Yerevan (coinco -chapter.com) – President Donald Trump increased the criticism of the chairman of the Federal Reserve on April 17 and said that his “termination cannot come quickly enough”.

Trump demands Powell's termination. Source: truth social

His comments got here a day after Powell warned that the great tariffs of the Trump government could trigger economic instability. At the identical time, the Supreme Court of the United States checks a separate case that would have an effect on independence from federal authorities, including the Federal Reserve.

Trump's attack followed Powell's speech on April 16 on the Economic Club of Chicago, where the Fed chairman described the federal government's trade for trade as “very fundamental political changes”, which “is significantly larger than expected”. He said the central bank is now facing challenges that it has not seen it for many years.

Powell discusses the economic prospects and the tariff effects. Source: FederalAlreserve.gov

Powell discusses the economic prospects and the tariff effects. Source: FederalAlreserve.gov

Powell did indirectly name the President. However, his criticism got here when Trump was the Fed to cut back interest and argued that the European Central Bank (ECB) was more determined.

In an Oval Office meeting, Trump told reporters.

“If I need to get him out, he shall be outside in a short time, imagine me.”

Powell's tenure runs until May 15, 2026. He was first nominated by Trump in 2017 and was ordered again in 2022 by President Joe Biden. US law currently protects its role for no reason, which protects the central bank from political interference.

But this protection could be tested. A case of the Supreme Court that has now been verified could reset the boundaries of the presidential authority to independent agencies, which can affect whether a President Powell can dismiss before the tip of his term.

The case of the Supreme Court can move Trump against Powell balance

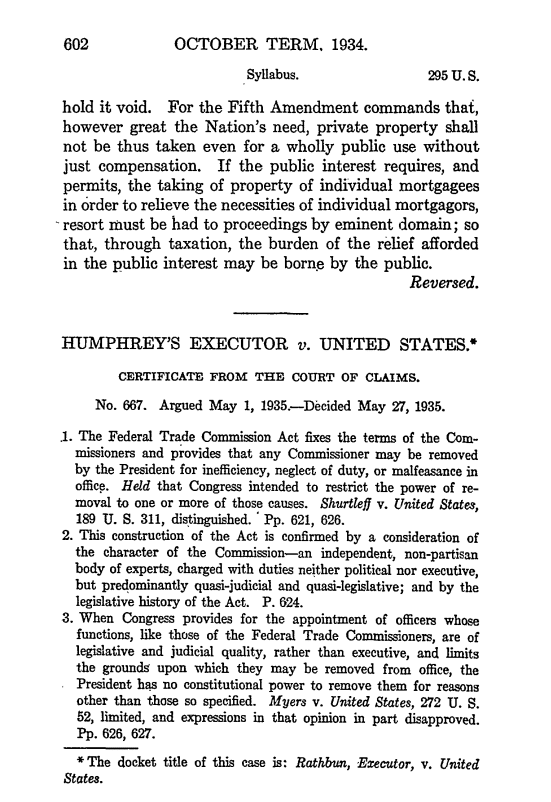

At the middle of the present legal debate is Humphrey's executor against the United States from 1935, which found that the congress can request a president to prove that he can prove – reminiscent of misconduct or neglect – to remove civil servants from independent agencies. Powell's position still protects this decision.

Humphrey's executor against the summary of the United States. Source: Supreme Court of the United States

Humphrey's executor against the summary of the United States. Source: Supreme Court of the United States

The Trump government desires to overturn this precedent. It is argued that the presidents should have the total authority to remove executive officers who oppose their agenda. The Attorney General of Trump, D. John Sauer, told the court.

“The president mustn’t be forced to delegate his executive authority to agency heads, which have been shown to contradict the political goals of the administration for a single day.”

The immediate case in front of the court includes the National Labor Relations Board (NLRB) and the Merit Systems Protection Board (MSPB), during which Trump released democratic civil servants and replaced them with its views. Former NLRB chairman Gwynne Wilcox warned in a letter.

“The independence of the Federal Reserve can be uncertain – a situation that had bad effects available on the market.”

Gwynne Wilcox response of the Supreme Court. Source: Supreme Court of the United States

Gwynne Wilcox response of the Supreme Court. Source: Supreme Court of the United States

Supreme judge John Roberts has already signed a brief arrangement, which enables Trump to eliminate each officials while the case progresses. A final decision could possibly be made soon and possibly open the door to more comprehensive distances in other agencies.

Trump puts the independence of the Fed under pressure

Despite Trump's repeated attempts to say authority via Powell, the Federal Reserve has remained independent. Powell said reporters in 2023 that “removing a Fed chair based on the law was not allowed,” and added that he intended to serve his full term.

The Fed board consists of seven members. All are appointed by the President and confirmed by the Senate, but can only be remedied “for reasons”, which suggests clear legal or ethical violations and no political disagreements. The law doesn’t define the “cause”, however the courts have interpreted it to exclude shots from contradictory economic views.

In recent years, Trump's attempts to check this limit have included the discharge of members of other independent commissions. In March and April 2025, he released two Democrats within the Federal Trade Commission (FTC) and two on the board of the National Credit Union Administration (NCUA). One of the dismissed NCUA members, Todd Harper, said that the step violates the non -partisan legal framework, which was adopted by the congress to guard the credit cooperative members and the deposits. “

Todd Harper reacts to Ncua fire. Source: LinkedIn

Todd Harper reacts to Ncua fire. Source: LinkedIn

Right analysts say that these measures could possibly be part of a bigger strategy for the redefinition of the presidential authority. Jaret Seiberg, analyst on the TD Cowen Research Group, wrote,

“The President notes the precedent that he has a comprehensive game of discretion against financial supervisory authorities that would include the Federal Reserve.”

Nevertheless, the legal fame of the Fed stays stronger than other agencies, no less than in the interim. In a choice of 2020 on the Consumer Financial Protection Bureau (CFPB), Chief Justice Roberts said that the Fed was “in a totally different league”. He quoted his multiple board and the unique financing model as reasons for the preservation of his independence.

Judge Samuel Alito repeated this position individually and wrote that the structure of the Fed “an intensely closed compromise between those that wanted a largely private system, and people who prefer a national bank controlled by the federal government”.

The Trump government emphasized this distinction. A letter wrote in a recently written to the court, wrote that the concerns in regards to the autonomy of the Fed were misplaced.

“The respondents focus strongly on other agencies just like the Federal Reserve Board,” he said, but “ignore [the Court’s] Observation that the Federal Reserve's office protection has a transparent query with a novel historical family tree. “

Trump against Powell increases the uncertainties of market uncertainties

Trump's repeated calls to Fire Powell have triggered alarms from economists and investors. They argue that weakening the independence of the Fed would damage their credibility and damage the US economy. The ability of the central bank to regulate inflation and unemployment will depend on making decisions freed from political pressure.

The Finance Minister of Trump, Scott Bessent, expressed a distinct view than the president. In a hearing in January, Bessent told the congress: “monetary policy is a jewellery box that should be preserved.” In an interview with Bloomberg, he added that the disturbance of Fed's autonomy could already unsettle the markets through tariff uncertainty.

Ray Dalio, founding father of Bridgewater Associates, continued. He warned that the economy is already approaching Trump's recession as a consequence of the aggressive trade policy of Trump. Powell has repeated these concerns and notes that recent tariffs “put feeding into unrestricted waters”.

Despite the pressure, Powell and other FED officers depend on economic indicators to find out rates of interest. Inflation stays above the two% goal of the FED, and the reduction in installments may have a break in the interim. In contrast, the ECB reduced rates of interest several times last 12 months.

ECB President Christine Lagarde defended Powell and said:

“I actually have great respect for my esteemed colleague and friend Jay Powell. We have a gentle, solid relationship between the central bankers.”

Legal results could set precedent

The Supreme Court doesn’t resolve directly on Powell's status. Instead, it is set whether Trump can remove members of the NLRB and MSPB for no reason, while their cases are still outstanding. However, the broader constitutional query – how far the space powers of a president – is the main target of the dispute.

Judge Clarence Thomas has already expressed interest in checking Humphrey's executors. In an opinion of 2020 he wrote,

“I might reject what’s left of this incorrect precedent.”

Justice Neil Gorsuch joined him.

If the court decides to reverse humphreys as a complete, the president could receive comprehensive authority to dismiss officials from the agency, including the Fed. That would mark a pointy break of just about a century of precedent and alter the structure of the federal government.

Until then, Powell stays on the spot. He made it clear that he won’t resign voluntarily. The law still protects its position, and the present structure of the Federal Reserve prevents the white house from firing its chair without an appropriate cause.

Nevertheless, the legal landscape can change. If the Supreme Court of Trump supports Trump within the case of the Labor Board, the subsequent test could be whether the identical argument applies to the Fed.

At the moment the query stays whether Trump can fire Powell. However, the court could soon give a solution that would redefine the boundaries of the presidential power.