading volume has already been searching for in the course of the jump and points to a brand new accumulation. If the ETH runs above the upper red trend line of the channel, the value within the upcoming sessions can strive for 3,619 US dollars.

Ethereum RSI sinks to 36 after the sale, signals a possible recovery

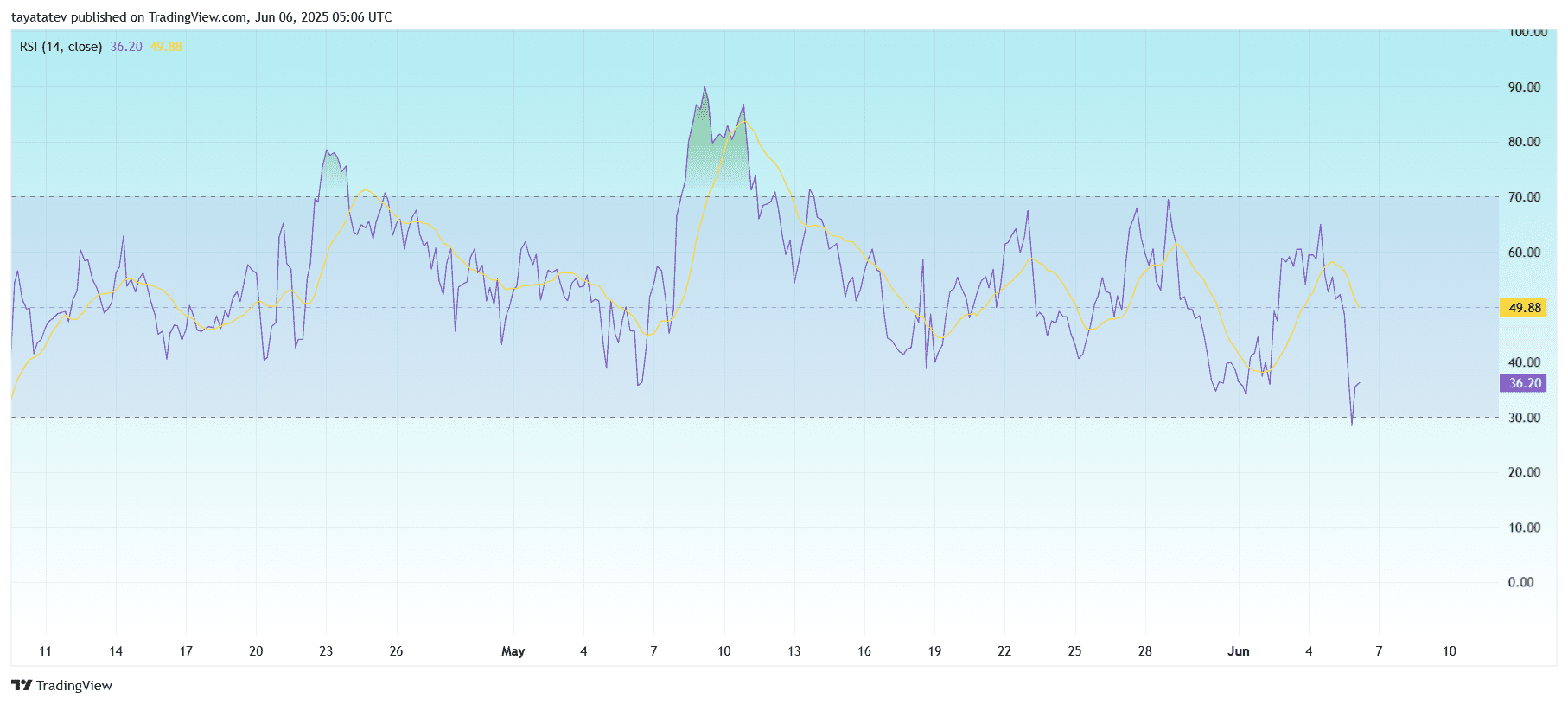

This diagram shows the relative strength index (RSI) for Ethereum (ETH/USD) to the 4-hour timeframe, which was published on June 6, 2025.

ETH/USD RSI indicator (4h). Source: Tradingview

ETH/USD RSI indicator (4h). Source: Tradingview

The RSI value is currently 36.20, which lies into the oversized zone. Any RSI reading below 40 often signals that the dynamics turn out to be weaker and sells pressure. It indicates that Ethereum recently experienced a powerful decline in purchasing power.

Previously, the RSI crossed under the sliding average line (49.88) and confirmed the bear impulse. However, the curve shows a slight upward bend, which indicates that buyers could return after the panic -probably with external events resembling the Trump musk tension, which affects the market mood.

If the RSI flies back over 40 and eventually exceeds the common line, this could re -signal a possible shift to bullish strength. Until then, the RSI shows that the ETH is within the restoration mode of oversized conditions.

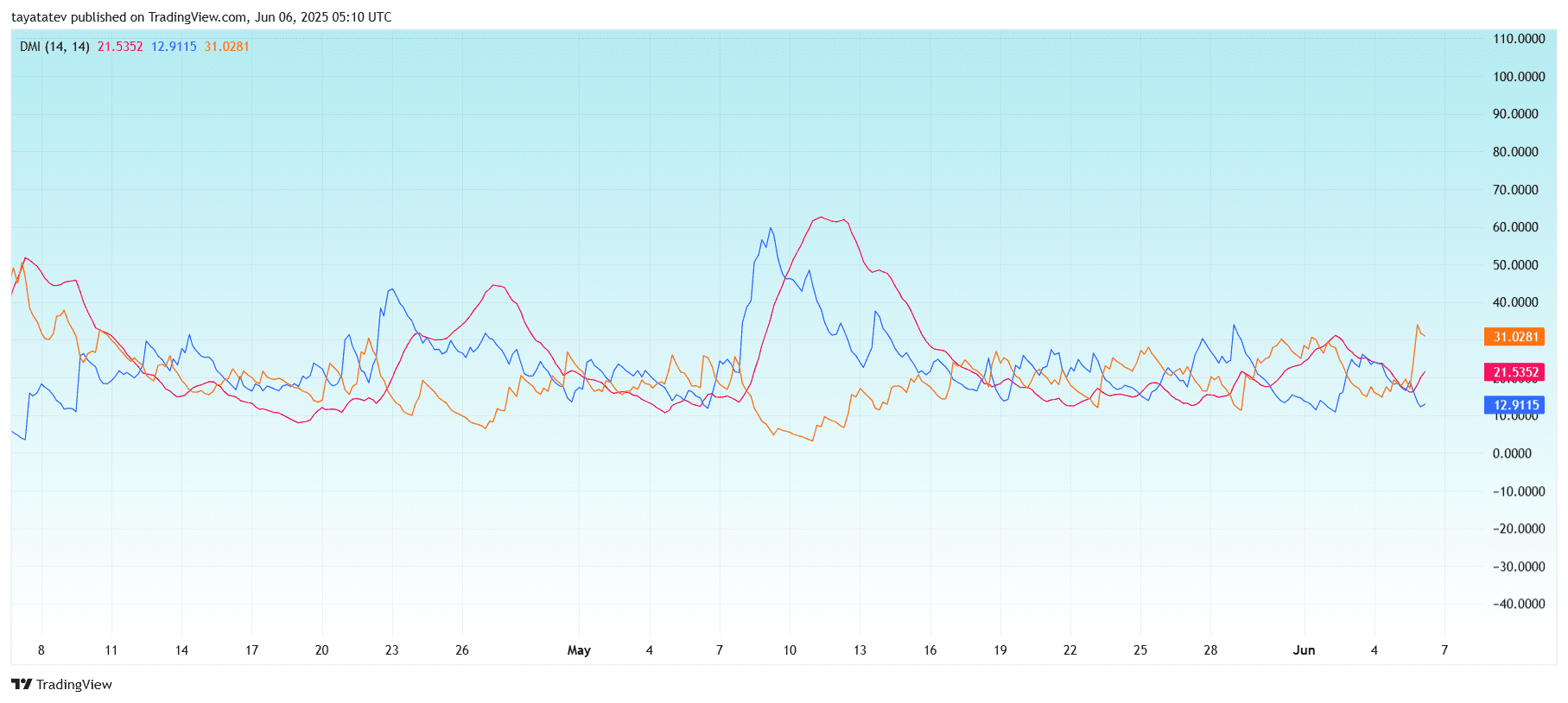

Ethereum DMI shows the bearish impulse with a moderate trend strength on 4h charts

This diagram shows the directional movement index (DMI) for Ethereum (ETH/USD) on the 4-hour timeframe, which was updated on June 6, 2025.

-

+DI (blue): 12.91

-

–Di (red): 21.53

-

Adx (orange): 31.03

The –di line (red) is above the +DI line (blue), whereby the sellers still have control over the short-term impulse. However, each direction indicators remain relatively low, which indicates a weak trend strength from each side.

ETH/USD DMI indicator (4h). Source: Tradingview

ETH/USD DMI indicator (4h). Source: Tradingview

In the meantime, the common direction index (ADX), which measures the strength of the trend, is 31.03. Since ADX is over 25, it confirms that the present bear trend has a certain strength – however it is just not extremely strong or decisive.

A powerful increase within the ADX without strong divergence between +Di and –di would mean that the market is moving with more conviction, but a transparent direction is missing. If +DI exceeds with an increasing ADX, this will signal a bullish reversal.

At the moment, bears have the upper hand, however the trend strength stays moderate. After a crossover, dealers can listen to the DI lines to anticipate the following step.