Trusted editorial content reviewed by leading industry experts and experienced editors. Ad Disclosure

With a gentle price recovery within the Bitcoin (BTC) market, popular market analyst with the X username KillaXBT predicts one other significant correction in the approaching days.

Historical Bitcoin data shows a recurring monthly price decline of 8%

In a December twelfth X post, KillaXBT outlines a cautious market insight that implies Bitcoin is headed for a price decline. According to the renowned analyst, the leading cryptocurrency consistently recorded an 8% price decline after the 14th day of the last five months. KillaXBT describes this remark because the 14th pivot that now has essential short-term implications for Bitcoin. Since hitting a price low of $80,000 in late November, BTC has formed an ascending channel and recorded a gentle series of upper lows and better highs.

Source: @KillaXBT on X

However, KillaXBT's forecast is predicted to interrupt this channel and potentially halt the incipient uptrend. Due to the recurring price pattern, Bitcoin investors should expect a price decline of at the very least 5% after December 14, the analyst said. This suggests a possible retest of the $85,000-$86,000 price zone.

Given the asset's broader bullish market structure, such a move could merely represent a short-term decline. However, the continued correction at first of the fourth quarter has already set a precedent and leaves room for an additional period of deeper downside if momentum weakens.

Is BTC Falling Below $50,000?

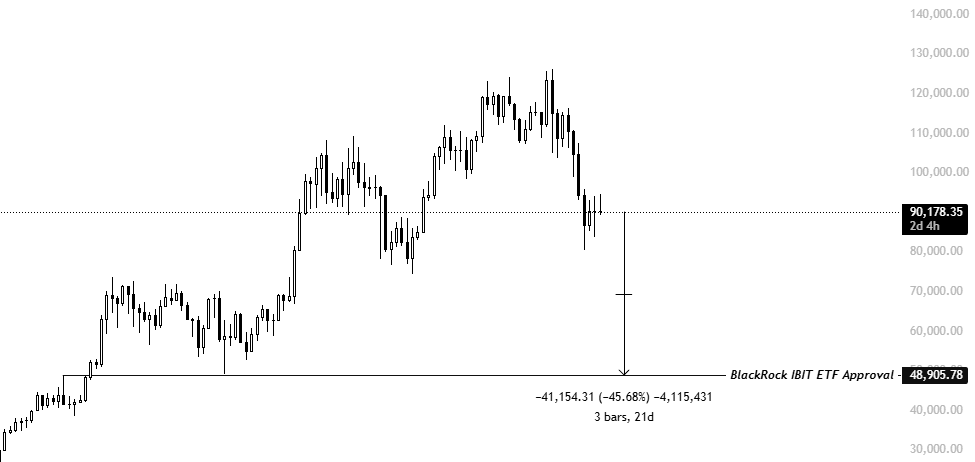

In one other X post, KillaXBT shares further pessimistic forecasts for the Bitcoin market. This time, the veteran analyst predicts that the crypto market leader will hit a price low of $48,905 despite recent price increases. KillaXBT's lower goal represents the Bitcoin price on the time of approval of the BlackRock IBIT ETF together with 11 other Bitcoin spot ETFs in January 2024. This forecast is probably going as a result of the final rationale that the present uptrend has been heavily supported by institutional inflows.

Notably, Bitcoin spot ETFs played a pivotal role in these institutional inflows, with total net assets of $119.18 billion. BlackRock IBIT holds greater than half of this traction because the undisputed market leader with $71.03 billion in net assets and $62.68 billion in cumulative net inflows.

Should Bitcoin return to pre-ETF approval price levels, this might represent an estimated 46% decline from current market prices. Such a move would likely signal a dramatic reversal in institutional positioning, suggesting that sustained ETF outflows, fairly than retail capitulation, could prove to be the principal catalyst for an additional crypto winter.

At press time, Bitcoin continues to trade at $90,348, down 2.18%.

BTC is trading at $90,373 on the day by day chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Pexels, chart from Tradingview

Editorial process At Bitcoinist, the main focus is on providing thoroughly researched, accurate, and unbiased content. We maintain strict sourcing standards and each page is fastidiously reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content to our readers.