Trusted editorial content reviewed by leading industry experts and experienced editors. Ad Disclosure

The price of Bitcoin appears to have cooled down after rallying past the $90,000 mark with great force last week. According to the newest price development data, this price increase will only be temporary in nature because the leading cryptocurrency appears to still be stuck in a bearish structure.

BTC price momentum continues to slow

On November 29, market analyst Axel Adler Jr. shared on the social media platform

According to Adler Jr., Bitcoin’s price momentum has been experiencing a slowdown since March 2024. This remark is predicated on changes within the monthly Relative Strength Index, an indicator that measures the speed and extent at which an asset's price changes.

Related Reading: Bitcoin Investors Aren’t “Remotely Optimistic Enough” – Bitwise Researchers

Data from CryptoQuant shows that the monthly Bitcoin RSI has fallen from overheated levels to 60% since March 2024, a period marked by significant price increases. From a historical perspective, this decline could mean further problems for the BTC price.

Source: @AxelAdlerJr on X

As Adler Jr. identified, based on this historical pattern, Bitcoin price may not reach its next low until between June and October 2026.

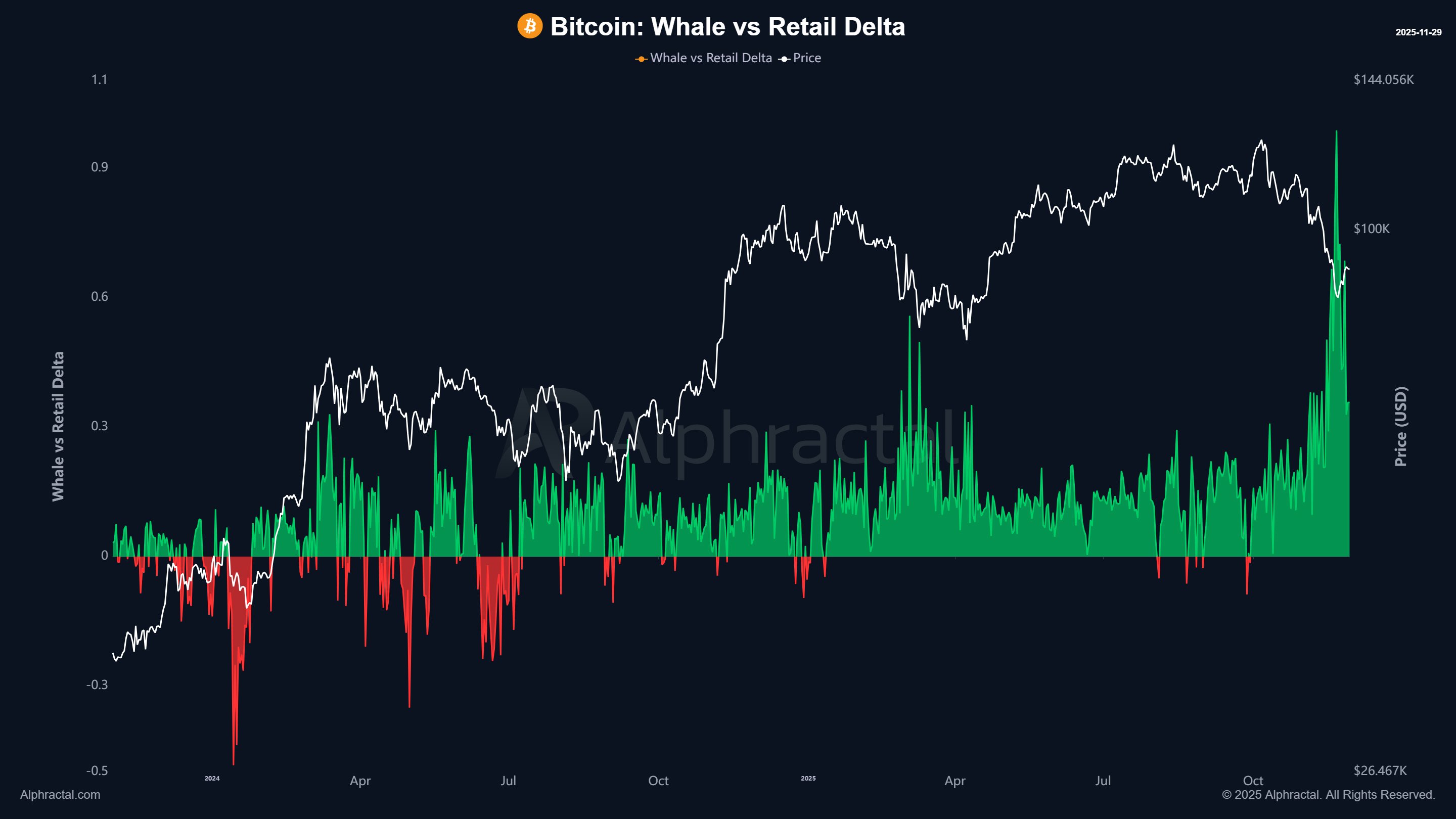

Bitcoin Whales Show Less Conviction: Alphractal CEO

From a special on-chain perspective, Joao Wedson, CEO and founding father of Alphractal, also takes a similarly not-so-bullish stance on Bitcoin’s short-term price. This rating is predicated on the positions of the biggest investors (whales) in comparison with retail investors.

According to Wedson, BTC whales are either closing their long positions or barely increasing their BTC short positions in comparison with retail investors. Typically, this trend results in a period of sideways price motion – as seen between March and April 2025.

Source: @joao_wedson on X

Wedson also noted that some bears are likely attempting to push BTC price towards the $80,000 mark before moving on to an accumulation wave. Ultimately, the mix of declining momentum and whales’ lack of conviction paints a somewhat bearish picture for Bitcoin.

As of this writing, the value of BTC is around $90,979, reflecting no significant changes within the last 24 hours. According to data from CoinGecko, the market leader is up greater than 7% on the weekly time-frame.

The price of BTC within the every day time-frame | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial process At Bitcoinist, the main target is on providing thoroughly researched, accurate, and unbiased content. We maintain strict sourcing standards and each page is rigorously reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content to our readers.