Moody's ranked the Credit rating from the United States from AAA on AA1 on May 16, 2025, citing long -term budget deterioration. The downgrading ended a century -old era during which the United States organized an ideal credit standing of all major agencies.

S&P rage the United States in 2011 and Fitch followed in 2023. The downgrading from Moody is leaving the country for the primary time for the reason that starting of the evaluation system without first -class points.

The agency identified the rising debts, rising interest payments and the shortage of a sustainable fiscal framework. The data of the US Ministry of Finance show that the general debt of the general public has now exceeded $ 34.7 trillion in comparison with around $ 23 trillion in 2019. Fred (Federal Reserve Economic Data )'s table confirms a robust increase in debt launch around 2020, with the curve accelerating sharp after the stimulus packages from the pandemic.

US Federal debt writing since 1960. Source: Fred

The visual trend shows that the debts have increased steadily between 2000 and 2020. After 2020, nevertheless, the pace was exponentially. By 2024, the overall debt of the federal debt approached the 34 trillion dollar mark. From the second quarter of 2025, the trajectory stays up, without visible signs of slowing down.

This downgrade coincides with a scarcity of agreement within the congress via a tax and expenditure proposal of three.8 trillion dollars. Moody warned that the annual deficit could reach 9% of GDP by 2035 if the tax cuts of the Trump era are called up by 2035.

The markets reacted quickly. The US Ministry of Finance increases and reflects the concerns about long-term loan costs. Equity Futures fell in line with the news. The White House rejected the evaluation lawsuit and explained that it was politically motivated, but didn’t release any additional political guidelines or counter data.

Moody's also marked systemic risks within the federal budget structure. Without significant political changes, the agency warned that the prices of debt employment eat a bigger proportion of the state budget, which makes it difficult to reform budget reforms in the longer term.

This downgrading doesn’t change existing bond conditions, but has an impact on the credit costs and the investigation. The US sovereign debts are still considered protected worldwide, but the shortage of a triple-a rating of all agencies could cause the reassessment in global fixed inputs portfolio.

Bitcoin supply on the stock exchanges meets latest drafts, mirror rising

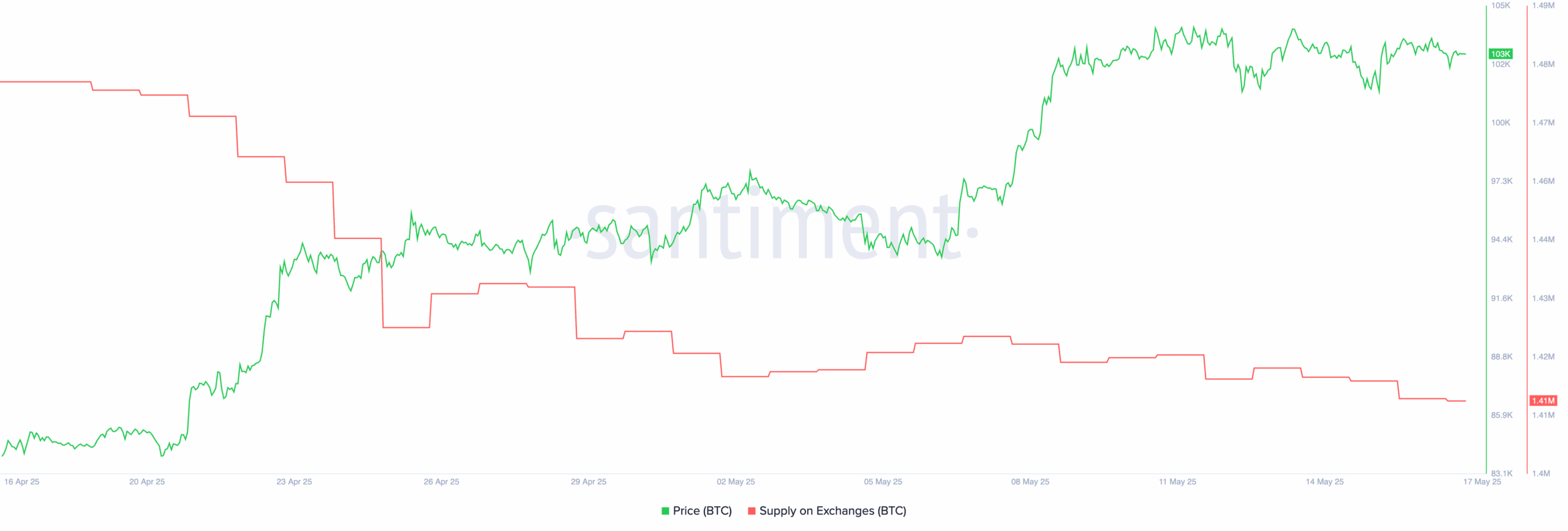

Between April 17 and May 2, the Bitcoin offer sank from 1.47 million to 1.42 million BTC. The illustration rose briefly to 1.43 million BTC by May 7, however the upward movement was short -lived.

Bitcoin price against exchange supply – April to May 2025. Source: Santiment

Bitcoin price against exchange supply – April to May 2025. Source: Santiment

By May 17, 2025, the offer has fallen back to 1.41 million BTC and marks a fresh local low point for exchange balance sheets. This decline comes despite the newest price fluctuations, the Bitcoin price lies around 103,000 US dollars, as shown in the identical data set.

The Santiment table shows a gradual decline within the red (exchange offer) against an increasing green line (BTC price), especially from late April to mid-May. The deviation between the exchange balance sheet and the market price often signals growing investor preferences for self -improvement.

If retailers reduce their participation within the stock exchanges, this means a shift briefly -term speculation on long -term storage. This behavior reduces immediate sales pressure, especially under uncertain macroeconomic conditions.

The diagram also shows that this trend has remained consistent even after crossing Bitcoin over $ 100,000. While the value movements proceed to fluctuate in a narrow area, the provision trends may show that investors will not be waiting as a substitute of selling them at the present level.

This current illustration – 1.41 million BTC on stock exchanges – has presented the bottom level for the reason that starting of April. Previous levels of resistance on this metric have now shifted down and reflects a broader caution each within the retail and institutional owners.

Such movements are vital for market structure evaluation. Sinking exchange balance sheet is usually aimed toward accumulation phases. Although this dynamic of care isn’t predictable, they’re a major a part of the persecution of investor behavior.

Bitcoin Price pursues 103,000 US dollars because Ichimoku Cloud stays flat

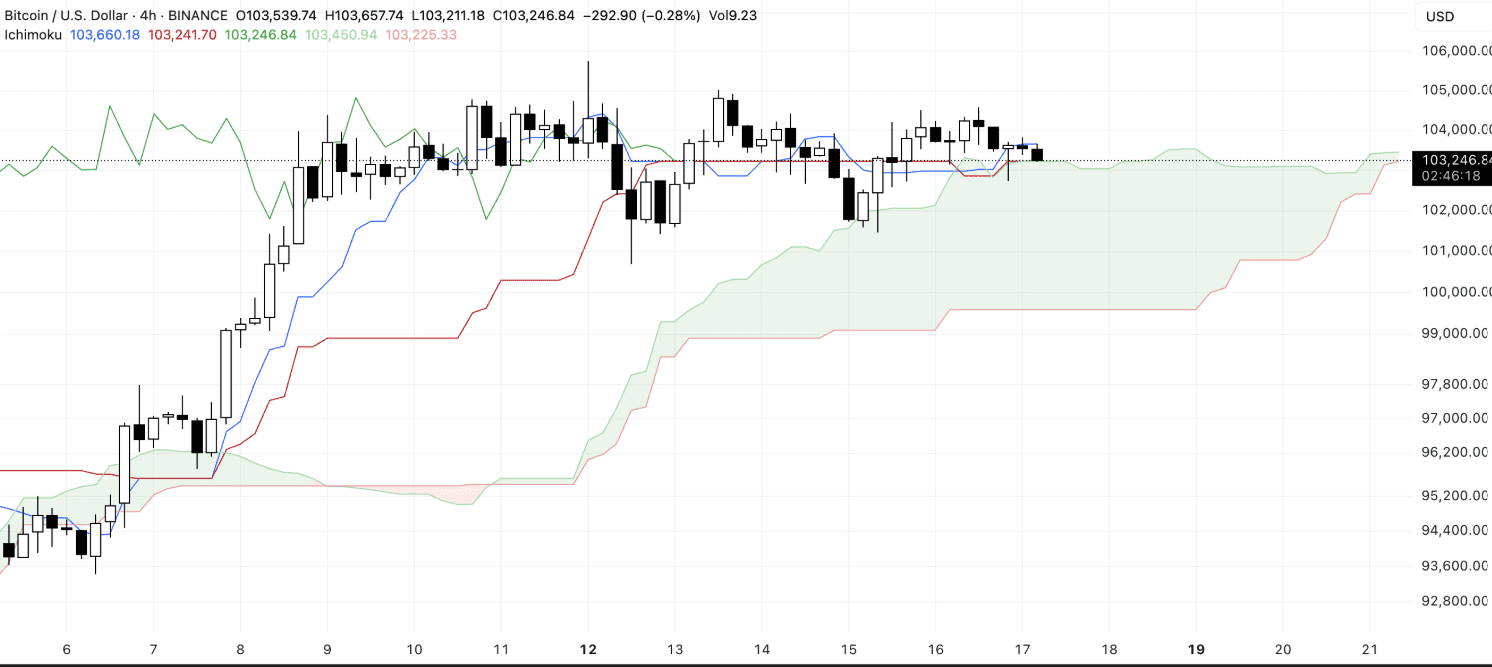

According to a 4-hour diagram from TradingView, Bitcoin will likely be traded near USD 103,246 on May 17, 2025. The Ichimoku -Cloud indicator shows a consolidation phase with out a clear breakout signal in sight.

Bitcoin consolidates for 103,000 US dollars for flat Ichimoku -cloud. Source: Tradingview

Bitcoin consolidates for 103,000 US dollars for flat Ichimoku -cloud. Source: Tradingview

The Kijun-Sen line (red) is $ 103,241 and is closely matched by the present price. This flat position signals a balanced market, neither buyer nor sellers dominate. The price has moved to the side for several sessions along this line, which indicates a reduced impulse.

The Tenkan-Sen line (blue) reads $ 103,660, just above the present level. The flat tendency reflects short -term indecisiveness. There isn’t any curve up or all the way down to suggest immediate trend development.

The lines of Senkou Span A and B, which form the green cloud, remain horizontally between USD 103,450 and USD 103,225. The thin and flat shape of the cloud indicates a scarcity of volatility and weak trend strength. The price is currently within the upper a part of the cloud, which is often considered a soft support level.

In the meantime, the Chikou Span (Green Lagging Line) is something above the newest price candles. This position could reflect a minimal bullish feeling. However, there isn’t any trend confirmation without increasing cloud structure or a cross about resistance.

This flat Ichimoku setup has taken place since May 11, despite several attempts from BTC to interrupt over 104,000 US dollars. The lack of divergence between the components of the indicator indicates that the market stays in balance.

The BTC volume can be easy, with the table not showing large candle movements within the last 48 hours. If Price doesn’t speak over the upper or lower base of the cloud, the trend can remain on this area.

Bitcoin looks like 105,755 US dollars in comparison with the important thing resistance

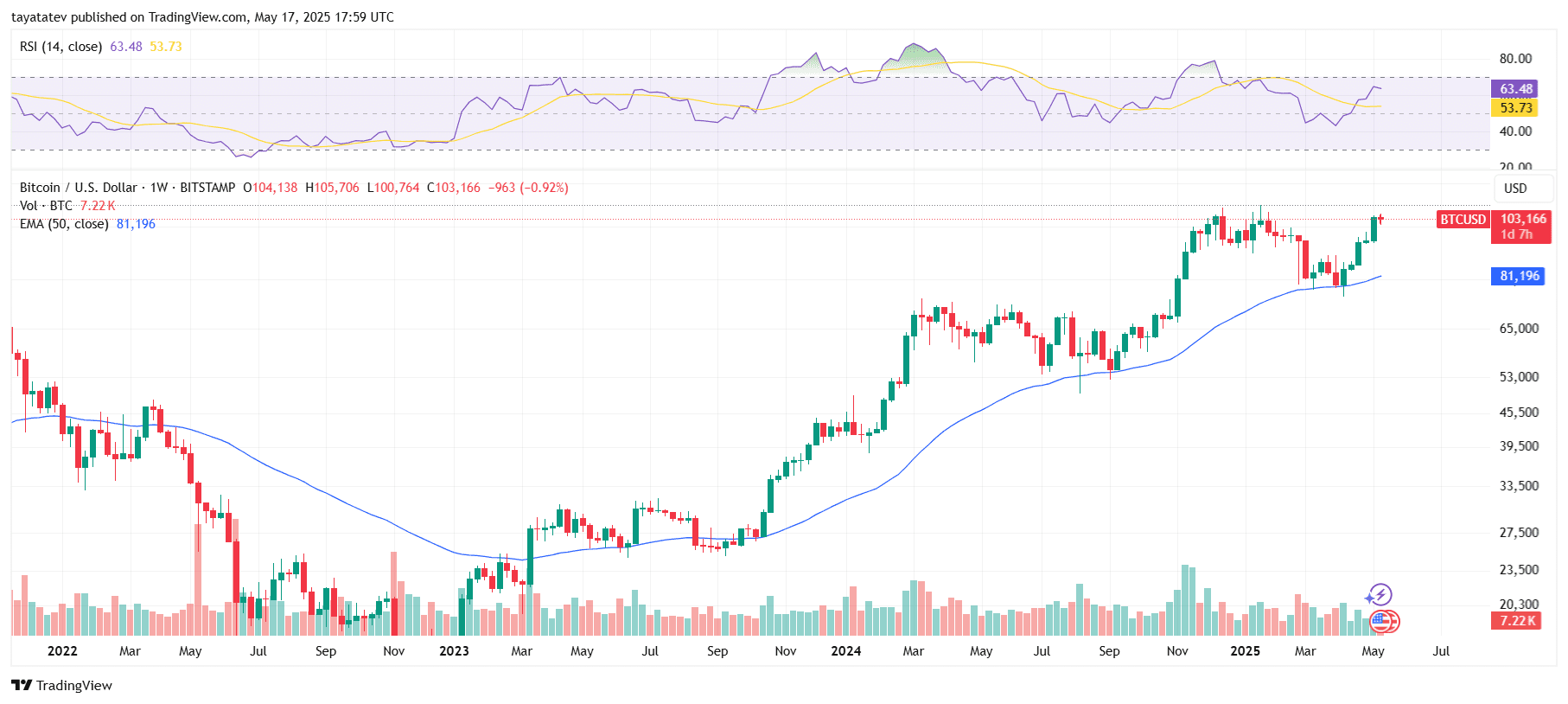

According to the weekly BTC/USD diagram in Tradingview, which was published on May 17, 2025, Bitcoin currently costs 103,166 US dollars.

Bitcoin Weekly Chart: Resistance at 105,000 US dollars, support at $ 100,000. Source: Tradingview

Bitcoin Weekly Chart: Resistance at 105,000 US dollars, support at $ 100,000. Source: Tradingview

This resistance zone is aimed toward the highest of a weekly candle fuck that was printed in early May 2025. Bulls tested the extent several times, but no candle body has closed it. The upper rejection suggests that sellers remain lively near this price range.

The support is 100,694 US dollars, the lower limit of the last weekly consolidation. When this support breaks, the diagram shows potential downward goals of 98.002 US dollars, followed by a lower level of $ 93,422. These were last seen through the Price Pullbacks in April 2025.

The 50-week exponential sliding average (EMA) is $ 81,196. The price stays far above it, which points out that an extended -term bullish structure is unbroken. However, the recent weekly candles show shorter bodies and upper wick, which reflects the slowdown upwards.

In the relative strength of the strength (RSI), the 14-week measured value is 63.48 and hovers just above the middle line, but significantly below the overbought threshold of 70. The climb of the RSI is barely up, but not steeply, but not steeply confirms that the bullish strength is present, but doesn’t speed up.

The volume of the last weekly candles has declined barely. The electricity volume is 7.22 K, lower than in February -März -Breakout. This tape supply vade suggests that the recent increase of over 100,000 US dollars was not accompanied by a robust increase in buying pressure.

Although the EMA positioning stays favorable, the flattening price behavior and the weaker RSI inclination indicate consolidation. For the bullish sequel, Bitcoin would need to close a weekly candle over 105,755 US dollars with higher volume.

Bitcoin is the property when the US debts rise

Since the Moody's US credit recruitment eliminates the ultimate top animal rating, Bitcoin's market role is again in focus. Fiscin stability and long-term deficit projections have paid more attention to Bitcoin price behavior.

Although Bitcoin stays in a good trading zone, the continued decline within the BTC offer on stock exchanges together with flat technical indicators shows indecisiveness. Investors proceed to watch the resistance and level of support.