Introduction to Bitcoin Mining Scams

Thai investigators have seized $8.6 million in Bitcoin mining equipment linked to Chinese transnational scam networks operating from Myanmar. The raid uncovered 3,642 rigs used to generate revenue and launder illicit funds through newly minted coins. Experts say the mines are a part of a wider transnational fraud infrastructure now spreading across Southeast Asia.

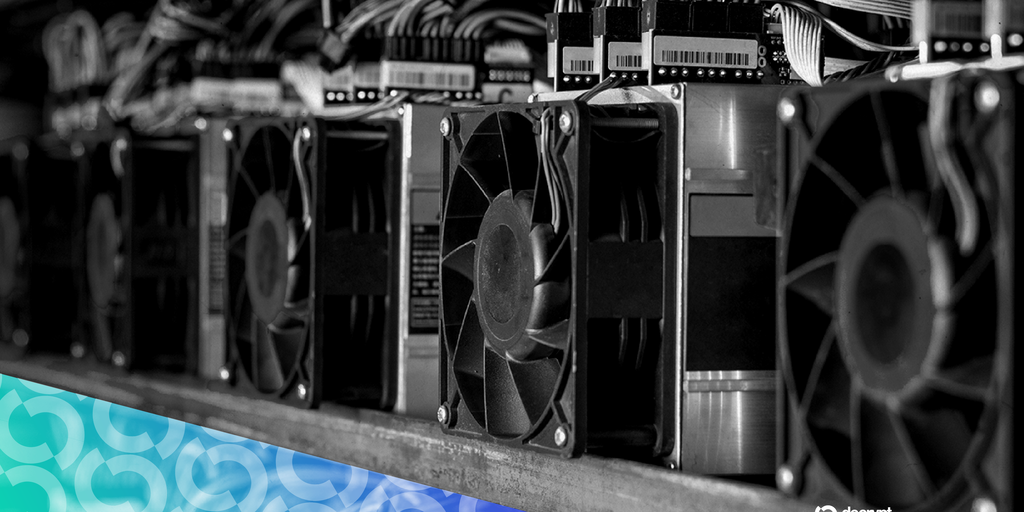

The Raid and Seizure

The Department of Special Investigation raided six locations in Samut Sakhon province and one in Uthai Thani, impounding 3,642 mining devices valued at $7.7 million and electrical equipment value $860,000. The raids come amid concerns that Bitcoin mining has evolved from energy-theft nuisance into critical infrastructure for international cybercrime networks. Thai Investigators discovered most devices were installed in soundproofed containers with water-cooling systems.

The Scam Networks

The operations were traced to Chinese scam gangs based in Myanmar that had collected financial transactions exceeding $143 million. The agency has reportedly requested assistance from the Chinese government to expand its investigation. Mining operations now serve dual purposes for criminal syndicates: converting stolen electricity into revenue while laundering illicit proceeds through seemingly legitimate digital assets.

Regional Crisis

The Thai crackdown follows mounting pressure across Southeast Asia to combat crypto-linked power theft. Malaysia’s state electric utility provider, Tenaga Nasional Berhad, recently reported that illegal crypto-mining operations have drained roughly $1.1 billion value of electricity over the past five years. Malaysian authorities have deployed drones with thermal imaging and handheld sensors to hunt illegal operations, with miners installing heat shields and CCTV cameras to evade detection.

Global Enforcement

Last month, U.S. Attorney for D.C. Jeanine Pirro announced the Scam Center Strike Force, an interagency initiative specifically targeting crypto scams perpetrated by organized Chinese crime syndicates. Experts caution that the "Chinese scam gangs" label oversimplifies the threat, and that the true challenge is a transnational franchise model with operations spanning multiple countries.

The Future of Crypto Scams

As enforcement increases, rigs will move to more distant areas or across borders, exactly the way in which scam compounds migrated. The real test shall be whether asset seizures start hurting the business model, not only the machinery. Experts warn that we shouldn’t expect these mines to vanish, just relocate, and that the specter of crypto-linked scams will proceed to evolve and spread.

Conclusion

In conclusion, the seizure of $8.6 million in Bitcoin mining equipment linked to Chinese transnational scam networks operating from Myanmar is a major step in combating crypto-linked scams. However, the specter of crypto-linked scams is complex and evolving, and would require continued cooperation and enforcement from governments and agencies across the region. As the usage of cryptocurrency continues to grow, it is crucial to remain vigilant and adapt to the changing landscape of crypto-linked scams.