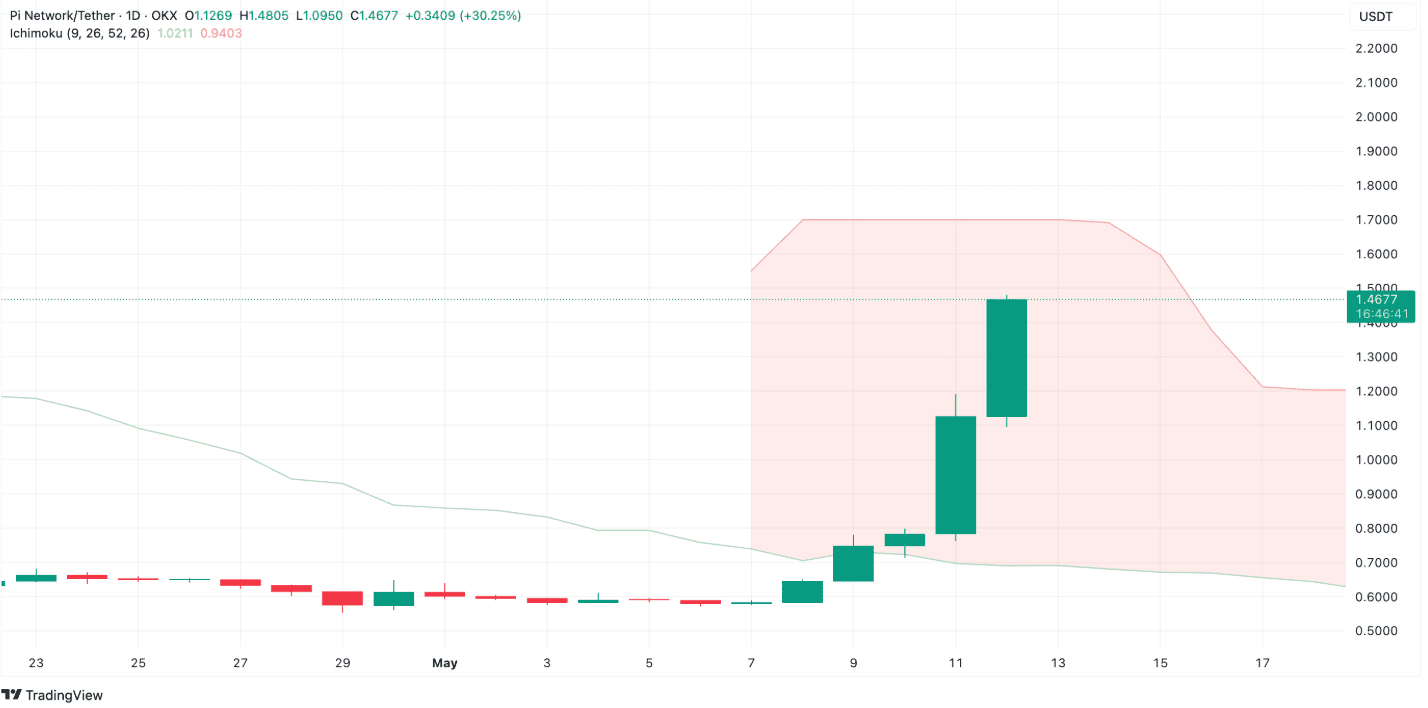

The native cryptocurrency of the PI Network, the PI -Token, experienced a pointy rally at first of this week. On May 12, 2025, it reached a high of about 1.70 US dollars before it was withdrawn. From 19:04 UTC, PI acts from the OKX Exchange at 1.1142 USD.

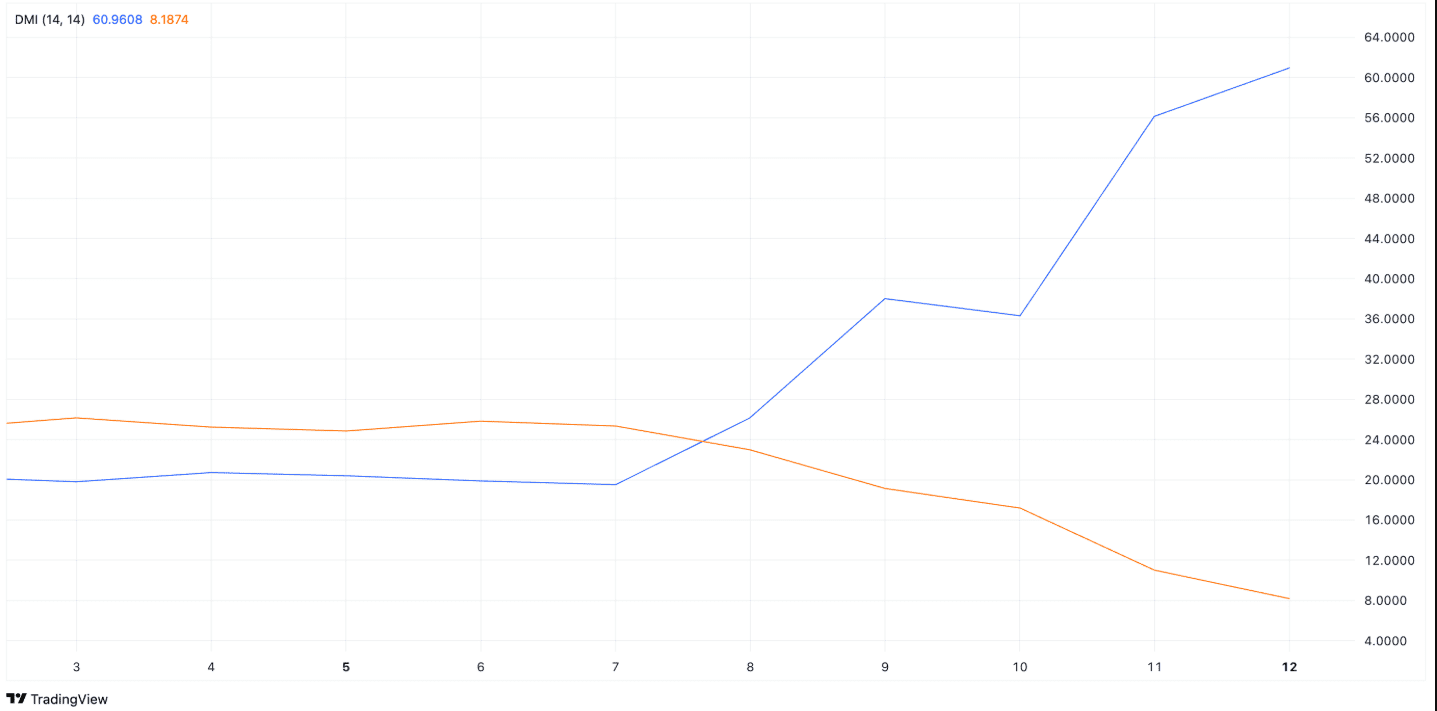

Directional Movement Index shows that the worth for getting Buy-side price deletes the leading range of ichimoku Cloud

Pi token pullback after USD 1.70 peak. Source: Tradingview

The token kept briefly over the 50-hour exponential sliding average (EMA), which has now been marked at USD 1.1249, but since then has fallen. This shows a short lived shift within the impulse. The volume reached a climax through the price shot and stays increased, with 735.77,000 PI being traded within the last session.

In the meantime, the relative strength index (RSI) fell from an overbought zone to 43.38, which reduces the acquisition pressure. The former Hochhoch of the RSI was 60.60, but the present reading value points to the neutral area.

Direction movement index shows the purchase-page dynamics

The directional movement index (DMI) confirmed the bullish trend. TradingView data showed that the +DI (positive direction index) reached 60.96, its most recorded value for PI tokens. This indicator measures the strength of the worth trends.

Pi token DMI meets 60.96 when the bullish trend strengthens. Source: Tradingview

Pi token DMI meets 60.96 when the bullish trend strengthens. Source: Tradingview

A +di Read these high signals of strong purchase pressure. It also shows that the PI rally is driven more by increased accumulation than by random volatility. The negative direction index (–ti) stays significantly below the +DI and shows that buyers are currently checking the market trend.

The DMI trend line rose in early May. Every each day conclusion showed a stronger upward pressure. Dealers proceed to watch the gap between +Di and -di to evaluate whether the dynamics will change.

Pi Price deletes the front span from Ichimoku Cloud

The PI price solved the leading span of the Ichimoku -Cloud. This indicator identifies potential PI resistance and PI support zones based on earlier price motion and moving average values.

The leading range A represents the primary key resistance. On May 12, Pi closed over this level and confirmed that the token moved through a major barrier. Now it’s approaching the leading Span BB, which is the subsequent level of resistance near $ 1.70.

Pi token breaks the Ichimoku Cloud Guided tour A. Source: Tradingview

Pi token breaks the Ichimoku Cloud Guided tour A. Source: Tradingview

If the worth is above the leading range A, this zone can now act as a brand new PI support. The structure of the cloud indicates that the token moves through vital impulse zones. However, the continued movement is dependent upon whether the acquisition of the acquisition will remain constant.