Yerevan (coinco -chapter.com) – Elon Musk has played a key role in Dogecoins Transformation from a parody to a speculative digital asset. His social media activities and its corporate decisions have repeatedly influenced the value and recognition of the Meme coin. In 2025, his commitment with the introduction of a US government authority called Doge achieved a brand new level, short for the efficiency of the Ministry of Government.

Musk's announcement by the Ministry of Government Efficiency (Doge) triggered an initial increase in Dotecoin's price. However, the profits didn’t take. Between January 21 and March 31, the addresses fell by $ 1 million to $ 9.99 million in Doge by 40.21%. At the identical time, briefs with over 10 million US dollars fell from 400 to 212, which marked a decline of 47%. According to Finbold, a complete of 41% fell by 41% in only greater than two months in only greater than two months.

Dogecoin Millionaire loss after the beginning of Dogge. Source: Finbold

Doonecoin was built as a joke. Musk converted it right into a speculative asset

Doonecoin began in December 2013. They selected the Shiba Inu -Mem, which is generally known as a “Doge” to present the coin. Their intention was satire, not serious investments.

Despite the joke, Dogecoin gained online traction. Elon Musk had tweeted it until 2020. His contributions ranged from easy mentions to memes, which increase the visibility of Dotecoin. In April 2019, he tweeted that Dogecoin was his “favorite cryptocurrency”. Within two days, its price of $ 0.002 doubled to $ 0.004.

Elon Musk called “CEO” from Dogecoin after an official X account. Source: @Dogecoin on x

Elon Musk called “CEO” from Dogecoin after an official X account. Source: @Dogecoin on x

“Musk's commitment converted Dogecoin from a satirical web token right into a speculative asset class by giving it with perceived legitimacy and entertainment value,” said Voloder. He added that Musk Dogecoin made a “cultural product with real economic consequences”.

Dogecoin was a meme coin with real price movements

The market response from Dogecoin on Musk's contributions increased by the start of 2021. As a musk “Dogecoin is the crypto of the people” tweeted, his trading volume rose overnight by greater than 50%. His influence also made Dotecoin very fleeting.

On May 8, 2021, Musk appeared continue to exist Saturday evening. When he called Dogecoin as a “hustle and bustle”, the value dropped by greater than 33%inside hours.

Musk calls Doonecoin a hustle and bustle. Source: SNL on X

Musk calls Doonecoin a hustle and bustle. Source: SNL on X

Dotecoin lacks a transparent development roadmap, offers no yield or integrated profit and depends heavily available on the market mood. Under such conditions, the value based on the actions of a single influencer can shift dramatically – especially one with thousands and thousands of followers and a big financial power.

Musk named a government department in response to Dotecoin

On January 20, 2025, the US Ministry of Government Efficiency (Doge) began its official website with the Dogecoin logo. This step led to a rise in the value of Dotecoin inside quarter-hour to a rise of dotecoin, which rose from $ 0.33 to $ 0.40, reversed earlier losses and marked a back rash of 20% in comparison with its intraday low.

The department founded by President Donald Trump and under the direction of Elon Musk goals to scale back federal expenditure and bureaucracy. The acronym Doge, which reflected the name of the cryptocurrency and the admission of his logo at the federal government center, triggered discussions concerning the mixture of web culture with official government initiatives .

Doge Agentor logo on the US government. Source: Department of Government Efficiency Web

Doge Agentor logo on the US government. Source: Department of Government Efficiency Web

On January 20, when the Doge website went live, Dotecoin's price rose by 13%inside quarter-hour. It briefly turned a previous downward trend and reached a highlight of $ 0.36.

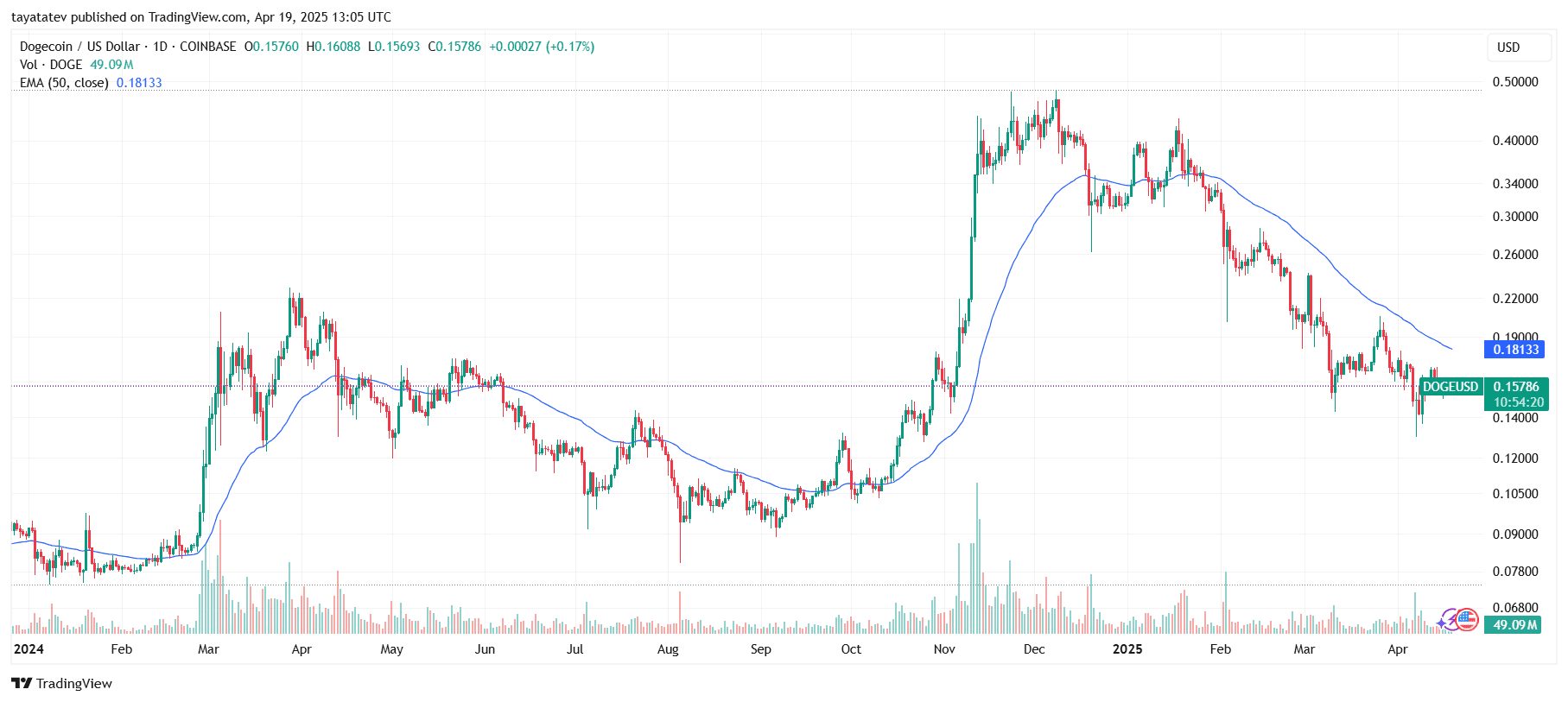

This rally was short -lived. From January 20 to April 12, the value of Dotecoin fell to USD 0.15 – a decrease of 58%.

Dogecoin Price and EMA Trend April 2025. Source: Tradingview

Dogecoin Price and EMA Trend April 2025. Source: Tradingview

The hype of Doge could have reversed its price dynamics

The price drop after Musk's Dog appointment signals a transparent change out there mood. Although the timing corresponds to the announcement, the broader economic conditions also influenced the decline of Dotecoin.

Central banks – led by the US Federal Reserve – have repeatedly increased rates of interest to combat inflation. These increases withdrawn the capital of risk assets akin to cryptocurrencies by making traditional options akin to bonds more attractive. As a result, the appetite in investors weakened speculative coins, including Dotecoin.

At the identical time, the regulatory pressure has grown. In the United States, the SEC has intensified enforcement and geared toward necessary crypto platforms and tea. The increased examination has added legal and compliance risks, especially for institutional investors, which has led to a cautious approach for giant crypto stocks.

The retail landscape has also modified. The 2021 increase brought thousands and thousands of latest users in crypto, a lot of virus memes and celebrities. But after the market had cooled down, many went. Commercial activity slowed down, the web interest faded and the Meme -Münz inflows decreased. This decline within the commitment of the bottom has made it difficult for Dogecoin to regain lost dynamics.

While these conditions provide a critical context, the severe decline within the high-quality Doge letters after the beginning of the Doge website indicates that the participation of Musk has influenced investor behavior. The overlap between the 2 events points to a response that is formed by mood, but is reinforced by tightening the financial and regulatory environments.

Ethical concerns regarding Musks Dogecoin activity

Musk's continued promotion of Dogecoin has triggered a brand new examination of the risks related to “parasocial investments”. This term refers to behavior during which individuals depend on distinguished figures for financial information without carrying out independent research.

Retail investors – especially those with limited financial experience – often go under consideration for public notes without fully grasping the potential disadvantages. This environment creates space for financial losses and misguided trust, especially in volatile and barely regulated markets akin to crypto.

While Musk has the correct to share personal views, his public statements can trigger considerable price movements and either trigger sharp rally or declines. His influence, which is reinforced by thousands and thousands of supporters and high visibility, raises concerns concerning the ethical responsibility of public figures in financial discourse.

According to the US law, market manipulation often includes conscious attempts to distort prices or to annoy the market participants. The Securities and Exchange Commission (SEC) examines such activities on the securities markets, but Dogecoin just isn’t under their responsibility. The Commodity Futures Trading Commission (CFTC), which monitors raw materials, could potentially examine the influence of Musk in response to its wider authority.

The legal limits remain unclear. However, the consequences of the social media posts from Musk are difficult to disregard. Even if he’s framed as a private comment, his tweets often result in immediate price changes. These repeated effects can function indirect market signals whatever the intention.

258 billion US dollar lawsuit is geared toward musk against dotecoin

In June 2022, investors filed a lawsuit of 258 billion US dollars against Elon Musk and accused him of carrying out a Doonecoin pyramid program. In the grievance it was said that Musk used tweets and media appearances to artificially increase the worth of the coin and profit from the flood, while others suffered greater than the costs later collapsed.

The case shows the increasing examination of the influence of the celebrities on the financial markets. Although the SEC Dogecoin has not classified as security, the legal process might be complicated as a consequence of the regulatory gray zone of the coin. If dishes find that Musk knowingly manipulated the market or misleaded investors, he might be exposed to civilian punishments or settled.

This lawsuit follows a pattern. In 2018, the Sec against Musk against misleading tweets in reference to Tesla. This case ended with an approval decree that signaled that the supervisory authorities are able to intervene if public statements influence investor behavior.