Cardano (ADA) shows signs of stagnation, whereby the value movement under 0.70 USD and network health indicators are reduced red. From June 4, Ada zu is currently $ 0.694, while development activities, user participation and whale movements indicate a careful market posture.

The activity of the Cardano developers drops by almost 40%

The data from the Github-linked tracking show that the event activity value from Cardano has decreased to 56.56, in comparison with 92,849 in the primary quarter of 2025 to 39% in recent months. This sharp fall indicates a withdrawal within the core protocol contributions and comes at a time when investor's mood is already steamed.

Cardano development activity. Source: Santiment

At the identical time, user activity has followed an analogous trajectory. The 7-day lively variety of addresses dropped to around 112,000, which corresponds to a decline of 46% in comparison with the January level, which culminated over 207,000. On June 4, the each day lively addresses were 23,273, which was as a consequence of a decline of over 63% in comparison with the annual high of around 64,000.

The double decline within the developer's engagement and user activity shows to a large rejuvenation of the ecosystem impulse.

Despite the weakening basics, the whole value of Cardano (TVL) with USD 337.59 million stays relatively stable, with a rise of 24 hours by 6.6%. However, the decentralized Exchange (Dex) area is modest and is $ 2.42 million. While TVL suggests that the capital has not yet left the ecosystem, the activity stays limited at transaction and application level.

Source: Defillama

Source: Defillama

AdA resistance at 0.7077 USD states

On the technical front, Ada stays limited below the psychological threshold of $ 0.70. The price campaign shows repeated failures within the violations of the resistance of $ 0.7077, which is marked by the retracement level of 0.236 fibonacci. The relative strength index (RSI) within the 4-hour diagram is 51 and reinforces a neutral impulse profile.

ADA/USD 4-hour price diagram. Source: Tradingview

ADA/USD 4-hour price diagram. Source: Tradingview

While ADA is saying support near 0.64 US dollars, the acquisition pressure has not tracked. The light trading volume shows a limited condemnation of bulls and bears alike.

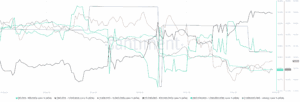

On-chain data show mixed behavior amongst the large owners of Cardano. Arrivals within the 1 The hundreds of thousands to 10 million ADA range have shown slight increase in increases within the participation, which indicates the localized accumulation. However, larger wallets – especially those that have 100 to 1 billion ADA – have maintained flat credit and showed no clear shift in positioning.

Cardano whale activity. Source: Santiment

Cardano whale activity. Source: Santiment

At the identical time, the mid-animal speeches between 10,000 and 100,000 ADA have barely reduced their investments, which is more careful with more agile investors. The lack of strong movements of upper shells reinforces the present lack of directed conviction.

Can Hoskinson's regulatory visual behavior change to chain behavior?

In a keynote speech, which was recently shared by Input Output, the founding father of Cardano, Charles Hoskinson, emphasized the necessity for a privacy-compliant defect infrastructure. With regard to the Midnight Network initiative, Hoskinson found that “privacy is not going to scale without compliance” and deleted it as the premise for the defi for institutional quality on Cardano.

Source: x

Source: x

However, this long -term vision has not translated into developer metrics or activity to a rise, which indicates that investors and the builder can remain as much as concrete rollouts or upgrades.

You may prefer it: Cardano founder Charles Hoskinson breaks the silence again: Ada vouchers which might be certain to Kyc not with private keys