On May 12, Puffer token fell by 11.24% to $ 0.2494 after Binance added it to the Alpha program. The price had previously reached $ 0.2844, but couldn’t receive USD 0.2774. Based on tradingView data, the decline occurred over a period of 18 days, with the entire trading volume of 66.42 million being recorded.

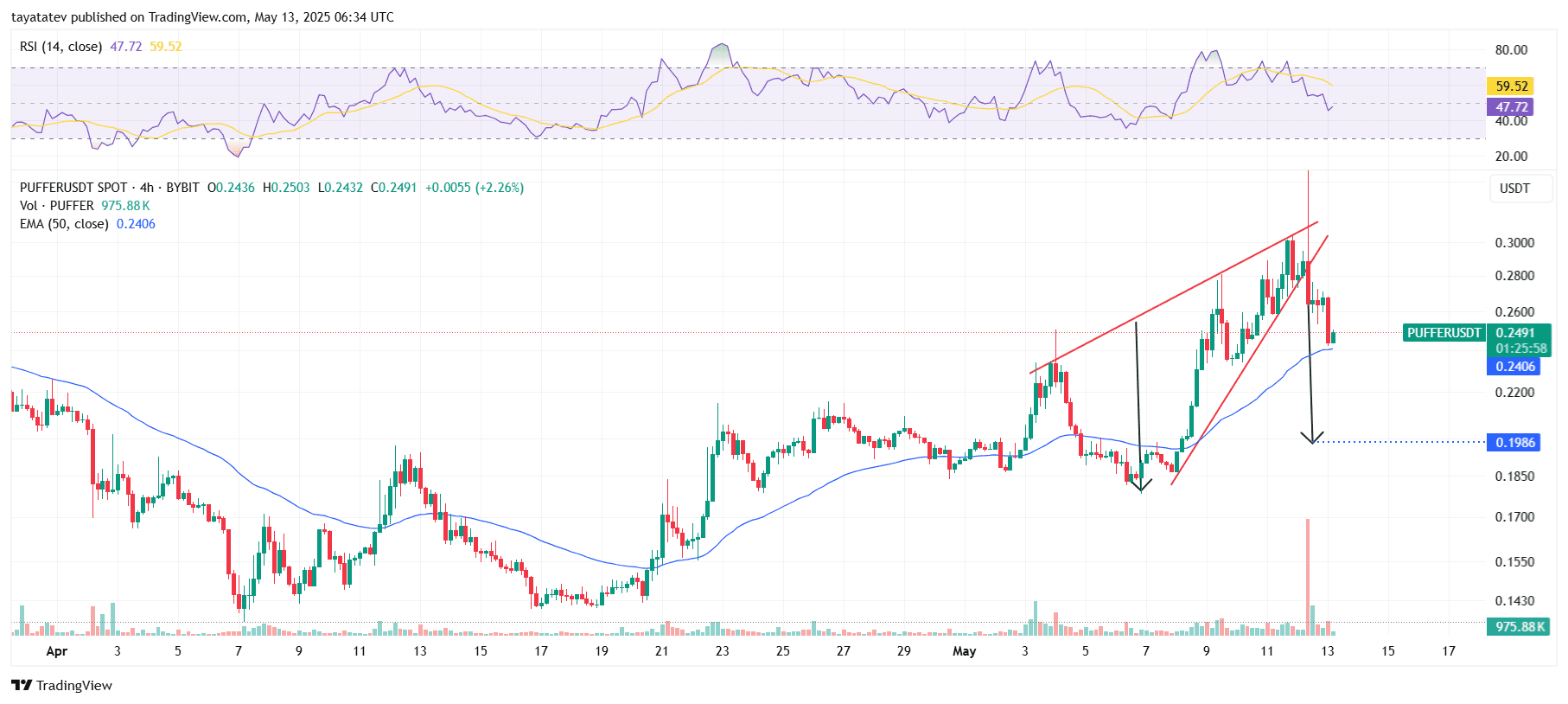

After Binance Alpha Airdrop, Binance drops by 11%. Source: Tradingview

The token currently deals between the support of $ 0.2212 and the resistance of $ 0.2774. Despite the Bony announcement by Alpha Airdrop and the increased exposure, the buffer price was lower through the session

Binance Alpha Airdrop triggers the distribution of the ball distribution and the amount swing

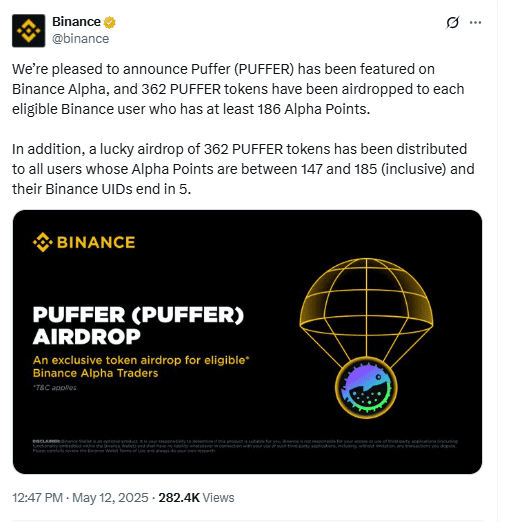

On May twelfth, Binance included the buffer token into his Alpha program and commenced a targeted Airdrop at justified users. The program granted each chosen user 362 buffer token.

Binance confirms buffer Alpha Airdrop authorization. Source: Binance on X

Binance confirms buffer Alpha Airdrop authorization. Source: Binance on X

Participants with greater than 186 alpha points mechanically qualified for the airdrop. A second admission level included users with 147 to 185 alpha points, whose Binance -uids led to “5”. These users were chosen based on predefined program conditions, not on random drawings.

The airdrop also drew attention to crypto -oriented platforms. Buffer was widely discussed on X, where users shared screenshots of their airdrop allocations and commented on the admission criteria. The token was one of the vital ceaselessly mentioned recent assets under Binance Alpha and contributed to the short -term trading impulse.

Buffer -token forms rising wedge pattern after Binance Alpha Airdrop

On May 13, 2025, Puffer/Usdt formed an increasing wedge pattern on the 4-hour diagram, based on Data from Bybit via Tradingview. The pattern appeared after the Binance Alpha Airdrop, wherein the buffer token price rose over $ 0.30 before it was withdrawn sharply.

Puffer token breaks a rising wedge, goals at $ 0.1986. Source: Tradingview

Puffer token breaks a rising wedge, goals at $ 0.1986. Source: Tradingview

An increasing wedge is a bearish pattern wherein each the support and the resistance lines down, however the support slope is steeper. This formation often signals weakening dynamics, especially after a robust upward trend. If the value breaks under the lower support line of the wedge, it often points out a possible continuation of the drawback.

In this case, the buffer token has already dropped 15% from the upper trend line of the pattern. The token now deals with $ 0.2491, just above the 50pro period exponential moving Average (EMA) at USD 0.2406.

If the breakdown confirms, Puffer token can drop by one other 25%and reach the extent of $ 0.1986. This goal corresponds to the peak of the wedge projected down. The volume tip while dripping supports this bear, because the rising volume typically confirms the pattern during breakdown.

The relative strength index (RSI) is currently 47.72, which is neutral, but tends to Bearish. It shows a shift from the sooner overbought level of 59.52. The RSI line has crossed the signal line and signaled that the impulse weakens.

At the identical time, the 975.88K volume confirms increased activity during correction. The EMA now acts as an instantaneous support level. If the value closes below this average, sales pressure can proceed to rise.

This diagram follows the recent climb of the buffer token, which is connected to the Binance Alpha Airdrop and its inclusion within the BNB chain's ecosystem. The rising wedge now illuminates a shift in the value structure and the start of a possible short -term downward trend.

Puffer token in Binance Alpha and utilized in the BNB chain

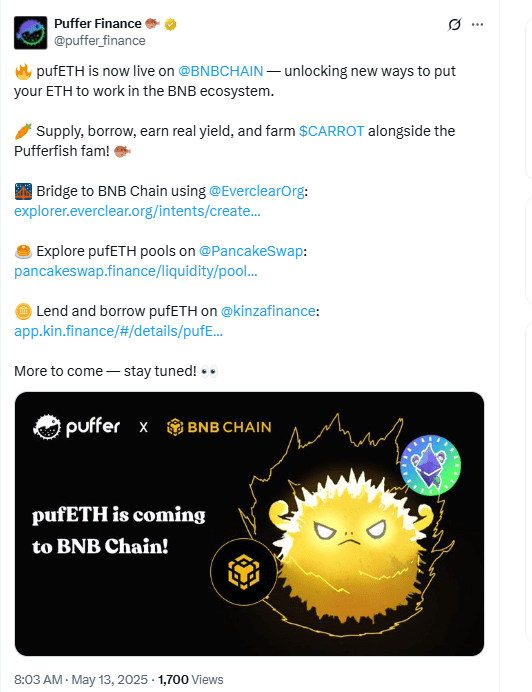

Puffer Finance confirmed his commitment within the BNB chain on the identical day. The project now supports the Crosschain activity between Ethereum and BNB chain. With the expansion, users in each networks can access plug-in and entertainment services.

Pufeth starts via buffer financing on the BNB chain. Source: buffer financing on x

Pufeth starts via buffer financing on the BNB chain. Source: buffer financing on x

The BNB chain integration supports the Roadmap targets published by the team. This includes improving liquidity, expanding Validator tools and providing a wider access to Defi functions.

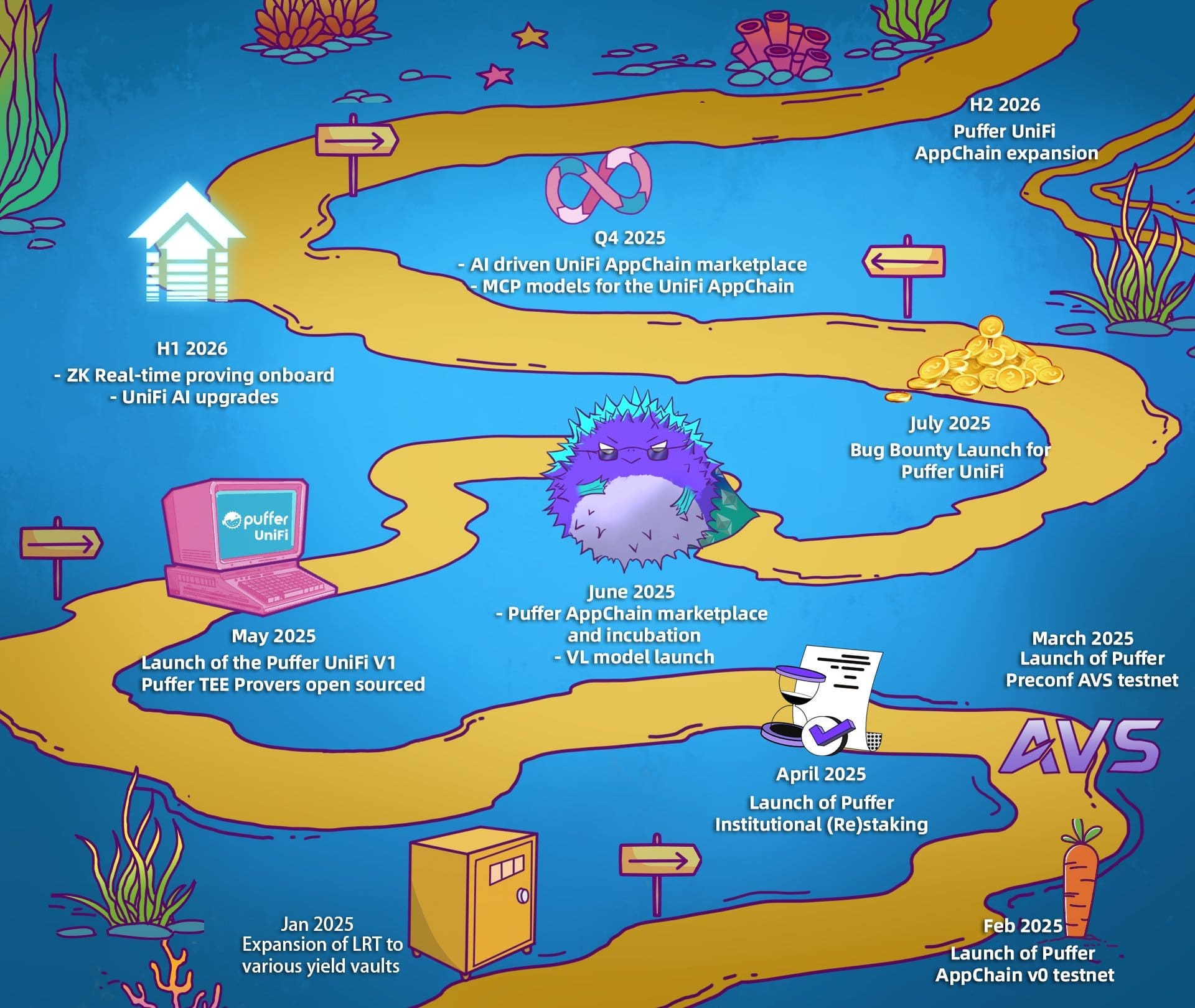

After the official roadmap, the next updates are planned:

-

May 2025: Unifi V1 Start

-

June 2025: Validator learning tools and Appchain Marketplace

-

Q4 2025: AI-operated Appchain updates

-

2026: real-time ZK reflection and AI model integration

Buffer financing 2025–2026 Roadmap emphasizes necessary starts. Source: buffer financing on x

Buffer financing 2025–2026 Roadmap emphasizes necessary starts. Source: buffer financing on x

The start of buffer on the BNB chain matches these schedules and adds further technical support for future milestones.