Lighter (LIT) saw a major uptrend shortly after its launch. The token broke out of an inverted head and shoulders pattern and rose nearly 21%, reaching a high of nearly $3.26. Lighter's upside price goal has now been reached and price motion has begun to slow.

What matters now isn’t the eruption itself, but what the structure looks like afterwards. Several short-term signals suggest that a cooling phase could also be developing.

The lighter price forms a fresh head and shoulders pattern

After peaking near $3.26 due to a very successful breakout of the inverse head and shoulders pattern, Lighter's price began to consolidate. On the 4-hour chart, the structure has resembled a head and shoulders pattern since January fifth.

Easier Breakout and Risk: Easier.XYZ

Want more token insights like this? Sign up for Editor Harsh Notariya's day by day crypto newsletter here.

The head printed near $3.26, the immediate swing high. The right shoulder is now forming barely below this level and is showing fading upward strength. This setup often signals downside risk if support fails.

The cutout is around $2.56. If LIT price falls below $2.56, the pattern would fully activate.

Breakdown Target: Lighter.XYZ

This move would open the door for an 11% decline. However, for the pattern-related 11% decline to occur, the Lighter price must first fall by 15% from the present price, which is around $3.01.

Capital flow and dip buying are beginning to decelerate

Capital flow data helps explain why this risk is increasing. Chaikin Money Flow, which tracks whether large capital enters or exits an asset, remained positive between Jan. 6 and Jan. 8, whilst the worth trended lower. This suggested that buyers were still facing selling pressure.

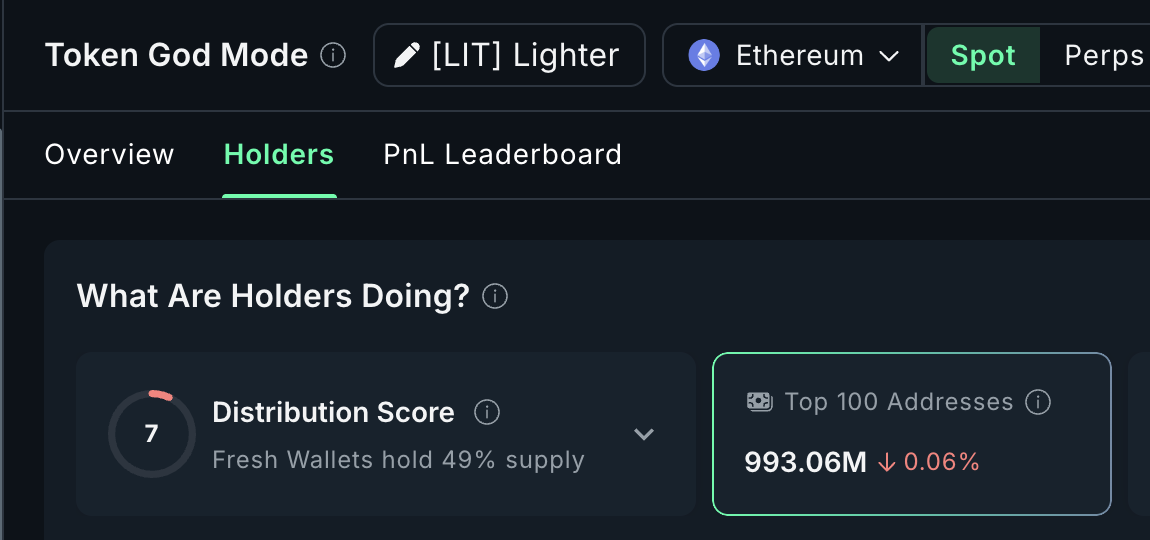

However, this support is starting to wane. On the 4-hour chart, the CMF has turned and is moving lower, even though it stays barely above zero. This shift signals that inflows are slowing reasonably than increasing. The lack of aggressive positioning by mega whales (top 100 addresses) within the last 24 hours also confirms the CMF decline. For the worth decline theory to fail, these addresses must rise again.

Dip buying data reinforces caution. The money flow index fell sharply between January sixth and ninth. While the worth has fallen progressively, the MFI has fallen much faster. This gap shows that dip buying is weak and traders are taking a step back reasonably than defending recent levels.

Taken together, the weaker CMF and declining MFI suggest that each capital inflows and buying interest are losing momentum.

Derivatives positioning and key lower cost levels to look at next

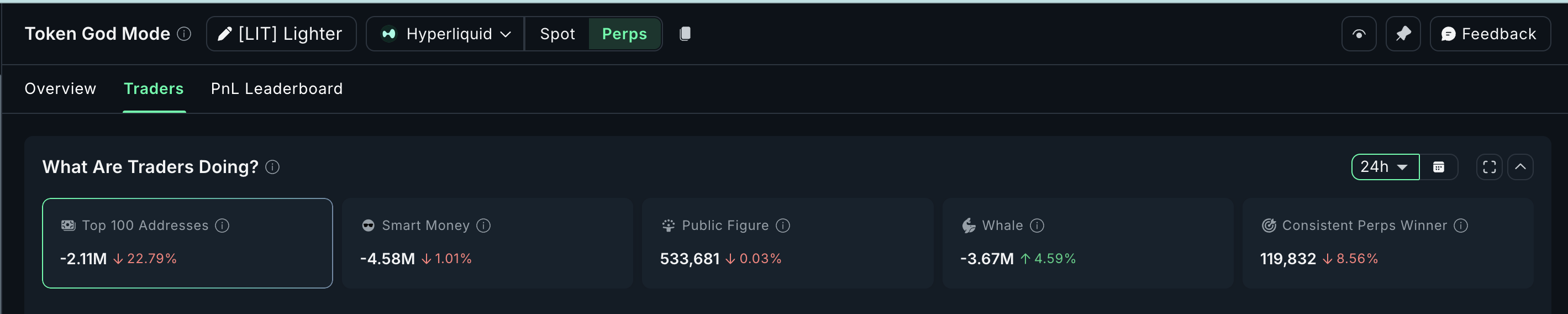

Lighter's offender positioning leans toward net shorts across most cohorts, indicating a scarcity of upside bias. Even the positive (long) positioning of the Perp winners recorded a decline of over 8%. The trend subsequently doesn’t indicate an expectation of a price increase.

The LIT price levels now determine the consequence. Holding above $2.97 would prevent the suitable shoulder from breaking. A move below $2.78 would put pressure on the structure. A fall below $2.56 would likely trigger the total bearish move towards the $2.30 zone, the lost starting low.

There can be a transparent level of invalidity. A robust 4-hour close above $3.26 would break the top and shoulders pattern and signal renewed bullish strength. A possible short squeeze may also help with this due to large short positioning.

Currently, Lighter is at an important turning point. The previous breakout of 21% has already occurred. Without recent capital inflows and stronger dip buying, the chart suggests that a controlled slowdown stays an actual risk reasonably than an instantaneous continuation of the rise.

The Post-Lighter (LIT) Risks a 15% Cooldown as a Bearish Pattern Forms – Is the Post-Launch Low Next? appeared first on BeInCrypto.

Article source: beincrypto.com

The Post-Lighter (LIT) Risks a 15% Cooldown as a Bearish Pattern Forms – Is the Post-Launch Low Next? appeared first on Crypto Adventure.