Trusted editorial content reviewed by leading industry experts and experienced editors. Ad Disclosure

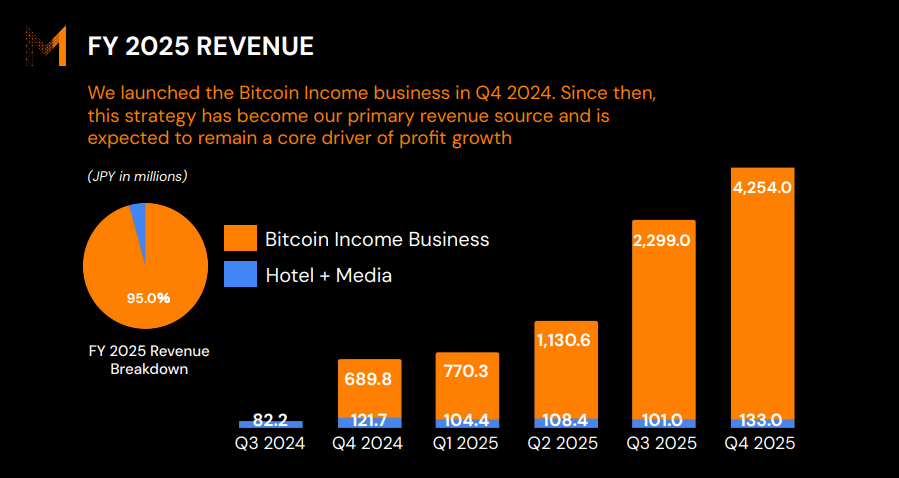

Metaplanet saw a dramatic increase in its recent results after shifting much of its business to Bitcoin. Revenue rose over 700% year-over-year to almost 9 billion yen (about $58 million), a rise the corporate links to revenue from BTC options and related services. The change happened quickly – the corporate only launched its Bitcoin income business in late 2024 – and now these activities account for just about all of its revenue.

Sales and business shift

According to its fiscal 2025 filing, about 95% of revenue was tied to Bitcoin-related businesses. Premiums from options sales and costs from trading products accounted for nearly all of this money flow.

Good morning planet. We are fully aware that the situation stays difficult for our shareholders given the recent share price performance. However, Metaplanet's strategy stays unchanged. We proceed to repeatedly accumulate Bitcoin, increase revenue and prepare for the following phase of growth.

— Simon Gerovich (@gerovich) February 6, 2026

Traditional industries resembling hotel and media work have been replaced by the crypto arm. This move quickly led to sales, but in addition focused the corporate's fortunes on a volatile asset.

CEO reiterates long-term treasury plan

Simon Gerovich has reiterated that his strategy stays in place despite the recent market downturn. He stated that there can be no change in direction and that accumulation would proceed. This public engagement is vital for continuity but doesn’t eliminate accounting and market risks.

Source: Metaplanet

The numbers behind the headlines

Metaplanet's operating profit was positive, at around 6.28 billion yen (nearly $40 million). The company reportedly still posted a net lack of nearly $620 million after a drop in valuation of its Bitcoin holdings.

A decline in market value of greater than $660 million worn out a lot of the operating profit using fair value accounting. Capital markets have been heavily tapped: the corporate has raised over $3 billion since switching to the treasury model.

Source: Metaplanet

Accounting losses versus operating strength

This gap between operating profit and net loss is a transparent example of how accounting standards interact with volatile assets. Profits from option premiums were generated and reported. At the identical time, unrealized losses within the coin supply needed to be shown within the balance sheet, which pushed the into the loss zone.

BTCUSD is currently trading at $67,777. Chart: TradingView

Bitcoin price motion

At the middle of this story is the market itself. Bitcoin's fluctuations have defined much of the Metaplanet 12 months. During the final sell-off, prices fell sharply, weakening the corporate's valuation, while periods of quieter trading allowed the choices business to generate stable income.

Traders pointed to headline risks and general risk aversion moves because the market plunged, and people pressures impacted the corporate's financial reports.

Investments and strategy

Holdings reportedly increased from about 1,762 BTC at the tip of 2024 to about 35,102 BTC at the tip of 2025, making Metaplanet one among the most important Bitcoin company holders in Japan.

The company describes the plan as a long-term treasury approach: acquiring and holding Bitcoin to avoid dilution by fiat currencies and capture potential long-term appreciation. This is an explicit bet on future returns offset by short-term volatility.

Featured image from Unsplash, chart from TradingView

Editorial process At Bitcoinist, the main target is on providing thoroughly researched, accurate, and unbiased content. We maintain strict sourcing standards and each page is fastidiously reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content to our readers.