Trusty editorial content, checked by leading industry experts and experienced editors. AD -open

Bitcoin occurs in mid -2025, which consolidated just under all -time highs and navigates a turbulent 12 months, which is characterised by Deep Macro and geopolitical volatility. The 12 months began with the renewed collective bargaining policy of US President Donald Trump, who rattled global trade relationships and the under pressure. An increasing US Ministry of Finance followed shortly, which the concerns in regards to the systemic fragility spoke when inflationary pressure collided with radiant liquidity. The outbreak of direct conflict between Israel and Iran has recently taken the fear of the financial markets and prompted a shift like gold.

In the center of this backdrop, Bitcoin has remained resistant and is currently consolidated by the $ 100,000 mark after helping $ 112,000 at first of the 12 months. While some investors fear that sales pressure will increase as a result of global instability, others imagine that the present structure points to strength reasonably than weakness. According to Top Analyst Ted Pillows, nothing has modified fundamentally for BTC. His technical perspective argues that Bitcoin remains to be reflected within the long -term brandy of gold and can remain on track for one more outbreak in the approaching weeks.

In view of the inflation risks which might be still concerned, the Fiat, which grows and changes capital to tight assets. Many don’t see Bitcoin as a speculative game, but as a macro hedge. An outbreak of over 112,000 US dollars could trigger the subsequent explosive train.

Bitcoin volatility pikes as a macro printing builds up

Bitcoin holds an organization over $ 103,000, even though it didn’t break up the utmost $ 112,000 prior to now week. The rejection led to a pointy correction of 6%, whereby the bears tried to force the value amongst a very powerful demand tones. Despite intensive macro prints and escalating geopolitical risk, Bitcoin stays structurally intact. The conflict between Israel and Iran has sent shock waves through the worldwide markets and pressed Safe-Haven's assets reminiscent of oil and gold, while shares fluctuate. Bitcoin, often thought to be digital gold, surprisingly showed strength in the midst of chaos.

The coming week could possibly be crucial for BTC. If the tensions deteriorate and the standard markets proceed to push, Bitcoin's behavior will test its developing role as a macro hedge. Investors observe exactly whether the capital continues to rotate under risk conditions.

Ted pillows remain optimistic. His technical evaluation suggests that nothing has modified structurally for Bitcoin. In his view, BTC is closely followed by Gold's historical outbreak patterns, which suggests that the digital asset only consolidates in front of one other leg. Bitcoin's long-term outlook at $ 160,000 to $ 180,000 on the highest of the cycle.

Bitcoin reflects gold price | Source: Ted pillows on x

BTC consolidate under the resistance

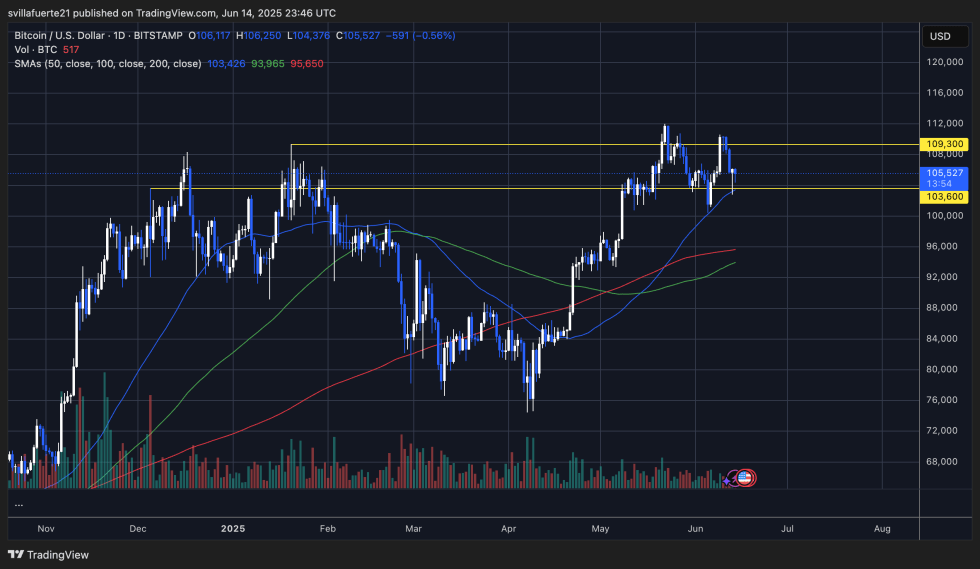

Bitcoin currently doesn’t break through at 105,527, after a failed attempt not to interrupt the extent of 112,000 US dollars at first of this month. The graphic shows a transparent rejection of this all-time area, which withdraws the value of $ 103,600 to $ 109,300. This zone stays the first battlefield between bulls and bears.

BTC holds a very powerful query of inquiries | Source: Btcusdt diagram on tradingview

BTC holds a very powerful query of inquiries | Source: Btcusdt diagram on tradingview

The sliding 50-day average, which is currently around 103,426 USD, acts as a dynamic support, while the 200-day MA near 95,650 USD stays a wider trend line for long-term owners. The volume is barely decreased throughout the recent decline, which indicates that the sell -out from the market participants has no strong conviction.

If BTC holds the extent of 103,600 US dollars – an earlier resistance that’s now supported – it may well set the stage for further pressure to 109,300 US dollars. A breakout above this level would probably open the door for price discovery over 112,000 US dollars. However, if Bitcoin doesn’t have the realm of 103,600 US dollars, the chance falls back to the region 97,000 to 100,000 US dollars wherein the previous demand was tested in May.

Selected picture of Dall-E, Diagram from Tradingview

Editorial process Because Bitcoinist focuses on delivering thoroughly researched, accurate and impartial content. We comply with strict procurement standards and every page is diligently checked by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and the worth of our content for our readers.