Bitcoin's breakout is on course, however the bounce needed just isn’t clean. Bitcoin price has reclaimed key trend support, history suggests a continuation and short-term selling has dried up.

But every increase upwards hits the availability. The reason for this just isn’t clear from the worth alone. A gaggle of holders are still selling their strength, which could delay the following rise.

The breakout structure continues to be intact

Bitcoin is trading inside a cup and handle structure on the every day chart. The price briefly moved towards the breakout near $92,400 before falling back, however the structure stays valid so long as key support stays in place.

The essential support signal is the 20-day EMA. An EMA, or exponential moving average, gives more weight to current prices and helps define short-term trend direction. Bitcoin reclaimed the 20-day EMA on January 10 and followed it with two green every day candles. This order is significant.

Bitcoin Structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya's every day crypto newsletter here.

In December, Bitcoin reclaimed the 20-day EMA twice, on December third and December ninth. Both times the recovery failed because the following candle turned red. On January 1st, the reclaim was followed by one other green candle. This move led to a rally of virtually 7%.

An identical constellation is now forming again. As long as Bitcoin stays above the 20-day EMA, the breakout theory stays on course. But the long upper wicks near $92,400 show that offer continues to be lively. This raises a matter: Who is selling?

Short-term and long-term holders are quiet, but ultra-long-term holders aren’t

On-chain data helps answer this query.

Short-term selling pressure has collapsed. Issued coin age band data, highlighting cohort-specific coin activity for the 7- to 30-day group, shows activity declining sharply, from around 24,800 BTC to simply 1,328 BTC, a 95% decline since January eighth. This means recent buyers aren’t rushing to sell to benefit from the upswing.

Short-term holders not selling: Santiment

The net position change of ordinary holders also turned positive on December twenty sixth. These holders, often viewed as long-term investors (holding for 155 days or longer), have been net buyers ever since and continued to purchase at the same time as Bitcoin peaked on January fifth.

The sale comes from one other group.

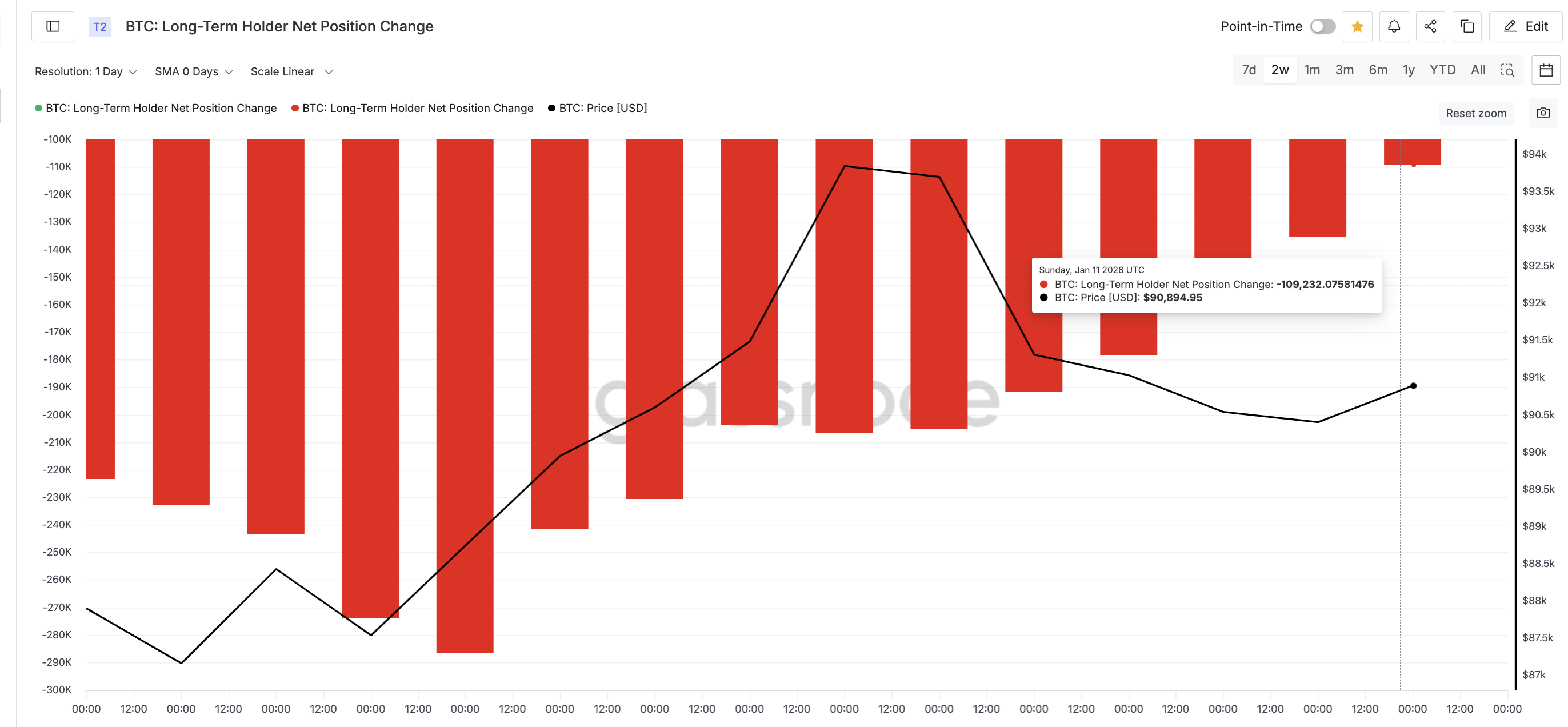

The net position change of long-term holders, which captures ultra-long holders whose coins could also be held for well over a yr, stays negative. On January 1st, this group distributed around 286,700 BTC. By January 11, these sales slowed to around 109,200 BTC, a decline of over 60%. Selling pressure is easing but has not yet turned to purchasing.

This explains the hesitation near resistance. Short-term sellers have disappeared, long-term investors are buying, but extremely long-term holders are still distributing enough supply to cap the worth for now.

Bitcoin price levels which might be key

Bitcoin now needs a clean every day close above $92,400 to pave the way in which towards $94,870. Breaking this zone would complete the breakout story and activate the measured upside goal of 12%. This move points towards the $106,630 area.

For this to occur, Bitcoin must stay above the 20-day EMA and forestall selling by ultra-long holders from pushing the worth back down.

On the downside, $89,230 is the important thing support. A every day closing price below this may weaken the breakout structure. A deeper decline towards $84,330 would completely negate the bullish setup.

For now, the Bitcoin breakthrough story continues to be on course. The only thing missing is the conviction of the oldest owners. Once this group stops selling, the delayed breakout could occur quickly.

The post Bitcoin's 12 percent breakout story lives on – but a gaggle is attempting to spoil the ending? appeared first on BeInCrypto.

Article source: beincrypto.com

The post Bitcoin's 12 percent breakout story lives on – but a gaggle is attempting to spoil the ending? appeared first on Crypto Adventure.