Ada fell by 5.2% within the last 24 hours and bumped into the decline of Bitcoin by 2.8%. The move pushed Cardano under the support level of USD 0.707, which has been the bottom since May. At the time of the letter, Ada acts near USD 0.68.

Whales reduce the exposure, while the marketplace for developer -Derser (ADA) becomes derivative market, becomes defensive

ADA/USD 4-hour price diagram. Source: TradinView

This breakdown occurred in the course of the increased trading volume and confirmed a powerful sales pressure. The decline also coincided with a wider market shift, because the Bitcoin dominance rose to 63.2%, which indicates the capital rotation of old coins.

The technical indicators of Cardano confirm a bearish outlook. A recently formed Cross of death, with the 50-day easy sliding average falling below the 200-day SMA. This crossover often signals a persistent downward trend.

In the meantime, the relative strength index (RSI) is 48.29, a neutral level, but follows a bearish divergence. On June 10, Ada rose to $ 0.716, but RSI couldn’t correspond to the upward train – which indicates that the bullish dynamic was weaker before the collapse.

Whales reduce exposure while developers decelerate

On-chain data show a reduced accumulation by large ADA owners. Arrivals that held between 1 million and 10 million ADA, held their credit from ~ 1.74 billion ADA initially of May to lower than 1.72 billion ADA until June 12 – a decrease of approx. 1.7%. Larger cohorts which have over 1 billion Ada have remained flat and showed no recent tributaries.

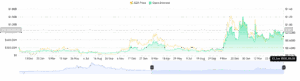

Source: Santiment

Source: Santiment

At the identical time, developer activity within the Cardano network has dropped sharply. According to Santiment, the event metric from 66 at the top of May went back to 35.02 – a decline of 47% over two weeks, which indicates that reduced code commits and updates were recorded.

The user's commitment also weakened. The variety of lively 30-day addresses currently fell from 1.2 million in December 2024 to 462,000, which corresponds to a decline of 61.5%-a clear signal for reduced organic demand and the participation of the user.

The marketplace for Cardano (ADA) is defensive

Traders resign within the derivative market. The open interest on ADA contracts fell 8.8%initially of this week, followed by an additional waste of 4.6%. This regular decline indicates that Leveraging Long positions – especially those who were opened almost 0.707 to 0.725 US dollars.

Source: Coinglass

Source: Coinglass

On June eleventh, long positions price around 251,000 USD were liquidated. This probably accelerated the collapse, triggered stop-loss orders and cascading liquidations. Nevertheless, Binances Langes/Short ratio stays high at 3.03 and shows a fragile bullish preload, which could proceed to calm down if the sale continues.

The everlasting financing rates have change into negative across large stock exchanges, which shows that retailers have short positions. This shift often reflects the growing bear conviction among the many speculators.

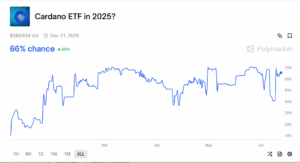

The mood of the investors was also influenced by a delay within the ADA ETF approval. Ada had previously submitted to Graustufen after a Spot Cardano ETF. The registration led the Bullish dynamics during this era and increased the costs over $ 0.70. However, this optimism seems to have cooled down without further developments or decisions because the announcement. Although polymarket data indicate a 66% probability of ada ETF approval in 2025, the short-term effect of the delay has cooled down speculative interest.

Source: polymarket

Source: polymarket