Trusted editorial content reviewed by leading industry experts and experienced editors. Ad Disclosure

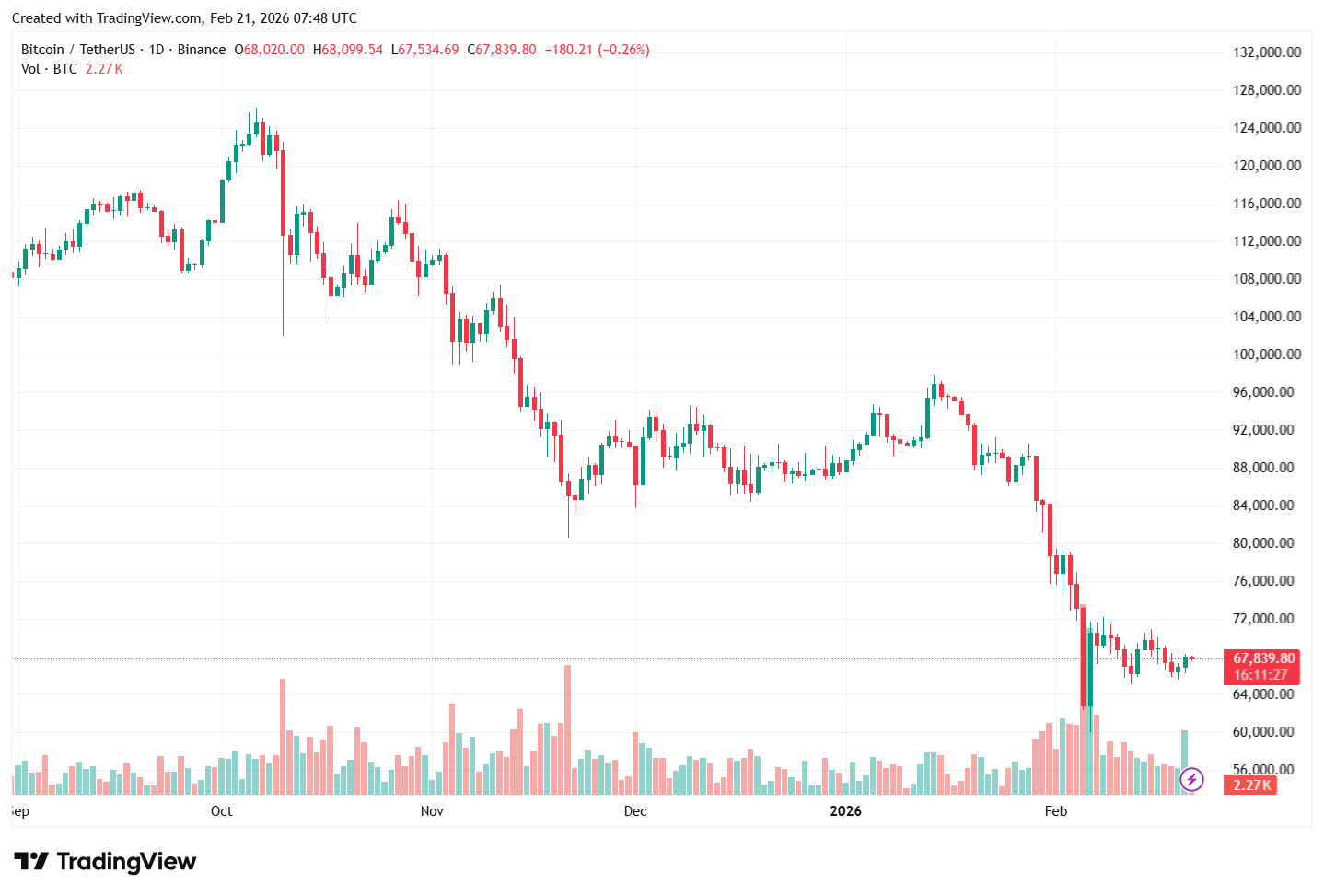

Bitcoin's price has remained in a consolidation zone below $70,000 to date this week, after spending much of last weekend above it. While the flagship cryptocurrency's price motion has been largely – and painfully – sideways in recent weeks, this represents a notable improvement from the beginning of February.

The recent month heralded a brand new low for Bitcoin just above $61,000, confirming the beginning of the bear market. Given the relative stability over the past few weeks, a recent on-chain valuation suggests that BTC and the broader cryptocurrency token are still vulnerable to further downside volatility.

The way forward for BTC lies within the hands of major investors: CryptoQuant

In the last bull cycle, Bitcoin's price performance was heavily influenced and influenced by the increasing inflow and activity of institutional investors (mainly through spot exchange-traded funds). Likewise, it seems that the massive investor cohort will proceed to be in the motive force's seat even through the bear market.

According to CryptoQuant’s latest market report, Bitcoin exchange inflows – and immediate selling pressure – have normalized for the reason that capitulation surge in early February. This trend might be seen within the decline in foreign exchange inflows from around 60,000 BTC in the beginning of the month to around 23,000 BTC now.

While the acute sell-off appears to be easing, a worrying trend is emerging amongst the most important Bitcoin investors. In its market report, CryptoQuant highlighted that the BTC exchange whale ratio rose to 0.64, the very best level since 2015, indicating that whale inflows account for a significant slice of exchange deposits.

Source: CryptoQuant

Meanwhile, the common BTC deposit size has also reached levels not seen since mid-2022, through the heat of the last bear market. This trend further reinforces the concept that institutional or large investors are behind the increasing supply of foreign exchange.

CryptoQuant noted that the altcoin market remains to be experiencing increased distribution pressure, with the common day by day variety of altcoin exchange deposits increasing from 40,000 within the fourth quarter of 2025 to 49,000 in 2026. This continued rotation of capital out of riskier assets reflects weakened market confidence and increases the chance of downside volatility.

![[20 February 2026] Redistribution of foreign exchange flows: Whales’ deposit activity is increasing amid declining stablecoin inflows](https://i0.wp.com/bucket.cryptoquant.com/research/vhKU3eAo_f9d6c7c031686bfd623832b4a9af0d3e55ed890a23e747cab76d866905521427.png?ssl=1)

Source: CryptoQuant

Meanwhile, the continued outflow of stablecoins from exchanges suggests a decline in marginal purchasing power (or “dry powder”) within the Bitcoin market. According to CryptoQuant data, nUSDT inflows into exchanges have fallen sharply from a one-year high of $616 million in November 2025 to only $27 million and have turned negative at times (-$469 million at the tip of January).

Ultimately, the mixture of increased selling pressure from major Bitcoin holders, increasing altcoin distribution, and ongoing stablecoin outflows suggests that the crypto market structure stays vulnerable to further downside volatility.

Bitcoin price at a look

As of this writing, the worth of Bitcoin is around $67,580, up barely by 1% within the last 24 hours.

The price of BTC within the day by day timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial process At Bitcoinist, the main target is on providing thoroughly researched, accurate, and unbiased content. We maintain strict sourcing standards and each page is rigorously reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content to our readers.