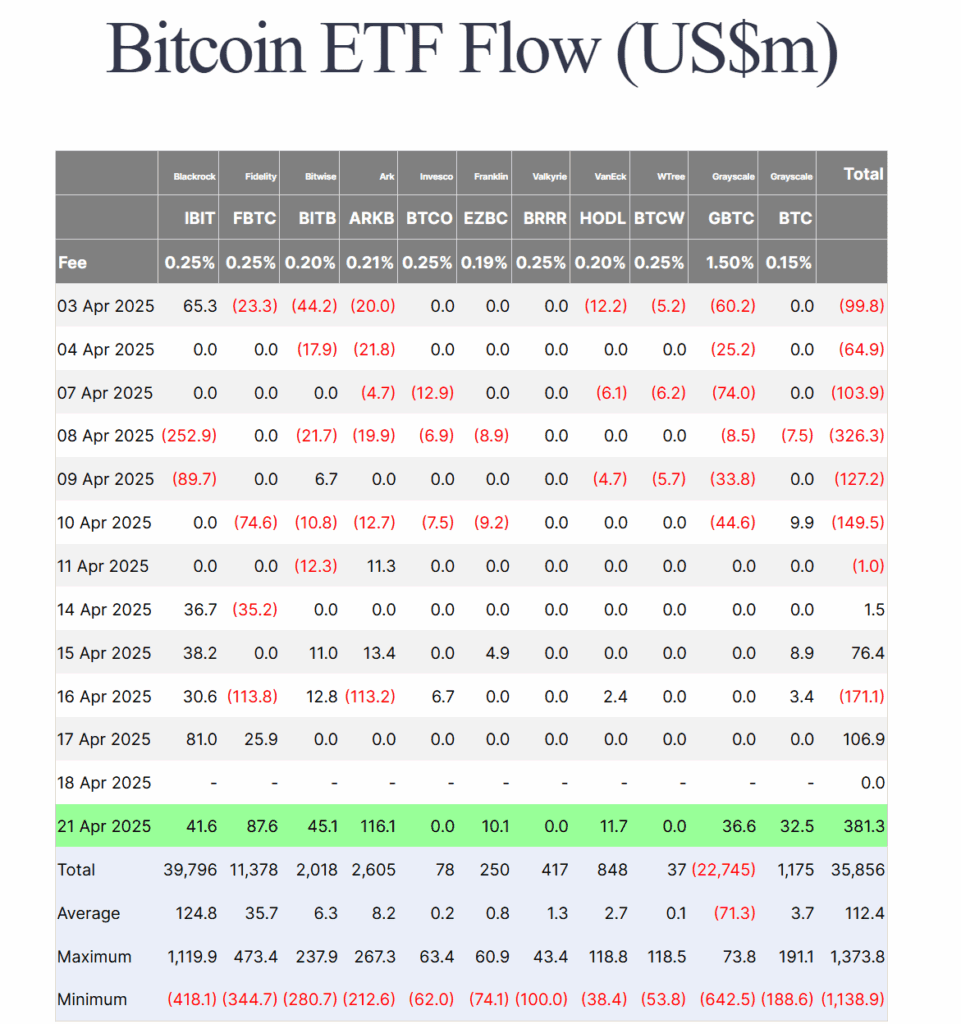

Noida (coincascapter.com) – Bitcoin Exchange Traded Funds (ETFs) are again in focus after a brand new increase in institutional inflows. On April 21, 2025, American Spot Bitcoin ETFs have had a net inflow of $ 383 million in the very best inflow since January-after Bloomberg and Bitwise Europe.

Bitcoin ETF Flows and Global Implicatebtc Price Throcks opposite the important thing test after a channel outbreak

The spike reflects the growing institutional interest after a restless first quarter, through which strong drains before the trend in March were vice versa in January. In parallel to the dynamics of the United States, the European Bitcoin Exchange products (ETPS) also attracted 50 million euros in tributaries, which further supported the narrative of world institutional re-assuming with the crypto-asset class.

Bitcoin -Tf flows and global implications

The inflows confirmed by Bitwise Europe André Dragosch on April 21 renewed the arrogance in Bitcoin ETFs, while the macro conditions are stabilizing. Blackrocks Ishares Bitcoin Trust (IBIT) and Fidelity's Wise Origin Bitcoin Fund (FBTC) dominated the upswing and took under consideration many of the inflows.

André Dragosch emphasized the growing interest in Bitcoin ETFs.

The day before, on April 20, the US -Bitcoin ETFs had already attracted 250 million US dollars, which determined the conditions for the next increase.

It is vital that drainage from the Bitcoin Trust (GBTC) from Grayscale has now slowed down significantly. Only 10 million US dollars left GBTC on April 20, a robust contrast to the early trend in 2025, when ETF drains in the midst of wider market tretracements led.

Bitcoin ETF flows. Source: Farside

Bitcoin ETF flows. Source: Farside

The shift indicates that institutional investors repeat confidence in structured crypto products, especially those related to essential asset managers. Reports initially of this yr emphasized how IBIT and FBTC were developed as preferred ETF vehicles as a consequence of lower fees and better liquidity.

The European market side seems to reflect these movements. A separate analyst found that on April 21, 53.5 million US dollars in Bitcoin ETPs occurred in large European stock exchanges and to be aligned with the broader upward trend within the USA.

The analyst forecasts on the X project that the institutional tailwind from Bitcoin could increase prices to $ 200,000 by the tip of the yr. Potential rate of interest increases within the US Federal Reserve, especially on the FOMC meeting in June, could dampen the appetite for risk assets.

Nevertheless, the continued increase in ETF flows signals a bullish institutional outlook and positions Bitcoin as a growing game in conventional investment portfolios. This trend could proceed to integrate Bitcoin by 2025 and, whether it is persistent, further integrate into the mainstream finance infrastructure.

BTC Price faces a key test after the Channel Breakout

Bitcoin (BTC) broke out of a rising parallel canal within the each day table and confirms a bullish structural shift for the primary time since mid -March. The Breakout carried the BTC Prize beyond the short-term EMAS cluster and now sees directly above its 100-day EMA (Blue), which now functions as dynamic support.

The technical breakout coincides with one other institutional interest, because the USSPOT -Bitcoin -ETFs have placed on their highest each day overall levels since January 2025. It is vital that the inflows reflect a shifting of the investor's appetite to regulated bitcoin exposure, especially about means managed by Blackrock and Fidelity.

BTC USD Daily Price Chart with RSI. Source: Tradingview

BTC USD Daily Price Chart with RSI. Source: Tradingview

Despite this tailwind, Bitcoin's price campaign is now fighting with a well-known hurdle near the zone of 88,000 to 89,000 US dollars. This region has previously triggered sharp rejections. Deleting this area could open the way in which towards a resistance level near 91,000 US dollars. By turning the immediate resistance, Bitcoin would aim to withstand near $ 95,000, which is anchored by a highly volume knot of $ 94,980 and 78.6% FIB retracement level.

The volume increased after the outbreak, although the conviction stays moderate. RSI is just below 60, which suggests more room for upward movement, although the newest divergence signals the necessity for caution. On the opposite side of the 200-day EMA and the 85,600 dollar marker form is supported immediately. A break under this region could expose BTC to 82,100 US dollars and eventually test the lower limits of the previously broken channel.

Although the BTC Prize was supported by ETF flows, Bullen have cut out their task when Bitcoin has to exceed the following level of resistance.