The PI network award rose by 27% this week and reached an intra -high of $ 0.7259 on May 10, 2025, based on tradingview data. The price within the 4-hour diagram against Tether (USDT) closed to OKX at $ 0.7237. This step was followed by a powerful rally of lower than 0.60 US dollars.

PI network (Piusdt) 4H diagram with resistance and EMA values. Source: Tradingview

The PI coin now acts just above the support level of $ 0.71. This support level is visible within the consolidation area after the recent eruption. The price stays in a narrow zone between $ 0.71 and $ 0.73.

According to the identical diagram, the PI network with high resistance is near 0.78 US dollars. This level previously acted as a ceiling in mid -April and continued to limit it.

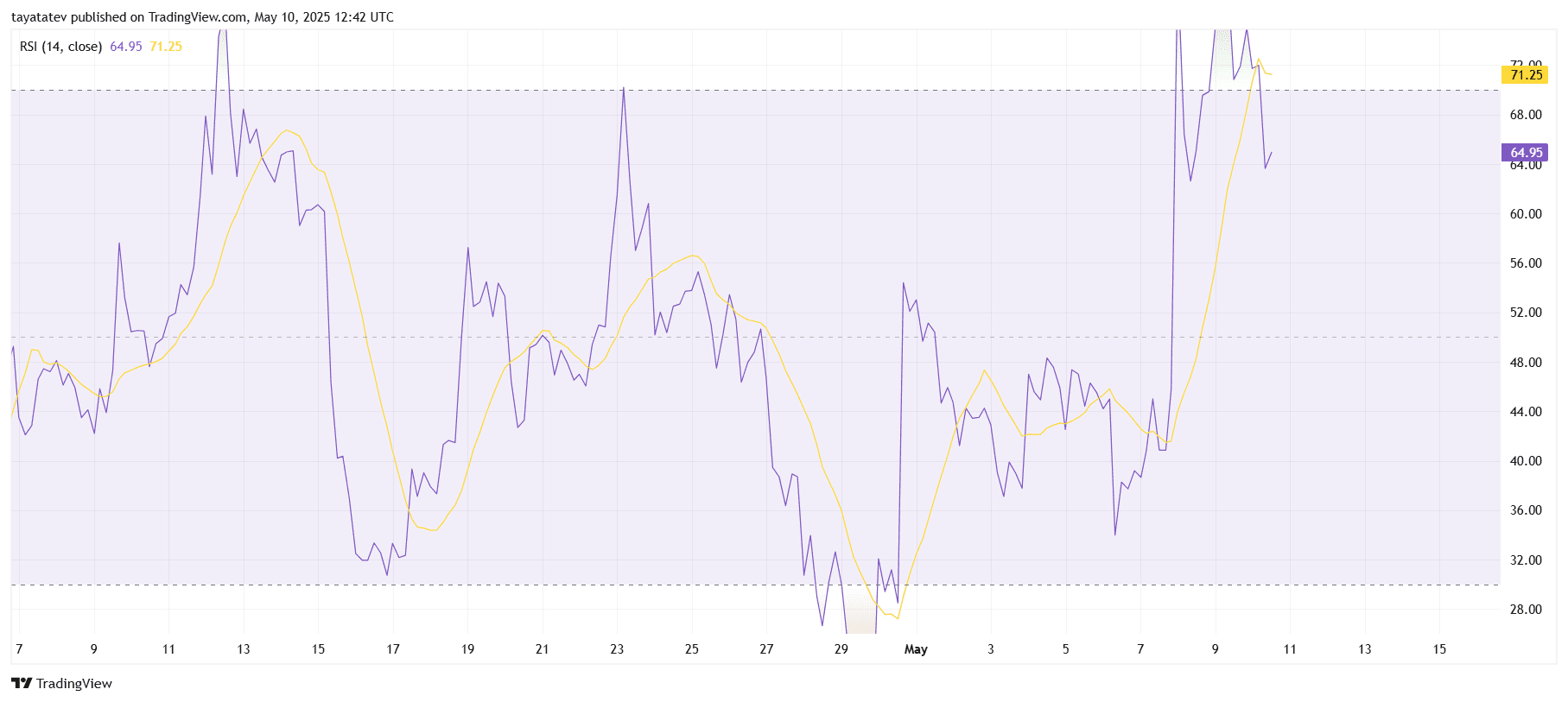

The PI network RSI is approaching the over -raned zone within the 4h diagram

The PI network RSI (relative strength index) reached 64.95 on May 10, 2025, based on the 4-hour trading view diagram. RSI is a technical indicator that measures dynamics. It ranges from 0 to 100, whereby the values over 70 are often overbought and over 30 are oversized.

PI network RSI breaks over 64.95 before the resistance test. Source: Tradingview

PI network RSI breaks over 64.95 before the resistance test. Source: Tradingview

Pi Network RSI is currently positioned directly below the overbought threshold. The signal line (a sliding average from RSI) is 71.25 and places it within the overbought area. This gap suggests that the recent upward dynamics were strong, but slowly slowed down when RSI withdraws from its climax.

In the last three days, the RSI jumped from lower than 65, which indicates a fast shift out there mood. Such movements often reflect aggressive purchase activities. However, the present RSI level shows that PI network has an optimistic dynamic, but approaches a zone wherein the upward movement can decelerate or pause.

This RSI setup reflects the increased demand for PI coin, that are supported by short-term price ranges. In combination with higher volume and support levels, it confirms that the momentum stays positive. Dealers often use RSI, amongst other indicators to envision price trends and potential reversal.

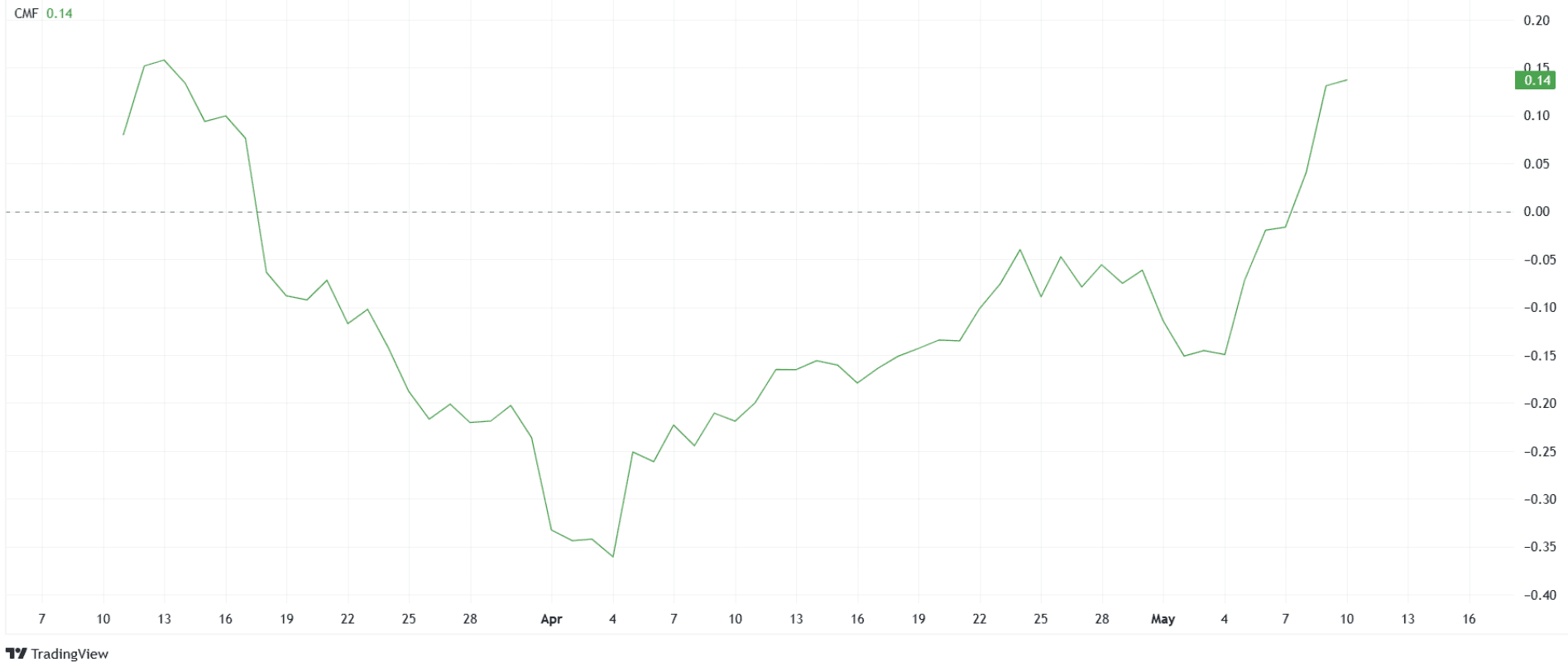

PI network CMF signals high inflows

The PI network -cmf indicator (Chaikin Money Flow) has shown a powerful increase. An increasing CMF reflects a powerful capital inflow within the asset. This implies that money from buyers penetrates PI network.

PI network CMF jumps to 0.14 strong tributaries. Source: Tradingview

PI network CMF jumps to 0.14 strong tributaries. Source: Tradingview

A positive CMF reading also matches the increased demand for PI coin. It supports the most recent price increase and shows trust in the present trend. The indicator indicates that retailers add their PI coin positions.

According to TradingView charts, Pi Network CMF is now in a positive area. This supports the dynamics of the old coin and is in voting with the RSI signal. Both indicators indicate the continued strength when the conditions apply.

PI network trade volume supports the market strength

The PI network trade volume rose this week and supported the upward movement. A better volume confirms lively participation out there. It shows that buyers arrange at the present price level.

The volume data also confirm the strength behind the PI -Network price profits. The price increases may not apply with out a strong volume. In this case, the amount has increased along with price and indicators similar to RSI and CMF.

The PI network trade volume is one of the crucial vital metrics that confirm bullish behavior. The increase increases the case for the continued price stability near the resistance. However, the following step is dependent upon how the worth reacts to the barrier of $ 0.78.